My biggest pet peeve when it comes to investing is the constant negativity by the uber-bears, the disheartened traders, the financial advisers or other know-it-all “professionals”, and even to a certain extent, the Bogleheads, who all stand on their collective soapbox together and declare that it’s impossible for the average Joe living on Main Street to beat the market.

Actually, it’s more than that. This notion is not just an annoyance to me. It fills me with abhorrence.

I hate the group-think that causes so many people to believe that success is not achievable.

It is.

I hate the idea that the stock market is a wild casino where only speculators and large risk-takers can win big.

It’s not.

I especially hate the idea that the stock market is rigged against the Average Joe.

Once again, it’s not.

In 2023 I beat the stock market, yet again.

My time-weighted returns came in at 28.02%.

That’s better than the 25.99% that the SPDR S&P 500 ETF Trust (SPY) returned during 2023 with dividends included.

And that 28% market isn’t even the risk-adjusted return. I was able to hit that mark while also raising my cash weighting throughout the year.

This 2023 beat marks the 9th time during the past 12 years that I’ve beaten the market.

So no, my record isn’t perfect. But, I’d say that a 75% win-rate is pretty consistent.

Yet, despite stories like this, so many people still believe that outperformance is out of reach

This is because of the constant chorus of negativity coming from the naysayers.

They do their best to convince themselves – and anyone who will listen – that outperformance is impossible.

So why try? They ask, rhetorically.

They do their best to channel their inner George Hurstwood and say weakly, “What’s the use?”

You probably didn’t expect to read a Theodore Dreiser quote today, but if anything, the fact that an English major with an affinity for American Naturalism is writing this report goes to show that anyone can succeed in the stock market.

Not only can anyone succeed… I truly believe that anyone can beat the market (on a consistent basis).

What so many people seem to forget is that it doesn’t take a genius or some super hero investor to beat the market. All you have to do is be slightly better than average.

Obviously, my competitive spirit pushes me beyond that threshold. I’m not content with being “slightly better than average” at anything.

That’s why I work so hard to stay on top of my holdings, research new opportunities, and most importantly, maintain an even keel so that I stay rational in the markets at all times (or at least, as close to that as is humanly possible).

Probably the best news for investors is that there are many ways to beat the market.

I’ll be the last person to say that there’s only one way to skin this cat.

But, over the years I have figured out a system that leads to success, personally.

And that’s what I’m going to talk about in this 2023 year-end review.

My Simple Formula For Success

Over the years I’ve become more and more convinced that all an investor has to do to succeed in the market is buy wonderful companies at fair prices and then be willing to hold, through thick and thin, so long as the fundamental and dividend growth thesis remains intact.

There’s a cliche phrase that you’ll hear in investing circles, “It’s time in the market that’s important, not timing the market.”

And it couldn’t be more accurate.

Compounding is the name of the game when it comes to true wealth generation and I’ve adopted that mindset, more than ever, during 2023.

I used to be a fairly strict value investor.

I was always looking for an attractive margin of safety. The bigger the discount, the better.

Mean reversion was my best pal and I truly believed that deep value was the way to go.

Well, those days are over.

These days, I guess you could call me a “fair value” investor.

Honestly, that’s all I need to see the pull the trigger these days.

And why is that? Well, because I’m only interested in buying the bluest of the blue chips and those companies rarely go on sale.

I’ve written about the power of compounding extensively throughout recent quarters. My readers know that I’m looking to buy what I call, perpetual compounders… meaning companies with long histories of extraordinary fundamental growth rates and reliable/predictable forward-looking growth prospects.

I want reliability, above all else. And my major 2023 investments reflect that.

Some examples of companies that I’ve dedicated a lot of capital towards this year are S&P Global (SPGI), Accenture (ACN), Broadridge Financial Solutions (BR) Canadian National Railway (CNI), Danahar (DHR), Thermo Fisher (TMO), Air Products and Chemicals (APD), and UnitedHealth Group (UNH). If you look at their histories, you’ll notice one thing in common: extremely consistent bottom-line growth.

I’m also looking to accumulate companies with monopolistic tendencies, high barriers to entry, and wide, competitive moats.

And of course, I want to see reliable dividend growth (I own a few non-dividend payers, but companies must benefit from extremely strong secular growth tailwinds for me to consider owning them if they don’t contribute to my passive income stream).

These are the types of assets that have – and should continue to – do well over long periods of time.

They require minimal work from a due diligence standpoint (because of their wide moats) and they involve relatively low stress (because of their reliable growth and strong competitive positions).

Understanding that time is my biggest asset, I’m happy to pay fair value for these types of companies and then let the compounding process begin.

If the market provides an opportunity to average down into these types of positions at a discount, well that’s great.

