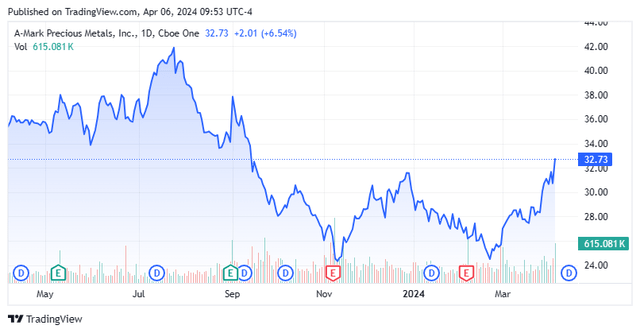

Shares of gold and silver trading platform A-Mark Precious Metals, Inc. (NASDAQ:AMRK) are down some 20% since reaching a 52-week high in June 2023, as its silver supply-demand dynamics remain soft. As a result, the company’s gross margins have been squeezed; however, a recent acquisition that provides it an entrée into the Asian market could spark an earnings turnaround. Gold is also now trading at an all-time high. With a share repurchase program and over a 2.4% current yield as the U.S. heads into an (always) uncertain election season, the recent insider buying in A-Mark merited a deeper dive. An analysis follows below.

Seeking Alpha

Company Overview

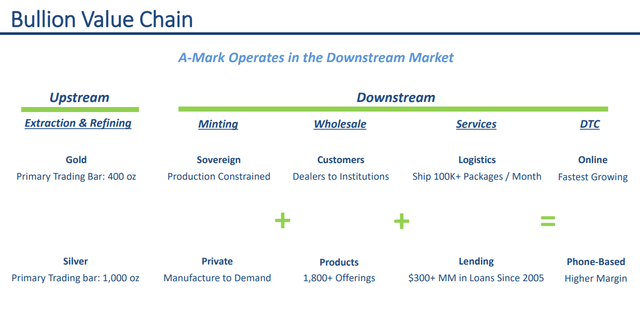

A-Mark Precious Metals, Inc. is a fully integrated downstream precious metals platform that provides gold, silver, platinum, palladium, and copper bullion, numismatic coins, and related products to both institutional and retail customers through multiple sales channels. It provides wholesale trading and distribution, minting (via relationships with sovereign and private mints, including its own), storage and logistics, as well as secured lending. A-Mark was founded in 1965 and went public in 2014 when it was spun out of Spectrum Group International (OTC:SPGZ), with its first trade transacted at $6.24 per share, after giving effect to a 2-for-1 stock split in 2022. Shares of AMRK trade around $32.50 a share, translating to an approximate market cap of $750 million.

The firm operates on a fiscal year ending June 30th. For the avoidance of doubt, the twelve-month period ending June 30, 2023 is FY23.

December Company Presentation

Approach

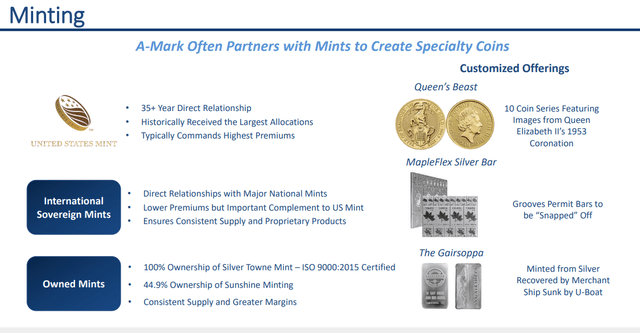

When A-Mark first went public, it was primarily a wholesale distributor to retailers, manufacturers, and fabricators with more than 200 precious metal coins and bars, plus the distinction being of one of only six concerns designated as an authorized buyer of products from the U.S. mints. To transform into a multi-channel, fully integrated downstream platform – ‘upstream’ is extraction and refining – for both wholesale and retail consumers, A-Mark has either outright purchased or increased its ownership interests in 13 related concerns since 2016. Its most recent acquisition of Hong Kong based LPM Group Limited in February 2024 for an upfront consideration of $41.5 million and potential earnouts of $37.5 million represents the company’s initial foray into the Asian market.

