Investment Thesis

Canoo Inc. (NASDAQ:GOEV) is a mobility tech company that engages in electric vehicles for commercial and consumer usage in the US. The company has been registering awful performance, with its shares plummeting by more than 99% over the last three years and underperforming the S&P 500 by a margin of about 133%.

Seeking Alpha

This poor performance has resulted in some abrupt decisions such as the most recent share split which, although it was geared towards remaining compliant with listing requirements, could result in a further decline due to lack of investor confidence. Despite the risk and uncertainty surrounding the share split, the company has some promising aspects that I believe could mark the onset morning rays of a bright day ahead. For instance, its new appointments to the board of directors, its most recent financial milestone, and the acquisition of assets to increase output. However, the company’s high costs and increased cash burn still pose a major solvency challenge which could darken the approaching bright day. For this reason, I recommend patience as we wait for the recent challenges to subsidize and a significant milestone toward profitability to be achieved before considering investing here.

Technical Analysis

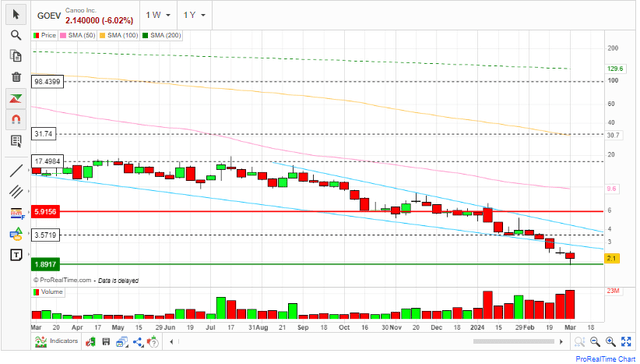

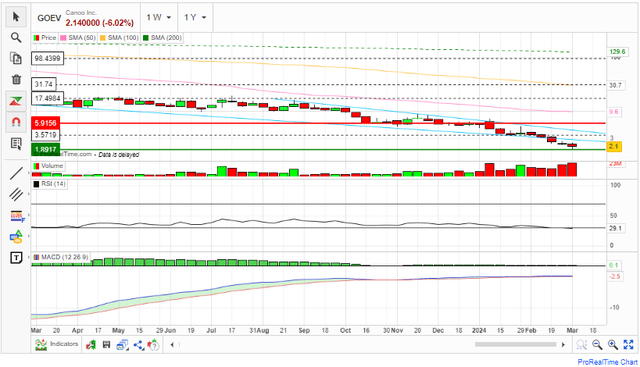

Before moving to fundamental analysis, let’s look at the price chart and evaluate future possibilities. To begin with, since Dec 2020, this stock entered a strong and unrelenting bearish momentum after hitting its all-high mark as indicated by the yellow trend line on the chart below. However, since October 2022, the bearish momentum appears to have lost steam, a sign that the stock could have bottomed, and it is currently in the consolidation phase (marked by the blue price range on the chart) where a reversal is likely.

TradingView-Author

I will dive deeper to evaluate the possibilities better. In doing that, I will use several technical indicators. To begin with, the price is below its 50-day, 100-day, and 200-day, a sign that this stock is bearish in the short, medium, and long-term horizons.

MarketScreener

Let us consider the oscillators to get a clear picture of this trend and future possibilities. Based on the MACD, it is clear that it is below the zero mark, a sign that the stock is generally bearish. However, it is worth noting that the MACD is almost at the same level as the signal line, and they are both flat, an indication that the bearish momentum has lost momentum and that this stock is consolidating. To add to this, the RSI is at 29.1, meaning that the stock has been oversold, and it could be due for a reversal. Notably, it is also flattening, further confirming my consolidation assertion.

MarketScreener

In summary, GOEV is in a bearish momentum, but there are clear signs that the bearish trend is losing steam and that this stock is currently consolidating and oversold; therefore, a trend reversal could be on the way. A good bullish signal would be when the MACD crosses the zero mark and moves above the signal line with a clear divergence.

The Share Split

Effective March 8, 2024, Canoo announced a 1-for-23 share reverse split. Before this call, shareholders had approved that decision in a held at the end of February. In the meeting, it was proposed that the split would range from 1-for-2 to 1-for-30 within one year. Surprisingly, this was effected hardly a week and at near the extreme ratio. This appears not to have inspired a lot of confidence in most investors as evidenced by the 11% shares drop premarket on Wednesday 6th when this announcement was made. Why the urgency, though? Notably, this split was executed to regain compliance with the $1 minimum bid price requirement of the NASDAQ.

Most importantly, the company had an ultimatum of up to March 25, 2024, to ensure compliance and this could justify the urgency. However, this doesn’t hold because, at the time of the announcement, the stock opened at $1.9780 which was 97.8% above the minimum bid requirement. Additionally, even following the split, the price has not improved significantly from the previous day’s close before the split on 8th March. The closing price on the 7th was $2.2770 which has declined to the current price of $2.13. To me, this tells me that the company’s objective was not achieved, which could be due to its unexplained urgency and a wide conversion ratio. As a result, the company still faces the “risk of delisting” because the management hasn’t achieved its objective. What I mean is, this was a rush decision when there was still a margin of safety of about 98%, and it may prove costly if the company’s fundamentals don’t improve.