But, it’s not necessary to generate outsized returns because of the outsized fundamental growth that these types of stocks produce.

Now, I should note that I’m not a 100% buy and hold investor.

Readers who follow my portfolio closely know that some of my biggest trades in 2023 were sales.

For instance, I trimmed my Apple (AAPL) position when its rally pushed its individual weighting up above a level where I felt comfortable. I knocked that AAPL weighting down from ~15% to ~9% in May and have felt great about the trade ever since.

Here’s the article I wrote about “The Biggest Trade” that I’ve ever made.

I sold AAPL for $173. Today, it trades for $184. Therefore, it moved up roughly 6.3% since my trim.

Well, as you can see below, the average performance of the stocks that I bought with the proceeds was higher (at 10.7%).

|

Company |

Ticker |

Apple Trade Buy Price |

Price on 1/4/2024 |

Gain/Loss % Since |

|

Accenture plc |

(ACN) |

$268.75 |

$337.92 |

25.70% |

|

Air Products and Chemicals, Inc. |

(APD) |

$292.90 |

$270.86 |

-7.50% |

|

ASML Holding N.V. |

(ASML) |

$643.29 |

$703.37 |

9.30% |

|

BlackRock, Inc. |

(BLK) |

$641.86 |

$784.15 |

22.20% |

|

Broadridge Financial Solutions, Inc. |

(BR) |

$153.72 |

$197.12 |

28.20% |

|

Danaher Corporation |

(DHR) |

$242.21 |

$230.81 |

-4.70%* |

|

Linde plc |

(LIN) |

$365.47 |

$408.71 |

11.80% |

|

MSCI Inc |

(MSCI) |

$469.22 |

$549.87 |

17.20% |

|

Thermo Fisher Scientific Inc. |

(TMO) |

$543.99 |

$528.82 |

-2.80% |

|

UnitedHealth Group Incorporated |

(UNH) |

$498.31 |

$542.03 |

8.80% |

|

Visa Inc. |

(V) |

$229.87 |

$257.98 |

12.20% |

|

Zoetis Inc. |

(ZTS) |

$179.34 |

$192.93 |

7.60% |

|

average |

10.70% |

*Technically, these DHR returns are better because of the VLTO spin-off, but I was too lazy to figure out the exact spin-adjusted returns were.

Thus far, with this trade I was able to reduce single stock risk, augment my passive income stream in a major way (55%), and generate relatively stronger returns (albeit, over a very short period of time).

Another major trade that I made happened more recently, when I sold approximately 3% of my portfolio to make the initial down payment on a new house that my wife and I are building.

That trade was tough to make because for years, I’ve been so focused on building out my passive income stream by accumulating dividend growth stocks… it felt odd selling. But, we need a couple of extra bedrooms for our family and I know the new home will result in improved quality of life.

You can see an in depth discussion of those trades here, where I discussed “Big Changes” that I made to my dividend growth portfolio.

This was a series of trades brought on by a unique life-moment, so I don’t have regrets.

It’s hard to part ways with blue chips. And the worst part about those trades is that it will take a lot of work to recoup the passive income losses associated with those shares. But, with mortgage rates as high as they are, I decided that it was a good idea to sell relatively low conviction stock holdings and lock in guaranteed returns.

Thankfully, rates have trended in the right direction since I made that initial cash deposit and it’s looking like I won’t have to make any large stock sales for the home (I’d be content to lock in the ~6.5% rates that I’m seeing right now). Here’s to hoping they continue to trend lower between now and June when I have to make a final decision.

I say all of this because I don’t want readers to think that I simply buy and forget everything.

I think that would be irresponsible.

It’s important to constantly monitor one’s holdings and sometimes, people need money unexpectedly.

Selling stock isn’t the death sentence that some people make it seem like, but I do believe that it’s something that should be done very carefully.

Although I think time in the market is every investors’ biggest resource, I also believe that there are justifiable reasons to sell stocks (even if they’re blue chips).

If fundamentals change, my investment thesis changes.

If my thesis breaks, then I tend to move on.

If dividend growth stops meeting (or exceeding) my expectations, then I tend to move on.

And lastly, if I lose faith in a company’s management team, I tend to move on.

You see, there are many fish in the sea. I follow hundreds of high quality companies that I’d be happy to own. So, if one stops working out for me, I’m not opposed to selling. But, before I do, I think about it long and hard because I know that in doing so, I could be parting ways with a compounder, which, statistically speaking, is more likely than not going to end in regret.

Letting Growing Dividends Be My Guide

To me, one of the simplest and easiest ways to identify a very high quality company is to use dividend growth as a basic screen.

I know that some investors love to hate dividends.

