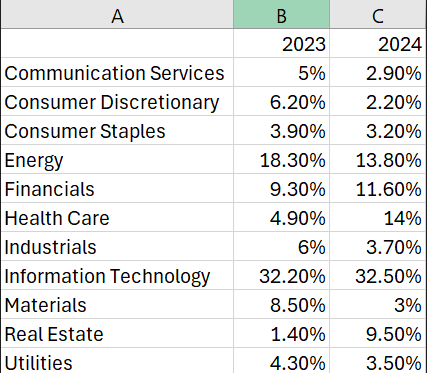

Earlier this year, Seeking Alpha’s Wall Street Breakfast conducted a survey of its large pool of investment analysts, and one of the key questions concerned expectations for the 11 S&P 500 sectors during 2024. Here’s a chart showing the sectors in column A, column B shows the percentage of investors that thought the sector would lead in 2023, and column C shows the percentage for 2024 responses.

The takeaway from that survey from a few months ago: Technology would continue to blast higher, continuing its strong run that apparently was started by a covert meeting of Jack-O-Lanterns (the S&P 500 bottomed right around Halloween last year). And, that healthcare, energy and financials would provide support for those tech gains.

How its going for those 11 sectors in 2024

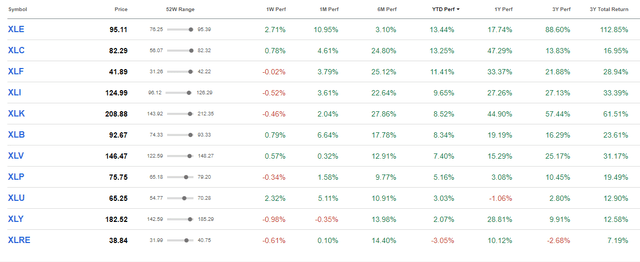

Here’s a performance snapshot, using the long-tenured Sector SPDRs from State Street, which have reliably tracked these sector-subsets of the S&P 500 for 25 years. My focus is on the year-to-date returns, which is how this table is sorted.

Seeking Alpha

Energy (XLE) and Communications (XLC) led the pack during the first quarter of 2024. Financials followed closely, and industrials fell just short of the 10.2% return for the full S&P 500 index. Note that like the traditional S&P 500 itself, all but one of these 11 sector ETFs is heavily-weighted to a small number of stocks. That has a lot to do with how they perform versus each other over shorter periods of time.

For example, to see why technology is a middle of the pack sector performer so far this year, just look at the fact that Microsoft (MSFT) and Apple (AAPL) are 24% and 19% of the Technology Select SPDR ETF (XLK). MSFT did its part with a 12% first quarter gain, but AAPL fell by 11%. That represented its seventh worst 3-month return in the past 10 years (40 quarters) and only late 2018 and the period ended June 30, 2022 were significantly worse over that time. It was an outlier for that market leader, but if it continues, it could prolong the drag on that sector.

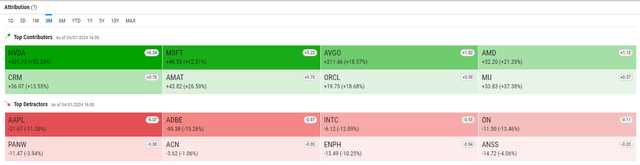

Technology stocks: an AAPL these days keeps higher returns away

This attribution analysis from Q1 shows that AAPL negatively impacted XLK 5x more than any other stock. The bigger they are, the harder they fall. And if it wasn’t for a whopping 82% return from Nvidia (NVDA) and MSFT’s strong quarter and weighting in XLK, the tech sector would have been toward the bottom of the 11 sectors on that table above.

YCharts

We could keep talking about tech, but it is fair to say that it has taken most of the air out of the room for investors lately. That’s why this break from recent tradition is intriguing. The Wall Street Breakfast survey indicated that of the top-5 sectors expected to have the strongest returns during all of 2024, three of those are in the top-5 so far.

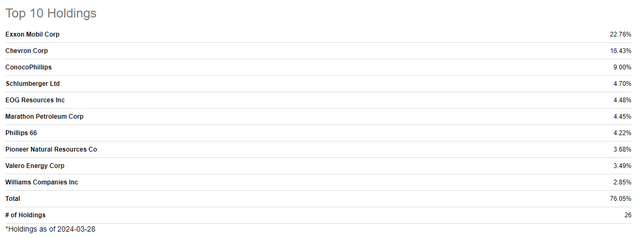

But again, with Energy and Financials, like a hurricane over the ocean, sweeping up all of the water in its path, the top-heavy nature of today’s US stock market can play tricks on the eyes of investors if they are not careful. Here’s the top 10 holdings in XLE, the Energy sector, which led all sectors during the first quarter. Look no further than Exxon Mobil (XOM), whose 17% gain and nearly 23% XLE weighting carried the day. Or, in this case, the quarter. It is reasonable to question whether those in the survey who expected “energy” to do well this year were talking about the broader sector, or just the “big guys” at the top.

Seeking Alpha

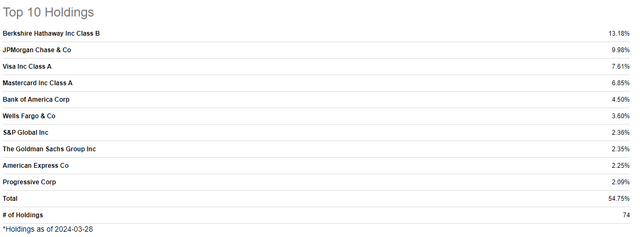

And as for Financials, the third best sector in the first quarter, the gains were more evenly spread out, but only among roughly 10 stocks. These 10:

Seeking Alpha

The vast majority of XLF’s gain this year has come from those top 10, which make up nearly 55% of assets in that ETF. That means there are 64 stocks that account for the other 45%. In other words, collectively, they don’t mean much when it comes to what drives the sector’s stated returns.

REITs (XLRE), Utilities (XLU) and Consumer Staples (XLP) were three of the four worst performers, though all but the real estate sector produced positive returns. Add in Consumer Discretionary (XLY) and we see that the survey respondents are certainly in the neighborhood so far this year, given their low expected full year returns for all but the REIT sector.

What held back REITs in Q1? Mobile phone tower builders, in part. This sector, like real estate itself, is a diverse group of use cases, from shopping centers and hotels to data centers and storage facilities. the sector can lead or lag for a wide range of reasons.

What’s next for the 11 S&P 500 sectors?

Looking forward, the S&P 500 and its 11 sector components are an important top-line way to go one step deeper than simply evaluating stock market performance across the market itself. This explains why sector rotation and even long-short sector strategies have been part of Wall Street’s arsenal for decades.

The second quarter starts with hints that the market may broaden out a bit. If that occurs, it could dramatically alter how this chart of sector performance looks at the end of June. We could see more of the smaller capitalization stocks in some S&P 500 sectors throw their weight around, so to speak, and be leaders in a way they have not been in some time.

But as they say in sports, the game is played on the field, not on the pregame show. Stay tuned

Read the full article here