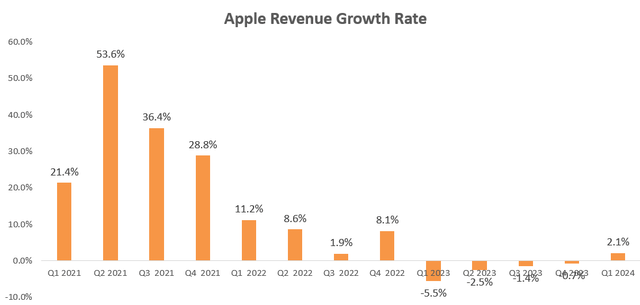

Apple (NASDAQ:AAPL) reported its Q1 FY24 results on February 1st, 2023, after the market close. I provided a ‘Buy’ rating in my previous coverage, highlighting the growth momentum in their service business. Their service revenue grew by 11.3% in the quarter, reaching an all-time record. I maintain a “Buy” rating with a fair value of $250 per share.

Q1 FY24: Service Growth Continues; Apple Vision Pro Launch

In Q1 FY24, Apple demonstrated robust financial performance, achieving a 2.1% increase in revenue and an impressive 16% growth in EPS, accompanied by significant margin expansion. Notably, service revenue exhibited a substantial year-over-year growth of 11.3%, now contributing 19.3% to the overall group revenue.

As emphasized in my previous article, Apple’s service business has emerged as a pivotal growth driver. The revenue from this segment surged by 14.2% in FY22 and 9.1% in FY23, underscoring its increasing significance. Importantly, the sustained growth in the service business plays a crucial role in mitigating the cyclicality of the overall business.

Apple Quarterly Earnings

I anticipate the continued growth of their service business in the near future. During the earnings call, it was disclosed that Apple has surpassed 2.2 billion active devices, setting a new record for the company. This extensive installed base provides a solid foundation for their service business growth in the future. Notably, during the quarter, paid subscriptions experienced double-digit year-over-year growth.

Over the earnings call, their management emphasized their strategic initiatives in advertising, cloud services, payment services, video, Apple Store, and AppleCare businesses. These growth initiatives aim to maximize the monetization of Apple’s massive installed device base. For example, they redesigned the Apple TV app, making it easier for users to watch all shows. These new offerings are expected to help Apple gain more paid subscribers and increase the recurring portion of total revenue.

In Q1 FY24, Apple closed with $173 billion in cash and equivalents, alongside a total debt of $108 billion. The company maintains a robust balance sheet, boasting a net cash position of $65 billion. During the quarter, they demonstrated a consistent capital allocation policy by returning nearly $27 billion to shareholders through dividends and share buybacks.

The Apple Vision Pro started to be available with a $3,499 price tag in Apple stores in the U.S. starting February 2nd, with a global rollout planned for later this year. This product holds significant importance within Apple’s ecosystem. According to Apple’s announcement, over 600 apps and games have been specifically designed for the Vision Pro. The immersive experience it offers allows users to collaborate and navigate digital resources seamlessly, extending compatibility with Apple’s existing devices.

During the earnings call, Apple’s management highlighted that major enterprises, including Walmart, Nike, Vanguard, Stryker, Bloomberg, and SAP, have already begun investing in Apple Vision Pro as their new platform for introducing innovative spatial computing experiences to both customers and employees. Leveraging the immersive capabilities of Vision Pro, these companies can enhance the customization of their product-selling experiences. The potential for Apple Vision Pro to become a new vehicle for e-commerce and entertainment seems promising.

In the near future, Apple will primarily generate sales for the Vision Pro product and its related accessories, including travel cases and covers, among others. To estimate the potential revenue contribution, I am using the Apple Watch as a reference. The Apple Watch achieved 12.8 million units in the third year after its product launch and reached 53.9 million units in 2022, according to Statista. Considering that Vision Pro costs more than $3,500, including tax, it is expected that the product won’t achieve a similar volume as the Apple Watch. Assuming Apple can sell 5 million units in the third year, it would generate $17 billion in revenue, representing around 4.5% of the group’s total revenue.

