In the face of impending Federal Reserve rate cuts, investors may want to consider extending duration from Treasury bills to short-term bonds.

Surprisingly, the coupon on short-term bonds does not fall after the Fed begins cutting rates, whereas the yield on 3-month U.S. Treasury bills drops significantly.

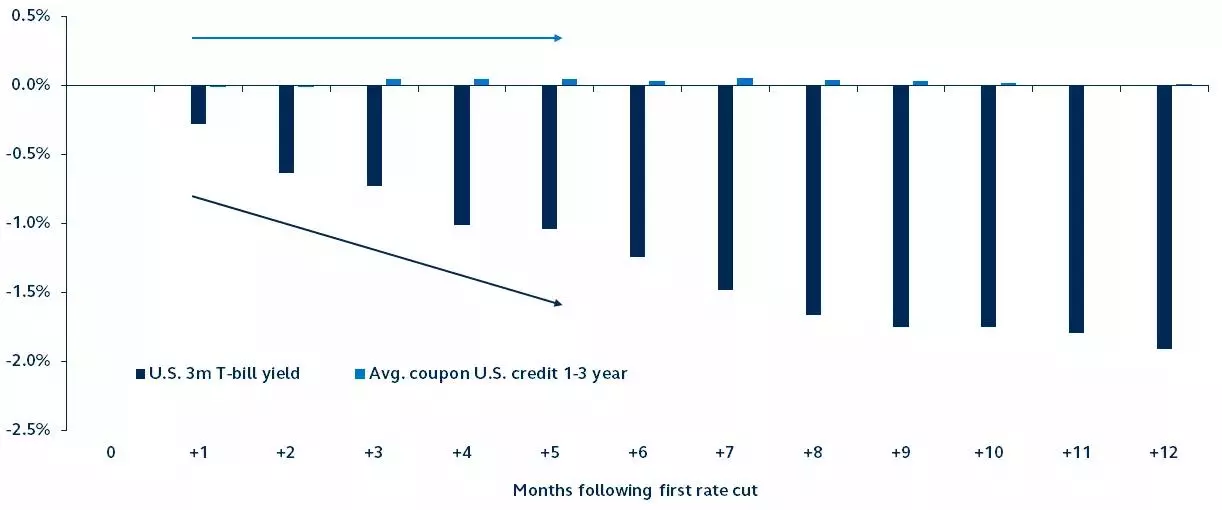

Change in 3-month T-bill yield versus short-term bond average coupon following first rate cut

Average per month following Fed rate cut, since 1982

Source: Bloomberg, Principal Asset Management. Short term bond data represented by the Bloomberg 1-3 Yr Credit Total Return Index. Data as of February 29, 2024.

With Federal Reserve policy rate reductions on the horizon, an intriguing divergence is emerging between money market funds and short-term bonds.

While anticipated rate cuts suggest a downward trajectory for money market yields, short-term bonds present a contrasting scenario – an expected increase in coupons.

During the previous six Fed rate reduction cycles, the average coupon on short-term bonds saw a marginal increase of 1 basis point (bp) twelve months post-cut.

This starkly contrasts the 3-month U.S. Treasury bills, which experienced a substantial drop of 119 bps in yield over the same period.

The counterintuitive movement in short-term bonds becomes more pronounced when their average dollar price is below par, a situation last observed in 1984.

Following the Fed’s cut that year, the average coupon on short-term bonds increased by 22 bps, whereas the yield on 3-month T-bills plummeted by 318 bps.

At the end of February, the average dollar price on the U.S. Credit 1-3 Year Index stood at $96.46. As short-term bonds pull-to-par and mature, new bonds will be issued with higher coupons than those maturing, increasing the average coupon on the portfolio – even if the Fed is cutting rates.

Despite the downward trajectory of T-bill yields following Fed cuts, the coupon rates on short-term bond funds hold upward potential, offering a compelling case for extending duration to short-term bonds during the volatile period ahead.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here