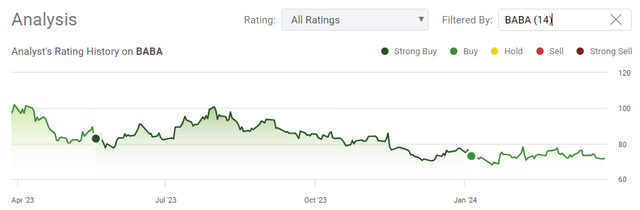

Investing in Alibaba (NYSE:BABA) has been an absolute trainwreck for many investors, including myself. The narrative about Chinese companies has been winning rather than the fundamentals. Maybe that’s the problem, as I continue to overlook the external negative factors while continuing to concentrate on the numbers. When BABA reported its Q3 numbers at the beginning of February, they produced a top and bottom line beat while increasing its buyback authorization by an additional $25 billion. No matter what BABA does, the market doesn’t respond well, and BABA continues to resemble a value trap rather than a value play. I have made several purchases under the $100 level and continue to dollar cost average into my position, but I am still in the red. This is all about the numbers, and if you believe the numbers then BABA could be a coiled spring waiting to burst. I have been wrong the whole way down, but I still believe there is an immense opportunity for investors who have a high tolerance for risk and are willing to speculate. While shares of BABA look like they want to bottom, they could very well continue to decline.

After going through their results and earnings call and looking at the current and forward valuations, I realized that the shares of BABA are still interesting, and I am not ready to deem this investment a loss. Chinese President Xi Jinping met with a group of American business executives, including Cristiano Amon from Qualcomm (QCOM) and Stephen Schwarzman from Blackstone Group (BX). It looks like China is trying to boost overseas investment into their country despite geopolitical tensions, which could end up being the catalyst for long-term BABA holders’ need to get back on the right side of the investment. While BABA’s shares haven’t done well, I plan on adding to my position because I believe that the opportunity outweighs the risks.

Seeking Alpha

Following up on my previous article about Alibaba

Shares of BABA have slightly declined since my last article was published on 1/5/24 (can be read here). The S&P 500 has appreciated by 12.02% since 1/5/24, while BABA continues to sit on the sidelines during the rally as shares have declined by -2.22%. In my previous article, I discussed why the investment could still work out even though shares were trading at a lower price than when BABA went public. Now that we have more data and significantly more information regarding how BABA’s cash will be used, I wanted to follow up with a new article. I will discuss why I think the numbers are real, BABA’s fundamentals, and why shares could act as a coiled spring.

Seeking Alpha

Risks to my investment thesis on BABA

While I am still bullish on BABA, shares have been in a perpetual state of decline for several years. The first risk to my investment thesis is that shares continue to trade sideways or continue lower, and more value erodes from its market cap. The next risk is that geopolitical tensions worsen, and Chinese investments in the American market remain scrutinized and underappreciated. There is also a risk that the numbers are inflated no matter how low the probability is. The bottom line is there are several factors working against BABA, and it’s a crap shoot if relations between the two nations improve and the investment community is willing to put fresh capital to work in Chinese stocks. There is also a risk that shares of BABA eventually get delisted in the U.S., which presents a different set of problems. I do suggest contacting your brokerage house and asking them directly what will happen to your shares if they get delisted. I have asked that question, and I am perfectly fine with the response I received, but it’s something that I suggest current and potential investors inquire about. Ultimately, shares of BABA may remain in their current depressed state, and the opportunity cost could be significant.

