Bilt Rewards allows Americans to be rewarded for paying their rent, which is most people’s biggest monthly expense, as the cost of living has become “insane,” according to the company’s chief executive.

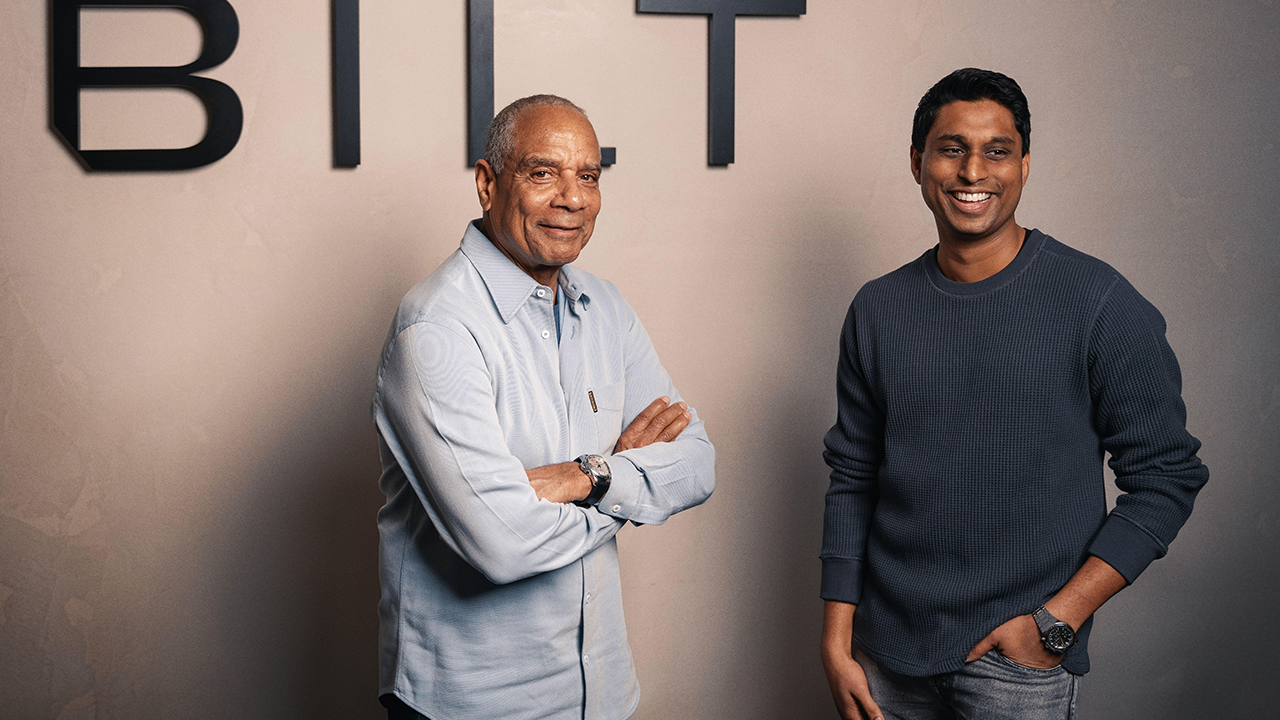

“With Bilt, for the first time, you get rewarded for paying your rent instead of lighting your money on fire,” Bilt Rewards founder and CEO Ankur Jain told Fox News Digital.

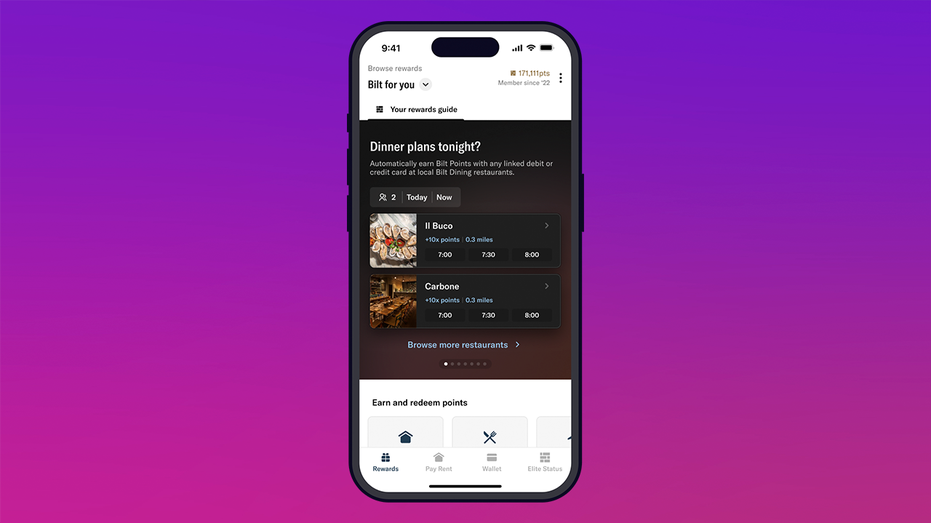

“You can now earn points in miles on your favorite airlines and hotels, and every rent payment you build your credit history just by paying your rent on time every month,” Jain continued. “We even get you closer to homeownership by counting those rent payments towards an eventual mortgage qualification.”

