By Christopher Gannatti, CFA

When we speak with investors, the question of valuation is probably the most popular point that tends to come up. This is particularly true when we are discussing technology-oriented topics.

People appreciate paradigms – in a world where it is uncomfortable that we actually do not know what will happen, if we can relate what might happen to a prior paradigm, this gives us greater comfort. The period of roughly 1995 to 2000 is getting some attention today, in that people see technology-oriented stocks rallying (just like during this period in the 1990s) and it is natural that, after a rally, there is a correction or crash (just like the one that began in 2000).

However, it’s important to recognize the limitations of any paradigm. In this case, we don’t know the length of the runway, and we have to recognize that the companies driving the bulk of U.S. market returns are in fact generating revenues and earnings and growing both of these important fundamentals. We are not talking as much about speculative growth stories that might generate earnings at some point in the future when considering such names as Microsoft (MSFT, [[MSFT:CA]), Alphabet (GOOG, GOOGL, Amazon.com ([[AMZN], AMZN:CA), Meta Platforms (META, (META:CA]]), Nvidia (NVDA, NVDA:CA), etc.

So far, we saw speculative growth companies leading in 2020 and 2021, with the monetary and fiscal stimulus of the COVID period, and then getting crushed in 2022, along with much of the tech sector. In 2023, the largest, most profitable companies exhibited the best recovery, and this trend has continued through most of the first quarter of 2024.

We believe that it will be difficult for valuations in 2024 to beat the levels seen in 2021 – when interest rates are at or near zero across the developed world AND money is being deposited from governments directly into people’s accounts, it becomes clear that a risk-taking mentality is being encouraged. This year is a much different environment.

How We Think about Software Company Valuation

We might go so far as to say that, with software companies, valuation by itself tells the investor almost nothing. First, those waiting for multiples to look more like to those in other sectors could be waiting a very long time, recognizing that the software business model simply commands higher valuation multiples than many other areas of the market. Second, while high valuations could function as somewhat of a risk gauge, indicating the potential for sharp corrections, these corrections are usually caused by other catalysts. It is unusual to say that software company share prices are dropping solely due to high valuations.

We have drawn inspiration for the following analysis from Janelle Teng, Vice President in the San Francisco office of Bessemer Venture Partners (BVP). WisdomTree has a business relationship with BVP for our cloud computing strategy, and Janelle puts out a fantastic sub stack called “Next Big Teng.”

In our opinion, if an investor can get a sense of valuation, profitability and growth, the combination of these three elements helps to zero in on a better sense of true opportunities. In this piece, we will look at two distinct groups of software stocks:

- BVP Nasdaq Emerging Cloud Index: This index is tracked by the WisdomTree Cloud Computing Fund (WCLD), before fees and expenses. It is an equal-weighted basket of companies that derive more than 50% of their revenues from business-oriented software delivered through the cloud model. BVP analyzes the underlying cloud companies two times a year to drive the additions and deletions to the index.

- WisdomTree Team8 Cybersecurity Index: This Index is tracked by the WisdomTree Cybersecurity Fund (WCBR), before fees and expenses. Team8 analyses the cybersecurity offerings of companies to find those that have a particular focus on where the future of the space is heading. Companies with a more diverse array of cybersecurity offerings and faster revenue growth will tend to see the biggest weights.

