With gold stubbornly holding above $2000/oz, it’s an interesting time to be looking at the gold sector for investment opportunities. Barrick Gold Corporation (NYSE:GOLD), being the second-largest gold miner in the world, is a must-consider for anyone looking to invest in gold equities. But being big doesn’t necessarily mean it’s a good investment, aside from having better liquidity in the stock. So, is Barrick just a must-consider, or is it actually a must-own? Let’s find out, starting with a quick overview of the company.

Barrick mines and projects (Barrick Gold)

With 4.05Moz of attributable production in 2023, Barrick is the second-largest gold producer after Newmont. A core asset for Barrick is its 61.5% stake in the Nevada Gold Mines (NGM) joint venture, which yielded attributable production of 1.86Moz for both 2023 and 2022, at an AISC of $1366/oz and $1214/oz respectively. Barrick’s share of NGM’s reserve was recently updated to show an impressive 29Moz at the end of 2023. Accounting for reserve replacement, the massive gold complex, which also happens to be the world’s largest, is likely to be producing for decades to come. Furthermore, it is located in Nevada, which is usually considered among the safest jurisdictions in the world. The remaining 2Moz+ of production is weighted heavily towards the Africa Middle East region, giving Barrick somewhat of a barbell risk profile.

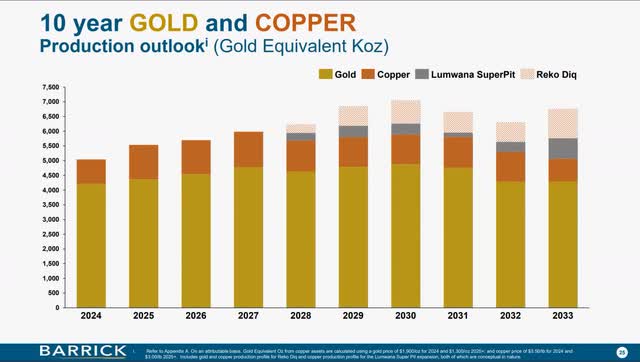

In addition to gold, Barrick produced 405Mlbs of copper in 2023, a business CEO Mark Bristow is eager to grow. Two growth projects are underway, both of which are expected to be completed in 2028.

10 year production outlook (Barrick Gold)

The Zambian Lumwana SuperPit is an expansion project at one of Barrick’s two producing copper mines, the other being the Jabal Sayid mine located in Saudi Arabia. The Zambian project was recently accelerated, pushing first production to 2028. Capex is estimated to be almost $2B, with production expected to double from 260Mlb last year to 528Mlb per year post expansion over a long 30-year mine life.

Unfortunately, I haven’t been able to find guidance on production cost after the expansion, but you would have to assume a reduction to make up for the initial capital expenditure. I am especially interested in cost because AISC for 2023 and 2022 was a high $3.48/lb and $3.63/lb respectively. Keep in mind that there are overhead costs on top of AISC, so with the current $3.82/lb copper price, I think Barrick is likely running the mine at a very slight loss at the moment.

Attributable production from Jabal Sayid is much smaller at 60-70Mlbs per year, but with AISC expected in the range of $1.7-$2/lb for 2023, it should be operating at a healthy profit margin.

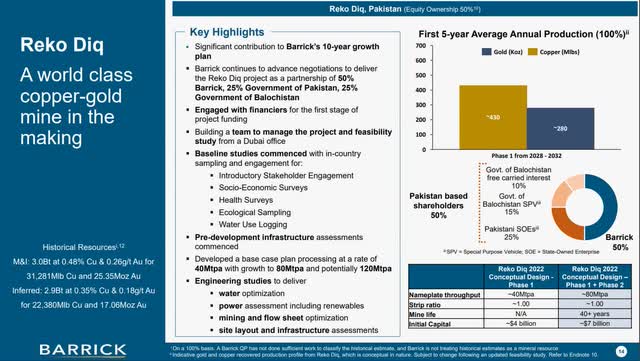

Reko Diq project overview (Barrick Gold)

Reko Diq is a very large open copper and gold open pit project located in Pakistan. At prevailing prices of $2013/oz of gold and $3.82/lb of copper, the revenue split is 75%/25% in copper’s favor during the first 5 years. Barrick currently owns 50% of the project, but is considering finding a partner for half its stake, taking them to 25%. Initial capex was estimated at $4B in 2022, which seems high for a 40Mtpa project in Pakistan, but perhaps they need to build a lot of infrastructure. With an M&I resource grade of 0.48% Cu and 0.26g/t Au at a low waste/ore strip ratio of 1, Reko Diq compares favorably to other large open pit copper mines, so I would expect low production costs. Once up and running, the mine is expected to produce for more than 40 years.

