Thesis

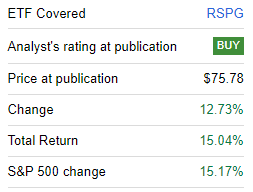

We wrote last August about the exchange traded Invesco S&P 500® Equal Weight Energy ETF (NYSEARCA:RSPG), touting it as an excellent choice to obtain a cross-sectional exposure to U.S. oil and gas, in an environment where tech was the favorite trade. Our original article highlighted how RSPG was unique in offering equal weight exposure to both large and mid-cap energy equities. The fund is substantially up since our ‘Buy’ rating:

RSPG Rating (Author / SA)

With a significant rally in oil and oil equities this year, and the market fixated on geopolitical risk, we are of the opinion RSPG no longer offers an attractive entry point, and will present in this article our opinion on the fund at this stage in the macro cycle.

Oil has rallied viciously in 2024

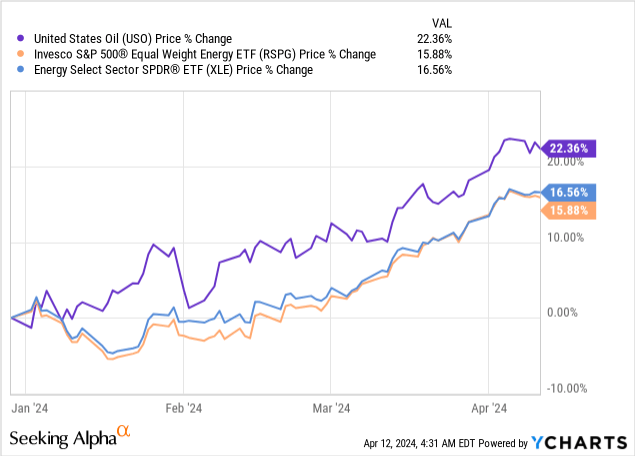

After being left for dead late last year, oil has managed to rally viciously into 2024:

Using the United States Oil ETF (USO) as a proxy for WTI, we can see from the above chart how the commodity has surpassed a +22% price increase in 2024. Oil equities are closely following suit, with the Energy Select Sector SPDR ETF (XLE) up 16%, while RSPG is up 15.8%.

There have been a number of factors contributing to the outstanding oil performance this year, starting with OPEC actions, yields firming up in the U.S., a technical bounce off the lower part of a historic range and now geopolitical tensions.

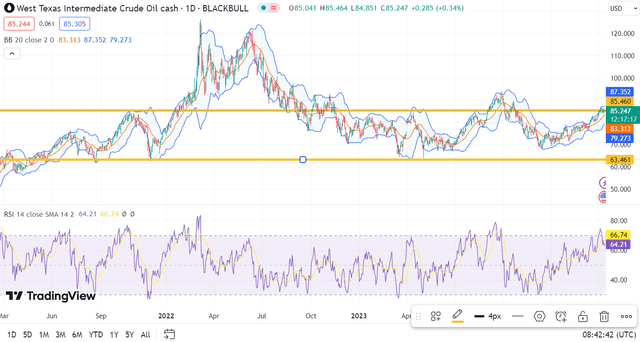

Oil is a cyclical commodity, and the OPEC cartel has kept it in a tight range in the past 2 years:

WTI Oil (Tradingview)

Absent the 2022 breakout, WTI oil has traded in a mid-60s to high 80s range for the past two years, closely managed by OPEC and Saudi Arabia.

After Russia and Saudi dropped the ball during Covid, engaging in a political spat that caused the commodity to gap down, the two countries have been much more coordinated as of late. While both want prices to be on the higher side, Saudi has been the most proactive OPEC member, spearheading production cuts and being a de-facto leader of the cartel.

While they have defended the bottom of the range, we believe they will also loosen production cuts now that the top of the range is reached. Saudi is a very cunning and agile producer, understanding that unwanted focus on high oil prices is not desirable, and having a well established range is efficient for operating margins as well as expectations management. Saudi in effect is trying to make oil production less of a cyclical business by reducing the volatility in oil prices, and thus establishing a more transparent pro forma metric on the oil revenues to be received by the kingdom.

Geopolitical tensions – sell the panic

Geopolitical tensions are synonym with the Middle East, and we have lost count of how many times tensions have flared up in the region. The latest development is an imminent potential Iran attack on Israel, to avenge the killing of a senior Iranian military figure in Syria. We are of the opinion that focusing on such an attack and being long oil on the back of this is not an ideal solution.

These historic conflict issues are priced in, since Iran / Israel tensions are not something new. If the attack is milder than expected or if it does not materialize at all, expect the market reaction to be very bearish oil short term. We have learned in time that the ideal trade is to sell such ‘panic’ events rather than buy them.