The Trend of Valuation vs. Profitability

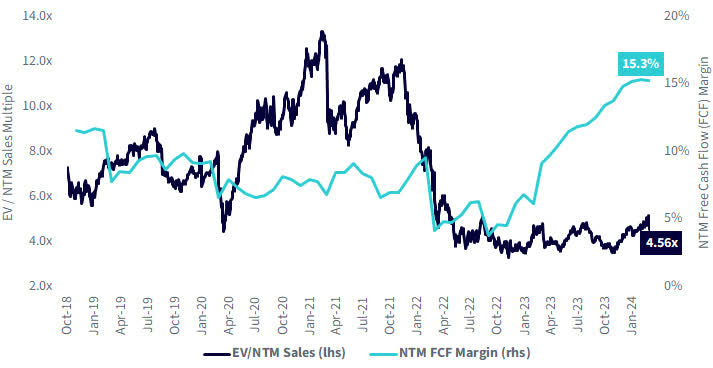

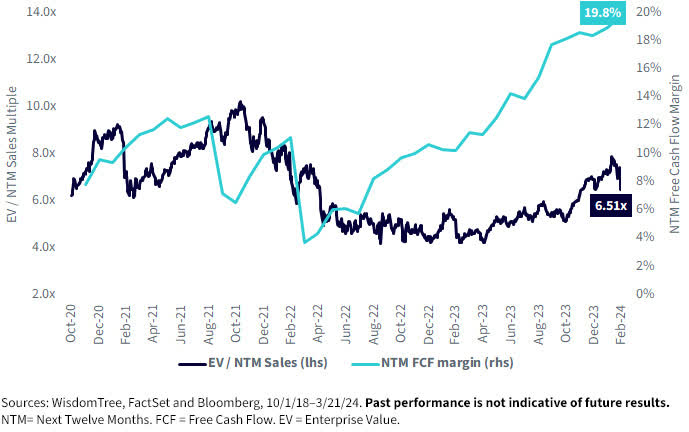

Within software, it is typical to look at statistics with a focus on the next 12 months, usually seen with letters “NTM.”

- A popular measure of valuation is the enterprise value/NTM sales multiple. The enterprise value (EV) combines the value of debt and equity, minus cash. NTM sales represent the forward-looking expectation of sales in the coming year, recognizing that equity markets do not tend to move based on the past but rather on the expectations of the future.

- A popular measure of profitability is the NTM free cash flow (FCF) margin. FCF represents a company’s cash from operations minus any capital expenditures, and the margin is seeking to compare this figure to the software company’s revenues. After the growth at all costs behaviors that were seen to peak in 2021, there has been more of a focus on profitability, and this ratio helps to visualize this trend.

Figures 1a and 1b tell us the following:

- Figure 1a showcases the valuation of the BVP Nasdaq Emerging Cloud Index relative to its profitability. The near-term peak valuation of this index on an EV/NTM sales multiple basis was observed in early 2021 and nearly touched a level of 14.0 times. Currently, we are between 4.50 and 4.60 times – a big difference. There can certainly be corrections, but we are not close to 2021 valuations measured on this basis. During these peak valuations, NTM FCF margins were at roughly 7.5%, but currently, this profitability gauge is close to 15%, a level about twice as high.

- Figure 1b showcases the valuation of the WisdomTree Team8 Cybersecurity Index relative to its profitability. The near-term peak valuation of this Index on an EV/NTM sales multiple basis was observed in late 2021 and slightly eclipsed a level of 10.0 times. The current valuation seems to have recently run up to about 8.0 times before falling back to 6.50. During these peak valuations, NTM FCF margins were at roughly 6.0%, but this profitability gauge is now above 19%, a level about three times as high.

Figure 1a: Valuation vs. Profitability for the BVP Nasdaq Emerging Cloud Index

Figure 1b: Valuation vs. Profitability for WisdomTree Team8 Cybersecurity Index

Are Investors Paying Up for Faster Growth and/or Higher Profitability?

Software companies can exhibit very large variations in growth, profitability and valuation. If investors were strongly rational, high growth and high profitability would command a premium valuation – this should be more highly valued than slower growth and lower profitability.

