Last February, I covered Whirlpool Corporation (NYSE:WHR) in “Whirlpool: Poor Economic Prospects As Collapsing Home Sales Hit Appliance Sector.” At that time, I had a bearish outlook for the stock due to my view that low home sales would naturally reduce demand for large appliances. Since then, WHR has lost around 20% of its value amid a series of negative earnings surprises. For the most part, my past view was proven correct over the past eleven months.

In 2024, we will likely see more clearly how the high-interest rate environment impacts Whirlpool. Fundamentally, the company has negative exposure to interest rates for three main reasons. One, the company has ample debt, so higher interest rates directly lower its profitability through higher interest costs. Second, the cost for people buying large appliances through financing is much higher, given the increase in interest rates. Even if appliances are sold at “zero interest,” the interest costs are usually accounted for in a higher sales price, hampering demand. Thirdly, high interest rates have dramatically lowered home sales, the primary driver of appliance demand.

On top of that, the high inflation environment, which has caused the high-interest rates today, is creating growing cost burdens for Whirlpool’s production. As such, Whirlpool has faced a material decline in gross profit margins. This has resulted in a more than 50% decline in operating margins since its 2021 peak. Even if we exclude the impact of its European market divestment, the company’s EPS fell by over 40% YoY from Q3 23 to Q3 22, with its income below its dividend – potentially signaling a dividend cut.

The company’s Q4 report was also a negative surprise. Its overall EPS was $3.85 vs. $3.89 in Q4 22, but its free cash flow was $366M vs. $820M in Q4 22. The company outperformed expectations on its EPS, but that was not translated into free cash flow, which is most important for its dividend. Its sales also rose by 3.5% YoY, which indicates another decline if we compare that to the consumer price index. Most importantly, its full-year sales outlook was reduced to $16.9B vs. a $17.67B consensus estimate, with its EPS target dropping to $13-$15, although I believe it could be even lower.

Accordingly, I believe it is crucial to take a closer look at this significant company as its trend may be necessary for WHR’s performance and many other US manufacturing giants.

The Demise of American Manufacturing?

Whirlpool is one of the oldest and largest appliance manufacturers in the US. Though most of its factories are in the US, it is not a global company. That said, the company is now racing to reduce its international scope, divesting itself of its EMEA business last year at a significant loss. Since the company is a household brand and has operated for so long, many investors may be biased toward viewing its current struggle as temporary. That is true to a degree, but it is also likely true that Whirlpool has significant long-term issues that are being exposed more clearly today due to higher interest rates.

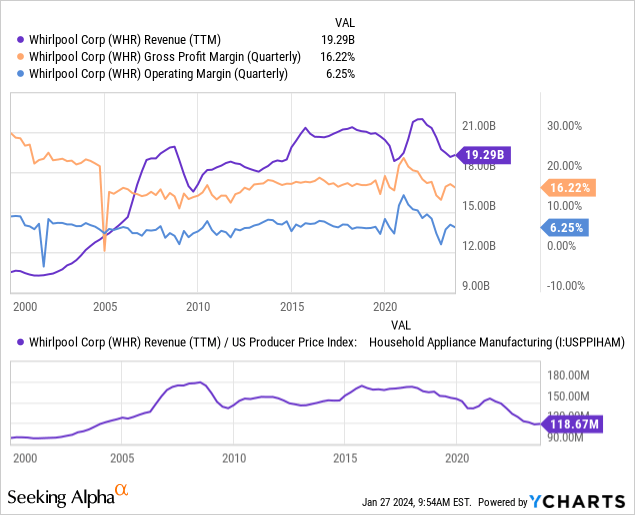

To a large degree, the decline in the firm’s margins followed a spike in its sales and profitability in 2021, when rates were low and many people had excess savings. Naturally, a reversal should occur after such a stimulatory environment, particularly considering appliances usually have long life expectancies. Its margins are only slightly below the long-term trend, but the company is clearly struggling to raise prices to keep up with its total costs. Although its revenue appears stable, it will fall very quickly if we adjust for appliance prices. See below:

The lower chart is the most telling, demonstrating how the firm has been unable to maintain total sales units since before 2020. There was a small spike in 2021 but a significant drop since then. Put simply, Whirlpool’s effort to raise prices to maintain fixed margins is significantly negatively impacting its unit sales volumes. Fortunately, the company has no inventory buildup, with its inventory-to-sales ratio being about as constant as it has been over recent decades.