They say that they’re very inefficient from a tax perspective.

They say that dividends are not “free money” and every time a company pays one, it should be worth less.

And to a certain extent, they’re right.

Dividends are “doubled taxed”… meaning, companies are taxed on their income and then shareholders are taxed again on the dividends. But, that doesn’t mean I don’t find them attractive.

Sure, it’s theoretically possible that any given company should use its cash flows on something more productive than paying a dividend… such as research and development, mergers and acquisitions, increased capex to build a moat, paying down debt on the balance sheet, or by simply buying back shares (the most tax efficient way to return cash to shareholders).

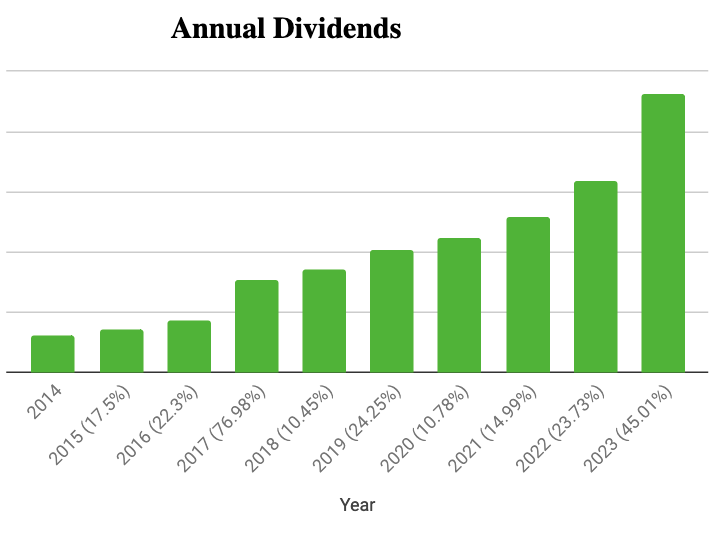

But, the fact is, there are companies on earth that generate such strong cash flows that they can do all of the above (and still have cash to spare).

When I say that I let dividends be my guide, I’m not talking about unsustainable high yields. I’ve been there and done that and it doesn’t work out well.

Instead, I’m talking about companies with generous management teams that generate predictable, reliably growing cash flows that lead to sustainable, reliably growing dividends.

