Shares of Paramount Global (NASDAQ:PARA) have had a rough 12 months, losing around a quarter of their value despite a very welcome rally post-Q3 results.

Source: Seeking Alpha

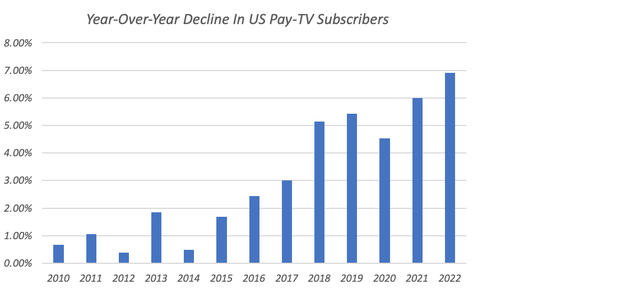

Of course, Paramount isn’t alone in its struggles. All the legacy media giants are in a state of flux these days, as not only do pay-TV subscriptions continue to decline, but the rate of attrition isn’t letting up. If anything it is actually accelerating. With the cable bundle still the overwhelming source of Paramount’s profits, and with direct-to-consumer still very much an unproven business model not just here but industry-wide, it is little wonder the stock is down so heavily.

While you can make a case that Paramount shares look bombed out, that is something you can say about its larger peers, too, and absent a more compelling value case I don’t see a strong enough reason to favor it right now.

An Inflection Point?

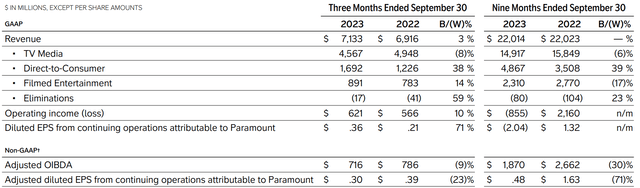

Paramount reports via three segments: TV Media, Direct-to-Consumer (“DTC”) and Filmed Entertainment. The company generated circa $1.9 billion in pre-D&A adjusted operating income (“OIBDA”) over the first three quarters, weighed down by ongoing losses in DTC (~$1.2 billion over 9M’23).

Source: Paramount Global

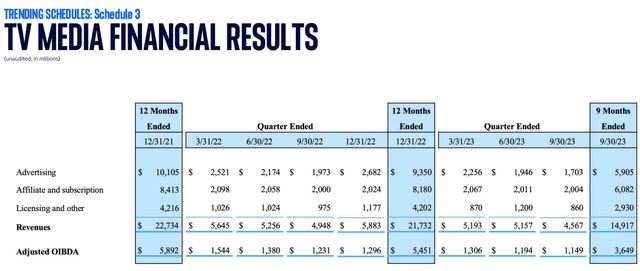

TV Media is the main profit source, raking in $3.7 billion in 9M’23 adjusted OIBDA. This segment houses linear TV assets like the CBS broadcast network; a collection of around 30 local TV stations in certain attractive markets; and pay-TV networks like Paramount Network, MTV and Nickelodeon.

Nationwide, pay-TV subscribers have obviously been falling, and they are down around 35% since 2010. This chart from my recent piece on peer Warner Bros. Discovery (WBD) shows how the rate of decline has been picking up:

Data Source: IBIS World

Although Netflix (NFLX) helped changed the game with their subscription video-on-demand (“SVOD”) service, you can see from the above that there is a bit more to it than that. The rate of decline really picked up when the likes of Paramount, WBD, Disney (DIS) et al started launching their own competing services to chase Netflix.

Not only that, but these are not just platforms for second runs and lesser quality content: fresh premium content is going on them. If companies increasingly put their best content on streaming platforms, why would consumers pay for a cable bundle unless they needed it to watch live content like sports and news? Said differently, the quality of pay-TV has fallen off a cliff even though prices keep going up. These companies broke the bundle.

Prior to the current stage of the SVOD revolution, subscriber declines were in the low single-digit per annum range as per the above chart. This is important because affiliate fees, retransmission fees and reverse compensation fees are around 40% of TV Media’s top line. These fees are what the pay-TV providers pay Paramount to show its networks, plus the fees paid by CBS affiliate stations (who themselves collect retransmission fees from pay-TV operators). Not just that, but this revenue is very high margin.

1-2% annual declines are manageable because it can be offset with similar, if not higher, hikes in per-subscriber prices. Sure, consumers would grumble a bit, but remember the bundle wasn’t broken until somewhat recently: those folks were still getting great content on TV.

Now, it looks like we may have reached an inflection point. Declines are increasing beyond the 5-6% per annum area and into high single-digit territory. This can’t be offset fully by price hikes.

For TV Media, that means serious pressure on not just advertising sales, but distribution fee revenue too. TV Media affiliate and subscription revenue fell 1% year-on-year over the first three quarters. Ad sales have also been tanking. The trend does not look great, although 2024 is a major election year and that will be a nice tonic for ad revenue:

Source: Paramount Global Q3 2023 Earnings Release

Furthermore, because pay-TV price increases only make sense for sports and news fans, the old bundle becomes even more unattractive for everyone else. There is thus good reason to expect this trend to carry on, at least until the only folks left are sports/news viewers.

