I usually provide quarterly updates about Alibaba Group Holding Limited (NYSE:BABA) and my last article about Alibaba was published three months ago following first quarter results. And while I did not really change my opinion or the rating since I started covering Alibaba – I was always bullish and only switched between “bullish” and “very bullish” – quarterly earnings per se were newsworthy and justifying an article and update in most cases.

This earnings release and earnings call however has been extremely interesting and the company reported many newsworthy items we must talk about. In the following article we are not only looking at the provided updates about the IPO of different business units, but we are also looking at the announcement of paying an annual dividend. But as always, we will start by looking at the quarterly results.

Quarterly Results

Although Alibaba slumped – once again – following the earnings release, the reported numbers were quite good, and the business did also beat analysts’ estimates for earnings per share as well as revenue. And it was demonstrated once again that the stock price movement is not necessarily a reflection of the fundamental business.

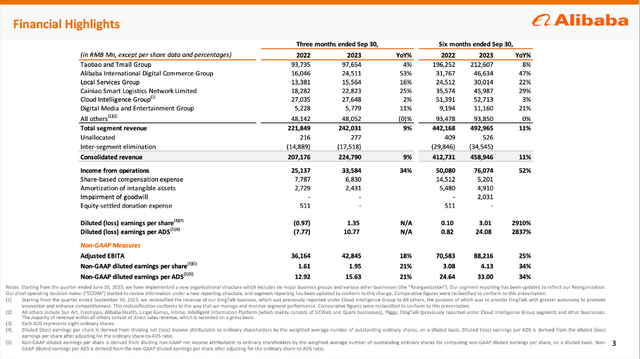

Alibaba grew its top line from RMB 207,176 million in Q2/23 to RMB 224,790 million in Q2/24 resulting in 8.5% year-over-year growth which is one of the better results in the last few quarters. Income from operations also increased 33.6% year-over-year from RMB 25,137 million in the same quarter last year to RMB 33,584 million this quarter. And when looking at the bottom line, we see a “reversal” from a loss of RMB 0.97 per share in the same quarter last year to RMB 1.35 earnings per share this quarter.

Alibaba Q2/24 Presentation

When looking at non-GAAP diluted earnings per share, we see an increase from RMB 1.61 in Q2/23 to RMB 1.95 in Q2/24 – resulting in 21.1% year-over-year growth. And especially free cash flow – one of the most important metrics in my opinion – increased 26.6% year-over-year from RMB 35,709 million in the same quarter last year to RMB 35,220 million this quarter.

Looking At The Segments

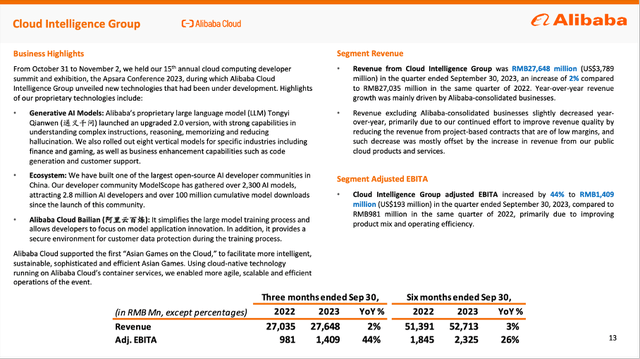

One of the most interest segments is the “Cloud Intelligence Group” – and the segment is interesting for different reasons. On the one hand, the segment is struggling and not really growing with a high pace – despite optimistic assumptions for the long run. In Q2/24, the segment reported revenue of RMB 27,648 million and this is only an increase of 2.2% year-over-year. But the business is getting more profitable and adjusted EBITDA increased 44% year-over-year to RMB 1,409 million.

Alibaba Q2/24 Presentation

On the other hand, the segment was closely watched due to the intent of Alibaba for a spin-off and IPO of the business unit. However, in its last earnings release we did find the following statement:

The recent expansion of U.S. restrictions on export of advanced computing chips has created uncertainties for the prospects of Cloud Intelligence Group. We believe that a full spin-off of Cloud Intelligence Group may not achieve the intended effect of shareholder value enhancement. Accordingly, we have decided to not proceed with a full spin-off, and instead we will focus on developing a sustainable growth model for Cloud Intelligence Group under the fluid circumstances.