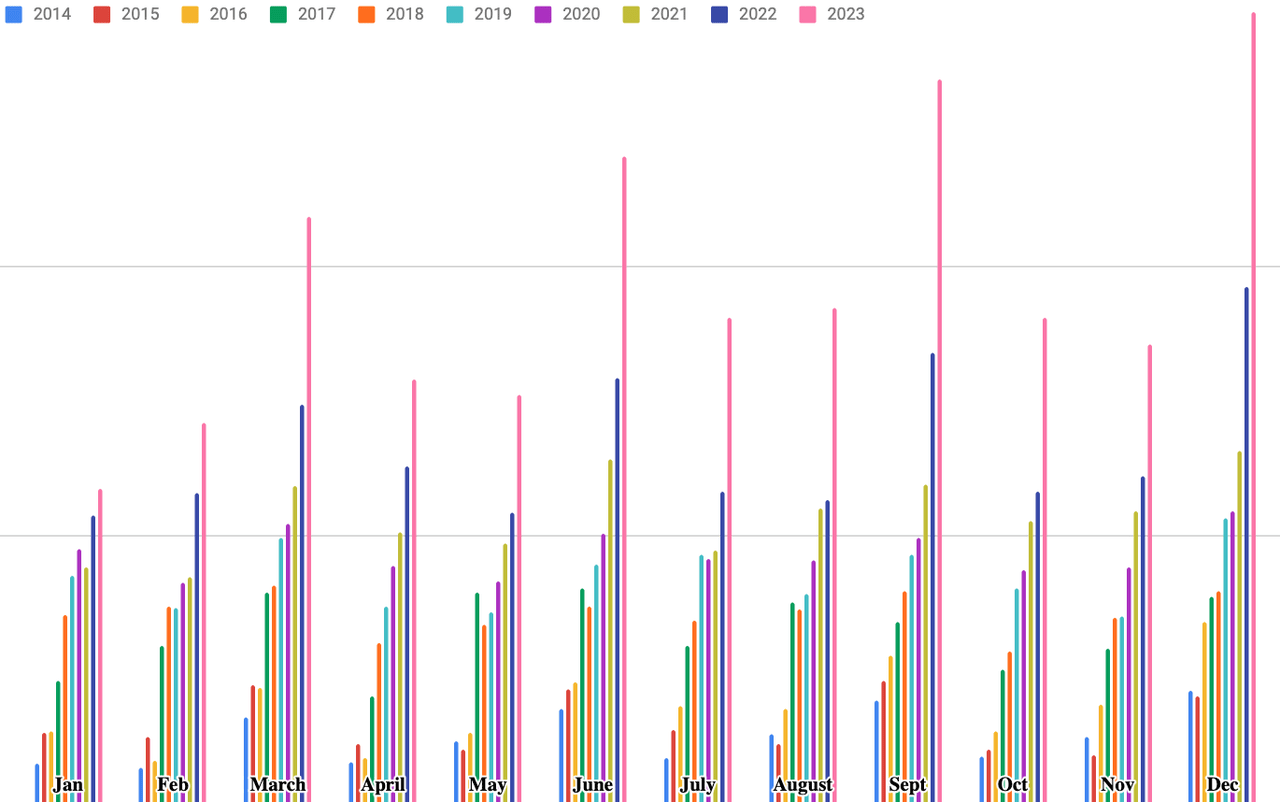

I post this chart every time that I publish a portfolio review because it’s what gives me peace of mind when thinking about my portfolio, my financial future, and ultimately, the financial legacy that I will leave behind.

Nick’s Data

I’m not just managing a portfolio… I’m managing a passive income machine.

I’m working on the schematics of something that won’t just compound like this for years, but decades… generations even.

To me, financial freedom is the moment that my passive income fully covers my lifestyle expenses.

I plan to live 100% on dividends in retirement. That means I won’t have to sell a single share that I’ve accumulated throughout my life to fund my expenses later in life. Therefore, the fruit of my labor will be long lasting. Because of the reliable dividend growth that I generate, I won’t have to worry about inflation eroding away my purchasing power. And since I don’t plan on ever touching my principle, I don’t have to stress over the idea of running out of money in retirement.

Most importantly, I can rest easy, knowing that all of the hard work my wife and I are doing now will be able to help our children, and their children, and their children after that, so long as they’re all educated properly.

I’m not just building financial freedom for myself with my passive income stream. I’m creating generational wealth which has the potential to keep my family free of financial burdens in perpetuity.

That scenario seems so much better to me than working for decades and then relying on something like the 4% rule to essentially die with nothing to show for my life here on Earth.

Now, I’m not there yet. But, the compounding that you’re seeing play out above helps me to track success and measure the time that I have left in my journey towards that ultimate goal of financial freedom.

It’s easy to track what percentage of my monthly and/or annual spend my passive income currently covers.

Since I’m still working, all of my passive income is reinvested, accelerating the compounding process organically. One day, I’ll exit the accumulation phase of my dividend growth journey and enter into the distribution phase. That will be a glorious day, indeed.

This realistic goal of total financial freedom is made possible by the power of compounding dividends.

One of the simplest screens that I use when adding or removing companies from my watch list is their annual dividend increase streak.

Obviously what’s in the past is in the past and cannot be used as an accurate predictor of the future; however, when I see that a company has been able to reward shareholders with a sustainably growing dividends for years (or decades, even) then I feel more confident about its corporate culture, the strength of its moat, and its leadership’s ability to adapt, evolve, and ultimately thrive, over time.

No company has reached blue chip status because they were without challenges.

The market is too competitive for that.

Blue chip/cash cow companies have reached their illustrious standings because of their proven abilities to constantly overcome hurdles and win against competitive threats, time and time again.

As a long-term shareholder in the market, I want to partner with proven winners.

Excellence never happens by accident.

And to me, a reliably growing income stream is the most tangible way to measure sustained excellence in the market place.

What’s more, a reliably growing passive income stream helps me to stay calm in the markets.

Knowing that my dividend income stream is going to continue to grow larger and larger, regardless of what the market is going on a day-to-day basis, allows me to overlook short-term volatility and remain focused on the long-term fundamental health and growth prospects of my holdings.

This long-term focus helps me to avoid common pitfalls in the market: namely, chasing momentum and buying high (because doing so would result in a lower yield on cost) and/or falling prey to fear and selling low (because doing so would damage my passive income stream).

The reason that so many investors fail in the market is their inability to overcome the basic emotions that are a part of human nature.

Fear and greed are our enemies in the market. Overcoming human nature isn’t easy. But, having a tangible dividend anchor to latch on to during volatility certainly helps.

The tangible nature of a dividend income stream is a great way to track success which can reinforce faith in one’s investment strategy and therefore, fight off the fear that would otherwise lead to mistakes.

And, it’s not as if I’m leaving a lot of chips on the table by owning blue chip dividend growers.

