Dear readers/subscribers,

I covered Healthpeak (NYSE:DOC) about 2 months ago in our private investment group, iREIT on Alpha. With its diverse portfolio of life science properties, outpatient medical care facilities, and continuing care retirement communities, it has a very interesting mix of assets, and is one of the more interesting healthcare REIT plays that we can see here.

Like with many other REITs, this company is unlikely to see significant AFFO growth in the near term – by that I mean that a sub-6% annual growth in AFFO is likely. The combined upside from these investments comes in the shape of two things – first off, the low valuation for the investment that they are currently trading at. Like other players in the space, on a historical basis, PEAK is quite undervalued to where it typically trades.

Secondly, a very good yield. As PEAK trades now, it’s over 6% yield, close to 7% in fact, and even at an elevated sort of risk-free rate of around 3-4% depending on where you invest and where you live, that is still a good yield with a very high rate of safety.

This is a follow-up to my article, and since then the company has changed its symbol to DOC and still is at a very low sort of valuation. I have been increasing my exposure to this REIT, as I view this as an overreaction, and I will show you why that is.

Healthpeak – Why you should invest at close to 7% Yield

DOC, as the symbol is now, is a high-quality healthcare play in the REIT sector. What do I mean by high-quality, and what do I mean by healthcare here specifically?

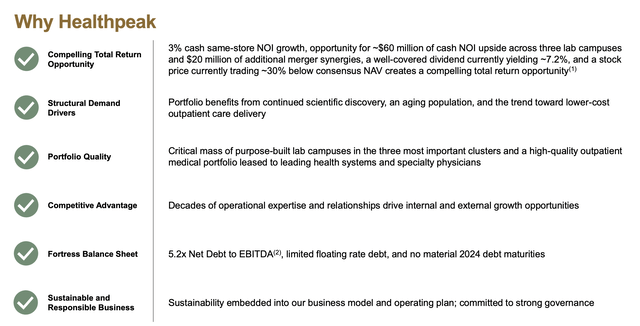

Well, like peers like Alexandria (ARE), this company is in the segment of healthcare and biopharma lab space – but unlike ARE, it also has a significant portfolio of healthcare/hospital assets. In terms of mix, this is around 50% to life science, with only 40% Outpatient medical care, and only 10% continuing care communities, which would by some be considered the highest risk in these sorts of plays.

Well, this company has the least amount of this and complements this with a further addition of quality – if not necessarily an addition of growth for the company (as I mentioned, it seems that growth is unlikely here in the near term, with a same-store growth of only 2-3% for the 2024 fiscal outlook) (Source: DOC IR).

But there’s plenty more upside to be had for DOC – and many more arguments as to why this is a good investment.

Let’s begin with what should be your first priority when putting capital into any investment. Just how safe is this company?

While it’s impossible for me to guarantee the veracity or success of any investment, we can put ourselves in a good potential for outperformance by picking above-average companies. At a 5.2x Net debt/EBITDA for a REIT, this company is among the least leveraged in this sector. At $3B of liquidity, there’s plenty of cash for the company on the books here, and being underwater in a main investment over the past 1-2 months at this time (Intrum, a difficult play with upside perhaps in 4-5 years), I know the value of having access to plenty of cash.

The company proved just how good its credit is by recently signing a 5-year $750M term loan swap to a fixed rate of 4.5%. That, for a REIT, is a sign of confidence in this market.

The biggest set of news for this company, and the main reason for my update on Healthpeak is the merger with Physicians Realty Trust less than 2 weeks ago.

DOC IR (DOC IR)

This merger now includes $40M worth of merger synergies for this year, with additional management internalization upsides, and also getting back $69M worth in proceeds from repayments of seller financing loans. The 2025E, which is in over a year, has an upside of $60M NOI in cash from untapped synergies and current downtime in trophy lab campuses. In addition, at these valuations, DOC could easily funnel some of its incoming cash pile into accretive buybacks of shares.

AFFO is expected to come in at $1.5-$1.56, which means it theoretically could come in below (slightly) the 2023 level. But at a dividend payment of $1.2, this leaves ample safety in the equation, even if the 2024E growth estimate is unlikely to be all that good.

Why is this perhaps a good thing for investors?

It allows us the opportunity to get this company at a very cheap valuation – more on that valuation later, but it’s a very good upside if you allow any sort of premiumization for what is essentially a BBB+-rated company.

The new combined management team has over 200 years of combined experience. This experience and this performance are confirmed by a very solid lease execution with 2023E above the 3-year average, with 5.1M sqft leased, marking record or near-record lease executions during a very difficult time.

The company ends the fiscal with a same-store occupancy of over 92% in outpatient, and 90% of the lease executions in the lab space are done with clients that already have previous relationships with DOC, showing just how important scale, know-how and relationships are in this field. This is not your standard healthcare, nursing home play – and I hope that comes through here.

The aforementioned $60M upside comes from various new high-quality developments across the company’s portfolio – Portside, Vantage, and Gateway specifically, with $20M of additional merger synergies, bringing the total to around $80M.