And of course, speculations were starting right away if the Chinese government somehow forced Alibaba to scrap the IPO and I think this brought back some fears about Alibaba that didn’t play a role in the last few quarters – the Chinese government putting immense pressure on Alibaba and having a huge negative impact on the business performance (for more information on the topic see here).

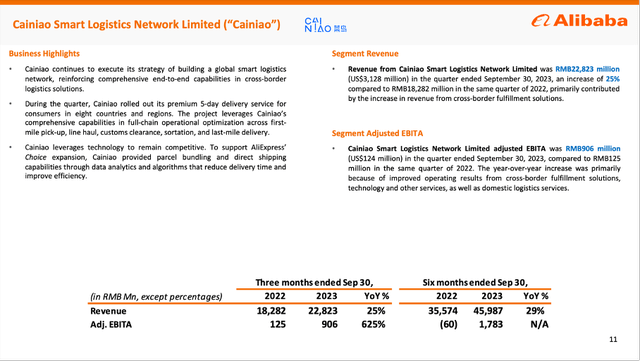

While Alibaba has cancelled the IPO of its Cloud Business Unit, it is moving along with the IPO for Cainiao. The A1 filling to the Hong Kong Stock Exchange has been submitted and the Cainiao Smart Logistics Network Limited has applied for initial public offering in Hong Kong.

Alibaba Q2/24 Presentation

In the second quarter of fiscal 2024, the business segment reported RMB 22,823 million in revenue and compared to the same quarter last year (RMB 18,282 million) this is an increase of 24.8% year-over-year. Aside from growing the revenue with a healthy pace, Cainiao is making good progress towards becoming more profitable. This quarter adjusted EBITDA was RMB 906 million, and compared to RMB 125 million, this is a growth rate of 625%.

Dividend And Share Buybacks

While the cancelled IPO of the Cloud Unit Business was a big surprise, the announcement of an annual dividend was certainly another big surprise. Alibaba announced an annual dividend of $1.00 per ADS and I certainly didn’t expect Alibaba to announce a dividend already. I also don’t know if I should be happy about the dividend. Of course, I appreciate the dividend as a shareholder, but the dividend is indicating that Alibaba doesn’t know what else to do with the generated free cash flow and obviously sees limited growth opportunities for its business. I understand that Alibaba is probably trying to attract income investors and drive the share price higher this way. But it isn’t the best decision in my opinion, and I don’t know if a dividend yield of 1.25% is enough to attract income investors.

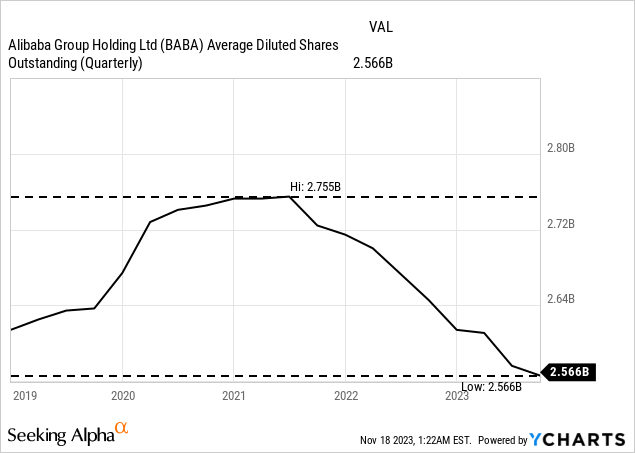

To be honest, I would rather like to see Alibaba using the cash to repurchase shares as the stock is so extremely undervalued (in my opinion). Of course, Alibaba is already buying back shares with a high pace and during the last quarter, the company repurchased 18.6 million ADSs for approximately $1.7 billion. Since 2021, when Alibaba started its share buyback program, the number of outstanding shares was decreased 7.2% from 2,755 million shares outstanding to 2,556 million right now. And under the current share buyback program a volume of $14.6 billion is remaining and with a current market capitalization of $200 billion this is enough to repurchase another 7.5% of outstanding shares (assuming that Alibaba will stay at this depressed level). The current share buyback program is effective through March 2025.

Cautiously Bullish: Easing Tensions?

