Introduction

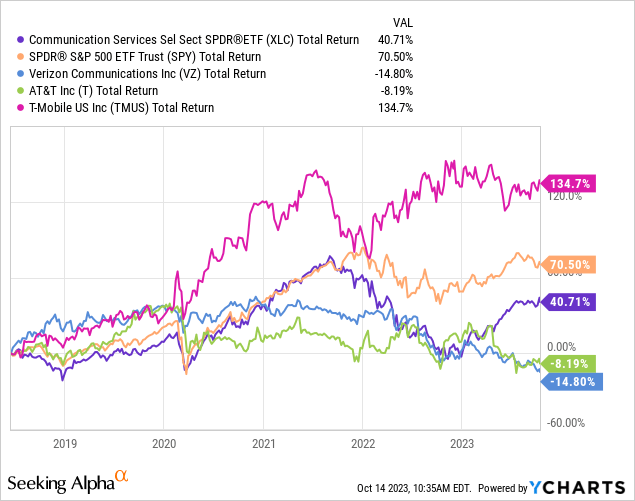

Telecom services haven’t been the best place to be. While the SPDR Communication Services ETF (XLC) has returned 41% since its inception in 2018, this was mainly due to the fact that more than a third of its assets are invested in Meta Platforms (META) and Alphabet (GOOGL). Verizon (VZ) and AT&T (T) have lost 8% and 15% since then, respectively. This includes dividends.

One company that stands out is T-Mobile US (NASDAQ:TMUS), the largest wireless communications service company in the U.S., with a market cap close to $170 billion.

In this article, I’ll dive into the details and explain what makes TMUS such a low-drama stock capable of outperforming its peers with an outlook of consistent dividend growth and aggressive buybacks.

So, let’s get to it!

One Of The Best

The T-Mobile U.S. company is the result of a major merger with Sprint. In 2020, the merger allowed TMUS to become a giant in its industry.

The integration and consolidation of Sprint’s network and assets were critical aspects of the merger.

TMUS had a strategy to deploy the acquired spectrum on combined network assets, enhance capacity, and optimize assets by decommissioning redundant sites.

T-Mobile U.S.

Substantially, all targeted Sprint macro sites were decommissioned as of December 31, 2022. This strategic approach allowed TMUS to achieve synergies and cost reductions by eliminating redundancies within the network and streamlining various business processes and operations.

Furthermore, the merger significantly impacted TMUS’s ownership structure.

Following the merger and subsequent transactions, Deutsche Telekom AG and SoftBank hold a considerable stake in TMUS, directly or indirectly.

Currently, Deutsche Telekom holds 51% of TMUS shares. SoftBank directly holds roughly 4% of the company. Deutsche Telekom intends to hold close to 50% of the company in the future. This is important in light of the buybacks we’ll discuss later in this article.

Also, thanks to the merger, TMUS now has an extensive nationwide 5G network and increased competitiveness, which supports its ability to provide services and innovative solutions to a broader customer base.

This network reaches 98% of all Americans and has allowed TMUS to beat its peers in key areas.

According to the company, TMUS has America’s largest, fastest, most reliable, and awarded 5G network, which aims to provide unparalleled coverage and capacity nationwide.

