I am constantly looking for new names in the aerospace and defense industry to cover, as I strongly believe that there exists value beyond the popular names in the aerospace and defense industry such as Lockheed Martin Corporation (LMT), Northrop Grumman Corporation (NOC) and RTX Corporation (RTX). In this report, I will be discussing the prospects of BWX Technologies, Inc. (NYSE:BWXT). Since this is my first time covering BWX Technologies, I will start with a brief description of the company and growth drivers, followed by an analysis of the company’s most recent results and outlook. I will conclude the report by determining a price target and rating for BWXT stock.

What Does BWX Technologies Do?

BWX Technologies is a multi-domain nuclear technology solutions provider. The company is organized into two segments, namely Government Operations and Commercial Operations. The Government Operations accounted for 80% of the net revenues with the remainder being accounted for by Commercial Operations. The Government Operations segment offers a variety of products and services. For aircraft carriers and submarines, the company produces nuclear reactors while the company also produces microreactors, and fuel-bearing precision components and provides services to down-blend stockpiles of high-enriched uranium. The Commercial Operations segment provides commercial nuclear steam generators, nuclear fuel and handling systems, reactor components, and medical isotopes amongst others.

What Are The Growth Drivers For BWX Technologies?

BAE Systems

What I do like about BWX Technologies is the exposure to government operations and commercial operations. Both provide different end markets with opportunities for growth. The naval propulsion business is supported by a 30-year shipbuilding plan where we see that BWX Technologies supports Virginia-class, and from 2026 onward Columbia-class, production as well as the opportunity that Ford-class aircraft carriers will be procured every four years rather than the current five-year cycle by 2028. Furthermore, the AUKUS, which is the trilateral security agreement between the U.K., U.S., and Australia, will support Australian demand for nuclear-powered submarines. The defense part of the business is firmly supported by long-term plans and the current geopolitical tension seen globally further supports long-term procurement.

I don’t see huge opportunities emerging globally in the sense that I do not expect that the current tension we see worldwide will result in additional sales in the near term. Since a Columbia-class submarine costs $17.5 billion and around $10 billion in costs was previously expected, submarines are simply not the kind of equipment that is affordable for many countries.

IMF

In the commercial end markets, there also are growth opportunities ahead. The decarbonization trend drives demand for nuclear solutions. Recently, Canada approved export financing for the construction of two CANDU-type reactors in Cernavodă in Romania, where I currently live. BWX Technologies is a provider of fuel and equipment for CANDU reactors, and there also are significant growth opportunities in the Small Modular Reactor market. Growth opportunities also exist for the medical isotopes market, where demand for strontium and germanium is strong and demand for new isotopes is also on the rise.

So, overall BWX Technologies has beneficial exposure to defense, decarbonization demand trends, and medical demand for existing and new medical isotopes, making it a multi-domain nuclear technology specialist.

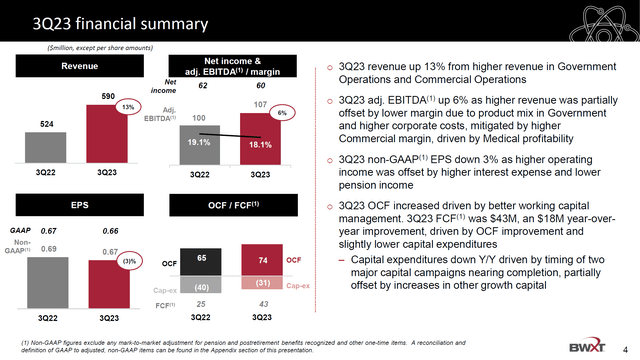

BWX Technologies EBITDA Growth Falls Short

BWX Technologies

So, I am positive about the growth drivers over the longer term. However, the most recent quarterly results showed that adjusted EBITDA growth of 6% fell short of the 13% growth in revenues. While profit growth falling short of top line growth is not something a company wants to see, I do think that for BWX Technologies it actually does make sense.

Government operations revenues were up 13%, driven by higher naval nuclear component manufacturing, uranium processing, and microreactor design progress. During the pandemic, the supply chains globally were disrupted quite significantly. Initially, aerospace and defense supply chains were isolated quite well, but they were impacted eventually, and the submarine supply chain had an extremely difficult time getting itself to the point where it needed to be to support demand. The growth in naval nuclear component manufacturing to me is an indication of continued recovery in the supply chain.

To further support growth, the company is also continuing to hire new employees, which negatively affects the costs side of the Government Operations business while there also was some mix and timing pressure. I see the onboarding of new team members as a short-term negative, but over the longer term, it supports the translation from demand to value.

Commercial Operation sales were up 10% driven by strong medical sales and nuclear services partially offset by lower nuclear fuel sales. Adjusted EBITDA was up 22% driven by strong medical sales and partially offset by a less favorable mix including more refurbishment projects in the sales mix.

Overall, I don’t think the results were bad, and the third quarter free cash flow looked strong with $18 million growth in free cash flow driven by better working capital management driving around $8 million in operating cash flow and $11 million lower CapEx. So, while EBITDA was not in line with revenue growth, the operating cash flow more or less was.

