Big 5 Sporting Goods (NASDAQ:BGFV) reported its Q4/2023 results on the 27th of February. The company’s financial results continue to disappoint investors, and the given Q1 guidance doesn’t show too signs of improvement.

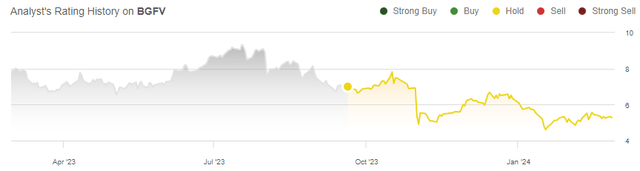

After my previous write-up published on the 20th of September titled “Big 5 Sporting Goods: Looking For Sustainable Earnings Level” initiating the stock at a hold rating, Big 5’s stock has had a bleak total return of -29% compared to an S&P 500 return of 14%. As the company’s financial weaknesses have persisted, the stock hasn’t found a bottom, making even the hold rating a too optimistic rating in hindsight. As predicted, the company has also cut its dividend – the quarterly dividend was halved to $0.125 from $0.25 in November, and Big 5 has again reduced the dividend to $0.05 with the Q4 report.

Stock Chart with Rating History (Seeking Alpha)

An Expected Weak Q4

The reported Q4 results weren’t great. The company projected same-store sales down by high single-digit to low double-digit percentages in October, with continuing pressure on consumer spending. The reported Q4 result was in line with the projection of a same-store sales decline of -17.7%, reporting revenues of $196.3 million compared to previous year’s Q4 revenues of $238.3 million. The reported revenues missed analysts’ estimates by $12.9 million.

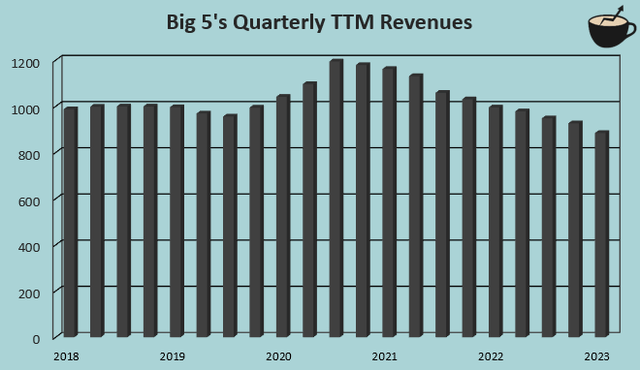

Author’s Calculation Using TIKR Data

As a result of revenues, margins also worsened. Despite Big 5 laying off staff resulting in a year-over-year SG&A decrease of $5.1 million, the company’s operating margin fell from 1.0% in Q4/2022 to -6.7% in Q4/2023. The gross margin was pressured down by 3.3 percentage points year-over-year with weaker consumer demand, and despite lower absolute SG&A costs, operational costs’ share of revenues increased. As such, the normalized EPS came in at -$0.43, missing analysts’ expectations by $0.04.

In the Q4 earnings call, the company relates a part of the weak performance to a weakening effect from weather in addition to continuing macroeconomic headwinds. I believe that the weather influenced revenues, but relating the weak performance very largely to weather doesn’t seem too sustainable with now ten consecutive quarters of year-over-year revenue declines.

Bleak Q1 Guidance Doesn’t Signal A Recovery

Big 5 guided for a weak Q1, continuing the long trend of weak sales. The management foresees a same-store sales performance down low double-digit percentages year-over-year, and a loss per share of $0.3 to $0.4 compared to a Q1/2023 EPS of $0.01. The guidance further underlines the company’s fundamentally poor performance. While Big 5 relates the weak guidance to a continued poor macroeconomic sentiment, I don’t believe that the underlying fundamentals are strong either with such a wide decline anticipated.

Weirdly enough, Big 5 hasn’t closed down stores despite the very weak financials. Many other apparel retailers, such as J.Jill and Genesco, both of which I’ve done prior write-ups on, have done so to improve profitability. With Big 5’s profitability and sales trend standing far below the two mentioned companies, I find it hard to believe that no store closedowns are needed from the company. It is clear from the financial performance, that operational optimizations are needed, and a recovering macroeconomic sentiment alone will not improve the financial performance sufficiently. The management seems to be stuck in an ugly situation, where actionable steps towards better earnings are urgently needed. The company didn’t outline very great savings in the Q4 earnings call, only relating to staff layoffs and reduced marketing – the reduced marketing should also result in lower sales in the future in an already weak sales performance.