December Company Presentation

Operating Segments

A-Mark views its operations through three segments: Wholesale Sales & Ancillary Services (WSAS); Direct-to-Consumer [DTC]; and Secured Lending.

WSAS consists of several units, including Industrial, Coin and Bar, Trading and Finance, Storage, Logistics, and Mint. For starters, this segment sells investment or industrial grade precious metals to coin fabricators (mints), refiners, as well as electronic and component parts manufacturers. It is also an authorized distributor for all the major sovereign mints (U.S., Australia, Austria, Canada, China, Mexico, South Africa, and the UK) and owns its own private mint in Indiana, which has allowed it to grow its coin and bar offerings to over 1,800 from more than 200 when it went public. These products are sold to a plethora of clients including coin and bullion dealers, banks, commodity brokerage houses, manufacturers, and investors. WSAS hedges the commodity risk of the firm’s own inventory and engages in transactions on behalf of its customers or other counterparties. It also provides ancillary services, such as financing, storage, consignment, and logistics.

December Company Presentation

The segment generated FY23 income before taxes of $90.5 million on revenue of $7.29 billion, representing 13% and 21% improvements over income before taxes of $79.8 million on revenue of $6.02 billion in FY22 (respectively), due in large measure to a 27% increase in the volume of silver sales.

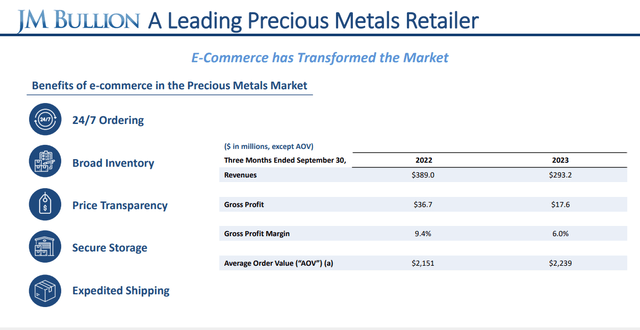

DTC operates primarily through two subsidiaries: JM Bullion (JBM) and Goldline. JBM, which became wholly owned in 2021, is an online retailer of gold, silver, platinum, palladium, and copper coins, rounds (coin-like thematic non-legal tender manufactured by private mints), and bars, totaling ~5,000 products through six websites. It also purchases precious metal products from consumers. The most interesting of these sites is CyberMetals.com, where customers can trade fractional shares of digital precious metals and have the option to convert them into physical products, which can be stored or shipped to the consumer. Goldline was acquired in 2017 and like JBM is a direct retailer to the investor community, although it employs television, radio, and podcast channels in addition to the internet to peddle its goods.

December Company Presentation

DTC contributed FY23 income before taxes of $110.9 million on revenue of $2.00 billion, reflecting an increase of 32% and a decrease of 6% from FY22 income before taxes of $84.3 million on revenue of $2.13 billion (respectively), as improved gross margins at JPM offset (ironically) a 14% decrease in the total volume of silver sold.

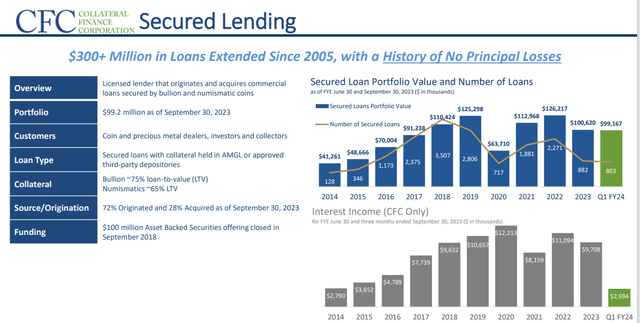

Secured Lending originates and acquires commercial loans secured by bullion, numismatic coins, sports cards, and sport memorabilia. It is not a big contributor to the company’s top or bottom line, generating FY23 net income before taxes of $1.8 million on interest income of $9.7 million.