One of the major concerns in the past few quarters was the rising tension between the United States and China. In my article At some point the buying opportunity will pass I wrote:

The biggest risk in my opinion is the political situation. It still seems to be unclear what position China will choose in the Russia-Ukraine conflict (with Europe and the United States and most other countries supporting Ukraine). In the last few weeks, it seemed like China is leaning more and more towards supporting Russia. In combination with allegations of China spying in the United States it could lead to new conflicts between the United States and China – including sanctions and economic consequences for China and Chinese companies.

And it would certainly be absurd to argue that the global situation got any better. Political tensions rather seem to intensify and Ray Dalio recently published a much-noticed essay titled Another Step Toward International War in which he wrote:

It appears that we are at a very critical juncture in which we will soon see if the Israel-Hamas war spreads and how far it spreads and, longer term, whether the great powers are forces for peace (and will back away from the brink of direct conflict) or get involved (and cross the brink). Hopefully the horrific and tragic images we are all seeing will encourage restraint. However, it is very likely the case that the images of civilian casualties we are seeing now and will see during an escalating war in Gaza will lead to new conflicts both between countries and within countries (e.g., repulsive violence against Jewish and Muslim populations in many countries). In my opinion, this war has a high risk of leading to several other conflicts of different types in a number of places, and it is likely to have harmful effects that will extend beyond those in Israel and Gaza. Primarily for those reasons, it appears to me that the odds of transitioning from the contained conflicts to a more uncontained hot world war that includes the major powers have risen from about 35% to about 50% over the last two years since I wrote my book Principles for Dealing with the Changing World Order.

And while the conflict between Israel and the Hamas is giving us little reason to be optimistic, it seems like the tensions between the United States and China are actually easing a bit. In the last few days Xi Jinping visited the United States. And many observers walked away with a rather positive feeling. Ray Dalio also commented:

As is typical during such Chinese dinners, there was time in the middle of the dinner when people got up, walked around the table, and chatted warmly with each other as old friends. The main feeling, I believe, that most people who were there went away with was one of friendship.

And political tension easing would certainly be a good sign – for the entire world as well as for Chinese businesses (including Alibaba).

Bullish: Wide Economic Moat

Another reason to be bullish about Alibaba in the long run is the wide economic moat around the business. And as I was looking at my previous articles about Alibaba, I noticed that I never really described the wide economic moat around the business.

Alibaba 2023 Annual Report

We can identify several different sources for an economic moat when looking at the different business segments. Let’s start by looking at Alibaba Cloud. I am certainly not a cloud expert, but I would assume that migrating all your data from one cloud provider to another is a difficult task – especially for businesses with huge amounts of data and many different applications. This is generating high switching costs for the existing customers and leading to consistent revenue streams for Alibaba’s cloud business.

Additionally, we can identify network effects – especially for marketplaces like Tmall. These marketplaces are simple two-sided networks and as every additional buyer has value for the sellers and every additional seller has value for the buyers (and vice versa) these huge networks are difficult to attack. And apparently Tmall has almost 900 million monthly active users (which is a huge part of the Chinese population).

Finally, we can see cost advantages for Alibaba. The company is among the top ten Chinese companies – according to revenue as well as earnings – and together with JD.com (JD) it is the major retailer in China. This is generating cost advantages for Alibaba that are hard to match for smaller competitors.

Extremely Bullish: Valuation

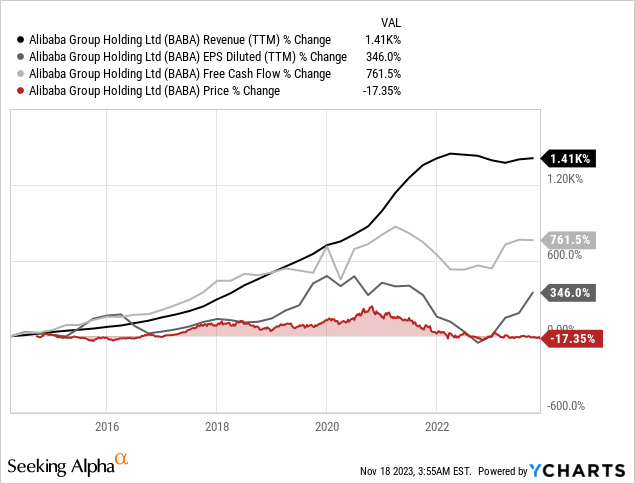

And a final reason to be bullish about Alibaba is the same reasons I mentioned in every single article since I started covering Alibaba – the low valuation the stock is trading for. And when looking at the stock price performance versus the fundamental performance of the business a huge discrepancy becomes obvious. Since the IPO of Alibaba, the stock price declined 17% – in the same time, revenue increased 1,410%. And due to declining margins, the bottom line did not keep up with these growth rates, but diluted earnings per share still grew 346% and free cash flow increased 762%.

