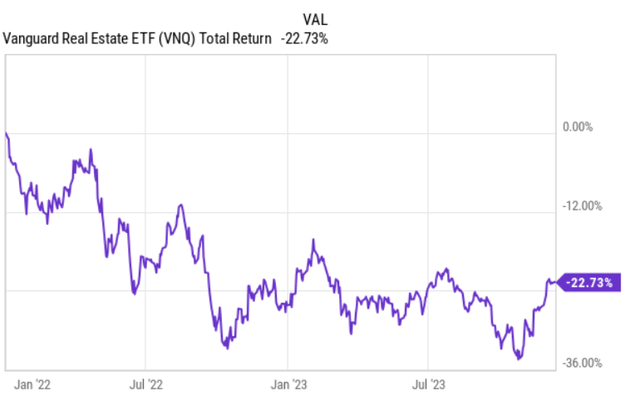

Commercial real estate as an asset class has in general registered subpar results since early 2022, when the Fed changed its accommodative stance to a clearly restrictive position.

YCharts

Yet, as we know, the commercial real estate sector itself is not homogenous. It consists of many subsectors, which to a large extent carry distinct risk and return characteristics.

For example, there is a huge difference between data center and retail real estate, where the former has advanced by ~20%, while the latter decreased by ~11% on a YTD basis.

A completely hammered office space – a couple of facts

In the case of the office segment, we are talking about the absolute worst performing element within the entire universe of different real estate subsectors.

The main driver behind the struggling office sector is structurally lower demand for office space due to the work from home dynamics. This has, in turn, caused several consequences further down the business chain or, in other words, a vicious cycle (e.g., lower demand leading to more vacant space, more vacant space creating pricing pressures, pricing pressures causing new investments to drop, declining prices and investment activity creating concerns among lenders, concerns among lenders limiting access to sound financing etc.)

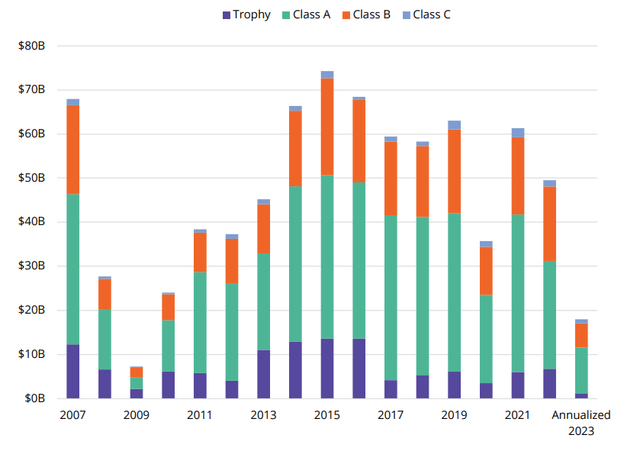

Now, let me quickly highlight a couple of data points, which should substantiate the fact that the office is in very bad shape as of now.

Avison Young – Market Report

The investment volumes among all key office categories has plunged in 2023 to similar levels we experienced around the GFC period. It seems that because of the high uncertainty, nobody is willing to commit notable streams of capital in the office space.

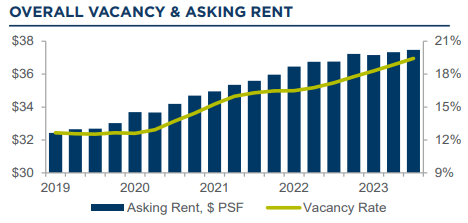

Cushman & Wakefield

And this is totally understandable given how consistently the vacancy rates are ticking higher, while asking rents PSF have remained flat during the most inflationary environment we have had in the past decade or so.

Avison Young – Market Report

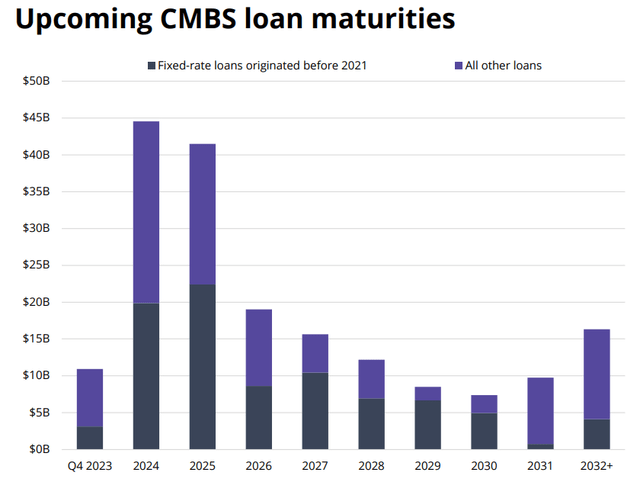

Finally, one of the main areas of concern is the upcoming debt maturity wall, which to a meaningful extent consists of very cheap loans assumed before the Fed decided to go the “hawk” road.

More practically speaking, this situation makes the market nervous (to say the least) and contemplate on the following (selected) question:

- Will the banks be ready to refinance these mortgages at more relaxed covenants?

