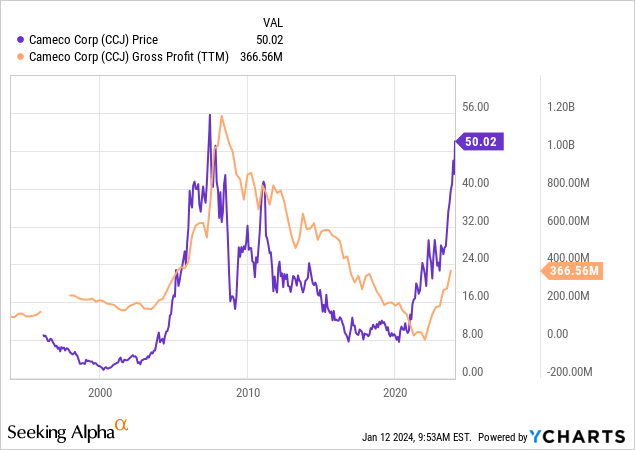

2023 was a challenging year for most energy commodity producers as fuel prices stagnated or declined worldwide. However, one fuel source performed exceptionally well. Over the past year, the spot price of uranium has risen by a staggering ~86% to its highest price level in over a decade. Cameco (NYSE:CCJ), the largest uranium miner on the public market, also rose by around 86% over the past year due to the increase in its profit outlook associated with higher uranium spot prices. See below:

Of course, while I was generally bullish on the uranium mining market before recently, I recently downgraded my view on the uranium miner ETF (URNM) to neutral due to potential overvaluation among uranium miners. Cameco is a significant factor in that ETF, being essentially one of the only substantial and profitable uranium miners. Most others have very inconsistent profits due to working in higher production cost areas like Canada or, such as the US, “miners” are in a near-eternal “pre-sales” status. In my view, while some aspects of the market are resoundingly positive, there is also tremendous hype around uranium, which may not transfer into a sound long-term outlook.

CCJ, despite its solid performance, is potentially significantly overvalued today. On a TTM basis, it trades at a “P/E” of around 103X and 77X on a forward basis. Its TTM “EV/EBIT” is ~67X while its forward “EV/EBITDA” is 82X. We must remember that mining stocks are usually exposed to cyclical risks, and reserve declines typically trade at valuations closer to 10X. Thus, for Cameco to be fairly valued today, it must have a very likely chance of rapid expansion to its EPS over the coming years. Of course, given the sharp rise in the price of uranium, there is some reason to believe that is possible if and only if high prices are sustained.

Long-Term Risks and Rewards in Uranium

To avoid restating old arguments, please refer to my recent article on uranium miners for a closer analysis of today’s market situation. To summarize, uranium is in both an acute and potentially long-term shortage. The acute shortage is primarily caused by Cameco’s various shutdowns of significant mining operations in response to lower prices and maintenance needs. The company has restarted operations in its key McArthur River mine this year but has been unable to normalize its production entirely. Of course, secondary uranium supply sources are dwindling along with mining production despite a decent long-term uranium demand outlook, pointing toward both acute and potential long-term shortages. This is more extreme because Russia is a major exporter, a problematic issue for the US and Europe.

That said, as detailed in my article on the market, uranium is also a very abundant commodity, and there is a vast supply of mines in suspension due to profitability. Many US uranium miners with significant reserves are waiting to ramp up production once prices rise sufficiently. The breakeven price is likely around $90/lbs, meaning that threshold was just crossed as it passed that level just a week ago. As such, it is no surprise that, over the past month, numerous US miners have commenced production due to strong market conditions and some financial encouragement from the US government.

On the one hand, uranium has a highly inelastic demand curve, as utilities mostly pay for enrichment, with raw uranium prices being immaterial to fuel costs. Uranium end-buyers care mostly about consistent and dependable supplies since raw prices are nothing compared to fuel potential. That said, uranium also has a very elastic supply curve, mainly when the breakeven level for developed-market miners (primarily the US and Canada, which have vast uranium reserves) is passed. It is radioactive, making it easy to find and not as difficult to mine as those commodities found more deeply in the ground.

In my view, this is the main issue with Cameco and most other uranium miners. The market is indeed headed into a more considerable shortage, which has resulted in much higher prices, causing many more miners to restart or begin production. In my view, this makes it very unlikely that a lasting shortage will impact the market as supply can meet demand as long as prices are over that $80 to $110/lbs range, making it more profitable to mine in the US and Canada. As such, it would be unwise to value Cameco at any selling price target much over $90/lbs.

What is Cameco Worth Today?

Last quarter, Cameco’s total unit cost of sales per pound, including D&A, is currently $52 to $53 (MDA pg. 18). I expect that figure may increase going forward as it continues to work to increase production in its Canadian mines, and due to the general inflationary trend in mining wages and other costs. The company can also produce up to 18.7M lbs but operates closer to 16M.