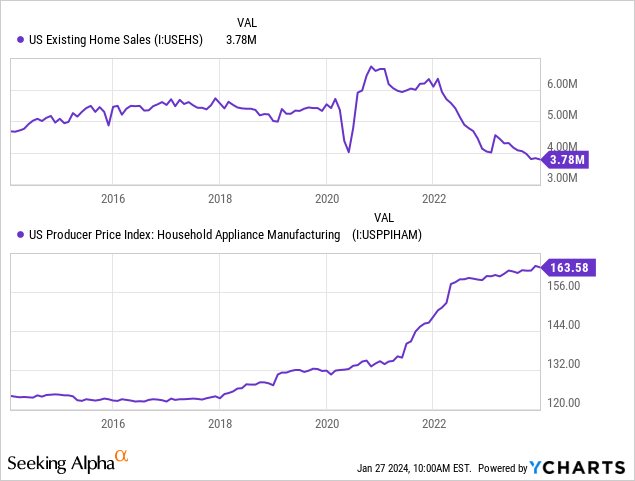

Still, with low home sales and appliance prices much higher, there is no reason to expect Whirlpool’s difficulties to fade anytime soon. This is a particular issue because high mortgage rates disproportionally lower first-time home buyers, a significant factor for new appliance sales. Existing home sales continue declining to extreme lows while appliance prices are still trending higher, albeit slowly. See below:

So, the primary driver of Whirlpool’s sales demand is still declining, and prices are not letting up. For Whirlpool, I expect that could mean a decline in profitability well below the usual standard because the general economic factors facing the company continue to worsen.

The company is also facing growing competition from competitors like LG and others not so US-focused in their manufacturing base. In my opinion, that is a significant long-term risk for the firm. For decades, the US has become a more difficult place to manufacture as more raw materials must be necessary, and labor costs rise faster due to a shortage of blue-collar workers. Over two years ago, the Whirlpool CEO warned that the US labor shortage was becoming structural. That is most certainly the case, as the younger generations are now smaller than the older ones and generally rank poorly on productivity surveys.

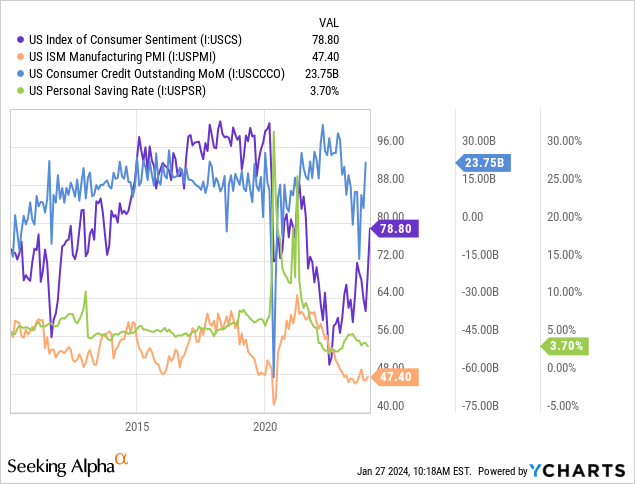

If we combine the inevitably growing labor issue with the decline in raw materials, Whirlpool’s business economics compared to competitors is relatively weak. Significantly, that issue should grow over the coming years until significant changes are made in the US economy to renew the manufacturing base. Further, there are relatively clear signs of a material cyclical decline in US manufacturing and weak consumer sentiment. See below:

Consumer sentiment is rebounding but rising with consumer borrowing, while personal savings levels are still decreasing. That is alright news for the company because it could point toward temporary respite. However, given the state of home sales, I believe that is still unlikely. Further, the massive buildup in consumer debt that is not matched by higher personal savings implies that any improvements in consumer spending will be short-lived. Additionally, the US manufacturing PMI has been in a contraction for a long time, more directly pointing toward lower metrics for Whirlpool.

