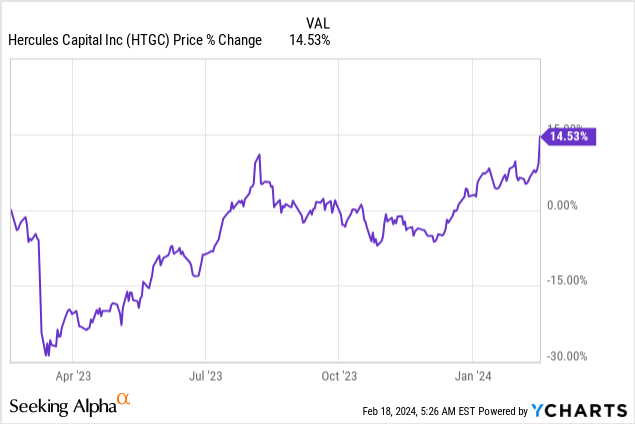

Shares of Hercules Capital (NYSE:HTGC) reached a new 1-year high on Friday after the BDC reported record total investment income for FY 2023 and beat consensus estimates easily. Before earnings the BDC also announced the payment of a cumulative $0.32 per-share in supplemental dividends which will be distributed to shareholders in equal installments of $0.08 per-share quarterly in FY 2024. Hercules Capital is the most expensive BDC in the industry and has limited upside from here, in my opinion. I believe a 63% premium to net asset value is hard to justify and I down-grade HTGC to hold, as a result.

Previous rating

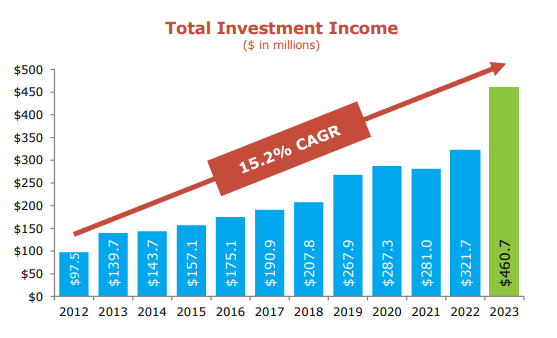

I rated Hercules Capital a buy in October 2023 — A Magnificent 10% Yield For Long-Term Investors — because the BDC is focused on expansion-stage, venture-backed companies that are neglected by traditional financing channels. As a result, Hercules Capital has been able to grow its portfolio and total investment income at double-digits in the last decade and the BDC is consistently returning supplemental dividends to investors as well. Following the BDC’s Q4’23 report and disclosure of record total investment income, I believe a hold rating makes the most sense now.

Portfolio growth, originations and debt yields

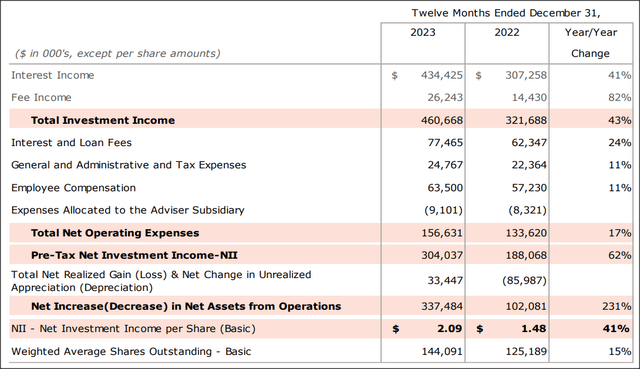

Hercules Capital had a record-breaking FY 2023 due to strong demand for capital in its tech niche. As a result, the BDC also achieved record total investment income of $460.7M in FY 2023, showing an increase of 43.2% compared to FY 2022. This growth was driven chiefly by new investment fundings and a larger investment portfolio: Hercules Capital’s assets increased 13% year over year to $3.42B by year-end 2023.

Hercules Capital

Hercules Capital’s record total investment income results were driven by strong demand for new investment capital in the company’s core operating industries Technology and Life Sciences. Hercules Capital also achieved record net investment income, which is the basis for the determination of a BDC’s dividend coverage: the BDC generated $304.0M in net investment income in FY 2023, showing a 62% year over year increase.

Hercules Capital

Hercules Capital’s non-accrual percentage — which measures the amount of investments for which payment problems have occurred — was 0.0% based off of fair value at the end of December quarter, meaning the BDC has top-range loan quality. The number of non-accrual loans decreased from 2 to 1 in the last quarter which serves to give Hercules Capital exemplary loan quality.

| $M | Q4’22 | Q1’23 | Q2’23 | Q3’23 | Q4’23 |

| Total Investments | $3,005.7 | $3,150.8 | $3,114.1 | $3,308.9 | $3,247.0 |

| Non-Accrual (at FV) | 0.1% | 0.0% | 0.0% | 0.8% | 0.0% |

| Non-Accrual (at cost) | 0.6% | 0.6% | 0.4% | 2.7% |

1.0% |

(Source: Author)

Coverage, dividend and yield

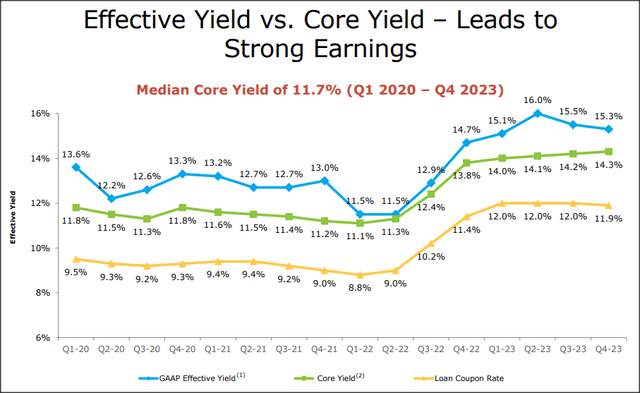

Hercules Capital’s record results were boosted by an uptick in yields throughout FY 2023 which is a reflection of the Federal Reserve’s tightening policy. The BDC’s core yields soared to 14.3% in Q4’23, showing a 3.1 PP increase since the end of FY 2021.

