Investment Thesis

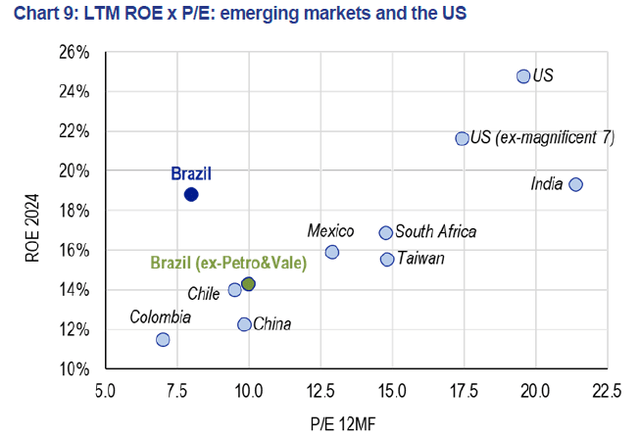

I recommend buying the iShares MSCI Brazil ETF (NYSEARCA:EWZ) which replicates the Brazilian stock market. Brazil has strong competitive advantages in its agriculture and should be an important global player in the energy transition. With a population of more than 200 million inhabitants, it is a consolidated democracy, and geopolitically distant from conflicts by maintaining a certain neutrality. Additionally, it trades below its peers with a Price / Earnings of 8x despite an excellent return on equity of 19%, higher than its peers.

Introduction

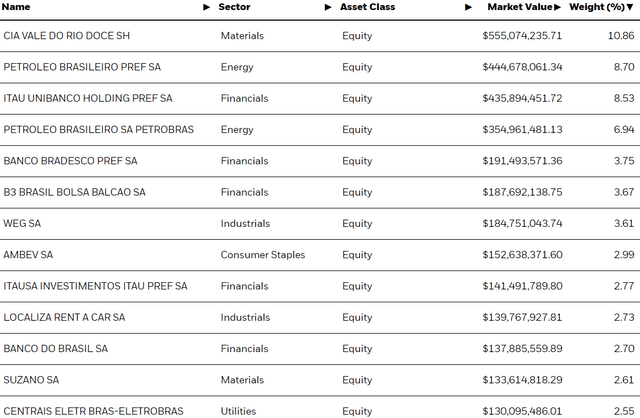

The iShares MSCI Brazil is an exchange-traded index fund that seeks to replicate the performance of the MSCI Brazil 25-50 Index. It has approximately 60 companies, covering around 85% of the total market value of companies that are traded on the Brazilian stock exchange. Below, we have the Brazilian companies with the greatest weight in the index:

Composition of the EWZ (ishares.com)

In the long term, the Brazilian economy, as well as other emerging markets, operate in cycles of growth followed by strong deceleration. In my opinion, the current Brazilian economic cycle can provide excellent returns for investors, as we will begin to see below in its competitive advantages.

Competitive Advantages Of The Large Farm

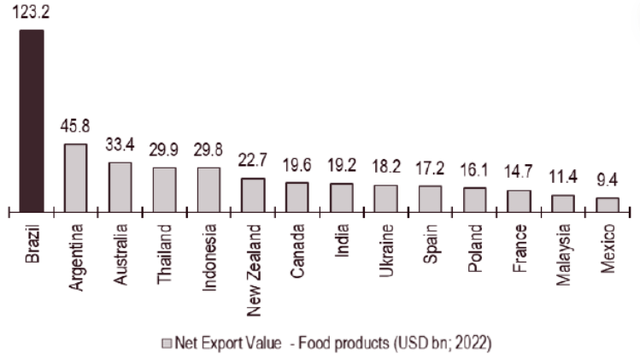

Brazil is a global agriculture powerhouse, given its characteristics as a commodity exporter. After increasing food production in recent decades, the country is now the second-largest food exporter in the world, second only to the USA.

However, Brazil is the largest net food exporter in the world (exports minus food imports). In 2022, Brazil’s net food exports totaled US$123 billion, almost 3 times more than the second country, Argentina. The US, despite being the largest exporter, is a net importer of food products.