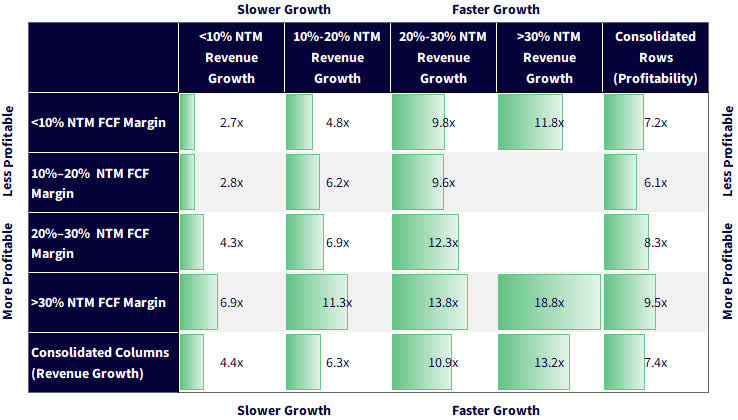

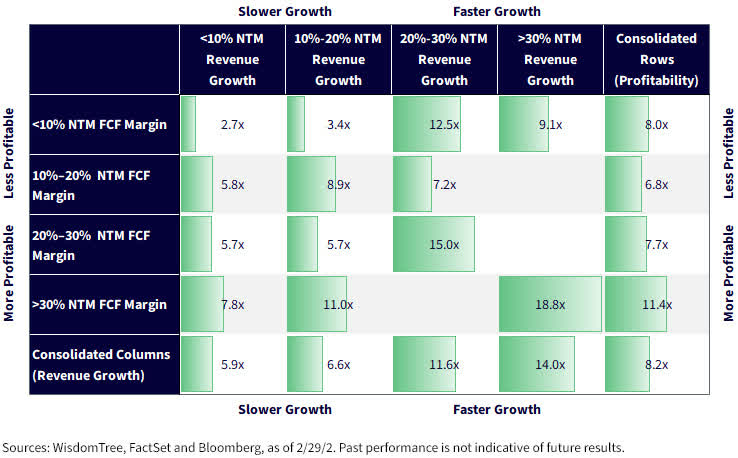

However, it’s important to test and monitor this thesis. We now turn our attention to figures 2a and 2b:

- How rationally are investors treating the stocks in the BVP Nasdaq Emerging Cloud Index? (figure 2a): We do see that companies with greater than 30% expected revenue growth and greater than 30% profit margins did in fact exhibit the highest valuation multiples. Similarly, those companies with lower than 10% profit margins and lower than 10% expected revenue growth did have the lowest valuations. The difference is pretty stark—the most desirable stocks had a multiple getting close to 20.0 times whereas the least desirable had a multiple below 3.0. Any time one is looking at the valuations of cloud computing companies, don’t forget to try to normalize it based on how fast those companies are growing their revenues!

- How rationally are investors treating the stocks in the WisdomTree Team8 Cybersecurity Index? (figure 2b): We saw roughly the same relationship here as we did with the cloud computing software companies. Investors appear willing to push valuations much higher for those companies with the highest profit margins and the strongest revenue growth. Important to any group-based analysis like this, we must note that the WisdomTree Team8 Cybersecurity Index has fewer than 30 stocks, so some of the groupings might only represent a stock or two.

Figure 2a: Normalizing Valuation on Revenue Growth and Profitability for the BVP Nasdaq Emerging Cloud Index

Figure 2b: Normalizing Valuation on Revenue Growth and Profitability for the WisdomTree Team8 Cybersecurity Index

Conclusion: Risk, Yes, but Not Bubble Territory

Software equities can be volatile, particularly when one is focused on thematic areas and companies that might have only entered the public markets more recently. However, we believe that the larger correction was what we all experienced during much of 2022, after the 2021 highs. Those looking at interest rates and thinking they may be more likely to fall than to rise from here could see another catalyst for software company valuations.

We do note, however, that if one is thinking about valuations versus expected growth and profitability, both the BVP Nasdaq Emerging Cloud Index and the WisdomTree Team8 Cybersecurity Index have exhibited improving profit margins – an important signal to see in 2024.

Important Risks Related to this Article

For current Fund holdings, please click the respective ticker: WCLD, WCBR. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WCLD: The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended.

WCBR: The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are internet related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended.

You cannot invest directly in an index.

The information set forth in the BVP Nasdaq Emerging Cloud Index is not intended to be, and shall not be regarded or construed as, a recommendation for a transaction or investment or financial, tax, investment or other advice of any kind by Bessemer Venture Partners. Bessemer Venture Partners does not provide investment advice to WisdomTree or the fund, is not an investment adviser to the fund and is not responsible for the performance of the fund. The fund is not issued, sponsored, endorsed or promoted by Bessemer Venture Partners. Bessemer Venture Partners makes no warranty or representation regarding the quality, accuracy or completeness of the BVP Nasdaq Emerging Cloud Index, index values or any index related data included herein, provided herewith or derived therefrom and assumes no liability in connection with its use. Bessemer Venture Partners and/or pooled investment vehicles which it manages, and individuals and entities affiliated with such vehicles, may purchase, sell or hold securities of issuers that are constituents of the BVP Nasdaq Emerging Cloud Index from time to time and at any time, including in advance of or following an issuer being added to or removed from the BVP Nasdaq Emerging Cloud Index.

Nasdaq® and the BVP Nasdaq Emerging Cloud Index are registered trademarks and service marks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. The corporations make no warranties and bear no liability with respect to the fund.

Christopher Gannatti, CFA, Global Head of Research

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.

Read the full article here