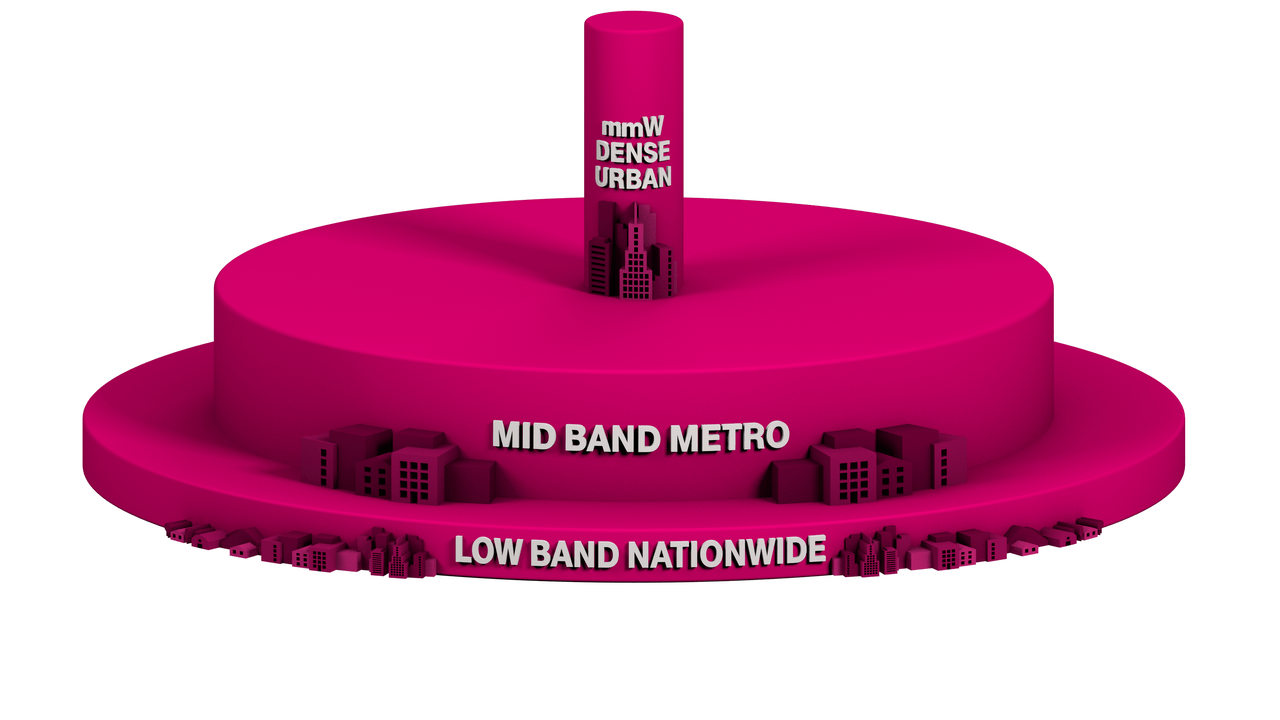

Their innovative “layer cake” spectrum approach, which can be seen below, incorporating low-band, mid-band, and mmWave spectrum, enhances the company’s 5G network, supporting innovation and competition in the wireless and broadband sectors.

T-Mobile U.S.

Needless to say, TMUS continually expands and improves its network to offer outstanding wireless experiences and innovative products like High-Speed Internet through fixed wireless solutions.

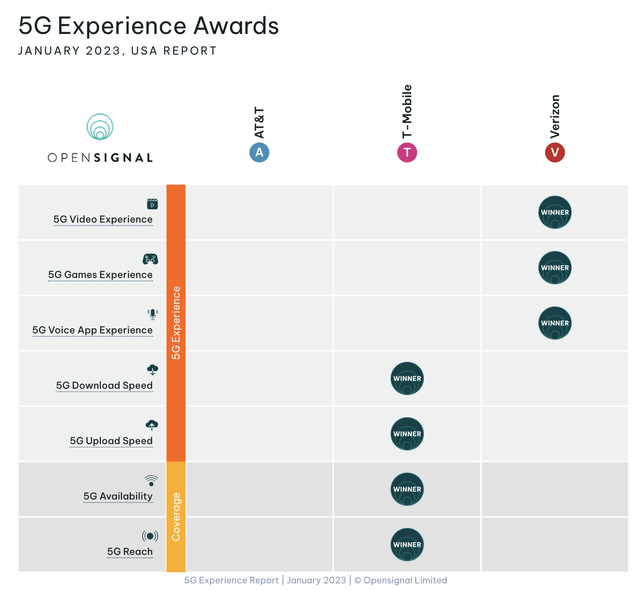

Even better than the company making these claims is that there’s evidence from independent parties that the company is indeed doing very well.