- Will the new cost of financing be at a level, which could be covered by the underlying cash flows?

- If the properties had to be marked to market, would there be any equity surplus left?

The opportunity

Despite the recent dynamics in the monetary policy, which start to finally secure some certainty in the market (i.e., that the rates will not go higher from here), the fundamental challenges are still there.

This is only logical given that the key challenge is not the financing itself, but the overall demand for office space. Obviously, putting on top of it the notion of way more expensive credit relative to the time when the demand for office was still strong renders the whole story more risky.

So, here is the thing: irrespective of whether the SOFR goes down by 25, 50 or 150 basis points in 2024, the overall office sector will still suffer.

Office REITs will still have to refinance at much higher interest rates and do so in a significant manner (volume), while every lender is aware of the secular demand, vacancy and new investment issues.

All this, in my opinion, creates a wonderful basis for long-term investors to apply their fundamental analysis and rely on the long-term horizon perspective to capture alpha.

Let me introduce you to two REITs, which, in my view, have been thrown out with the bathwater despite embodying fundamentally sound characteristics that should reward patient investors.

#1 Alexandria Real Estate Equities, Inc. (NYSE:ARE)

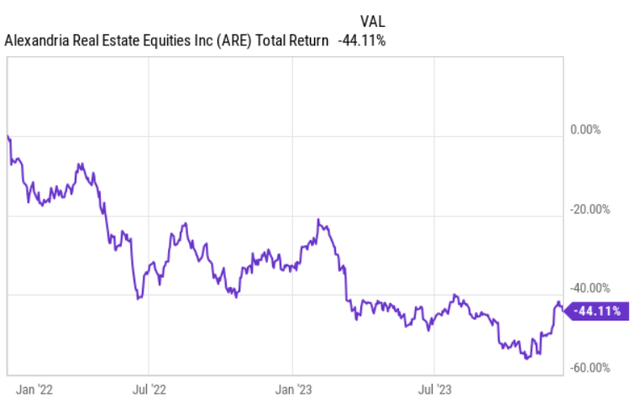

ARE is one of the names, which has suffered considerably since early 2022.

YCharts

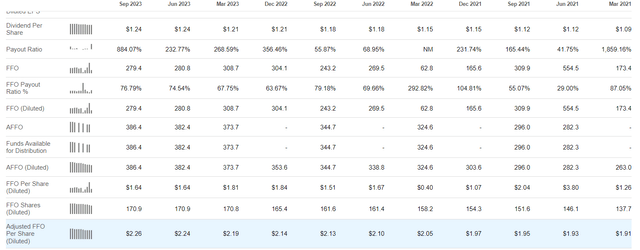

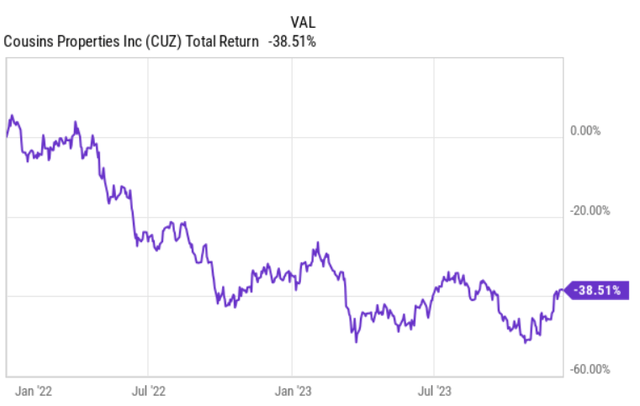

Even though ARE is down by ~44%, the underlying earnings have kept improving. For example, the quarterly AFFO per share metric has gotten better 11 quarters in a row.

Seeking Alpha

The combination of declining share price and growing earnings has led to a situation, where currently, ARE’s P/CF multiple (~13x) has reached an all-time low from the historical 10-year perspective.

Seeking Alpha

If we add to the equation the consensus estimate on future FFO, the picture becomes even more attractive. In other words, if the share price remains constant at this level, the multiple should, theoretically, continue going lower, which I highly doubt is the case against the backdrop of very resilient fundamentals and already significant lows in the existing valuations.

There are a couple of elements, which make ARE so unique and unfairly punished by the market, but the following two are the most critical ones.

First, ARE carries one of the best balance sheets in the industry, with great characteristics across the board. For example, ARE has no debt maturities until 2025 and until then the interest rate risk is completely neutralized due to fixed rate debt and additional hedges on the revolver.

ARE Investor Presentation

Plus, ARE has a strong triple B rating and is just one notch away from receiving an upper investment grade credit rating, which puts the company in a very favourable position to refinance at optimal rates.

And second, while ARE is completely protected from the looming debt maturity wall issues in the office sector, it is also to a great extent isolated from the fundamental struggles (e.g., reduced demand for office space).

Most of ARE’s portfolio consists of AAA and trophy type properties for which there is inherently more durable demand, given the attractiveness and locations of these properties. Moreover, one of ARE’s focus points is life science and pharma tenants for which the properties are specifically tailored to accommodate their needs, which are not impacted by the work from home dynamics.