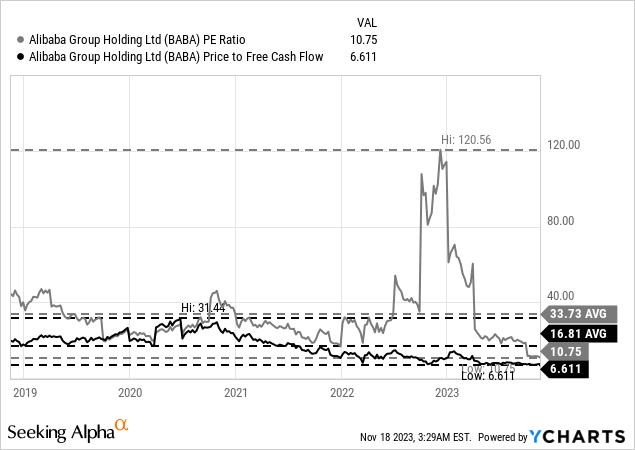

When looking at these metrics we should not ignore that there could be many reasons for a stock price not being able to keep up with high fundamental growth rates. One reason could be the extremely high valuation at the beginning and therefore the stock performance can’t keep up and we see a reversion to the mean of the P/E ratio and P/FCF ratio – despite a growing business This has certainly been the case for Alibaba and following the IPO the stock had been trading for about 50 times earnings and free cash flow.

And while these high valuation multiples might not have been justified, the current valuation multiples also aren’t. At the time of writing, Alibaba is trading for 10.7 times earnings and only 6.6 times free cash flow. And especially trading for a mid-single digit P/FCF ratio is absurd for Alibaba, a business still growing with a solid pace and with a wide economic moat around the business.

And aside from looking at the low P/E ratio and P/FCF ratio, we can also use a discounted cash flow calculation to determine an intrinsic value for Alibaba. I mentioned above that the dividend is implying that Alibaba is rather growing with a low pace. Nevertheless, we should expect a solid growth rate for the years to come as Alibaba will still be able to perform well. The current quarter also demonstrated that Alibaba is still able to grow its top line in the high single digits.

As a starting basis we can take the free cash flow of the last four quarters of $28,072 million (this time we use the amount in U.S. Dollar as we are also looking at the share price in USD) and use a 10% discount rate as well as 2,556 million outstanding shares (the last reported number). In a first calculation let’s be very cautious and assume zero growth for the years to come. Even when assuming that Alibaba is only able to generate the same free cash flow as in the last four quarters till perpetuity, the calculated intrinsic value is still $109.83.

This is also assuming that Alibaba is not able to put the generated free cash flow to any good use. It assumes that Alibaba is not buying back any shares or that the share buybacks are necessary to offset declining revenue and/or declining margins. In my opinion this is extremely unlikely, and we can confidently assume growth rates at least in the mid-single digits – share buybacks alone are enough to grow with this pace. And when calculating with 5% growth from now till perpetuity we get an intrinsic value of $219.66 for Alibaba. Of course, we should not ignore the political risks and not ignore the declining margins but in my opinion 5% growth for the years to come is still too low.

Conclusion

I will certainly hold on to Alibaba although the last two years have been difficult, and I am starting to feel like an idiot that is telling you again and again that Alibaba is a bargain while the stock is continuing to decline, and people are losing money on paper. But patience is also an important trait for every long-term investor – aside from having a game plan and a clear investment strategy.

And Jack Ma – founder of Alibaba – is also staying bullish on Alibaba and reiterated that he will keep backing Alibaba and holding his shares. The family office also pointed out that the current stock price is far below its fair value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here