According to the Opensignal January 2023 5G Experience Report, T-Mobile has the highest download speeds, the highest upload speeds, the best availability, and the best reach.

Opensignal

TMUS focuses on becoming “Famous for Network” by utilizing its spectrum portfolio strategically. Their spectrum assets cover a wide range, from low-band to mmWave, allowing for a robust 5G network.

TMUS caters to both postpaid and prepaid customers, as well as business customers under its T-Mobile for Business brand. The majority of their service revenues come from postpaid and prepaid customers.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Postpaid |

42,562 | 53.1 % | 45,919 | 57.7 % |

|

Equipment |

20,727 | 25.9 % | 17,130 | 21.5 % |

|

Prepaid |

9,733 | 12.1 % | 9,857 | 12.4 % |

|

Wholesale and Other Service |

– | – | 5,547 | 7.0 % |

|

Other |

1,022 | 1.3 % | 1,118 | 1.4 % |

Having said that, T-Mobile is focused on growth and returning cash to shareholders.

There’s A Lot Of Growth For T-Mobile

T-Mobile is expanding its network and services.

For example, last month, the company announced plans to deploy 5G in Comcast’s (CMCSA) 600 MHz spectrum.

Fierce Wireless

As reported by Fierce Wireless (emphasis added):

T-Mobile and Comcast took a time out from making digs about each other’s broadband and wireless offerings to forge a spectrum deal. In an SEC filing, T-Mobile revealed that it has agreed to lease, and eventually acquire, Comcast’s 600 MHz spectrum licenses for a price of between $1.2 billion to $3.3 billion. The final price of the deal will depend upon how many licenses T-Mobile ends up using.

T-Mobile EVP and CFO Peter Osvaldik told investors during a Bank of America Media, Communications & Entertainment Conference today that the company plans to start deploying 5G in some markets right away. Osvaldik said this additional low-band spectrum is appealing for 5G because of its ability to penetrate buildings and provide a wide swath of coverage, not because the company is concerned about capacity. “This allows us to deploy more of our low-band 5G strategy,” he said. “We have the radios ready to go.”

T-Mobile already has a significant amount of 5G deployed in the 600 MHz spectrum band. The company’s low-band 5G, which it calls “Extended Range,” uses 600 MHz and reaches about 323 million POPs.

The entire deal includes 71 licenses covering 149 million people. Each market’s license covers 10 MHz of spectrum, except for Nashville, Tennessee, which covers 20 MHz of spectrum.

This is part of the company’s plan to increase its market share in rural areas from 16.5% to 20.0% by 2025.

On top of that, T-Mobile is expanding into fiber. Bloomberg reported that the company is in talks with a unit of Tillman Global Holdings LLC to build out a fiber-optic network, which would set the stage for the No. 2 U.S. wireless carrier to enter the landline broadband business.

Bloomberg

A deal would make T-Mobile an anchor tenant in a newly formed infrastructure joint venture between Tillman FiberCo and private equity firm Northleaf Capital Partners, according to people familiar with the situation. The $500 million agreement between Tillman and Northleaf was first reported by Bloomberg on Aug. 10.

The company is also exploiting the iPhone through its Phone Freedom program, which allows customers to upgrade their phones more often without additional costs.

T-Mobile U.S.

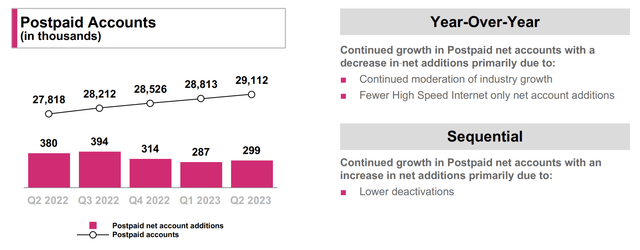

In its 2Q23 earnings call, the company noted that it saw substantial growth in postpaid accounts, particularly in T-Mobile for Business, and gained traction in various markets, illustrating its evolving value proposition.

