Today, we take a look at TG Therapeutics (NASDAQ:TGTX) for the first time in years. The shares of this B-cell therapy concern are down some 60% from their 52-week high after rival multiple sclerosis therapy Ocrevus achieved non-inferiority as a subcutaneously injected therapy. Meanwhile, initial sales of the company’s anti-CD20, IV-administered MS treatment Briumvi were solid, achieving $92 million in FY23, with FY24 Street expectations north of $260 million. An analysis follows below.

Seeking Alpha

Company Overview

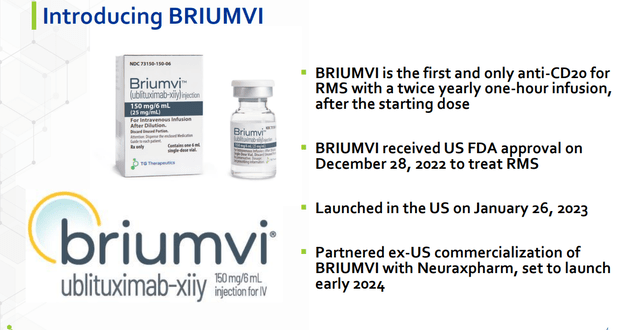

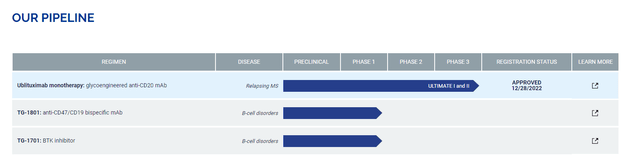

TG Therapeutics, Inc. is a Mooresville, North Carolina-based commercial stage biopharmaceutical concern primarily focused on the development of treatments for B-cell mediated diseases, typically autoimmune diseases and blood cancers. The company’s one product, Briumvi (ublituximab), is approved for the treatment of relapsing forms of multiple sclerosis (RMS).

TG has three early-stage clinical programs, but the priority is on developing a subcutaneously injected (SC) version of Briumvi after rival Roche (OTCQX:RHHBY) achieved bioequivalence for an SC version of its blockbuster MS therapy Ocrevus (ocrelizumab). The company previously marketed Ukoniq (umbralisib) for the treatment of marginal zone lymphoma (MZL) and follicular lymphoma [FL] until its accelerated approval was rescinded by the FDA when ongoing studies brought to light its negative survival benefit in 2022.

TG was formed as TG Bio in 2010 and reverse merged into Manhattan Pharmaceuticals in late 2011. Its first trade was conducted at $1.74 per share, after giving effect to a 1-for-5.625 reverse stock split in 2012, at which point it converted to its current moniker. Shares of TGTX trade right around $14.00 a share, translating to an approximate market cap of $2.05 billion.

January 2024 Company Presentation

Instead of conducting research, discovery, and preclinical work, the company in-licenses its assets, effectively running filters to find the best B-cell candidates available and inking collaborative agreements with the licensor.

Briumvi

January 2024 Company Presentation

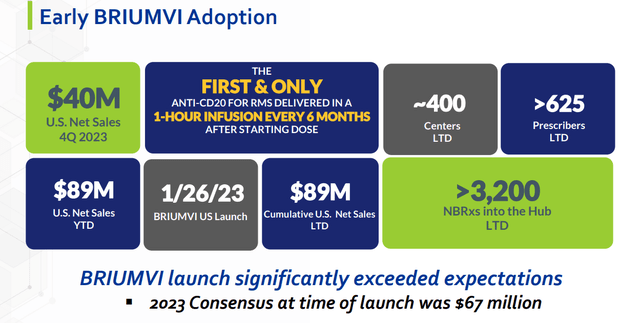

TG’s commercial asset, Briumvi, is no exception, having been onboarded through an agreement with LFB Group in 2012 under quite favorable terms. The company has paid out a total of $25 million in milestones payments to date and is potentially on the hook for regulatory milestones of only $6 million and high single-digit royalties for a treatment that generated $92.0 million in its first year on the market, including $43.1 million in 4Q23, up 72% sequentially over 3Q23 (60% sequentially in the U.S.).