December Company Presentation

Share Price Performance

Owing to inflation boosted by pandemic assistance, lingering dislocations in the global supply chain, and the war in Ukraine – to which the subsequent sanctions on Russia compelled it to purchase precious metals to circumvent them and trade with China, India, etc. – the precious metal complex received a significant shot in the arm with A-Mark a beneficiary. Its stock reached an all-time high of $44.60 a share in April 2022. And despite the company turning in a strong FY23 in which its non-GAAP earnings of $6.88 per share and Adj. EBITDA of $225.0 million represented 4% and 16% improvements over FY22 – punctuated by a $1.00 a share special dividend paid in September 2023 – its stock price could not attain new record levels, peaking at $42.11 in July 2023.

After falling victim to multiple compression, shares of AMRK have devalued just over 20% since their July 2023 peak on disappointing operational performance.

2Q FY24 Financials

The tough environment driving the poor outcomes was highlighted when the company reported 2QFY24 financials on February 6, 2024, posting earnings of $0.72 a share (non-GAAP) and Adj. EBITDA of $25.1 million on revenue of $2.08 billion versus $1.49 a share (non-GAAP) and Adj. EBITDA of $48.7 million on revenue of $1.95 billion, representing decreases of 52% and 48% and a gain of 7%, respectively. It should be noted that the increase in revenue would have been a decrease of 7% if not for a $231.6 million increase in forward sales contracts (essentially hedging vehicles that inflate the real revenue figure). The culprits were both lower volume sales of gold and silver that could not be offset by higher average selling prices and tighter gross margins (2.21% in 2QFY24 versus 3.28% in the prior year period). The bottom line missed Street consensus by $0.09 a share.

This more or less mirrored Q1’24, where Adj. EBITDA was down 51% both sequentially and year-over-year. Fiscal year to date, Adj. EBITDA was $55.5 million, down 50% from the prior year period, as gross profit margin decreased from 3.65% to 2.09%, reflecting weakness at both its WSAS and DTC segments. A large overhang of silver and relatively tepid demand from its currently un-prompted retail customer base have created pressure on margins, which management is using as an opportunity to stock up on inventory.

Shares of AMRK fell 3% to $26.18 in the subsequent trading session and continued lower until they rebounded off their 2024 low of $24.22 touched on February 23, 2024.

Balance Sheet & Analyst Commentary

Despite the tough operating environment, A-Mark’s balance sheet is solid, reflecting cash of $28.5 million against debt of $298 million for net leverage of 1.6. It should be noted that if the trend of 1HFY24 continues, that net leverage figure would move towards 2.4 by fiscal year end. That said, the company pays a $0.20 a share regular quarterly dividend for a current yield of just under 2.5% and has also been an opportunistic buyer of its stock, repurchasing 611,360 shares in 1HFY24, representing nearly 3% of the total outstanding.

Despite needing to navigate recent headwinds, A-Mark is still unanimously liked by its small Street following, featuring one outperform and three buy ratings and a median price objective of $39. On average, they expect the company to earn $3.03 a share (non-GAAP) on revenue of $8.96 billion in FY24, followed by $5.14 a share (non-GAAP) on revenue of $10.14 billion in FY25.

Also bullish is board member Jess Ravich, who purchased 20,000 shares at an average price of $25.63 per on February 27, 2024, raising his ownership interest to 143,668 shares.

Verdict

A-Mark’s recent move into Asia will likely pay significant dividends, essentially expanding the balance sheet of LPM Group, allowing it to conduct bigger transactions and offer a broader array of products in its territory. That move and the sense that a bottom is being put in gross margin-wise by the company as the U.S. heads into another tumultuous election season are reasons for Street analyst and director Ravich’s optimism. Also, with the stock market at record levels, money has been drawn away from the precious metals market and that may change as the uncertainty of the next four years looms.

For sure, it is a low-margin business but a steady and profitable one. With shares of AMRK trading at just over 10 times FY24E EPS and 6.5 times FY25E EPS while yielding 2.45% and repurchasing shares, the value is attractive. It is also very reasonable on an EV/TTM Adj. EBITDA basis at just over 6. The over 20% decline in share value over the past nine months represents a solid entry point.

Read the full article here