Paramount+ Raising Questions

Paramount’s DTC segment has been reporting significant losses, albeit those losses are narrowing as scale increases and cost leverage kicks in. Paramount+ had 63.4 million subscribers as of Q3. That was up over 17 million year-on-year and, encouragingly, 2.1 million sequentially. It still trails Disney, WBD and Netflix by a large margin.

Scale is obviously crucial. Under the old cable bundle, networks collected their distribution fees from 100 million-plus households. Churn was not a major issue because folks couldn’t pick networks à la carte. What’s more, if Paramount wasn’t releasing a hit show, someone else in the bundle probably was – maybe AMC was releasing Mad Men or Walking Dead, or HBO was releasing Boardwalk Empire or Game of Thrones. You got filler content like Gold Rush via Discovery to tide you over. Today, those folks can unsubscribe from a platform in a click or two. It takes them less than 10 seconds.

There are all kinds of other downsides. For example, under the cable bundle, Paramount didn’t really need to deal with the consumer too much, helping profit margins. Now it has to get out there and market its service. That costs money. All round, it’s just a less profitable business model, made worse by the fact that all the streamers are operating their own discrete platforms.

The above is why management sounded positive about the carriage deal between Disney and Charter, which added the basic ad-supported tier of Disney+ to the bundle. As I said in the piece on WBD, this is also one reason why European pay-TV subs are still relatively healthy. As per management:

So first, in many respects, this is a domestic hard bundle idea. And we’ve seen clear benefits with international hard bundles, namely increased subs, no acquisition cost and lower churn. That is offset by a lower potential D2C unit revenue, given that in some shape or form, you’ll be dealing with a wholesale structure. But still, when you net it all, we see the LTV as compelling.

Bob Bakish, Paramount Global President & CEO, Q3’23 Earnings Call

The unforgiving business model of standalone streaming is also why Netflix is the only one to make money so far. It has been reporting GAAP profits for a while, though until quite recently it was not actually generating free cash flow.

Paramount+ still trails most of its peers in terms of scale. I would add a couple of points to this. Firstly, note that Paramount+ offers live sports on its streaming platform. I don’t see the logic of taking these eyeballs away from linear TV at all. Remember, even the broadcast networks, which show a lot of NFL and are free over-the-air, generate a lot of their fee revenue from pay-TV. Sports are about the only thing propping the whole thing up. Why put this on a streaming platform? While WBD has taken NBA onto its Max offering too, it is at least making it a premium add-on and charging a $9.99 monthly fee, albeit with a generous trial period. If you loved NBA and wanted to leave the bundle, you would end up having to pay $20 a month just for the games on TNT. That probably doesn’t make much sense. Disney has sensibly left ESPN where it is until it can figure out a profitable streaming model, if it exists. Note that DTC ESPN+ is not a direct stream of ESPN, mainly offering programming that it can’t fit on the linear network.

The second point is that at least two of Paramount’s competitors are not totally reliant on making DTC work. Disney has a $9 billion EBIT business in the form of its parks segment. Maybe it can afford to be more flexible and use DTC as a demand creation tool for its parks and experiences offerings. NBCU, though in a bind like Paramount and WBD, is owned by Comcast (CMCSA), which runs a cable business. Selling internet is not affected by any of this, and actually benefits as folks need faster internet connections. Unlike with video, internet service providers also don’t have to pay fees to the networks, so that business will be higher margin by default. This might be why analysts are raising questions as to whether Paramount+ should be jettisoned entirely, as Paramount looks especially vulnerable versus peers.

A Tough Value Call

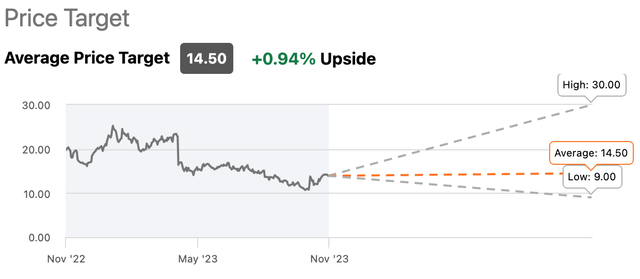

Paramount Global shares trade for $14.40 apiece as I type. Street analysts are all over the place on this one, slapping price targets on the stock that land anywhere between $9 and $30. At the average, Paramount has very little upside according to the analysts that cover it. As per Seeking Alpha:

Source: Seeking Alpha

Compare that to peers Disney (13% upside), (WBD) (52%) and (CMCSA) (18%). Paramount looks a little light, and remember, it arguably has the most risk in its business, certainly versus Disney and Comcast.

These price targets will probably be based on a multiple of EV/EBITDA applied on forward earnings projections. That multiple represents the future cashflows of these businesses discounted back to whenever the target price date is. Given the large amount of uncertainty now in these businesses, you may reasonably question the utility of such models. That’s fair. Wells Fargo’s Steven Cahall (see the link in the last section) thinks Paramount could command $30 billion for its studios alone – enough to cover its current enterprise value with a chunk of spare change. M&A, breakup or strategy change: these are perhaps the strongest bull cases here right now. Absent that, Paramount just doesn’t offer enough of a value case compared to peers, though I continue to hold.

Read the full article here