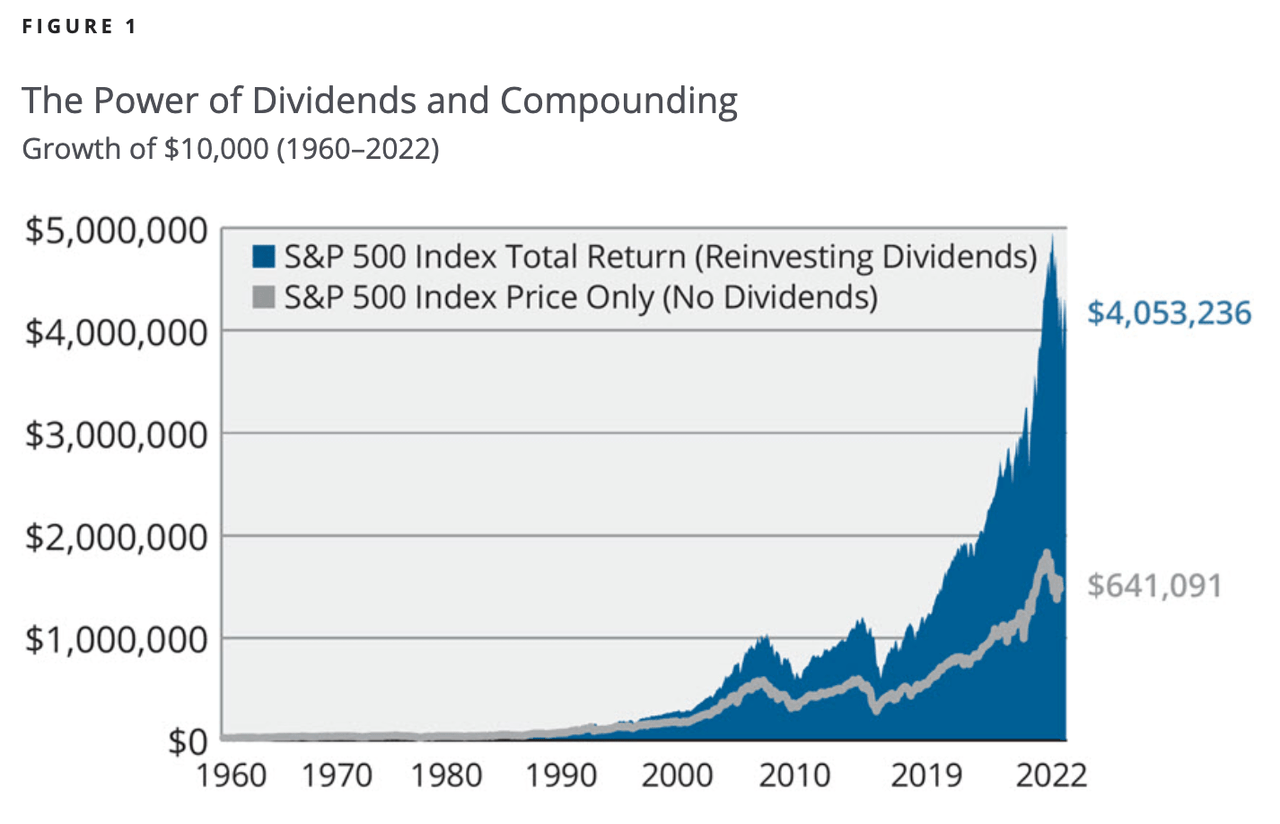

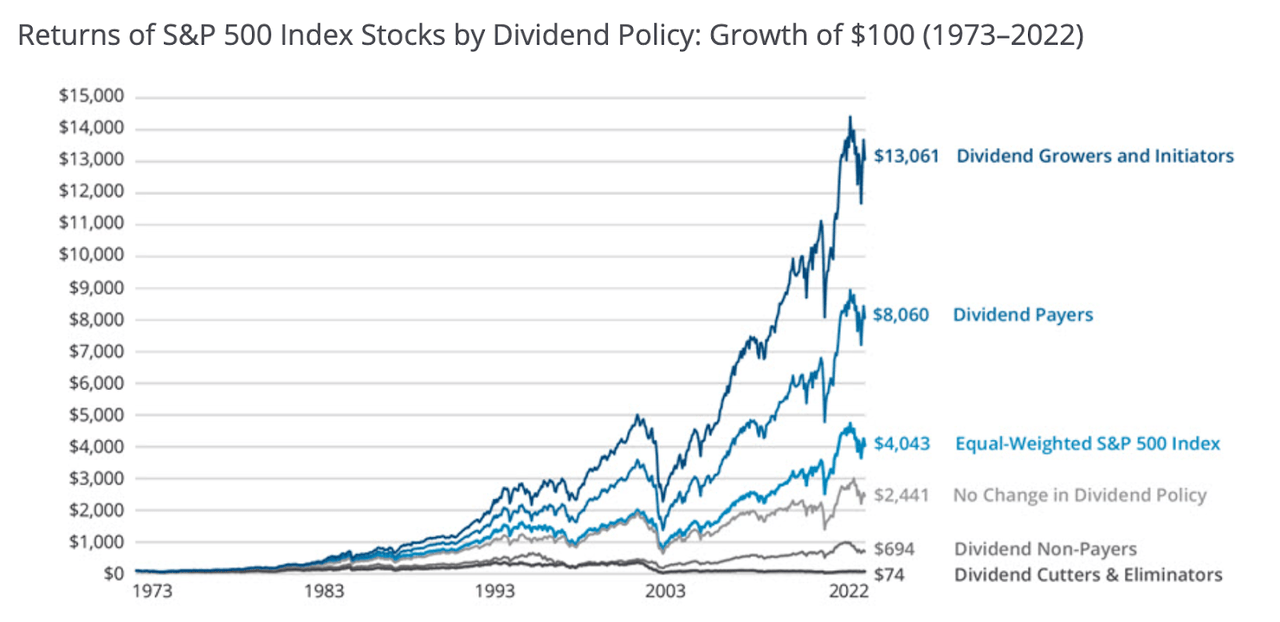

I’ve seen several long-term studies which show that dividend growers outperform over the long-term.

Probably the most notable one (in my opinion, at least) is a 2022 report published by the Hartford Funds which found two things:

One, the majority of long-term total returns came from dividends…

The Power of Dividends Study

And two, the best performing stocks in the S&P 500 are those that reliably grow their dividends…

The Power of Dividends Study

Why is this the case, you wonder?

Well, in a nutshell, because the market is a weighing machine and the fundamental growth that supports reliable dividend growth over the long-term also supports rising share prices.

I know that none of this is new or especially revolutionary information for most readers. But, as I said before, a K.I.S.S. strategy, revolving around very high quality compounders and reliable growing dividends work.

My results clearly show this and I’m sure that there are many other investors – living on both Main Street and Wall Street – who can attest to the power of simply buying and holding blue chips and watching their dividends compound over time.

Nick’s Data

Look, the market goes up and down. It’s unpredictable and that volatility can be unsettling. On the other hand, dividends are much more predictable because they’re based on underlying fundamentals and not investor sentiment.

A jagged stock chart doesn’t help me sleep at night, but these dividend graphs do.

To me, that’s what dividend growth investing is all about.