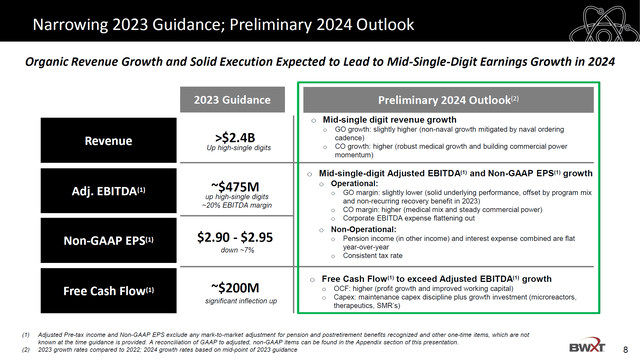

BWX Technologies Sees Single-Digit Growth

BWX Technologies

For 2023, the company is expecting high-single digit growth, pointing at Q4 being somewhat weaker than Q3 growth numbers as well as the 9M growth figures. Adjusted EBITDA is expected to be $475 million pointing at stronger margins compared to Q3, while $200 million in free cash flow points to strong cash inflow in Q4, as is quite typical for many companies in the aerospace and defense industry. So, the 2023 guide is pointing at growth on key metrics, and also for 2024 growth is expected. The company is expecting mid-single digit growth, with slightly higher growth in Government Operations sales and higher Commercial Operations growth driven by strong growth in end-market demand. Due to the mix, the higher margins of Commercial Operations will be partially offset by Government Operations, leading to EBITDA growth possibly in line with revenue growth, while free cash flow will be significantly better.

So, BWX Technologies is not high growth, but if you look at the long-term demand trends, and given that the naval propulsion segment benefits from long-term embedded construction plans, I do like the prospect of sustained long-term growth rather than fluctuating growth.

Does BWX Technologies Pay A Dividend?

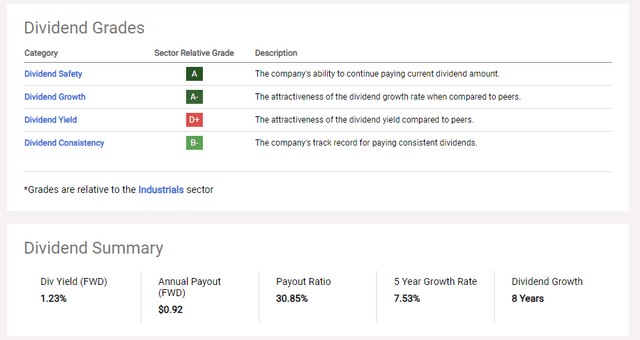

Seeking Alpha

The short answer is “Yes.” The yield most definitely is not an extremely attractive one at 1.23%, but with share prices having risen nearly a third over a 1-year period it would be unrealistic to assume that dividend could keep up. The company scores well on Dividend Safety, Growth and Consistency, with a 7.5% growth rate and 8 years of consecutive growth. What I do like is that the company has a payout ratio of just 30%, which would allow for further comfortable dividend increases.

The 10-year yield on cost is around 3.7%, so I would say that BWX Technologies is not the kind of stock you would want to buy solely based on its dividend because its yield is low and the yield-on-cost takes quite some time to get to acceptable levels if we look at the past 10 years.

BWX Technologies Offers Upside Despite Current Fair Valuation

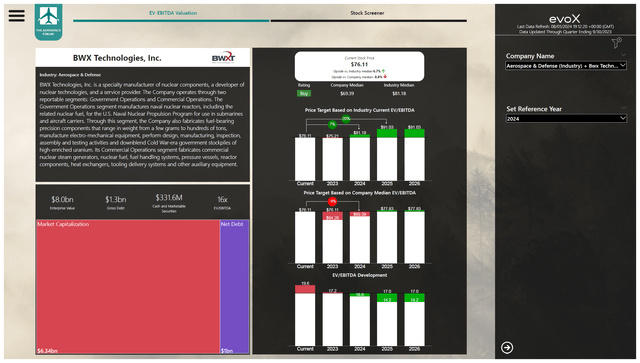

The Aerospace Forum

Currently, BWX Technologies is valued fairly in line with peers, with 2023 earnings baked into the stock price. However, at this point, I believe it is fair to factor in 2024 earnings, which would provide an $81.20 price target with a 7% upside and 20% upside toward 2025 earnings. The upside is not huge, but the company has an appreciable 3-year alpha value and its business leans on some growth in end-market demand.

Conclusion: BWX Technologies Provides Technology Solutions For The Future

I believe that BWX Technologies, Inc. is positioned attractively to provide nuclear technology solutions in the fields of defense, nuclear power plants and medical applications. In each of these fields, the company can count on producing and servicing existing products, while there are also new application fields. These include new medical isotopes and small modular reactors that offer compelling long-term growth opportunities for the business, while naval propulsion solutions as the core of its business are embedded in long-term shipbuilding plans.

Read the full article here