January 2024 Company Presentation

Backing up a bit, Briumvi is an anti-CD20 monoclonal antibody that was approved by the FDA for patients with RMS in December 2022 (and by the EC in June 2023) after it demonstrated superiority to Sanofi’s Aubagio (teriflunomide) – which generated peak sales of $2.04 billion in 2020 before succumbing to generic competition in 2023 – by significantly reducing the annualized relapse rate [ARR], the number of T1 gadolinium-enhancing lesions, and the number of new or enlarging T2 lesions in two Phase 3 trials. [T1 and T2 are types of MRI scans.] Briumvi is administered every 24 weeks via one-hour IV infusion after an initial regimen consisting of a four-hour starter dose, followed 15 days later by a one-hour dose.

January 2024 Company Presentation

Launched into a $22 billion multiple sclerosis treatment market (according to Fortune Business Insights) in January 2023, consensus Street expectations call for Briumvi to generate FY24 net sales of $263.9 million and FY25 sales of $412.7 million. Anti-CD20 treatments account for ~40% of the market and 50% for those starting a new therapy, led by Roche’s twice-annual (for four hours) IV therapy Ocrevus, which generated FY23 net sales of ~$7.2 billion, as well as Novartis’ (NVS) once-monthly SC Kesimpta (ofatumumab), which produced FY23 net sales of $2.2 billion. Briumvi’s ~1,000 prescriptions in 4Q23 translated to a ~10% domestic market share of patients starting on a CD20 therapy.

It should be noted that Briumvi produced ARRs <0.10 in both its Phase 3 trials – the only therapy ever – equating to a relapse once every 12 treatment years, versus 0.16 for Ocrevus and 0.10 and 0.11 for Kesimpta in their two respective Phase 3 clinical trials. Furthermore, Briumvi is markedly cheaper than its CD20 competition, with an average annual cost of ~$59,000 versus ~$70,000 for Ocrevus and ~$92,000 for Kesimpta.

That said, Roche announced that its twice-yearly, 10-minute SC Ocrevus formulation achieved non-inferiority against IV Ocrevus in a 236-patient Phase 3 bioequivalence trial read out in July 2023. Having pioneered the anti-CD20 MS space when Ocrevus was approved in 2017, this result places Roche in a commanding position to defend its multi-blockbuster turf. Although TG CEO Michael Weiss described Roche’s SC product as “clunky,” 94% of patients said they were either satisfied or very satisfied with the SC procedure. Roche anticipates approval for SC Ocrevus in both the U.S. (September) and EU (mid-year) in 2024. TG will respond with an SC version of its own, with a bioequivalence study expected to commence mid-year 2024.

The preponderance of Briumvi’s FY23 net sales were domestic. That said, TG entered into an exclusive ex-North America commercialization agreement with European CNS concern Neuraxpharm, encompassing the rest of the world except certain Southeast Asian countries and South Korea covered by a previous agreement with Ildong Pharmaceutical. In return, TG received $140 million upfront and is eligible to receive $505 million in milestone payments plus double-digit royalties up to 30%. TG does retain an option to buy back all rights under the agreement for two years in the event TG is acquired.

With B-cell levels depleted by 96% at 24 hours after a single dose of Briumvi in its two pivotal trials, management believes its anti-CD20 therapy could have applications in over 20 indications. As such, it plans to commence a study for ublituximab in an autoimmune indication outside MS later in 2024. It is also conducting a Phase 3b trial to assess the impact of reducing the duration of Briumvi’s loading dose from four hours to one.

Other Clinical Programs

January 2024 Company Presentation

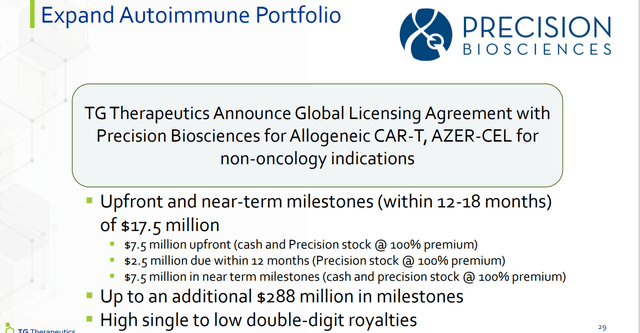

Azer-Cel. To further expand its autoimmune portfolio, TG entered into a licensing agreement with Precision BioSciences (DTIL) to onboard allogenic CD19 CAR-T therapy azercabtagene zapreleucel (azer-cel) for non-oncology indications in January 2024. For the license, TG will pay a $17.5 million consideration in the form of cash and investments, some of which is contingent upon easily achievable milestones. Precision is then eligible to receive up to $288 million in additional milestones and high single-digit to low double-digit royalties. TG anticipates initiating an early-stage clinical trial for azer-cel sometime in 2024.