Food and Agriculture Organization

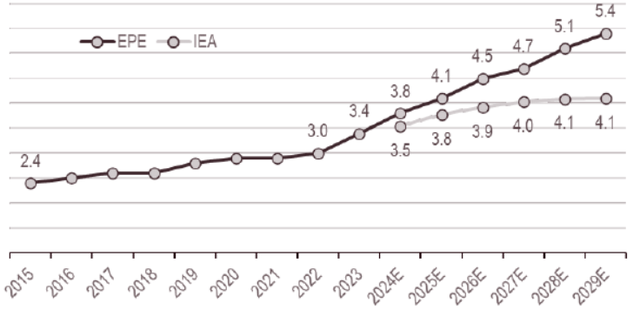

The country is also competitive in the oil industry. The country is the 7th largest oil exporter and should rise in the ranking as its production increases in the coming years – EPE (Energy Research Company) estimates that Brazil will be the 5th oil producer by the end of the decade.

According to the IEA’s “2023 World Energy Outlook”, Brazil is expected to record the second-highest growth rate in oil production in 2022-35, at ~1 mb/d – already the EPE’s most optimistic forecasts estimate that production grows to 5.4 mb/d in 2029 (+ 2.4 mb/d, or an increase of 80% in the period).

Increase in Brazilian oil production (EPE & IEA Projections)

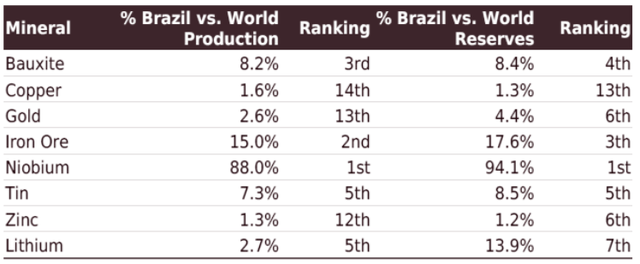

Finally, Brazil is also a mineral power. The country produces more than 90 different minerals, is the second largest in iron ore and the largest producer of niobium.

Brazil in the mining market (US Geological Survey)

It is also a relevant player in copper (1.6% of global production) and lithium (fifth-largest producer in the world), minerals crucial to the energy transition. Brazil is one of the world’s largest commodity players, and this representation corroborates my bullish thesis for the EWZ.

Brazil’s Position In The New Global Geopolitics

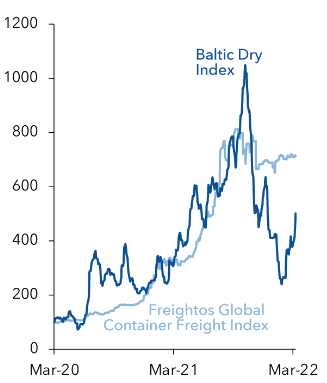

Until the start of the pandemic, the world was experiencing great globalization and competing on price. In other words, countries, from a supplier and buyer perspective, sought the cheapest supplier to be competitive in the globalized market. This caused direct investment in China, for example, to jump from 1 billion euros in 2008 to 35 billion euros in 2016. This order began to change after the pandemic in 2020, which caused a major disruption in the supply chain, such as the price of sea freight.

Shipping Costs (Haver Analytics)

At this time, there was a lack of semiconductors in the world, for example, which caused the prices of durable goods to rise sharply. In this case, the countries, considering the perspectives of supplier and buyer, came to the conclusion that it was no longer so advantageous to have few suppliers of raw materials at low prices. This is due to the scarcity of raw materials, and the inability to meet demand. In this context, Brazil began to be recognized as a more attractive supplier of raw materials to the world.

While the supply chain was adjusting around the world, the Ukrainian War occurred, and here we had several more events, such as Russia interrupting the supply of gas to Europe.

At this time, countries realized that price was not the most important thing, but that they needed several suppliers to guarantee the supply of products, and more than that, they needed trust in the supplier, and Brazil has a reputation for being very neutral when it comes to any geopolitical conflict.

