A little over a year ago, in the middle of February of 2023, I found myself analyzing Gates Industrial Corp (NYSE:GTES). For those not aware of the company, it operates as a producer and seller of engineered power transmission and fluid power solutions. Most of the company’s products are sold on the aftermarket, but it does sell some of them directly to OEMs (original equipment manufacturers). And generally speaking, the company has done quite well. When looking at the industry in which it operates, how cheap shares were, and how well the business had done in the years leading up to that original article, I concluded that a ‘buy’ rating was logical.

Usually when I assign a ‘buy’ rating, it is my belief that the firm in question should see its share price outperform the broader market for the foreseeable future. But that has not, unfortunately, come to pass. Shares have seen some nice upside, totaling 17.1% in all. But that falls short of the 25.5% rise seen by the S&P 500 over the same window of time. In revisiting the firm, I found that there does appear to be some weakness building. More likely than not, 2024 will be a bit worse for the company than 2023 was. But when you consider how cheap the stock remains, both on an absolute basis and relative to similar firms, I would argue that additional upside is warranted from here.

A gradual shift

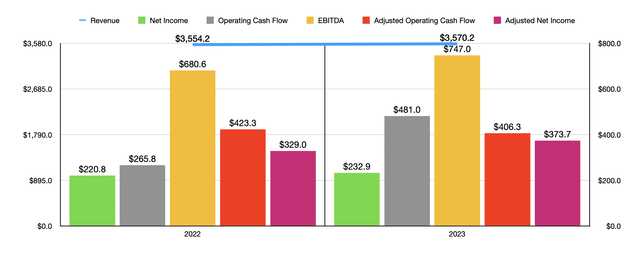

If you were to look at the fundamental data of Gates Industrial Corp for just 2023 relative to 2022, you would see a business that is continuing to grow. Revenue of $3.57 billion was slightly higher than the $3.55 billion in revenue generated in 2022. That increase in sales was driven almost entirely by a $200.4 million benefit that came from price hikes on the company’s products. This was offset, to some extent, by lower volumes shipped. The company was also hit to the tune of $8.9 million from foreign currency fluctuations. So on an adjusted basis, revenue this past year would be a bit higher than what was ultimately reported.

Author – SEC EDGAR Data

The bottom line also saw improvement for the most part. Take net profits as an example, they managed to grow from $220.8 million in 2022 to $232.9 million last year. Even though the company saw an increase in interest expense and selling, general, and administrative costs, these were more than offset by margin improvement when it came to the gross profit margin. This grew from 35.1% of sales to 38.1%. That, according to management, was because of lower volumes, foreign currency fluctuations, reduced freight costs, and more. Even if we make certain adjustments to this, net income would have risen from $329 million to $373.7 million.

Other profitability metrics largely followed suit. Operating cash flow, for instance, shot up from $265.8 million to $481 million. Though if we adjust for changes in working capital, we would get a decline from $423.3 million to $406.3 million. The other important metric to look at is EBITDA. It managed to improve year over year, climbing from $680.6 million to $747 million. For the most part, this all looks quite positive. But the picture does start to change if we look at just the most recent data available. This data covers the final quarter of the 2023 fiscal year.

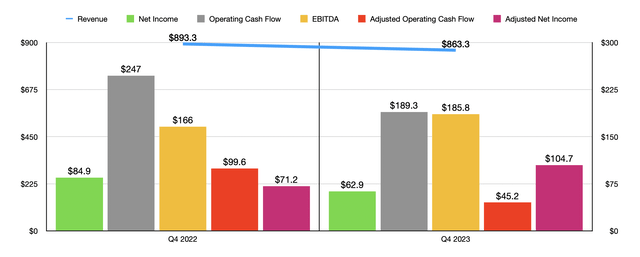

Author – SEC EDGAR Data

In the chart above, you can see precisely what I am talking about. Revenue in that quarter totaled $863.3 million. That’s 3.4% below the $893.3 million generated the same time one year earlier. This drop in revenue, according to management, was driven by weakness in certain product categories such as Personal Mobility and Diversified Industrial. Management blames this on the end markets these categories serve experiencing weakness themselves. Fortunately, this pain was partially offset by strength in the Automotive category. Considering that supply chain issues have been easing and that inflationary pressures are letting up, I don’t find it surprising that automotive would be a bright spot for the firm.

The pain in the final quarter was not limited to revenue. Net profits also fell, dropping from $84.9 million to $62.9 million. This was in spite of the fact that the company’s gross profit margin shot up from 34.7% to 39.1%. However, the firm was negatively impacted by a 3% rise in selling, general, and administrative costs, combined with a $35.3 million swing and other expenses from a gain of $25 million in the final quarter of last year to an expense of $10.3 million this year. Fortunately, if we make certain adjustments, we get a rise in that income from $71.2 million to $104.7 million. But this doesn’t stop other profitability metrics from taking a hit. Operating cash flow fell from $247 million to $189.3 million, while the adjusted figure for this dropped from $99.6 million to $45.2 million. The only other profitability metric to fare well was EBITDA. It managed to grow from $166 million to $185.8 million.

With 2023 now over, it’s important to start looking into the future. And the cool thing is that management has provided some guidance for the year. They expect weakness to continue, with revenue down as much as 3% this year. Although they did say it could be as high as up 1%. So we will have to wait and see. Earnings per share of between $1.28 and $1.43 should translate to net profits, at the midpoint, of $362.5 million. The company also gave guidance that suggests that operating cash flow should be at least $426.2 million. And lastly, EBITDA is expected to be between $725 million and $785 million. At the midpoint, that would be $755 million.

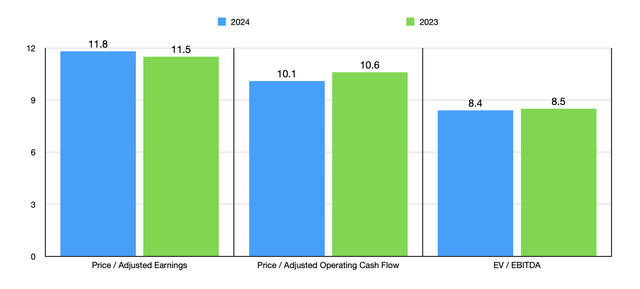

Author – SEC EDGAR Data

With these estimates, it becomes very easy to value the company. As shown in the chart above, the stock does look cheaper on a forward basis using two of the three estimates. Not only is the stock attractively priced on an absolute basis, it’s also relatively cheap compared to similar firms. In the table below, you can see how the stock is priced compared to five similar enterprises. On a price to earnings basis, two of the five companies ended up being cheaper than it. This number drops to one of the five using both the price to operating cash flow approach and the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Gates Industrial Corp | 11.5 | 10.6 | 8.5 |

| ATS Corporation (ATS) | 30.0 | 45.7 | 14.3 |

| Mueller Industries (MLI) | 9.8 | 8.8 | 5.2 |

| Franklin Electric Co. (FELE) | 24.6 | 15.0 | 15.4 |

| John Bean Technologies (JBT) | 5.4 | 44.4 | 12.4 |

| Albany International (AIN) | 26.8 | 20.1 | 12.7 |

Takeaway

From all that I can tell, this year might not be the best for Gates Industrial Corp, but the market does seem to be overreacting to that reality. Shares have seen nice upside, but given how cheap the stock is, upside should be greater than what has been achieved. This leads me to keep the company rated a ‘buy’ today even though the easy money has already been captured.

Read the full article here