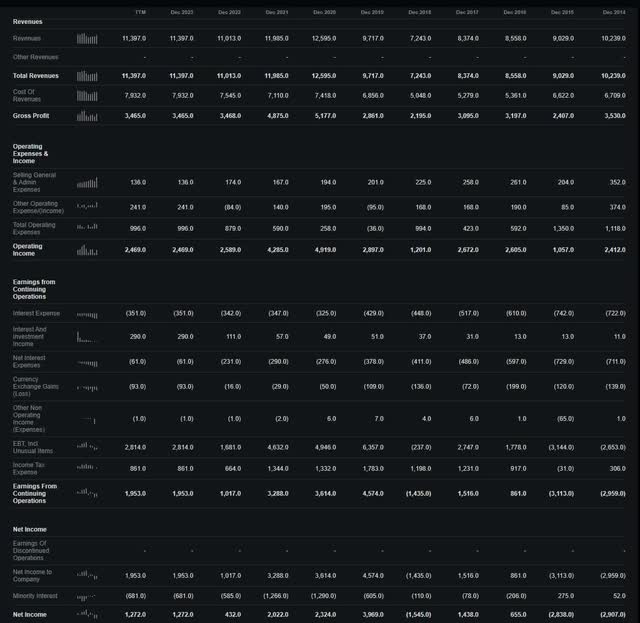

Barrick income statement (Seeking Alpha)

Barrick currently has a market cap of $25.6B and a forward P/E of 15, according to Seeking Alpha, which puts the implied 2024 analyst earnings estimate at $1.71B, a 34% increase on the $1.27B net income reported for 2023. This compares to a current company reserve life of 17 years at 4.1Moz/y, the midpoint of 2024 guidance. Reported reserves do not include Barrick’s 50% stake in the very large Alaskan Donlin Gold project. The Donlin project is being moved forward by NovaGold, who owns the remaining 50%, but production appears to be many years out. Donlin is a high-grade open pit project with reserves of 34Moz at 2.1 g/t and LOM production of 1.1Moz/y, with the first five years being 1.5Moz/y, which would rank it among the world’s largest mines. If you include Donlin, Barrick’s reserve life increases to 21 years.

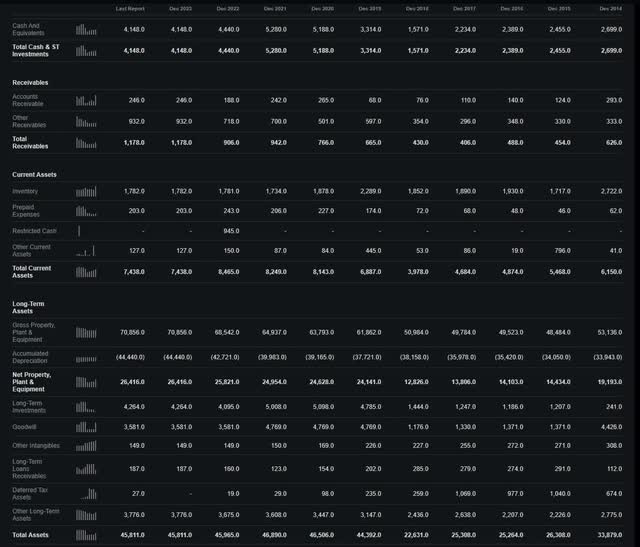

Barrick balance sheet (Seeking Alpha)

Barrick’s balance sheet is fairly clean, with $4.1B in cash and $5.1B in debt. Considering strong operative cash flow and a relatively diversified portfolio of mines, I think Barrick is in a strong position financially.

With regard to valuation, being a proud goldbug that believes in higher gold prices, something I always consider is how much I pay per yearly production ounce by investing in the company. The current market cap of $25.6B divided by forward guidance of 4.1Moz for 2024 gives you a valuation of $6244/oz produced per year, or $5688/oz AuEq including copper. Compared to peers, this is a relatively high valuation, which means you get less leverage to a rising gold price, but on the other hand, you get an industry-leading company reserve life and a highly diversified portfolio of assets, plus a strong balance sheet.

Considering slight production growth expected over the next decade, but also significant jurisdictional risks, I think the current valuation of a forward P/E of 15 is very reasonable, so I rate the company a Hold. Being bullish on gold, I still expect Barrick to be a good investment, but if you are willing to take on more risk, I think there are more attractive names in the space. One such example is Calibre Mining which is valued at a more modest $1500/oz of the expected yearly production rate in 15 months when Valentine is up and running. I covered Calibre in an article recently, for anyone interested.

To any potential Barrick Gold investor, I would remind you that there has been a significant shift in focus to include copper in the production profile. Last year, CEO Mark Bristow publicly expressed interest in a merger with copper giant First Quantum that later ran into a lot of trouble with their flagship Cobre Panama mine, so perhaps it wasn’t so bad that the deal didn’t go through, with First Quantum now down 70% from its 2023 summer high. In any case, it shows that Mark Bristow is serious about his copper ambitions, so it’s something a potential investor should be comfortable with.

As always, I will happily answer any questions you might have in the comment section below.

Read the full article here