One additional issue is that the company is selling far more uranium than it produces due to its contracts, meaning it is buying uranium at often higher prices closer to the spot to resell at lower contract prices. From pg. 24 of its MDA, we can see that its total production cost was $44.6 CDN or $33.4 USD last quarter, far below its total unit sales cost because its cash costs for purchasing were $79 CDN, closer to the spot. Thus, for 2024 and beyond, I will estimate its total production costs will be around $42/lbs, higher due to the continued ramp-up of its Canadian mines. Still, its production costs should be lower as it relies less on external sources.

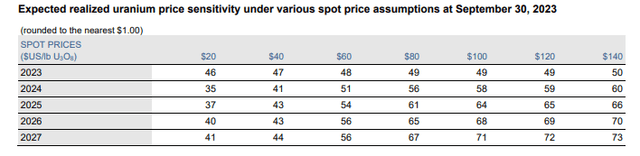

Secondly, we must realize that uranium spot prices are not equal to realized prices. Uranium buyers and producers do most business in long-term price contracts, with the spot market being comparatively illiquid. Thus, it is problematic that CCJ has become so correlated to spot prices when its profitability is not. See its realized price expectation based on changes in spot prices below:

Cameco Realized Price vs. Spot Estimate (Cameco MDA Report Q3 2023)

Uranium spot prices are currently around $92/lb, giving us a 2024-2027 realized price outlook of ~$57 to ~$69, with a positive trend. Even if spot prices rise to $140, that will only increase the realized price outlook by a few dollars due to its contract volumes. Thus, Cameco has minimal direct upside associated with the increase in spot prices and some risk due to it potentially needing to buy externally at higher spot prices to fulfill its contracts at lower prices, as seen in 2022-2023.

At any rate, we will estimate Cameco to ramp up production to 18.7M lbs, and spot prices remain constant, giving us a $63/lbs realized price target over the next four years. Its production costs may begin at around $42/lb but should average closer to $45/lb if we account for the rising cost trend. Combined, that gives us a marginal profit per pound outlook of ~$18, or an estimated annual operating profit of around $336M on its uranium production. I will hold its fuel services gross profit outlook constant at around $90M annually (extrapolated from the average of its recent metrics, MDA pg. 26), giving us a total operating income outlook of $426M.

As detailed on its MDA pg. 53, the company does not clearly note ongoing operating costs in this segment. However, the company’s means of modeling segment profitability are subject to multiple interpretations due to its use of the “other” category. Thus, I encourage investors and analysts to take note of the company’s provided details and assume some uncertainty around the estimates I provide.

Cameco has a great deal of “other income” and derivatives and financing costs which cause its operating income to deviate from its reported income. I will only extrapolate on those figures in this category with demonstrated consistency. The company has a finance cost of $22.9M per quarter (consistent YoY) but a finance income of ~$34M, up dramatically YoY, likely due to higher realized interest rates. The company has a significant $1.7B cash position, giving it positive interest rate exposure. In total, that represents a ~$45M positive annual income benefit, giving me a $471M pre-tax annual income outlook with its 26% effective tax rate, which translates to a $348M annual net income outlook, or around $0.8 per share. This outlook is well within the $0.40 to $2.2 range provided by other analysts for its 2024 EPS and beyond.

The Bottom Line

It is essentially a given that Cameco will earn an EPS of around $0.8 and potentially as high as $2 over the coming five years because its contracts are already made at prices far below the spot. To increase production, Cameco will need to increase output in its Canadian mines, which have much higher operating costs than its Kazakstan operations. Thus, while we’re seeing higher spot prices, that is almost entirely offset by higher production costs associated with the transition toward more outstanding North American uranium production. Higher spot prices have a very small profit impact on Cameco’s long-term outlook due to this and the fact that it has already contracted most of its future production. Further, if it cannot increase output sufficiently, higher spot prices could be problematic for Cameco as it is forced to buy at higher prices externally than it has contracted.

In the foreseeable future, CCJ is trading at a “P/E” of around 62X, with its lowest potential forward valuation (through 2028) being 23X, which is still a high figure for miners. As such, I firmly believe CCJ is very overvalued today, likely by over 50%, due to a fundamental misunderstanding of the uranium market and its contract pricing. CCJ is a go-to trade for uranium speculation, but its income has little correlation to the spot price of uranium.

In my view, it is possible that uranium rises to over $140/lb due to the acute shortage. I would not bet against CCJ because investors will likely continue to buy the stock if that occurs; however, even such a significant increase would hardly improve its EPS outlook for the next five years. Thus, while the bull market may continue for some time, I doubt it will last too long, making me bearish on CCJ today. That said, the Sprott Physical Uranium Trust (OTCPK:SRUUF) might be a much better option to take advantage of the bull market.

Read the full article here