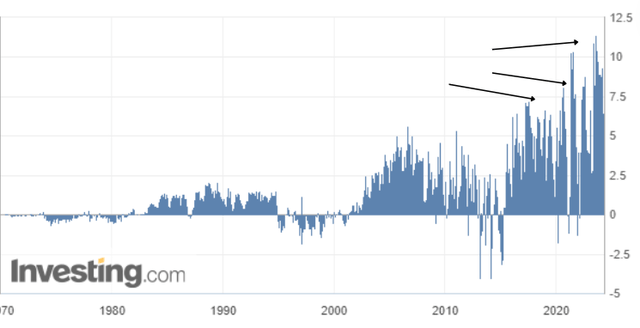

We can see in the graph below how these geopolitical events contributed to Brazil having an increase in its trade balance:

Trade Balance (Investing)

This new position of Brazil in global geopolitics corroborates my bullish thesis for EWZ. Additionally, unlike some peers in the emerging market, Brazil has relatively solid institutions. As an example, we have the independent Central Bank. The Brazilian Central Bank has done an excellent job of combating inflation.

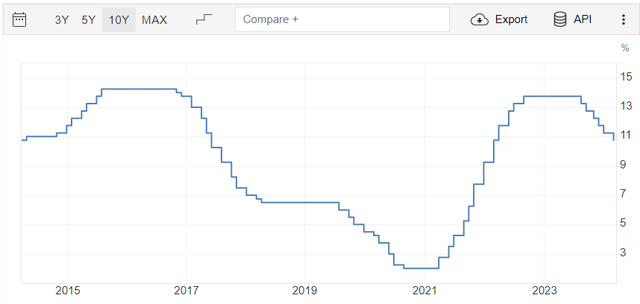

We must remember that central banks around the world adopted an expansionary fiscal policy in the midst of the pandemic, and this ended up bringing inflation to the world sometime later.

Brazil was one of the first countries to raise its interest rate. And after the FED began the process of raising interest rates, Brazil was very advanced and with restrictive interest rates at 13.75%.

What was the result? Brazil is going through a soft landing, and with inflation under control, it continues to cut interest rates, which are currently at 10.75%.

Brazil Interest Rate (Trading Economics)

In this sense, Fitch raised Brazil’s rating to BB, and although it is still a speculative level, with two reassessments to the investment grade remaining, Fitch reinforced that Brazil has a large and diversified economy, high per capita income, internal markets funds and a large cash cushion that support the government’s financing flexibility.

In short, the unique position that Brazil finds itself in compared to its emerging peers and the improvement in economic prospects corroborate my bullish thesis for EWZ. But given these good prospects and competitive advantages, how is Brazil priced by the market? But does the valuation take into account these competitive advantages and better prospects for the economy?

Valuation Is Very Favorable

When we look at the valuation of Brazilian assets compared to the world. Petrobras and Vale have been the big profitable companies on the Brazilian stock exchange in recent years, which is why there is an indicator that excludes them (Brazil ex-Petro&Vale). We can see the excellent risk-return ratio offered:

ROE x P/E (Bloomberg & BTG estimates)

Surprisingly, Brazil has a higher return on companies’ equity than Mexico (EWW), South Africa (EZA), Taiwan (EWT), Chile (ECH), China (MCHI) and Colombia (GXG). However, its price / earnings is only greater than that of Colombia, a country with 51 million inhabitants and much less relevant than Brazil in the international community. Another highlight is that Brazil has a ROE similar to India (INDA), but India has more than 20x price / earnings.

Considering that EWZ returns to trading at the average of its emerging peers (excluding India) we have an average price / earnings of 11x. This great potential corroborates my bullish thesis for the shares, and considering that Brazil’s average price/earnings is 8x, this implies an appreciation potential of 37%, and a fair value of the EWZ of $42.8. But what do the Seeking Alpha tools show us?