Whirlpool’s Balance Sheet Adds to Woes

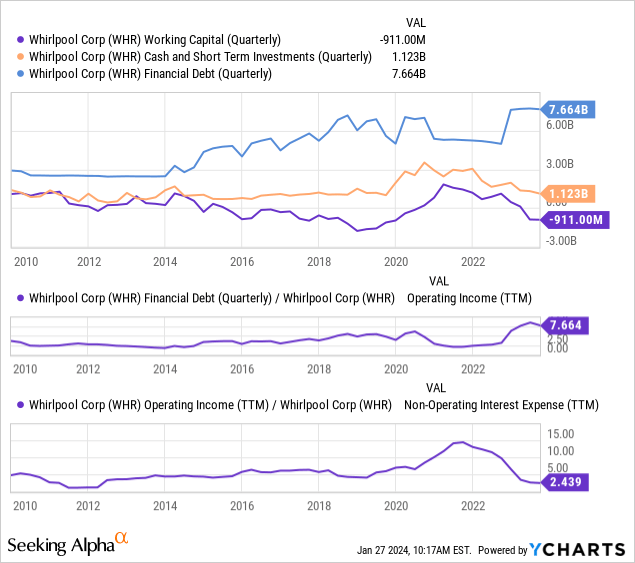

Although Whirlpool’s balance sheet is not terrible, it could become a significant issue if its income deteriorates. Indeed, if troubles remain, I believe WHR may have a dividend cut by the end of the year or in 2025. The company has $7.6B in financial debt and has lost the cash improvements it saw during the 2020 cheap loan programs. Its working capital is now back in troubling negative territory, indicating it will need to refinance debt this year, likely at a higher rate. Its debt leverage and times interest earned ratios, using operating income (because its EBIT is negative due to one-off losses from its divestment), are relatively poor. See below:

The combined rise in interest rates, high debt, and declining operating income have made Whirlpool a less solvent company. It has a $1B term loan maturity this March, a $1.5B maturity in September 2025, a $300M senior unsecured loan maturity in 2024, and another $350M in 2025. As such, it is no surprise that the company’s credit was downgraded with a negative outlook early last year. Its credit risk has not been updated since, but given the sharp decline in its operating income since then, I believe its downgrade risk is notable. That is a particular issue, given that it has a “BBB” rating, putting it on the cusp of “junk” territory.

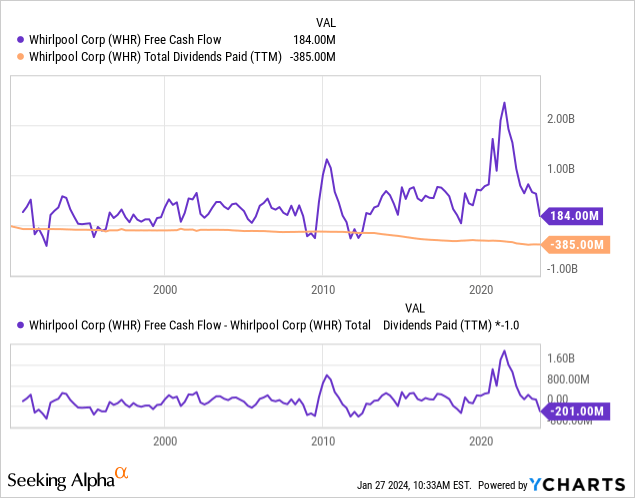

Adding to its issues, Whirlpool has continued to raise its dividends in recent years despite no improvement in its free cash flow or most of its bottom-line metrics. See below:

This issue has risen in the past ten years as Whirlpool has consistently raised its dividend despite having stagnant profits. Over the past year, it paid out $201M more in dividends than it earned in free cash flow. I expect its FCF will continue to trend due to economic issues, making its dividend potentially unjustifiable to creditors.

The Bottom Line

While Whirlpool’s metrics are poor, its valuation is also low. Its dividend yield is 6%, while its forward “P/E” is 7.3X. That said, I personally differ from the consensus view that its EPS will rebound in 2024. In my view, insufficient macroeconomic evidence suggests a rise in appliance demand. Conversely, it seems that most of the evidence points toward a continued decline.

I may not be bearish on the stock if I were confident that WHR would see an income rebound in 2024. However, I believe there is a high risk that its situation will worsen, particularly in its overall sales and interest costs, potentially leading to a dividend cut due to its lack of coverage. Overall, I am bearish on WHR, but I would not bet against it because its valuation is low enough that its immediate downside risk should not be too extreme. However, if it sees continued strains in early 2024, where a dividend cut becomes more likely, I may give an updated view that changes that opinion.

Read the full article here