Even better, T-Mobile achieved record-breaking Q2 postpaid phone net additions, the highest in eight years, driven by exceptional gross adds and historically low postpaid phone churn.

T-Mobile U.S.

Notably, T-Mobile secured the lowest postpaid phone churn in the industry for the first time.

This came with industry-leading service revenue growth, core adjusted EBITDA growth, and a notable surge in free cash flow.

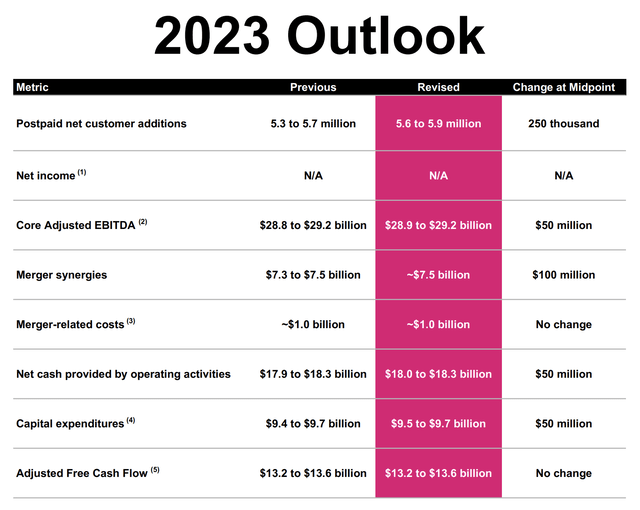

As a result of this performance, on top of merger synergies and its strong network, the company increased its full-year guidance.

T-Mobile U.S.

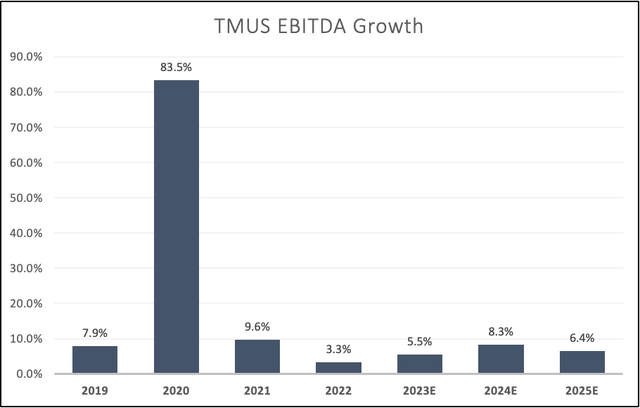

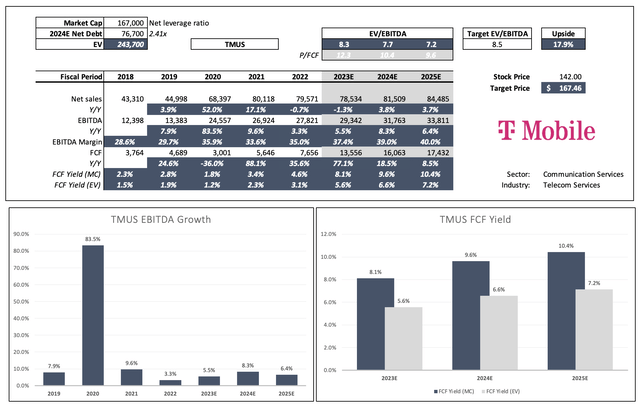

Even beyond 2023, the company is expected to maintain strong mid-single-digit annual EBITDA growth.

Leo Nelissen (Based on analyst estimates)

This brings me to the next part of this article.

Shareholder Returns & Valuation

Last month, the company said it is authorizing a shareholder return program of up to $19 billion. This would translate to more than 10% of its market cap!

The company plans to distribute its first dividend of approximately $750 million in 4Q23 as part of its return program.

Additionally, it will pay around $3 billion in dividends in 2024, with payments on a regular quarterly basis. Share repurchases will also be included in the program.

This translates to a 2024 dividend of slightly less than 2% based on these comments. Also, this dividend is expected to be hiked by 10% per year.