Nicholas Ward’s Dividend Growth Portfolio

|

Core Dividend Growth |

52.61% |

|||

|

Company name |

Ticker |

Cost basis |

Portfolio Weighting |

2023 Gain/Loss |

|

Apple |

(AAPL) |

$22.79 |

8.89% |

53.94% |

|

Microsoft |

(MSFT) |

$72.84 |

4.65% |

56.96% |

|

Broadcom |

(AVGO) |

$234.30 |

4.61% |

101.68% |

|

BlackRock |

(BLK) |

$462.83 |

2.22% |

14.01% |

|

Qualcomm |

(QCOM) |

$76.44 |

1.91% |

34.92% |

|

Air Products and Chemicals |

(APD) |

$259.89 |

1.67% |

-10.69% |

|

Canadian National Railway |

(CNI) |

$112.23 |

1.56% |

5.42% |

|

Starbucks |

(SBUX) |

$48.10 |

1.53% |

-4.78% |

|

Johnson and Johnson |

(JNJ) |

$114.02 |

1.43% |

-12.04% |

|

Merck |

(MRK) |

$73.71 |

1.28% |

-1.91% |

|

PepsiCo |

(PEP) |

$106.84 |

1.26% |

-5.33% |

|

Honeywell |

(HON) |

$142.19 |

1.22% |

-2.14% |

|

Lockheed Martin |

(LMT) |

$354.14 |

1.11% |

-5.09% |

|

Parker-Hannifin |

(PH) |

$255.96 |

1.09% |

57.90% |

|

Broadridge Financial Services |

(BR) |

$148.90 |

1.08% |

52.91% |

|

Lowe’s |

(LOW) |

$135.11 |

1.05% |

11.81% |

|

RTX Corp. |

(RTX) |

$80.22 |

1.04% |

-16.54% |

|

Coca-Cola |

(KO) |

$42.38 |

0.98% |

-6.39% |

|

Amgen |

(AMGN) |

$136.07 |

0.94% |

10.14% |

|

Deere & Co. |

(DE) |

$347.85 |

0.92% |

-5.76% |

|

Texas Instruments |

(TXN) |

$110.11 |

0.89% |

4.44% |

|

Cisco |

(CSCO) |

$23.80 |

0.85% |

5.38% |

|

Illinois Tool Works |

(ITW) |

$130.90 |

0.76% |

18.89% |

|

Brookfield Infrastructure |

(BIPC) |

$31.06 |

0.72% |

-9.14% |

|

Brookfield Renewables |

(BEPC) |

$33.49 |

0.70% |

1.84% |

|

Ecolab Inc. |

(ECL) |

$143.58 |

0.69% |

34.74% |

|

Hershey |

(HSY) |

$217.10 |

0.68% |

-17.84% |

|

L3Harris Technologies |

(LHX) |

$192.50 |

0.68% |

1.78% |

|

Rexford Industrial Realty |

(REXR) |

$51.69 |

0.65% |

3.30% |

|

Linde |

(LIN) |

$355.48 |

0.60% |

29.01% |

|

AvalonBay Communities |

(AVB) |

$164.30 |

0.59% |

15.93% |

|

Northrop Grumman |

(NOC) |

$385.78 |

0.48% |

-13.36% |

|

Essex Property Trust |

(ESS) |

$214.97 |

0.47% |

17.33% |

|

Waste Management |

(WM) |

$158.46 |

0.45% |

14.05% |

|

McDonalds |

(MCD) |

$249.04 |

0.42% |

12.17% |

|

Sherwin Williams |

(SHW) |

$219.30 |

0.42% |

30.30% |

|

Prologis |

(PLD) |

$118.30 |

0.42% |

18.29% |

|

Republic Services |

(RSG) |

$123.71 |

0.31% |

28.16% |

|

Camden Property Trust |

(CPT) |

$114.08 |

0.30% |

-10.29% |

|

Alexandria Real Estate |

(ARE) |

$130.96 |

0.29% |

-12.03% |

|

Agilent Technology |

(A) |

$116.28 |

0.28% |

-7.34% |

|

Carlisle Companies |

(CSL) |

$228.31 |

0.24% |

33.35% |

|

Mid-America Apartments |

(MAA) |

$163.02 |

0.14% |

-13.49% |

|

Automatic Data Processing |

(ADP) |

$220.60 |

0.14% |

-1.97% |

|

High Yield |

7.01% |

|||

|

Realty Income |

(O) |

$62.34 |

1.67% |

-10.00% |

|

AbbVie |

(ABBV) |

$79.08 |

1.09% |

-4.56% |

|

British American Tobacco |

(BTI) |

$37.42 |

0.89% |

-27.57% |

|

Enbridge |

(ENB) |

$39.33 |

0.89% |

-7.71% |

|

National Retail Properties |

(NNN) |

$38.38 |

0.62% |

-6.35% |

|

Toronto Dominion Bank |

(TD) |

$65.06 |

0.60% |

0.73% |

|

Federal Realty Trust |

(FRT) |

$114.86 |

0.49% |

0.38% |

|

Royal Bank of Canada |

(RY) |

$100.18 |

0.29% |

7.99% |

|

Altria |

(MO) |

$42.08 |

0.24% |

-11.38% |

|

Pfizer |

(PFE) |

$38.17 |

0.23% |

-43.84% |

|

High Dividend Growth |

13.46% |

|||

|

Visa |

(V) |

$111.30 |

2.82% |

25.54% |

|

S&P 500 Global |

(SPGI) |

$358.53 |

1.48% |

31.43% |

|

UnitedHealth Group |

(UNH) |

$484.60 |

1.15% |

1.51% |

|

Nike |

(NKE) |

$62.68 |

1.14% |

-8.57% |

|

Thermo Fisher |

(TMO) |

$529.96 |

1.02% |

-4.05% |

|

Accenture |

(ACN) |

$270.99 |

0.99% |

29.84% |

|

MasterCard |

(MA) |

$90.44 |

0.97% |

22.98% |

|

Danaher |

(DHR) |

$211.57 |

0.77% |

-0.49% |

|

Intercontinental Exchange |

(ICE) |

$97.23 |

0.63% |

24.41% |

|

ASML Holding |

(ASML) |

$649.43 |

0.57% |

37.73% |

|

Zoetis |

(ZTS) |

176.61 |

0.49% |

34.40% |

|

Booz Allen Hamilton |

(BAH) |

$75.49 |

0.42% |

22.31% |

|

MSCI |

(MSCI) |

469.41 |

0.39% |

22.66% |

|

Moody’s |

(MCO) |

$326.70 |

0.38% |

41.27% |

|

Carrier |

(CARR) |

$32.67 |

0.24% |

38.07% |

|

Non-Dividend |

7.45% |

|||

|

Alphabet |

(GOOGL) |

$44.34 |

4.76% |

56.74% |

|

Amazon |

(AMZN) |

$94.07 |

2.39% |

77.04% |

|

Salesforce |

(CRM) |

$233.58 |

0.20% |

95.24% |

|

Palantir |

(PLTR) |

$10.79 |

0.10% |

168.70% |

|

Special Circumstance |

7.25% |

|||

|

NVIDIA |

(NVDA) |

$61.61 |

3.22% |

245.94% |

