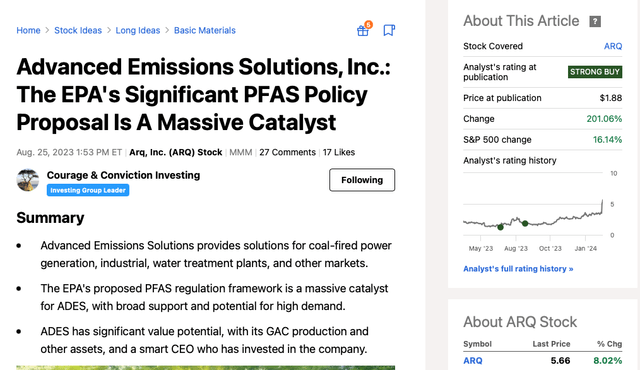

This is a follow up article on Arq, Inc. (NASDAQ:ARQ). For perspective, I covered this stock, on Seeking Alpha’s free site, for quite some time. Most recently, on August 25, 2023, I wrote: The EPA’s Significant PFAS Policy Proposal Is A Massive Catalyst. And by the way, in early 2024, Advanced Emissions Solutions, Inc. changed its name to Arq, Inc.

Seeking Alpha

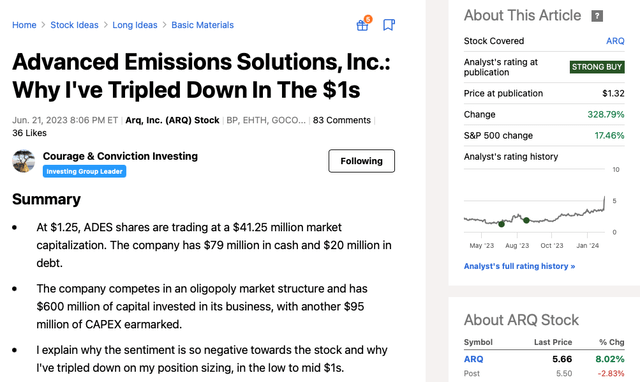

In addition, and highly controversial at the time of publication, on June 21, 2023, with shares then trading at only $1.32 per share, I wrote: Why I’ve Tripled Down In The $1s.

Seeking Alpha

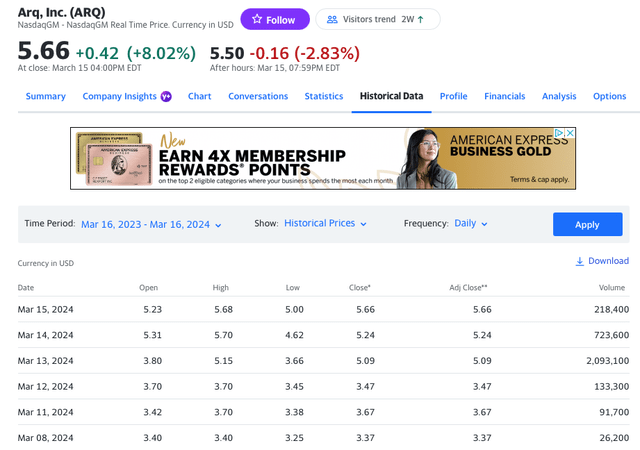

This past week, ARQ reported very strong Q4 FY2023 earnings. Moreover, its March 13, 2024 conference call was amazingly good. On the week, last week (March 11th – March 15th) ARQ shares finished up 68%!

Yahoo Finance

What The Bears Got Wrong

Back in June 2023, the Arq bears made the following arguments:

- The company would generate negative Adj. EBITDA because natural gas prices were so low.

- The company wouldn’t have enough money to fund the upgrade of its Corbin, KY and Red River, LA plants to get to granular activated carbon production online. Therefore the company would have to raise a bunch of dilutive equity.

- The company’s, admittedly expensive, $10 million term loan would cause the company to default.

- The New CEO, Bob Rasmus, was an unknown quantity and there were a few negative Bloomberg articles on the Hi-Crush bankruptcy.

- Recency bias led the shareholders base, with so many holder that got burned, led to very negative sentiment on the stock.

Fast forward to last week, and Arq’s Q4 FY 2023 earnings report and call, and all of these fears proved incorrect and mis-guided. The only correct bearish argument, which proved remotely accurate was Capex would run higher than originally anticipated, but only about $15 million. And a big part of this is management’s decision to accelerate the pace of the construction and engineering, as on site crews are work ten hours day, and six days a week, which costs more.