BILT REWARDS ANNOUNCES $200M EQUITY INVESTMENT, RAISING VALUATION TO $3.1 BILLION

Jain said Americans have grown accustomed to airline, hotel, and other loyalty programs, but Bilt offers such rewards for anyone renting their home. The company teamed up with Wells Fargo on a co-brand credit card to make things even easier for members. Jain said that part of the reason why he started the company was that the “cost of living has just gotten so out of control,” so people should at least be rewarded for paying their biggest monthly expense on time.

“I mean, it is impossible to figure out how to save at the end of the month and have discretionary, like, extra cash to go take a fun trip or visit someone when you’re paying your rent, you’re paying your student loans, you’re paying a couple Uber rides a month, you want to go out once or twice a month for dinner,” Jain said. “It’s insane.”

He said a lot of members are thrilled to finally receive an extra incentive for paying rent. Bilt Rewards offers members to redeem points for airlines, hotels, car rentals, activities, top fitness studios, or even next month’s rent, among other things. Members can also earn points when using a Bilt-linked debit or credit card on dining, fitness, rideshares, travel and more.

Jain explained that nearly four million homes across the nation work with Bilt and offer the service as a way to pay their rent online. But you don’t have to have the Bilt Rewards credit card to cash in, and the company has even figured out a way for members to pile up points if their landlord accepts a physical check.

“Anybody can go to BiltRewards.com, sign up, start paying their rent through Bilt – we’ll actually send the payment to your landlord if they’re not in our network, and you can start getting rewarded already, no matter how you pay,” Jain said.

“That’s the exciting part… anybody can come and sign up for Bilt,” he continued. “You can actually even… pay the rent in the app, and we can send a check to your landlord on your behalf at no cost also. So, even if your landlord is old school and still takes paper checks, there’s still a way to get rewarded on those rent payments.”

KEVIN O’LEARY DELIVERS HIS TOP TIPS FOR BUILDING BUSINESSES, PINCHING PENNIES AS COSTS SOAR

Last month, Bilt Rewards announced a $200 million equity investment, which pushed the company’s valuation to $3.1 billion. The company is rapidly expanding, and influential media executive Sean Walsh stepped down from Daily Mail after building their brand in the United States with the goal of doing the same thing as the managing director of external relations for Bilt Rewards.

Former chairman and CEO of American Express Ken Chenault and NFL Commissioner Roger Goodell were recently added to the Bilt Rewards board.

Bilt has also grown through its Neighborhood Rewards program, which rewards members for spending on vital items such as food and transportation in their local community, all while building credit history.

“The amount of backwards concepts in the way that the mortgage and credit system works in the United States is so infuriating. I mean, if you’re a young person in this country today, and you need to build credit to be able to get a mortgage one day, they tell you, ‘Sorry, you can’t get credit because you don’t have credit,’” Jain said.

“It’s this vicious little cycle that makes no sense. And so, we said with Bilt, ‘Everybody’s paying their rent. So why is it that when you pay your rent on time it’s not building your credit history?’ So, we fixed that,” he added. “At the end of the day, everybody would like to get some value back for your biggest expense. It’s just crazy that it hasn’t been the case.”

DAILY MAIL EXEC SEAN WALSH TO EXIT AFTER ACCEPTING HIGH-LEVEL POSITION AT BILT REWARDS

Members of the Bilt Rewards Alliance include companies such as Greystar, Asset Living, Willow Bridge Property Company, AvalonBay, Equity Residential, Related Companies, GID, Starwood, Cushman & Wakefield, Bozzuto, Camden, Brookfield, GoldOller, Berkshire Residential, ZRS, Invitation Homes, Highmark, Beztak, Nuveen, Trammell Crow, PGIM and more. Nearly four million households have committed to Bilt as their payments and rewards platform.

Bilt says its annualized member spend is approaching $20 billion, and the company achieved EBITDA profitability in 2023. The recently raised $200 million in capital will help additional growth of the Bilt Rewards Alliance across multifamily, single-family and student housing sectors nationwide. Bilt’s Neighborhood Rewards program will also be strengthened with the newly raised capital, and the company plans to eventually launch mortgage payment rewards.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Read the full article here