Investment action

I recommended a buy rating for Mister Car Wash’s (NYSE:MCW) when I wrote about it the last time, as the business continued to win market share and growth was evident in its positive comps, unlike competitors. Based on my current outlook and analysis of MCW, I reiterate a buy rating. I believe MCW can continue to grow at 10% in the growth stage, with the potential to outperform if the upsell initiative is executed well.

Review

Once again, MCW reported a strong 3Q23 performance that beat consensus estimates. Revenue grew 8% on top of a 12% comps while adj EBITDA margin remained steady at 30.6%, suggesting that growth was not driven by promotions. The key metric that I track—same-store sales [SSS]—also grew in the quarter by 1.7%, indicating that growth on a per-store basis has not weakened. I expect MCW’s growth momentum to continue full steam ahead, with the potential to accelerate in FY24. The factors driving my view are: strong membership growth in Unlimited Wash Club [UWC] and the rollout of the Titanium offering.

MCW continues to show good execution in its UWC strategy, as the program saw a membership increase of 11.3% in the quarter. While the addition of 6,000 net new members is the slowest sequential addition that MCW has ever printed, I don’t think this represents any signs of weakness. First of all, 2H is typically the weaker season for net new members, based on MCW historical data, so the difference between 2Q23 and 3Q23 is huge. Secondly, MCW is currently testing its promotion strategy, which has led to an increase in churn rates. Lastly, management has specifically called out that core churn rates remained in line with historic ranges. Put together, this suggests that the slowdown in net new members is not because of churn but because of slower growth.

The performance of the subscription business remained very stable in the quarter. Core churn rates remained in line with historic ranges and we did not see customers trade down to lower-priced packages. 3Q23 call

The reason for slower growth was because management decided to shift focus to upselling existing UCW users to the titanium package, which has a higher ARPU. Naturally, there are fewer resources driving growth among members. Moreover, MCW is still undergoing the process of rolling out the titanium offering across all units, which is expected to be reconfigured by the middle of 1Q24, slightly ahead of the initial plan for the end of 1Q24. With this disruption out of the picture, it should free up more resources to drive member growth and Titanium’s penetration. While the magnitude of the increase is small, 3Q23 saw a turnaround in UWC sales per member, growing by 0.2% vs. 3Q22 (the first positive growth in FY23). That said, I think investors need to reset their expectations for membership growth, as management indicated they are going to focus on driving the Titanium package penetration. The good news is that management noted that early reads from the program are encouraging. As such, I expect UWC sales growth to be balanced between ARPU growth and member growth. Management’s target for UWC penetration for titanium is at least 10% within the first year of implementation, which is by mid-Q25. Hence, I continued to think MCW could see growth acceleration in FY24, especially if the offering performs better than expected, particularly on EBITDA, as the revenue from Titanium carries a high incremental margin.

In terms of store growth, MCW doesn’t seem to be facing a lack of growth opportunities either. So far, MCW is on track to add 35 new greenfield locations this year, with 21 added year-to-date, and they plan to add more than 35 greenfield locations next year. Assuming the same sales per location, this already implies high-single-digit percentage growth, making my 10% growth rate assumption in the DCF model plausible if we take into account the potential ARPU growth and M&A opportunities.