For example, the fact that as of Q32023, ARE had 96% of its portfolio occupied despite the increasing vacancy levels in the overall sector is a clear testament of ARE’s solid portfolio quality.

#2 Cousins Properties (NYSE:CUZ)

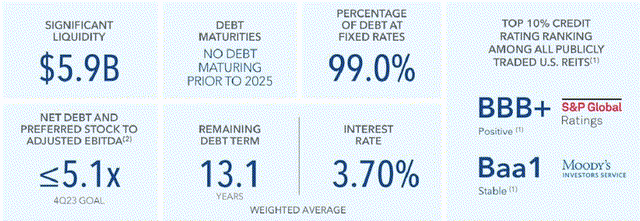

CUZ is the second obvious office REIT, which has suffered along with the sector while having a fundamentally sound and resilient business.

YCharts

Since the underlying earnings and cash generation have remained stable and relatively unaffected by the prevailing headwinds, the valuations have quite naturally come down to very attractive levels.

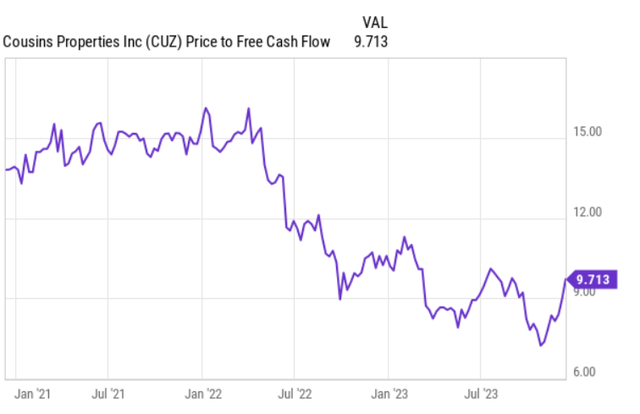

YCharts

In P/CF terms CUZ trades at a single digit multiple, which is close to the lowest level in the past 3-year period.

Seeking Alpha

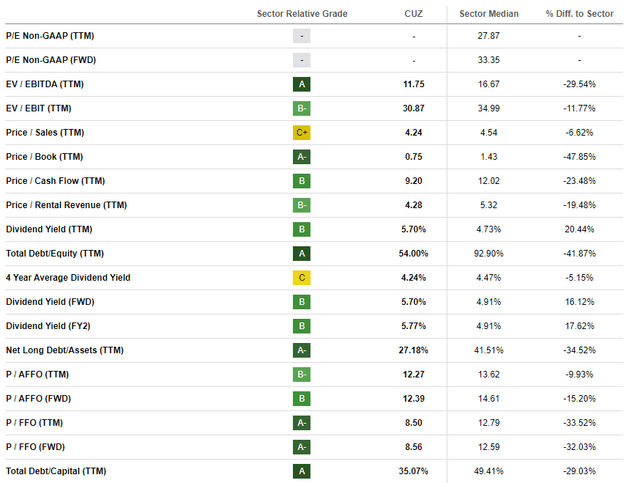

The Seeking Alpha valuation table also depicts the valuation situation very nicely, where we can see that no matter what ratio we take, CUZ looks cheap.

Moreover, similar to ARE’s case, the forward multiple (e.g., P/FFO) is projected to go down considering the FFO growth expectations and assuming a constant share price.

In my opinion, this presents a wonderful buying opportunity for long-term value investors. Here are additional arguments on top of the already solid fact of stable (and slightly growing) FFO despite plunging share price.

Just like ARE, CUZ carries a high quality portfolio consisting of AAA and trophy properties, which are placed in high demand locations.

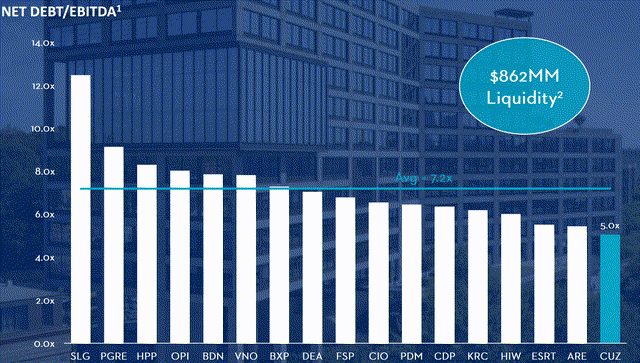

It also has a robust financial profile, which is underpinned by one of the soundest balance sheets in the industry.

CUZ Investor Relations

Moreover, conservative FFO distribution of ~50% in conjunction with only 2.8% of debt maturing in 2024 introduces an additional layer of safety.

The bottom line

The overall office sector is currently going through major struggles, where the reduced demand leads to rising vacancy levels, pressures on the pricing and more constrained access to financing. The huge debt maturity wall, which consists of cheap loans issued before the Fed’s tightening cycle, makes matters even worse.

As a result, the market has rotated away from the sector, causing valuations to drop across the board.

This has created opportunities for fundamentally sound and resilient office REITs, which carry strong balance sheets and have unique portfolio that warrant solid earnings generation.

ARE and CUZ are clear examples of this.

Read the full article here