Hercules Capital

The rise in debt yields has driven a massive increase in net investment income. Hercules Capital’s record net investment income translated to $2.09 in NII per-share which calculates to a dividend coverage ratio of 1.1X. The coverage ratio includes the payment of $0.32 per-share in supplemental dividends in FY 2023.

Before earnings, Hercules Capital declared a new supplemental cash distribution of $0.32 per-share which will be paid each quarter in the amount of $0.08 per-share. The new distribution is the same as before and implies a total annualized dividend payout, assuming no growth in the standard quarterly dividend, of $1.92 per-share which implies a forward dividend yield of 10.3%.

Why I Am Down-grading Hercules Capital

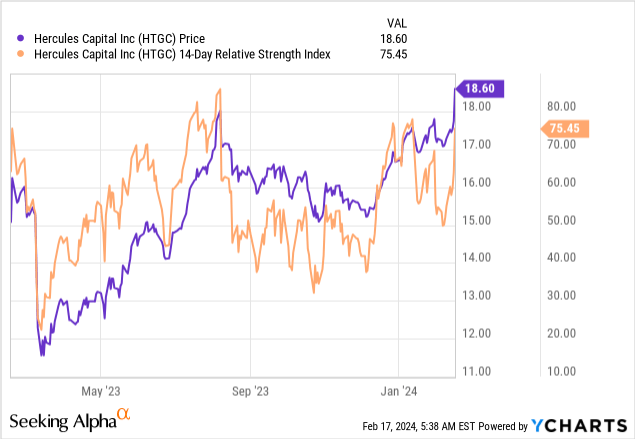

I really don’t like to buy a high-yield investment like Hercules Capital at a stretched valuation near 1-year highs. While I don’t try to time the market, I believe dividend investors will have a better opportunity to buy Hercules Capital in the future as shares have run a bit hot here and are now, according to the Relative Strength Index, overbought. A value above 70 is typically regarded as reflecting technically overbought territory and HTGC’s RSI exceeds 75 right now.

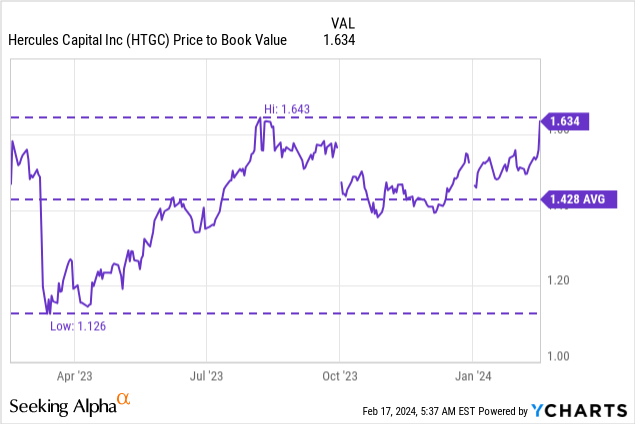

From a valuation point of view, Hercules Capital is trading at a massive 63% premium to book value which is close to the summer high of 1.64X NAV. The 1-year average P/NAV ratio is 1.43X and shares of the BDC have had a historical P/NAV valuation range of 1.13X to 1.64X, so Hercules Capital is now trading at the upper end of the historical range.

The BDC deserves a premium to book value given its outstanding performance record, but a 63% premium is a bit rich. A more sensible valuation multiplier would be a 1.1-1.2X net asset value, in my opinion, which would be closer to the bottom P/NAV trading range and below the 1-year average P/NAV ratio. This valuation range implies a fair value price range of $12.57-13.72 per-share.

Risks with Hercules Capital

The combination of a high premium to net asset value and at the same time a narrow focus on a small number of core industries could potentially be a recipe for a large valuation drawdown if the U.S. economy was headed for a recession. Over time, Hercules Capital has consistently delivered portfolio and investment income growth, so I am not worried about the BDC’s dividend coverage in a recession setup and the BDC could scrap its supplemental dividend in case it had to.

Final thoughts

Hercules Capital is a top-drawer BDC that had an impressive FY 2023. The BDC grew aggressively last year, resulting in higher assets and record total investment income. The BDC benefited chiefly from higher debt yields and generated solid dividend coverage. The return of another $0.08 per-share quarterly in supplemental dividends was obviously a positive take-away from the earnings release. As solid as Hercules Capital’s results were, I see issues with the valuation: HTGC is now trading at a 63% premium to NAV which is excessive and at the top of the BDC’s historical P/NAV range. For this reason, I am down-grading Hercules Capital to hold!

Read the full article here