|

Main Street Capital |

(MAIN) |

$39.74 |

0.88% |

19.89% |

|

Owl Rock Capital |

(OBDC) |

$13.64 |

0.86% |

26.71% |

|

Blackstone |

(BX) |

$97.51 |

0.72% |

75.14% |

|

Canadian Pacific Kansas City |

(CP) |

$71.64 |

0.69% |

5.58% |

|

CME Group |

(CME) |

$183.73 |

0.43% |

27.78% |

|

Ares Capital Corp. |

(ARCC) |

$17.28 |

0.29% |

7.86% |

|

Brookfield Asset Management |

(BAM) |

$23.67 |

0.16% |

41.15% |

|

Veralto |

(VLTO) |

$83.81 |

<0.10% |

n/a (mid-year spin off) |

|

Cash Equivilents |

12.02% |

|||

|

Fidelity Treasury Money Market Fund |

(SPAXX) |

$1.00 |

9.91% |

0.00% |

|

WisdomTree Floating Rate Treasury Fund ETF |

(USFR) |

$50.40 |

1.41% |

-0.06% |

|

SPDR Bloomberg 1-3 Months T-Bill ETF |

(BIL) |

$91.63 |

0.70% |

-0.10% |

|

Cash |

0.20% |

|||

|

Most |

Recent |

Update: |

01/04 |

Note: these aren’t necessarily my 2023 return on a company by company basis.

I held the majority of these stocks throughout the year; however, I acquired many of these companies throughout 2023 (or averaged down into existing positions to take advantage of weakness).

For instance, I accumulated all of my Agilent position during 2023, so even though that stock is showing a -7.34% gain, my cost basis is $116.28, meaning that my A returns were 19.5% during 2023.

There have been numerous examples like this throughout the year, which goes to show the power of buying blue chips on dips and the positive impact that it can have on total returns.

Conclusion

2023 was an amazing year for my portfolio.

Not only did I post market-beating 28% growth, but my passive income rose by 45%.

I’ll be the first to say that this is not sustainable.

This passive income growth wasn’t because of enormous dividend increases or even additional cash savings, but simply, asset allocation decisions that I made throughout the year.

Rising interest rates allowed me to make capital allocation decisions (namely, moving my cash savings out of my bank account yielding 0.04% and into Fidelity money market accounts with the same liquidity… but a ~5% yield).

Anytime that I make a move in the markets, I do my best to make sure that it’s increasing my passive income stream.

That was an easy thing to do this year because of the safe, high yields associated with cash.

I know that relatively risk-free 5%+ yields won’t stick around forever.

If the Fed begins cutting rates in 2024, I may experience my first ever negative year-over-year passive income growth year.

Remember, I’ll already be up against the ~3% equity reduction associated with my recent home purchase.

Those lost dividends can be overcome with additional savings and active management, but a series of rate cuts would be more difficult to solve (from an income perspective).

If that’s the case, it will be a bummer.

But, that’s life. Sometimes you have to make investments in things are aren’t market related and over the long-term, I suspect the new home will appreciate nicely (similar homes in the area have risen at an ~8% annual clip over the last decade or so).

Furthermore, I still know that the organic growth being thrown off by my remaining holdings is still humming nicely, generating ~10% annual growth.

In 2024 I will do my best to stay nimble with my cash position and adapt accordingly to the interest rate environment. However, I do not plan to chase yield in the equity space to replace any lost income associated with money market accounts.

I’m not willing to put my capital at unnecessarily high yield to maintain my portfolio’s current yield.

Everything that I do in the market is about long-term, sustainable growth.

This time next year, I assume that asset allocation will be a big discussion of my annual report. It’ll be interesting to see how everything shakes out.

2023 was a year where building cash made sense. 2024 might be a year of aggressive allocation towards equities.

Only time will tell.

But, I’m not going to complain about the wonderful opportunity that 2023 provided to generate fairly risk-free yield and even if that disappears in the relatively near future, I’ll be grateful for the opportunity to generate relatively high yields and reinvest that income back into the market all year.

Now, here’s to hoping for wonderful opportunities to put all of the cash that I’ve built up this year to work.

I have my watch list ready to go… now I just need to stay disciplined and wait for my price targets to hit.

Right now I have nothing but gratitude for my financial situation and I know that I’ve been blessed.

I wish everyone else a prosperous 2024 as well!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here