As it turns out, Arq posted positive Adj. EBITDA in both Q3 FY 2023 and Q4 FY 2023 despite near record low natural gas prices. They did based on Bob’s strong leadership of cancelling / letting money losing contracts roll-off. And in Q4 FY 2023, they collected on a take or pay agreement. Next, CEO, Bob Rasmus, said the following about the company and emphatically said they don’t need to raise any new equity:

Despite this increase, we remain in a position to fund the project from cash on hand, cash generation, ongoing cost reduction initiatives, potential customer prepayments for GAC contracts and a planned refinancing and potential expansion of our term loan for which we already have a term sheet in place and importantly, we have no plans to dilute our existing shareholders by selling equity. While the news of the cost increase is disappointing, it should not detract from the overall attractiveness of the project. Market prices for GAC continue to increase. We remain confident in our ability to contract our capacity prior to production.

Lastly, as a major bull and long-time shareholder of Arq, I’ve had the opportunity to speak with Bob, via Zooms calls, on at least two occasions. I’ve been very impressed Bob, as a CEO, as a strategic/ shareholder oriented stewards of shareholders’ capital, and as someone who gets stuff done. When I looked at his history, I saw someone who left a lucrative private equity principal role, in 2012, to found and take Hi-Crush public. My thought process was different than the first level conventional wisdom or popular opinion. He someone with enough vision to see the shale oil revolution, lights year ahead of the mainstream public and Wall Street, and setup Hi-Crush to be a key supplier. For a few years, Hi-Crush printed money. Unfortunately, though, in oil, there are boom and bust cycles, and when the Saudi’s decided to try and destroy U.S. shale, oil prices crashed from the $120s to the $20s, in a short period of time. During this nasty shake-out period, shipping better quality white sand from Wisconsin to the Permian got too expensive, as railroads are oligopolies, and during the crash, Wisconsin white sands got dis-intermediated by lesser quality Texas or closer located frac sands, which wasn’t captive to the railroads (the all in delivered cost was lower due to much lower shipping costs).

Fast forward today, and Bob is doing exactly what he said he would do and leading Arq well. I am very impressed with his leadership.

Why I Think Arq Can Have Another Leg Up, And A Shot A $10+

As someone who knows this company inside and out, the most exciting part of this story was Arq’s March 13, 2024, 8:30am ET, conference call.

I am going to share five key highlights.

(All quoted materials is from Arq’s Q4 FY 2023 conference call).

1) If The EPA Validates Its Policy Paper, On PFAS, At The Current Guidelines, This ‘WOULD’ Translate To 3X to 4X Higher Demand, from the current 170 Million (annual) pound per year municipal water baseline demand!

Moving to Slide 13. We believe the GAC market remains significantly undersupplied at a time when demand is expected to significantly increase. Just a few weeks ago in February, the EPA provided an update, which highlighted the scope of their ambition to significantly reduce the presence of PFAS in our communities. These initial proposals are expected to be fleshed out in the coming weeks according to the EPA. Should these proposals, which includes a nearly 95% reduction in currently permissible PFAS amounts become formal regulations, it would serve as a major catalyst for even greater demand for our products and solutions. To provide context, if currently proposed regulations were enacted, this could generate an increase in demand for granular activated carbon products of 3 times to 4 times within the municipal water market alone above the current approximate 170 million pounds annual usage. And this is not just a US dynamic, as we expect other global geographies, notably the EU will follow a similar course. Hence, our enthusiasm as it relates to our LSR European opportunity. It’s clear that as these rules tighten, many of our customers will need to apply even stricter approaches to their existing facilities, amplifying the physical product and value we can deliver to them.

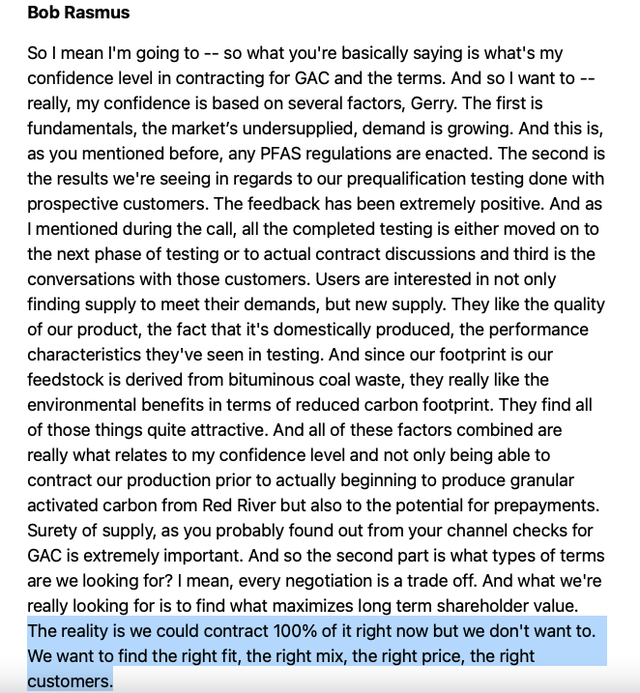

2) On The Analyst Q&A – Bob said they could contract 100% of 25 Million Pounds, of FY 2025 GAC production, today, as in March 2024!