When I look at BABA as a company, I still believe I am getting a great deal, and given a better geopolitical landscape shares could see significant upside

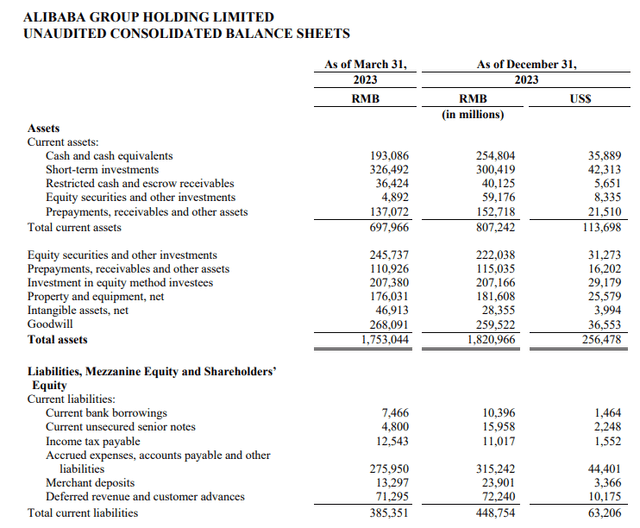

I am looking at BABA as I would any other company. I am dissecting the financials and looking at the entire entity to see what I am investing in. Starting with the balance sheet, BABA has a solid foundation. When shares of BABA are purchased, you’re making an investment in a company that has $86.54 billion in on-hand liquidity. BABA has $35.89 billion in cash and cash equivalents, with an additional $42.31 billion allocated toward short-term investments. BABA also has another $8.34 billion in equity securities and other investments that can be immediately liquidated. Looking at the long-term assets on the balance sheet, BABA has an additional $31.27 billion stashed away in equities and other investments, with another $29.18 billion invested in equity method investees. In total, between on-hand and long-term investments, BABA has $146.99 billion in liquidity. BABA’s total liquidity is equivalent to 81.91% of its $179.46 billion market cap. BABA has $19.66 billion in long-term debt on its balance sheet and $95.6 billion in total liabilities when you factor in accrued expenses, capital leases, and their other liabilities. BABA could eliminate all its debt and have over $127 billion in liquidity remaining or eliminate every liability and still have over $45 billion in liquidity on its balance sheet. This is one of the best balance sheets I have read, and it’s not every day that you can acquire shares in a company that has over 80% of its market cap on the balance sheet in the form of cash.

Alibaba

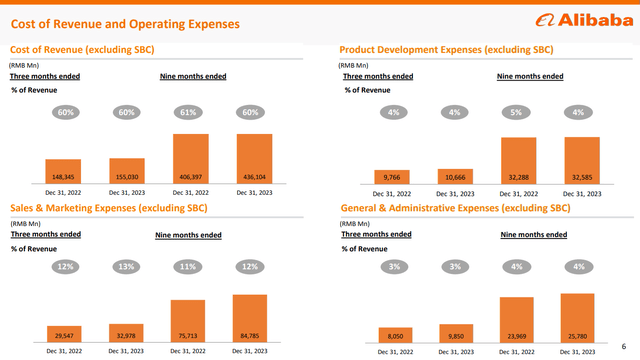

BABA has a strong foundation, and while you’re purchasing a large amount of cash, you’re also getting a conglomerate of operating companies generating tens of billions in profitability. In the trailing twelve months (TTM) BABA has generated $130.67 billion in revenue. BABA has produced $49.53 billion in gross profits, which has placed its gross profit margin at 37.91%. BABA is producing $25.6 billion in EBITDA, and $21.51 billion in free cash flow (FCF). On the absolute bottom line, BABA has generated $14.13 billion in net income in the TTM. In addition to getting almost of the equivalent of the market cap in cash from the balance sheet, BABA is generating over $130 billion in revenue and $14 billion in net income. This is a company that operates in the largest country in the world, and as the population continues to expand, they should increase their top and bottom line.