Company Website

TG-1701. The company has two other programs in the clinic, one of which is TG-1701, an oral Bruton’s tyrosine kinase (BTK) inhibitor undergoing assessment in a Phase 1 study across multiple B-cell cancers. BTK plays a key role in the B-cell receptor signaling pathway that engenders survival and growth of malignant B-cells.

TG-1801. The other is TG-1801, a first-in-class, bispecific CD47 and CD19 antibody undergoing evaluation as a monotherapy and in combination with ublituximab against B-cell lymphoma in two dose-finding Phase 1 studies. Enrollment in the second study is ongoing.

That said, neither TG-1701 nor TG-1801 have been mentioned in a quarterly corporate update since March 2022, just before the removal of Ukoniq from the market.

Balance Sheet & Analyst Commentary

Owing in large measure to the $140 million upfront consideration from Neuraxpharm, TG held cash and investments of $217.5 million at YE23, which should be enough to carry it to cash flow positivity – contingent, of course, on the impact of SC Ocrevus, if and when approved. Based on the Street’s projections for Briumvi FY24, it should fall just shy of breakeven this year and move into the black in FY25.

So far in 2024, Goldman Sachs ($13 price target) and Bank of America ($7 price target) have maintained Hold/Sell ratings on the stock. B Riley Financial ($29 price target), H.C. Wainwright ($45 price target) and J.P. Morgan ($22 price target) have reissued Buy ratings. Collectively, they expect the company to lose $0.11 a share in FY24, followed by a gain of $0.48 a share in FY25.

Share Price Performance

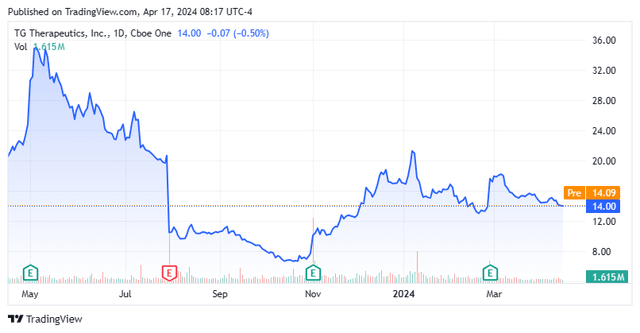

It has been a wild ride for shares of TGTX, which surged to an all-time high of $56.74 in January 2021, carried by approval-worthy results from Briumvi’s two Phase 3 trials, released in December 2020. However, even the short-lived approval of Ukoniq the following month could not propel them any higher. Tepid Ukoniq sales followed by its removal from the market in April 2022, as well as a delay in the FDA review process for ublituximab cratered TG’s stock 94% in 17 months to $3.48 a share in June 2022. With the eventual approval of Briumvi, shares of TGTX rebounded 925% to a 52-week high of $35.67 in May 2023, only to be rocked by the news of Roche’s success with its SC Ocrevus, cratering them 82% to $6.46 in October 2023. The slide was also aided by a lumpy launch of Briumvi. However, with two solid back-to-back quarters to finish 2023, TG’s stock rebounded 251% to $22.67 a share in January 2024, only to eventually settle back down here at $14.00 a share.

Verdict

With Roche expecting approval for SC Ocrevus in 2024 in both the U.S. and EU, there is a cloud over Briumvi, which from an IV administration standpoint was poised to grab a significant share of the MS market. Briumvi sales will continue to improve until SC Ocrevus’ likely approval. However, blockbuster status now only seems achievable if and when TG can respond with an SC version of its own. Therefore, TG Therapeutics, Inc. shares seem like they are unlikely to rebound in a major way until this uncertainty is resolved.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here