The oil market has been a significant focus of mine since prices crashed in 2022. While fossil fuel companies rarely gain widespread attention today, they offer particularly low valuations with high free-cash-flow yields, even at today’s lower oil price. More importantly, explorer and producer stocks are great hedges against geopolitical risk, considering oil and natural gas are significant targets in geopolitical conflicts, seemingly occurring in fossil fuel-producing regions. The energy market is a primary target in both the Middle Eastern conflict and the related shipping issues and the Russia-Ukraine war, with its natural gas and oil woes.

While oil and natural gas prices have not materially risen due to these risks, I believe that may occur, particularly if the ongoing shipping shutdown in the Red Sea is prolonged or other oil-producing countries become involved. In my view, even if the odds of an event that causes oil to rise dramatically are low, it is worth hedging that risk with North American E&P’s because they would be among the few to benefit from such an event. Further, even if oil and natural gas remain near their current price, most North American E&Ps trade at low valuations and have reduced debt and solid free cash flow today, making them lower-risk investments than in the past.

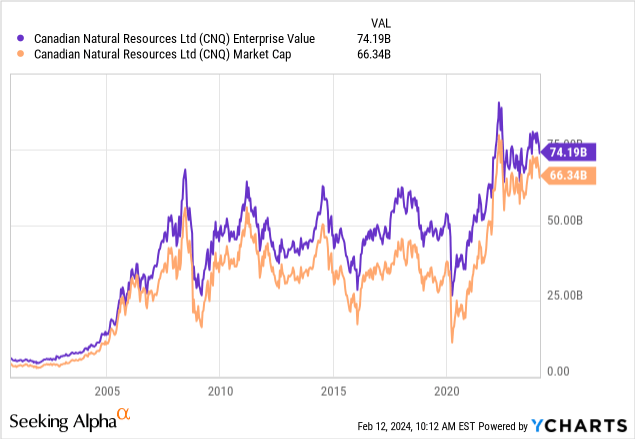

This point was illustrated in my 2022 article, “Canadian Natural Resources: “OPEC+ Put” Ensures Prolonged Dividend Growth” regarding the stock (NYSE:CNQ). At that time, I was bullish on CNQ because it had an attractive valuation, particularly given its high earnings quality. Further, I believe, and continue to believe, that the E&P, like others in North America, has limited downside risk today because OPEC will reduce production should oil fall below $70 per barrel. However, this issue is becoming complex as North American oil production rises, making OPEC’s hold on the market less effective. Even still, the secondary hedge is the US effort to refill the SPR reserve, given oil has rarely fallen into the range where that will occur. Thus, oil E&Ps have limited downside risks and potentially huge upside potential in the case of “black swan” risks that reduce global production.

Canadian Natural Resources is a Dividend King

Unlike many North American E&P’s, Canadian Natural Resources focuses on the liquids segment over gas. In Q3, roughly 95% of its gross revenue was from crude oil and NGLs, while just 5% was from natural gas. Most of its production is in North America, though the firm has small growth projects in the North Sea and Offshore Africa. In my opinion, focusing on North American liquids is ideal because liquids are far more able to be shipped around the world, and North American production is isolated from today’s geopolitical conflicts. Thus, Europe is buying more from North America as it struggles to obtain oil from Russia and now the Middle East.

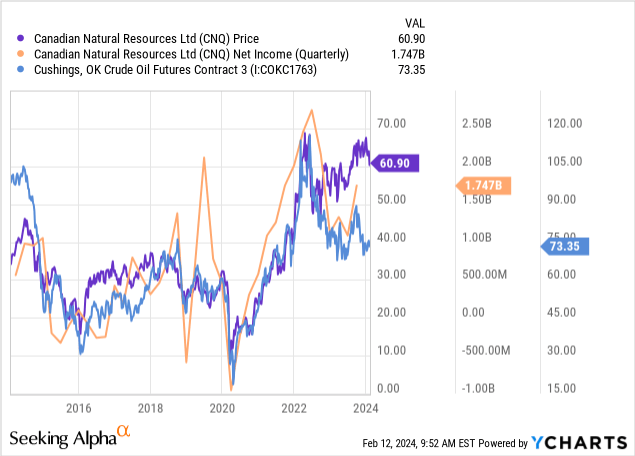

CNQ’s value and income are highly correlated to the US oil price. See below:

According to its data, CNQ’s breakeven on In Situ Oil Sands is around $41 per barrel WTI historically, which is below that of its Canadian peer group. The company has also had excellent production growth, aiming for a 3-7% increase this year. It also had a staggering ~32-year total proven reserve life index, making it Canada’s largest natural gas reserve. The company’s debt is also not huge, with over half of its maturities beyond 2030, meaning its borrowing costs are primarily fixed at “pre-2022” low-interest rates.