Updated Valuation

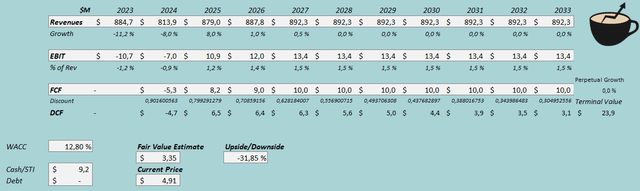

After the weak Q3 and Q4 results and a weak Q1 guidance from my previous write-up, I believe that significant decreases to my DCF model assumptions need to be made. The 2023 revenues came in several percentages below my expectations, and the Q1 guidance implies that decreases are going to continue into the first half of 2024 as well – I estimate a revenue decrease of -8% for 2024 instead of a growth of 5% in my previous model, ending the revenues at $813.9 million instead of $993.1 million in my previous model for 2024. Afterward, I estimate a macroeconomic recovery to cause a growth of 8% in 2025, but the growth to fall back into no perpetual growth in a few years instead of 2% in the previous DCF model due to the continued weak performance. The margin estimates also need to be adjusted downwards. I estimated the EBIT margin to eventually recover to 2.8% in my previous model, but I now estimate a margin of 1.5%, signifying the achieved 2019 margin prior to the COVID-19 pandemic.

With the mentioned estimates along with a cost of capital of 12.80%, the DCF model estimates Big 5’s fair value at $3.35, around 32% below the stock price at the time of writing. The estimate is down from a previous estimate of $7.57 despite a lower cost of capital and now implies a very weak future return.

DCF Model (Author’s Calculation)

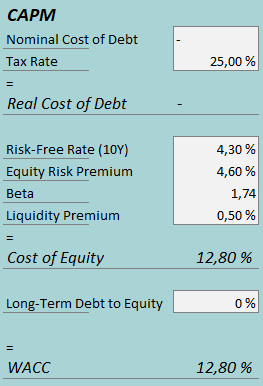

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

As Big 5 doesn’t hold debt intended for financing purposes, I estimate the company’s long-term debt-to-equity ratio to be 0%. For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.30%. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. I use the same beta estimate of 1.74 as I did in my previous write-up despite Yahoo Finance now estimating the beta at 2.46, as I believe the lower beta represents a more fair long-term assumption after the current weak retail trends improve. Finally, I add a small liquidity premium of 0.5%, creating a cost of equity and WACC of 12.80%. The cost of capital is down notably from the previous write-up’s WACC of 14.59% due to a lower equity risk premium estimate and a very slightly lower risk-free rate, partially countered by a lower long-term debt estimate.

What Needs To Change

For me to be more optimistic about the stock, Big 5 seems to need large changes. The company has seen too weak financials for a very long time, which makes me believe that Big 5’s fundamental demand is weakening. The company needs to improve its offering and brand image into a more competitive position and cut costs to improve its operating earnings from a negative, 2023 figure and weak long-term level. A macroeconomic recovery will likely boost revenues, but I see a sufficiently large recovery as unlikely.

The current market capitalization reflects quite poor faith in such actions, which is very understandable. The stock could have a very good return if the management can deliver clear earnings improvements, but the current situation and financial performance don’t create a strong sense of belief for me.

Takeaway

After a too-optimistic first write-up with a hold rating estimating a stronger financial performance, I am now becoming increasingly sceptical of the company’s future. The company reported weak Q4 results and a bad Q1 guidance, implying an eleventh consecutive quarter of revenue decreases. With an already thin & worsening long-term profitability trend, and weak revenues, I now see the stock’s likely return as poor despite a significantly pressured stock price. The seeming lack of a clear path to greater profitability from Big 5’s management also worsens my belief in the long-term financials. As such, my DCF model now estimates a significant downside for the stock, and I downgraded my rating to sell.

Read the full article here