EWZ According to the Seeking Alpha Grades

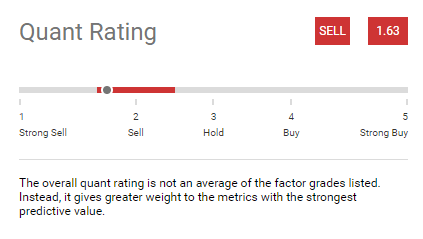

According to the entire development of the thesis, the outlook seems quite positive, right? However, that’s not what Seeking Alpha’s Quant tool shows:

Quant Factor (Seeking Alpha)

Let’s dig deeper into why the tool recommends selling:

ETF Grades (Seeking Alpha)

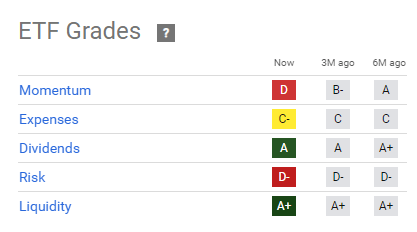

Analyzing deeply, we see that the tool gives excellent grades for dividends (as we have seen, Brazilian companies have high ROE), and for liquidity. Additionally, expenses receives a hold rating. However, momentum and risks receive D and D- respectively.

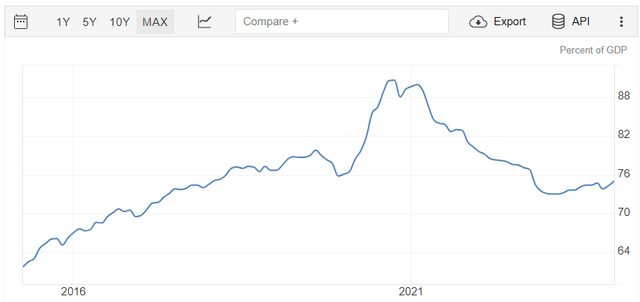

And in fact, since 2008 Brazil’s valuation has been low compared to its peers. This is mainly due to the Brazilian fiscal scenario, as a reference, Brazil has 75% gross debt/GDP, while its emerging peers have around 60%.

Brazil Gross Debt To GDP (Trading Economics)

However, the fiscal scenario has been improving with structuring reforms such as pension reform, with great help from the Bolsonaro Government, gross debt/GDP rose from 89% to 75% in the midst of a pandemic, bringing austerity to public accounts.

The new Workers’ Party Government has a goal of bringing the public accounts deficit to zero in 2024, and having a surplus in the following years. Based on this premise, I believe that Brazil’s momentum should improve, which corroborates my bullish thesis for the shares. However, we need to know the risks of the thesis.

Potential Threats To The Bullish Thesis

One of the great risks for the retraction of the Brazilian economy, consequently justifying the low multiples, is the expectations of an interest rate cut in the USA. Currently, Brazil still has the 2nd highest real interest rate in the world, although it has been cutting its interest rate. As a reference, in August 2023 it was 13.75% and is currently at 10.75%, the market is already pricing in the interest rate falling to 9% at the end of the year. An interest rate reduction beyond 9% (which would be a great stimulus for the economy) will depend on how much the FED can reduce its interest rate.

The Brazilian economy is very dependent on China, which apparently no longer has the demographic dividend and is facing a very strong real estate crisis, including several articles stating that China has become uninvestable. Therefore, if you believe that China will not experience strong GDP growth again, you should not get too excited about Brazil’s thesis.

Finally, Jair Bolsonaro, who was considered the candidate of Brazilian fiscal austerity, was defeated in 2022 by Lula of the Workers’ Party. It is worth remembering that Lula was once imprisoned for corruption, and the Workers’ Party has already faced numerous accusations of crimes in Brazil. I recommend that investors strongly examine the risks, which have brought great volatility in recent years.

The Bottom Line

The valuation shows that EWZ trades at a significant discount of 27% to its peers in terms of price/earnings, despite an excellent return on equity for Brazilian companies.

Furthermore, Brazil may play a crucial role in the world in the coming years with the energy transition, and may play an important role as a supplier of raw materials to the world, due to its wealth of grains, ore, oil and other commodities.

Based on this analysis, the recommendation is to buy EWZ. Investors should pay attention to the global investment scenario in emerging markets, with Brazil very well positioned ahead, and having a combination of low price and high return. In my opinion, the risk-return ratio is extremely attractive, and this opportunity does not usually last long.

Read the full article here