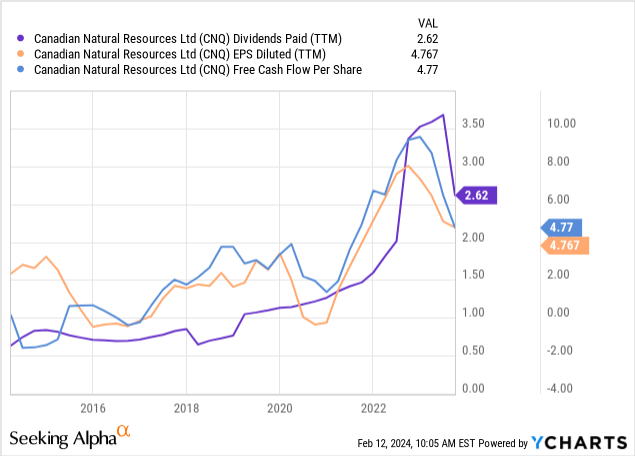

These points give CNQ a great risk-reward profile with solid immediate cash flows and potential for continued growth. Further, CNQ’s profile gives it significantly lower risk than the smaller E&P’s, though it still has considerable upside given the potential appreciation in oil. Like many others, its CapEx spending is also low today despite its high profits, giving it exceptional free cash flow that can be used to raise its dividend further. Although its dividends will fall with lower oil prices, its coverage remains excellent, with just over half of its free cash flow going to dividends. See below:

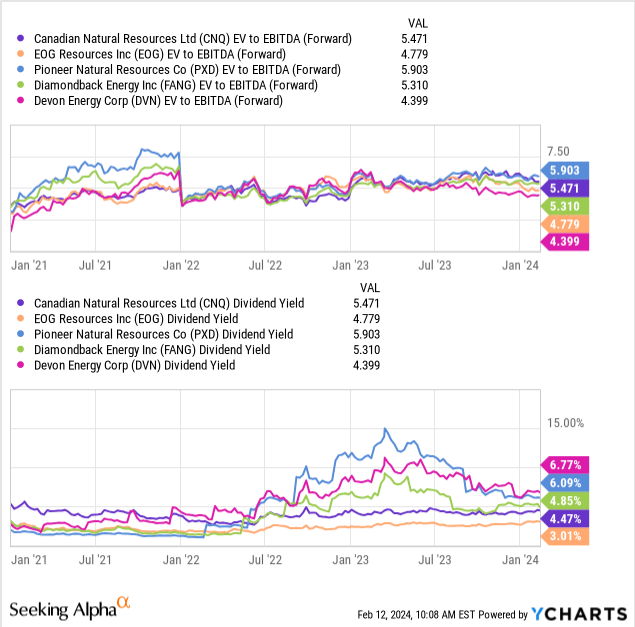

Of course, all of these positive factors have some cost. CNQ trades at a slight valuation premium to its peer group. That is clearer in its “P/E” ratio and slightly lower dividend yield than its peers. However, the bulk of that difference is due to CNQ’s superior debt profile. If we remove that factor by looking at forward “EV/EBITDA,” we can see its EV premium is around 3-6%, depending on the measurement. See below:

CNQ trades at a 3% premium to the median figure compared to these five firms and a 6% premium to the average of the highest and lowest statistics (5.15X). Thus, CNQ’s “premium” is within the margin of error if we consider its lower debt level using the “EV/EBITDA” figure. See below:

We could argue that CNQ may fall by around 5% compared to its peers to meet a better fair value. However, a small premium is reasonable given its lower breakeven cost and higher reserve level. Indeed, if I were to count all of its positive factors compared to its US peers, I could argue that CNQ is slightly undervalued today. That said, the degree would still be so slight that CNQ is undoubtedly trading at a fair value level today, with no firm indications of discount or premium.

Updated Outlook For Oil in 2024

CNQ’s performance is almost entirely tied to the oil price. Its good managerial focus and balance sheet health improve its risk profile, but CNQ will still crash or rally in line with changes in the oil price. The North American oil market is interesting today because we see much higher production and pronounced demand. That said, exports are also high while storage is low. Further, as I’ve long argued, most production growth is not from drilling but well completions, which will not secure long-term production increases.