Yahoo Finance

A Reason To Be Optimistic?

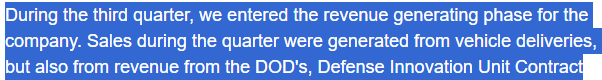

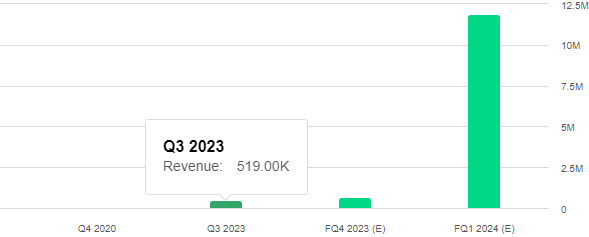

While stock splits and other similar strategies are short-term and quick fixes for a poorly performing stock, the only promising thing to guarantee a bright outlook for a stock is its improving fundamentals. Given this background, GOEV appears to be on the right trajectory considering its topline growth. Just to begin with a recap, since its IPO in 2020, this company has not been generating revenues, which shows how immature its model or rather its business has been. Fortunately, in the third quarter transcript call dated November 14, 2023, Greg Ethridge noted that the company had reached a new milestone in its finances, which is the revenue generation stage. Below are his words.

Q3 2023 Transcript

During the quarter, revenue came in at $519k, which was a significant improvement from none since its IPO in Dec 2020. Most importantly, it is projected that in the 4th quarter of 2023 and the 1st quarter of 2024, revenue will improve significantly to about $703.8k and $11.90 million respectively. This in view lends credence to the CFO’s assertion that this company has entered a new growth phase, which paints a bright outlook and perhaps a reason to believe this stock could be about to enter a bullish trajectory as well.

Seeking Alpha

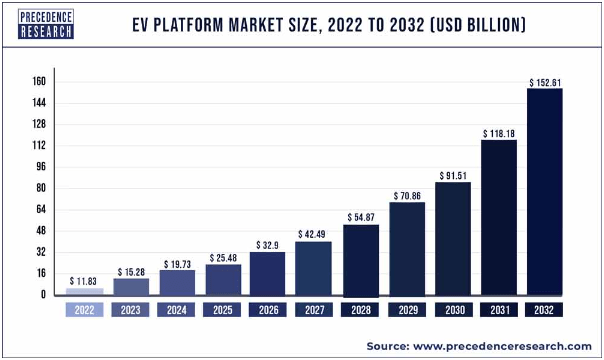

While there is this bright outlook, I find some strong levers that I believe will support this anticipated growth. To begin with, On Jan 8, 2024, it was announced that this company had acquired manufacturing assets at a discount of about 80% aimed at increasing output in its Oklahoma facility. With this anticipated output improvement, I believe the company is preparing to tap into the strong projected EV market growth, which should accelerate its revenue growth. According to precedence research, the global EV market is projected to grow by a CAGR of 29.14% between 2023 and 2032.

Precedence Research

In addition, the company’s addition of Deborah Diaz and James Chen to the board of directors is very strategic, and I believe these additions will be instrumental for the company’s success. Just to mention briefly why I believe so, Deborah brings in a wealth of experience, having served as the Chief Technology Officer at NASA and CIO for Science and Technology at the US Department of Homeland Security. I believe his expertise in technology and digital transformation, as well as governance, will be invaluable for GOEV scale-up and transformation.

For James, his strong background in the EV industry considering his service as the Vice President of Regulatory Affairs and Deputy General Counsel at Tesla as well as Vice President of Public Policy & chief Regulatory Counsel at Vivian Automotive is undisputed. His focus on commercial fleets and vision for electrification coincides with GOEV’s business model, which focuses on EVs. In my opinion, these two great individuals will be an important pillar in this company’s transformation.

One More Thing: Weak Financial Health

While this company has a bright financial outlook, its shorter and potentially medium financial health is in a crisis. First off, despite reporting revenue of $519K in the MRQ, the cost of revenue was at $903K, translating to a negative gross profit. Further, This company is still in its young stages where cash burn is high, with R&D expenses coming in at $22 million and admin expenses amounting to $24.9 million. Considering its weak cash flow generation at the moment and the high cash burnout, I believe a massive dilution or debt financing is inevitable in the near future, which could affect the company’s future performance.

Investment Takeaway

Based on this analysis, GOEV is a young company that has just entered its revenue growth phase. Its financial health is still weak given its poor cash flow generation and high burnout rate, which calls for a dilutive issuance or debt financing. In my view, this could affect the stock performance perhaps in the short and medium terms. However, the company’s long-term prospects are promising given its growth initiatives such as the new leadership addition and assets acquisitions. Given this background, I recommend patience here as we wait for this company to complete its current realignment for long-term success. My buy decision would be guided by the MACD crossing the zero mark and being above the signal line with a clear divergence. Until then, hold.

Read the full article here