Alibaba

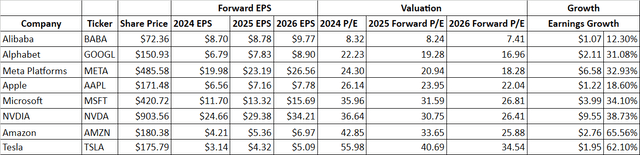

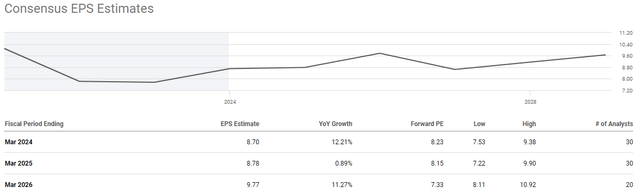

When I look at the analyst estimates for BABA, they are projected to generate $8.70 in earnings per share in 2024 and $9.77 in 2026. BABA is trading at 8.32 times 2024 earnings and 7.41 times 2026 earnings. None of the Magnificent 7 trade anywhere near these levels, and the main difference between these companies is where they operate. The lowest valuation in the Magnificent 7 is Alphabet (GOOGL), which trades at 22.23 times 2024 earnings and 16.96 times 2026 earnings. BABA is effectively trading as if it’s a tobacco company, even though it operates a conglomerate of segments, including digital media and entertainment, wholesale commerce, retail commerce, international commerce, cloud infrastructure, and a logistics network. If you trust the numbers, from a valuation standpoint, BABA looks like an absolute steal.

Steven Fiorillo, Seeking Alpha Seeking Alpha

BABA’s capital allocation plan is bullish

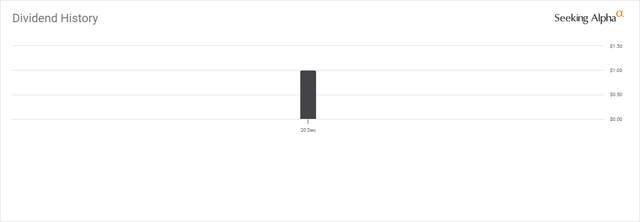

One of the big questions was whether BABA’s numbers can be trusted. There has been speculation on this point, but one of the signs that you can trust the numbers is in their capital allocation program for me. BABA implemented a dividend program that started in December of 2023. BABA paid a $1 annual dividend with a yield of 1.4%. By allocating a portion of the earnings back to shareholders through a dividend, it helps strengthen the case that its profitability is factual. If BABA grows its dividends in 2024 and becomes a dividend growth company, then we could see more credibility attached to its name and a new segment of investors become interested in the company.

BABA also has a strong buyback program as they repurchased 36.6 million ADS shares for a total of $2.9 billion during their 3rd quarter. During the 2023 calendar year, BABA repurchased 112.2 million ADS shares for a total of $9.5 billion. BABA reduced its share count by -3.3% in 2023. BABA had $10.3 billion remaining in approved liquidity on its share repurchase program, and its board of directors approved an additional $25 billion in repurchases through the end of March 2027. Over the next 3 years, $35.4 billion will be authorized for buybacks, which is the equivalent of 19.67% of its market cap.

While I am not in a position to guarantee that the numbers are real, the evidence indicates that BABA is generating enough capital to return billions to shareholders through a dividend program while buying back tens of billions worth of shares. I think the capital allocation program adds a level of legitimacy to BABA and will help make the investment more attractive as the float continues to be reduced while BABA continues to generate billions in quarterly profitability.

Seeking Alpha

Conclusion

Investing in China has been a losing proposition for some time, but there is a chance that geopolitical tensions get better. If you don’t have a high threshold for risk, then BABA may not be a good investment because there are many unknown factors, especially when it comes to policy from the CCP. When I look at the current valuation, the capital allocation plan, and what you’re getting from the business, BABA is a company I am willing to invest in despite the risks. Over the next several years, BABA could see significant appreciation if the narrative changes and capital flows into Chinese investments. I think the recent move by Xi Jinping is a telling sign of things to come. Maybe I am being naive, but I feel that China wants to increase its position on the global stage, and to do that, they know its policies and stances need to change. BABA is a risky investment, but there is a lot of upside potential, and if shares were to double in value, they would still trade at less than 15 times 2026 earnings. It could take several years, but I think BABA has the potential to get back to at least $150 or maybe even $200.

Read the full article here