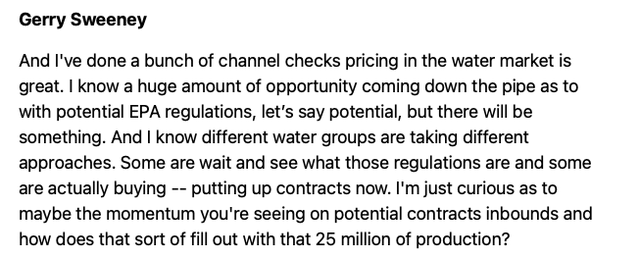

See here: The Question

Arq’s Q4 FY 2023 Conference Call

The response:

Arq’s Q4 FY 2023 Conference Call

3) Arq Wetcake (Corbin, KY) Could Have A Big Demand/ Environmental Blending Feedstock In Asphalt

I’d also like to highlight some very encouraging advances our team is making in the development of new and alternative uses for our Arq Wetcake feedstock. While still early stage, we are increasingly confident in this product’s ability to serve as a blending feedstock in the manufacturing of environmentally responsible asphalt while providing environmental advantages, cost advantages and benefits related to limiting and reducing the effects of temperature swings. This is a great example of our team’s relentless focus on innovation and ability to think of new and creative ways to maximize the applications and value of our existing portfolio products and capabilities. With our ongoing optimization of the PAC portfolio, we have driven significant improvement in gross margin and profitability.

4) Corbin, KY Arq Wetcake Production By Q2 2024 and Red River and Red River’s GAC Production by late Q4 FY 2024

They are running 6 day and 10 hours shift, to get Red River online and into production for late Q4 2024.

Development at our Corbin facility remains within budget and on time for commissioning in early second quarter of 2024. Construction of our incremental 25 million pound GAC line at Red River commenced in October 2023 with commissioning targeted for the fourth quarter of this year.

5) PAC Should Be Cashflow Positive, in FY 2024

This is important as this market segment carries a higher ASP than our existing PGI segment. The PAC business is expected to generate net cash in 2024.

Legacy Contracts Rolling Off

Our average selling price for the fourth quarter improved 18% year-over-year or 16% on an annualized basis. We continue to eliminate negative margin contracts as we focus on profitability over volumes and have now taken these loss making contracts down from roughly 24% of volumes in 2022 to 14% in 2023. And as of March 31st, we will have just one negative margin contract remaining, reflecting approximately 2% of forecasted 2024 volumes.

Risks

- Additional CAPEX overruns or delayed production.

- The EPA somehow not enacting its PFAS policy paper.

- Natural gas prices (front month contracts) remaining in low $2s MMBtu for an extended period of time.

My Skin In The Game

It is fun to write articles and offer bull ratings and tell people what to buy or sell. It is little different when you’re aggressively eating your own cooking and where you’ve stuck with an investment thesis during the thick and thin times, as you believe your thesis, even when it was wildly unpopular.

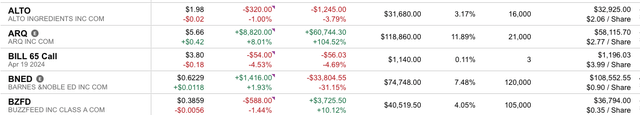

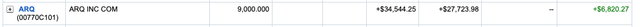

Enclosed below are the three different family accounts where I own Arq shares.

The Flagship Account

Fidelity Actual Partial Portfolio Snapshot

The Smaller Account

Fidelity Actual Partial Portfolio Snapshot

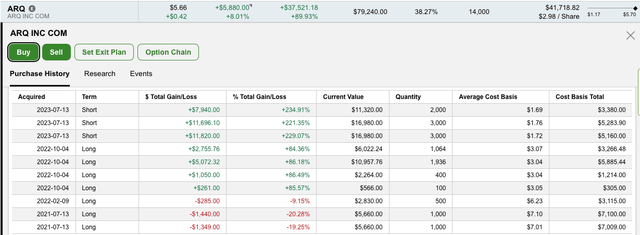

A Sleepy Rollover IRA

Fidelity Actual Partial Portfolio Snapshot

(In this account, please look closely at the purchase date. There are shares owned with an original purchase date of July 2021).