Valuation

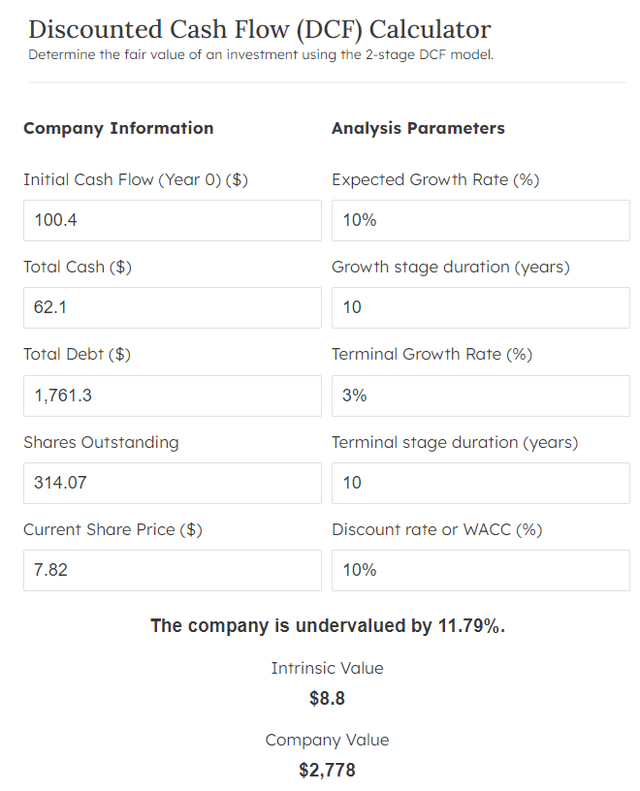

Finmaster

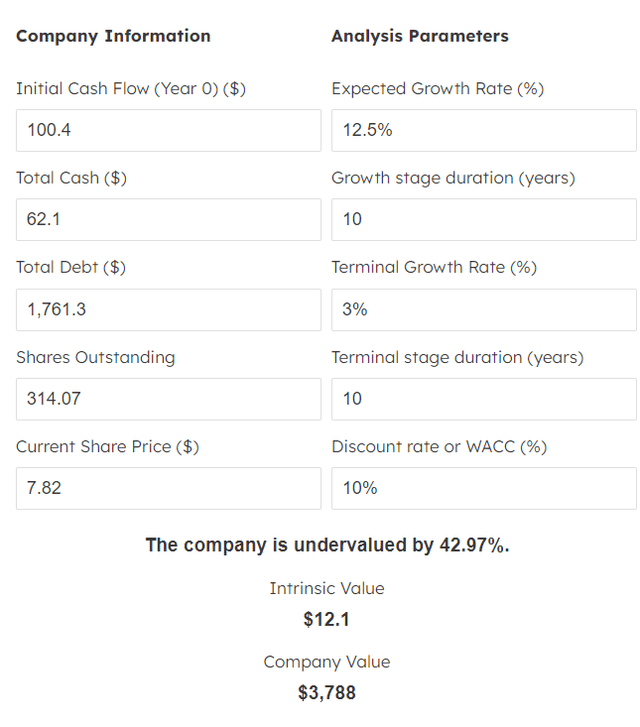

MCW share price has moved up by 10% since my update in August 2023; as such, the upside is now less attractive at ~12% based on my DCF model. The key assumptions in my simple DCF model remain the same: 10% expected growth rate and 3% terminal growth. However, as I noted above, there is potential for MCW to accelerate growth if they are able to successfully drive the titanium offering penetration within UWC. Suppose that is the cause. Using MCW historical growth as a benchmark, I think MCW can grow at 15% for the first 5 years of the growth stage before dropping back to 10% for the last 5 years of the growth stage (average out to be 12.5% for simplicity sake). In this upside case, MCW could be worth ~$12, which is where it was trading at the start of 2022.

Finmaster

Risk and final thoughts

Risk is that the consumer demand environment remains weak. Retail customers demand tend to be impacted by macro-related headwinds, as such demand could be volatile in the near-term. Also, driving Titanium offering which is higher-priced might be net detrimental as consumers are less likely to spend more. Failure to successfully execute this up-sell initiative coupled with the weaker membership growth could steer the stock sentiment towards negative.

To conclude, I maintain my buy rating for MCW, as I expect continued strong performance and the potential for growth acceleration. The slowdown in net new members stems from management’s shift to focus on upselling existing UWC users to the higher ARPU Titanium package. This strategy, though causing a temporary slowdown, could accelerate growth if well executed as it has higher ARPU.

Read the full article here