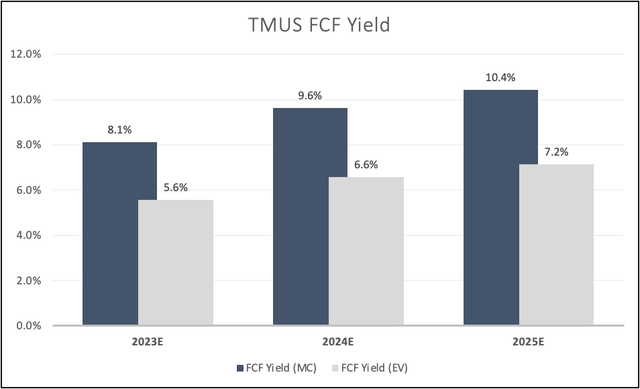

It also helps that the dividend is protected by a boatload of free cash flow.

Next year, the company is expected to generate $16 billion in free cash flow. This translates to an FCF yield of roughly 9.4%. In 2025, free cash flow is expected to exceed $17 billion.

It also has a 2024E net leverage ratio of 2.4x EBITDA and an investment-grade BBB credit rating.

In other words, shareholders are in a great position to benefit from the company’s elevated and consistently growing free cash flow.

Leo Nelissen (Based on analyst estimates)

So, what about the valuation?

- We have a company with a wide competitive advantage, consistent growth due to intelligent mergers and acquisitions, a healthy balance sheet that is now accelerating share buybacks and dividends, and ongoing merger synergies.

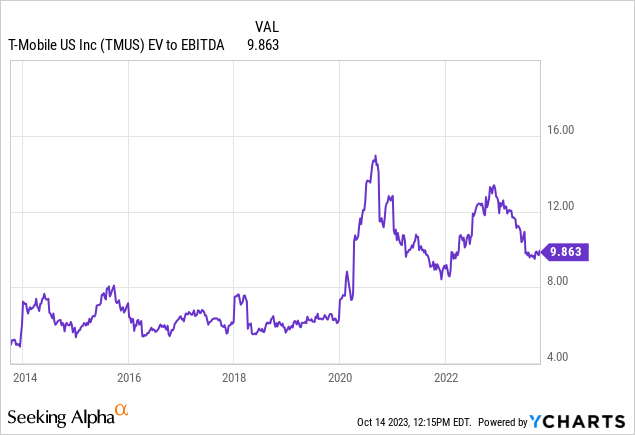

Since the merger with Sprint, the company has traded close to 10x EBITDA.

Even if we give the stock an 8.5x multiple to incorporate the environment of elevated rates, we get a stock that is approximately 18% undervalued.

Leo Nelissen (Based on analyst estimates)

Applying an 8.5x to 9.0x multiple would give the company a fair stock price target between $167 and $177, translating between 18% to 25% upside.

The current consensus price target is $174.

Having said all of this, I’m bullish on both Verizon and T-Mobile. However, whereas Verizon makes for a great “distressed” turnaround play, which I discussed in this article, T-Mobile is a much stronger long-term compounder.

While its initial dividend won’t turn the company into a strong income play right away, I believe that TMUS is the best play for conservative dividend growth investors seeking industry exposure.

Takeaway

T-Mobile U.S. has emerged as a standout performer in the telecom sector. The company’s strategic merger with Sprint and its focus on network expansion has propelled it to the forefront of the industry.

With America’s largest, fastest, and most reliable 5G network, TMUS consistently outperforms its competitors.

Furthermore, TMUS’s commitment to growth is backed by its market expansion into rural areas, fiber-optic network ventures, and innovative programs like Phone Freedom.

It also looks like shareholders are in for a treat, with a substantial return program, sustainable dividends, and strong free cash flow.

When it comes to valuation, TMUS is poised for substantial upside, making it an attractive long-term investment. While Verizon offers a compelling turnaround opportunity, T-Mobile shines as a robust choice for conservative investors seeking steady dividend growth.

Depending on what investors are looking for, I think TMUS stock is the way to go.

Read the full article here