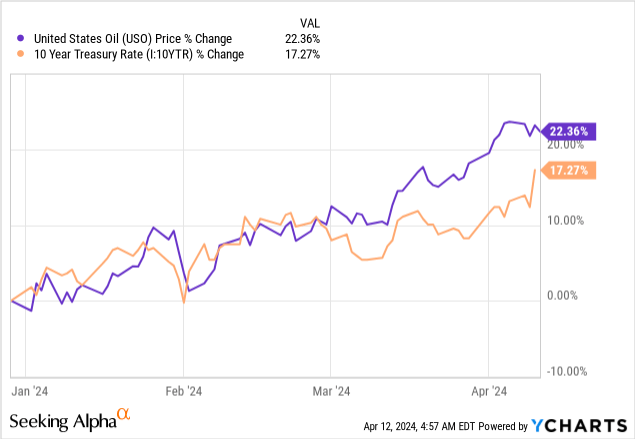

U.S. yields have spiked on higher commodity prices

U.S. yields have spiked this year on the back of stronger than expected inflation, driven by housing and commodity prices:

Notice how well correlated 10-year yields are with oil prices this year. The above chart presents the USO price change versus 10-year U.S. yields. We believe the bulk of the increase in yields is now behind us, with the market now pricing 1 or 2 rate cuts for 2024, while the same can be said for oil prices for now.

2024 is a presidential election year, and oil prices moving even higher would probably trigger SPR releases and political pressure from the U.S. on Saudi to increase production. All parties involved in the international oil trade understand there is a palatable range that suits all parties, while extremes are to be avoided. We feel WTI oil above $90 would be in the overpriced extreme and trigger political backlash. Inflation needs to come down in the U.S. for both political and fiscal reasons.

Underlying equities are now overbought

An investor can drill down into the ETF’s components via the ‘Holdings’ tab on the ETF’s landing page in Seeking Alpha. The fund is an equal weight one, with each holding representing an equal weight in the ETF.

Similarly to oil, the underlying holdings are overbought now, flashing a red signal:

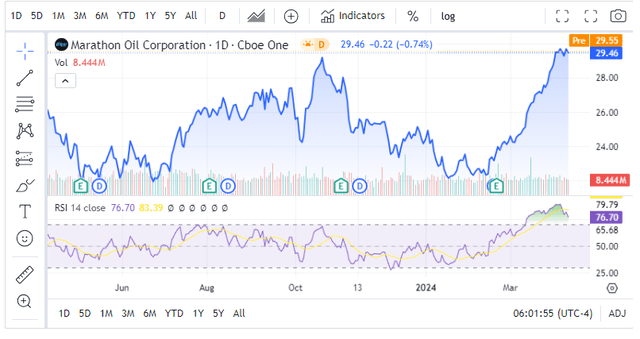

MRO Technical Picture (Seeking Alpha)

The above is Marathon Oil (MRO), one of the holdings in the fund. The lower part of the graph presents the RSI figures for the name, with the stock deep in overbought territory. As a reminder for a retail investor:

The relative strength index (RSI) is a momentum indicator used in technical analysis. RSI measures the speed and magnitude of a security’s recent price changes to evaluate overvalued or undervalued conditions in the price of that security. Traditionally, an RSI reading of 70 or above indicates an overbought situation. A reading of 30 or below indicates an oversold condition.

MRO shows an RSI of 76, deep into overbought territory. As an investor, you want to buy an asset when it is ‘cheap’ or oversold. Conversely, one lightens up on exposure or does not enter a name when it is overbought. The same technical set-up can be observed for most names composing RSPG.

Upside risks

The upside risk scenario is represented by a conflict in the Middle East, which would see oil prices spike much higher from current levels and potentially account for a protracted period of extreme high prices. Higher oil would eventually translate into higher profits for Oil & Gas majors, which would ultimately benefit RSPG holdings. However, do note that Oil & Gas equities have a significant lag to spot oil prices since the forward curve is not equivalent to current spot levels, and companies need time to transform elevated prices into profits.

We feel however that the OPEC cartel has the ability and the will to combat such an event via reversing their production cuts, which just occurred in March 2024:

NEW YORK — Some members of oil cartel OPEC, led by Saudi Arabia, and allied producers like Russia are again deepening their voluntary crude supply cuts. Announcements from several OPEC+ countries extend reductions of some 2.2 million barrels a day, the secretariat for the multinational organization noted Sunday. Saudi Arabia led the pack by extending its previously-implemented cut of 1 million barrels a day through the end of 2024’s second quarter.

Conclusion

RSPG is an energy exchange traded fund. The vehicle represents an equal weight approach on U.S. large and mid-cap energy names. The fund is up over +15% since we covered it with a ‘Buy’ rating, benefiting from the significant oil rally this year. With WTI oil at the top of its historic range and oil equities in deep overbought territory, RSPG no longer presents an attractive entry point. New money would do well to wait into entering the fund, while holders would be well served by selling some covered calls at today’s levels.

Read the full article here