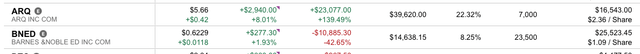

Additionally, year-to-today, in the family accounts, in 2024, we have $38K of realized gains in Arq. In order to fund my outsized Barnes and Noble bet, I’ve had to monetize some of my Arq gains.

Realized FY 2024 Arq Gains

Flagship Account

Fidelity Closed Positions

Smaller Account

Fidelity Closed Positions

As a quick aside and speaking of Barnes and Noble. I intentionally included my long position in Barnes & Noble Education (BNED), to show I’m still very much long BNED shares. On January 22, 2024, I wrote: After The DOE Scare, Why I’ve Tripled Down. Fast forward to today, and despite BNED posting strong Q3 FY 2024 Adj. EBITDA results as well as maintaining its full year FY 2024 Adj. EBITDA guidance, of $40 million (its fiscal year end April 30, 2024), the company has a proverbial gun to its head. Its Senior Secured lender, Bank of America (BAC), has given the company a drop dead date, of April 3, 2024, with one possible one week extension, to do the following: 1) get a refi 2) sell the business 3) do some type of M&A and/ or 4) raise equity.

As you can see above, I still believe I have a great thesis here, but I acknowledge the bet is now binary. It is possible that BNED goes to zero, in the most adverse scenario. That said, again, the business is clearly inflecting, I would argue FY 2025 and FY 2026 Adj. EBITDA can materially grow, and the DOE scare, has proven just that, only a scare as there wasn’t close to a consensus, in February or March 2024 DOE hearings. And by the way, this equitable access model, the model that BNED pioneered with its FDC, was designed and it’s based on an Obama era policy that is truly win-win, and there ample empirical evidence of its efficacy. Again, I’m an analyst, author, and person that bets my higher conviction ideas and sees them through regardless of the outcome and uncertainty: win, lose, or draw.

Putting It All Together

Bob Rasmus and the entire Arq team are doing a great job. I’m thrilled he is the CEO. The company has posted two consecutive positive Adj. EBITDA quarters, despite the near record low natural gas prices that negatively impacted coal fired electric generation. The GAC market is structurally under supplied and new green field or brown field GAC expansion would cost upwards of $4 to $5 per pound of capacity, not to mention the years it would take to get permitting, raise the capital, and actually build out the plants. Also, this is an oligopoly market. With or without the EPA’s landmark PFAS policy enactment, which could happen as soon as within weeks to months, policy makers in Europe and in many U.S. States aren’t waiting for the EPA’s lead to enact their own regulations PFAS regulations. With or without the EPA, the train has left the station and policy makers are investing to stop PFAS from continuing to compromise our water supplies.

Furthermore, Arq has a huge advantage with its 30 years supply of bituminous coal at its Corbin, KY plant. This gives the company a cost advantage and its patented Arq technology has other optionality, to sell Arq wet cake into other market segments.

Yes, the stock has moved up smartly, from the mid $3s to mid $5s, however with only 34 million shares in existence, we aren’t talking about a big move in market capitalization, in the absolute sense. Based on the relatively thin/ light trading volume, March 13, 2024 notwithstanding, I would argue very few people on Wall Street have even ever heard of Arq. Secondly, if the blue sky scenario takes shape, and the EPA does enact its PFAS policy (from its original March 2023 policy paper proposal), the market hasn’t yet awaken to how compelling the math is here. As I stated early, and I’m quoting Arq’s Q4 FY 2023 conference call commentary:

Just a few weeks ago in February, the EPA provided an update, which highlighted the scope of their ambition to significantly reduce the presence of PFAS in our communities. These initial proposals are expected to be fleshed out in the coming weeks according to the EPA. Should these proposals, which includes a nearly 95% reduction in currently permissible PFAS amounts become formal regulations, it would serve as a major catalyst for even greater demand for our products and solutions. To provide context, if currently proposed regulations were enacted, this could generate an increase in demand for granular activated carbon products of 3 times to 4 times within the municipal water market alone above the current approximate 170 million pounds annual usage. And this is not just a US dynamic, as we expect other global geographies, notably the EU will follow a similar course.

As one of the few publicly traded companies, this is one of the few vehicles for investors to bet on raising GAC demand. In a blue sky scenario, I don’t think it requires an impressive imagination to think Arq shares could see $10+ on the screens.

We shall see.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here