Looking ahead, I envision that Apple will generate revenue from both product sales and platform-related services. This will occur as more third parties design their e-commerce or entertainment platforms on Apple Vision Pro’s system. Apple Vision Pro is poised to become another powerful vehicle for Apple’s service business over the long run.

FY24 Outlook

For Q2 FY24, Apple anticipates flat revenue growth compared to the same quarter last year. The explanation offered is that Q2 FY23 experienced a $5 billion pent-up demand due to supply chain issues for the iPhone 14 Pro and Pro Max products, causing a challenging comparable quarter. Despite this headwind, Apple expects iPhone revenue to be on par with the previous year, and they anticipate continued double-digit growth in service revenue.

While the market may worry about the $5 billion comparable headwind, I find Apple’s guidance for the next quarter to be reasonable. Looking at the full year, I anticipate low-double-digit growth in service revenue, contributing more than 2% to the overall company growth. During the earnings call, Apple highlighted the significant milestone of surpassing one billion paid subscriptions across all services on their platform, a noteworthy accomplishment considering it’s more than double the figure from four years ago.

Considering IDC’s forecast of a 3.8% growth in worldwide smartphone shipments for 2024, if Apple can outpace the market with a 4% growth rate in FY24, the total revenue is projected to grow by 5.5%. Adjusting for the $5 billion pent-up demand from FY23, my estimate places Apple’s total revenue growth at 4.2% for FY24.

Valuation

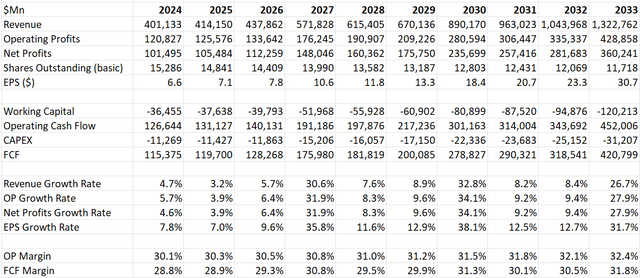

Based on the analysis above, I posit that Apple’s revenue could experience a growth of 4.2% in FY24. Consistent with my earlier model, I anticipate that revenue growth will be propelled by the iPhone launch cycle. This pattern involves two years of relatively low growth, followed by a robust year driven by the introduction of new products.

I am incorporating Apple Vision Pro’s revenue into the valuation model, assuming Apple can sell 0.5 million units in FY24, and then gradually ramp up to 20 million in ten years. Compared to the trajectory of the Apple Watch, I believe this is a reasonable assumption for Apple Vision Pro.

Margin expansion is expected to be fueled by operating leverage, the company’s cost-cutting initiatives, the decline in commodity prices, and a strategic shift in the business mix towards services. These margin assumptions remain consistent with the previous model. As per my estimate, they should be able to deliver 20-30bps annual margin expansion.

Apple DCF- Author’s Calculation

With these parameters, the estimated fair value is $250 per share in the model. Apple’s current stock price is trading at approximately 25 times forward free cash flow, a valuation multiple that appears quite reasonable for a high-quality growth technology company.

Key Risks

Apple’s main risk lies in its China operations, where the Great China business contributes approximately 19% of the group’s revenue. Several analysts queried about their China business during the earnings call. Unfortunately, their Great China revenue witnessed a decline of 12.9% in Q1 FY24, with iPhone revenue dropping in the mid-single digits in China. Adding to the challenges, Huawei launched its Mate 60 Pro last August, heightening competition in the premium smartphone market.

According to Counterpoint, Apple is grappling with competition from a resurgent Huawei in the premium segment and numerous Chinese OEMs making inroads into the volumes of iPhone 13 and 14 in China. Moreover, the growing geopolitical tensions between China and the U.S. in recent years pose an additional risk to Apple’s business in China, as patriotism becomes a significant factor.

Conclusion

I am optimistic about the momentum in their service business, showcasing double-digit growth and capitalizing on Apple’s extensive installed device base. Consequently, I maintain a ‘Buy’ rating, assigning a fair value of $250 per share.

Read the full article here