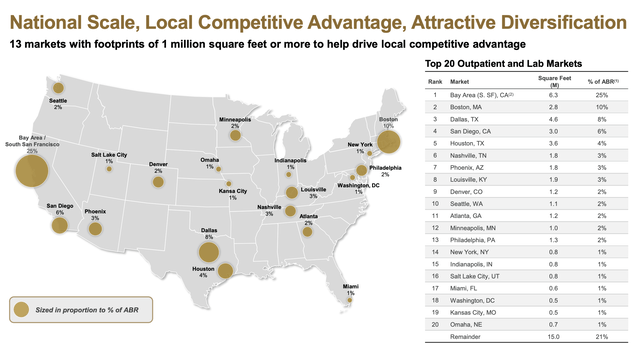

This also isn’t an overly excessively concentrated REIT. While some exposure exists to the SF/Bay area, this isn’t as scary as you may think, given the amount of customer lab space in this area. I do not at a favorable outlook for California in general, but when it comes to this play, I consider it an acceptable one.

DOC IR (DOC IR)

Simply put, what we have here is $1.7B worth of annualized base rent, or ABR, with the largest client being HCA Healthcare at 9%. Beyond that, the second-largest tenant is 3%, and after that, it’s all 1% or below. So in terms of diversification, plenty of that here.

The company has zero 2024 maturities. Even 2025E is less than a billion. The company’s current liquidity is enough to cover 2025, 2026 and almost 2027 with no additional cash needed at all, and with a WAAR (weighted average interest rate) of 3.8%, this is a company that has managed to keep its debt very low.

Let’s look at the company’s valuation

The valuation for Healthpeak – the second compelling reason for investment

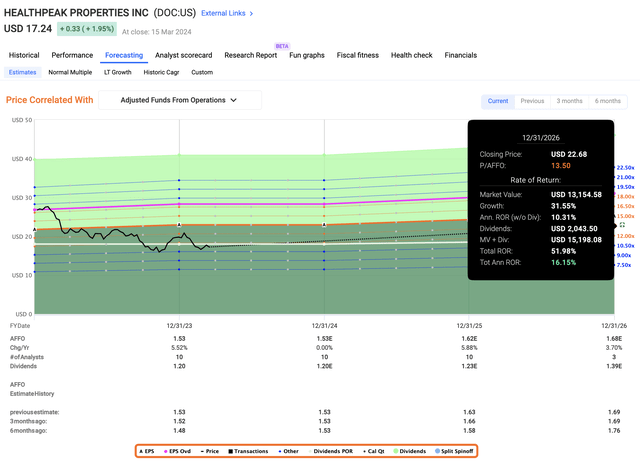

So, I hope I’ve shown you that you can consider this company a qualitative REIT with an attractive set of fundamentals, likely to at least be safe in its performance. In terms of growth, DOC seems unlikely, as I see it, to generate any significant AFFO growth this year. The midpoint in the estimate is $1.53 currently, and that is essentially a growth of 0% at this time.

Because of that, the share has taken a decent amount of punishment and is currently hovering at 11x P/AFFO, which is quite a low for a company that often has traded above 22-23x P/AFFO (Source: FactSet).

From this time forward, we can give the company a myriad of different estimates and expectations – but let’s start at the low end – let’s assume you’re giving no more than a 13-14x P/AFFO. That would represent an over 10-25% discount depending on what period you look at, but typically this company has commanded close to 20x P/AFFO. Even at the longest-term estimate based on historical numbers, you’re only finding 16.5x P/AFFO – and back then, the company had a significantly different asset profile and aim.

So when you say that you want 13.5x P/AFFO as an estimate, you’re going in at a very discounted rate.

Healthpeak Upside (F.A.S.T graphs)

But even at that rate, you’re getting more than 15% annualized. You could in fact go as low as 9x P/AFFO, and you’d still come out without losing money based on a 3.4% annualized AFFO growth rate until 2026.

Are you starting to see the picture?

So that’s a base/bearish case – though I’d still argue it’s a very bearish case at 13.5x. But if we move to the other side of the equation, we’re instead forecasting a 10-year average of 17x P/AFFO. That’s below the insane 22x+ levels we saw some year or two ago, but still at a valuation that I believe reflects the underlying quality of the assets here, as well as the slight 3-4% annualized rate of growth.

At 17x, you’re getting 25% per year inclusive of dividends, or 86% in ~3 years.

How likely is DOC to reach these targets?

Well, the company does not, ever, negatively miss estimates on a 1-year forward basis even with a 10% margin of error. The company either beats them – 25% of the time – or hits them. (Source: FactSet)

Based on this, I give Healthpeak a high-conviction “BUY” and show you why this 7%-yielding healthcare REIT is a large position in my portfolio, about 1% in personal and commercial, and why I’ve added more shares in the last few weeks as the company dropped even further.

I’m also not at capacity but may add more as well.

I believe you can consider the same if you feel that the company sits your investment profile.

My thesis for this company is as follows.

Thesis

-

Healthpeak is one of the better healthcare REITs out there. Its portfolio is sound, its fundamentals are safe, the yield is extremely well-covered, and the company has an attractive future prospect based on both stability and slight growth of its prospects. The next few years will be tough for REITs in the space, but I believe that PEAK will be one of the REITs that survive and thrive.

-

Based on this, I consider this company an attractive “BUY” at a good price, where we can see a conservative double-digit upside. Ever since selling off its senior portfolio, the company’s earnings capacity has been declining from 2015 levels – but it’s stabilizing, and I see a potential for growth in the next few years.

-

I give the company a conservative P/FFO of at least 15-17x, implying a long-term PT of $27/share, and an upside of at least 15% here. I maintain this as of this article.

-

PEAK is a “BUY” and a good one.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria, now also being cheap.

Read the full article here