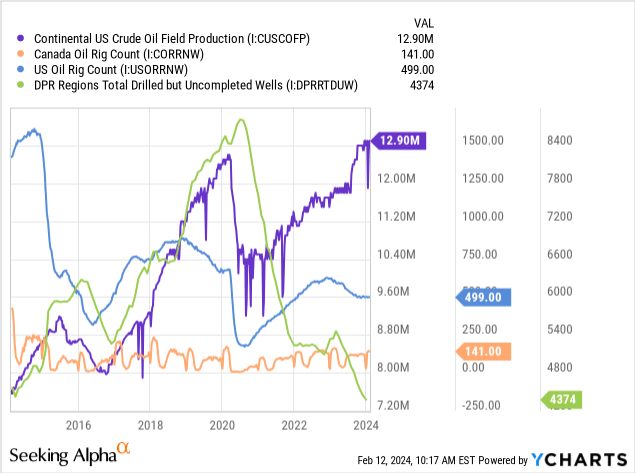

The oil rig count in Canada is moderate, while it is generally low in the US, having declined with the price of oil in 2023. However, production is very high, mainly due to the competition of “drilled but uncompleted wells.” See below:

The “DUC” issue is one that I believe warrants more news and analysis. Most E&Ps are raising production by completing drilling projects made during 2016-2020. This allows them to raise output without increasing CapEx, as we see with CNQ (although the “DUC” data is US). In the short term, that means higher production; however, since completed wells have high immediate production losses, we’re likely to see a reversal in production unless the rig count rises. Unless oil is much over $100, I do not expect the rig count will increase dramatically because the breakeven cost for new wells is generally in the mid-$60 range, but perhaps around $70 if we consider rising costs.

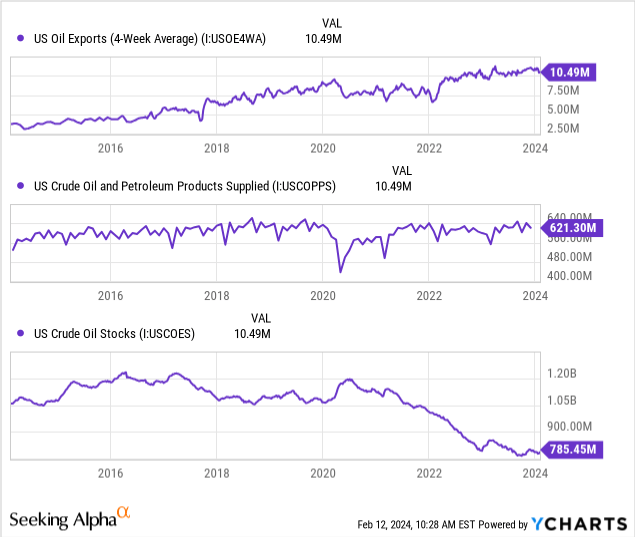

Further, oil demand is high. US exports remain elevated due to Europe’s increased demand, while US consumption is steady in its normal range. See below:

For the most part, we can assume these metrics hold in Canada, which is an even more prominent net exporter. US crude oil storage is also very low despite supposed efforts to refill the SPR reserve. Again, this has a two-fold benefit for CNQ because the SPR refill effort will likely occur once oil crosses below $70, giving the market a “put” against a recession. Further, because US storage is so low, the price impact of an external geopolitical event would be much higher, given it would cause an emergency more quickly than in the past.

The Bottom Line

I would not be surprised to see CNQ face a correction in the short term. It is back near its past resistance level and is pushing off of it negatively, potentially implying a slight decline toward its peers. Unlike its peers, CNQ has been remarkably resilient despite the decline in oil prices, potentially giving it a minor perception of overvaluation. That said, I do not believe CNQ is overvalued due to its superior earnings and operating quality. Still, it is undoubtedly not trading at a significant discount relative to its peers.

Although a minor correction is feasible, I remain moderately bullish on CNQ. I believe its downside is limited to around $50 per share unless an extreme black swan market event occurs, which it may. That is based on my assumption that OPEC and the US SPR will be more supportive should oil demand decline and prices lower. Further, CNQ’s upside could be very high, as I expect oil will rise well over $100 per barrel given the trends in drilling levels.

A geopolitical black-swan event could make oil worth far more than that due to the instability of most Eurasian oil-producing countries today. I believe the risk factor is not accounted for in the oil price, perhaps because it could be so bearish for most assets that the risk is overlooked. For me, stocks like CNQ are not an opportunity to profit from bad news but a much-needed hedge against that potential. Fundamentally, that is my favorite aspect of CNQ today, fortified by its North American quality focus.

Read the full article here