Co-authored by Treading Softly.

When I was a young child, my brother loved to play unfair games with me. My brother always had a strong desire to win and hated losing. Perhaps some of you can relate to that. He used to walk over to me with a coin in his hands and would simply say, “Heads I win, tails you lose,” before flipping the coin in the air. When I was little, I never fully understood that no matter what I chose, I was going to lose; I was just excited about the outcome. It wasn’t until I got older that I realized that the game wasn’t a fair one for me to win.

It’s a rare and special situation where we are the winner regardless of the outcome. For most of us, we feel that our lives are better governed by the concept that “you can’t win for losing.”

When it comes to the market, I have long advocated that investors should focus on investing for income. This way, various everyday aspects of the market no longer impact your portfolio. You’re able to ride out many negative circumstances, volatility, and market fears if you receive regular income from the markets directly into your account.

Lately, I have been heavily encouraging investors and retirees to create a rate-agnostic portfolio. There’s been a lot of misunderstanding about what I said. I didn’t mean that your portfolio isn’t going to see volatility when rates change. What it means is that your portfolio will not be negatively impacted income-wise due to changes in interest rates. My portfolio is designed such that if interest rates rise, several of my holdings will greatly benefit while other positions may lag. Inversely, if rates drop, some of my holdings will directly benefit while others will lag. In this scenario, whether interest rates go up or down, I win. Just like my brother, I can go up to the market and say, “Heads, I win, Tails you lose.”

Let’s take a look at two holdings that allow me to do just that.

Pick #1: PDO – Yield 12.2%

PIMCO Dynamic Income Opportunities Fund (PDO) is a relatively young CEF (Closed-End Fund) from what I consider the highest quality CEF management team in the bond sector. PIMCO has a long history of providing investors with strong returns and high dividends.

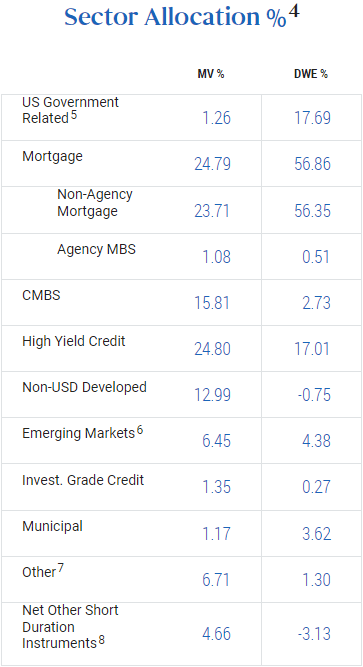

Like several of PIMCO’s bond funds, PDO has a diversified mix of assets across several debt classes. Yet, each fund has different allocation levels. Here are PDO’s sector allocations: Source.

PDO Website (Market Value & Duration Weighted Exposure)

Like PDI, PDO has a significant allocation to mortgages. PIMCO bought up a lot of non-agency MBS following the mortgage price, taking advantage of debt that others were selling for pennies on the dollar. Mortgage prices have been hit hard by higher interest rates, but default rates remain low and the fundamentals of residential mortgages remain solid.

PDO has an almost equal allocation to “High Yield Credit”, which is the largest allocation for one of my favorite all-time PIMCO funds, PTY. High Yield Credit, for PIMCO, generally means below investment-grade corporate borrowers. PIMCO often focuses on what it calls “special situations,” buying up debt for companies that are semi-distressed and will be looking to restructure. When other investors hear “bankruptcy,” they often run away, selling the debt cheap just to get rid of it. PIMCO is more active, often buying up debt in large amounts and then being active in negotiations to restructure it in a way that is favorable for them relative to the price they paid. PIMCO has historically proven to be very adept at identifying recoverable value in these situations.

The third-largest sector for PDO is CMBS, which also is what differentiates it from both PDI and PTY. CMBS is “commercial mortgage backed securities,” which are mortgages that are secured by commercial real estate. CMBS loans are non-recourse, so the default rate tends to be fairly high. Borrowers have an incentive to walk away from the loan if the economics no longer make sense. As a result, the art behind investing in CMBS involves identifying when the market is overestimating the risk of default, or underestimating the recoverable value. This is the kind of granular valuation decisions that PIMCO has excelled at. It is no secret that commercial real estate has been all over the news, and many are trying to reduce their exposure. This reminds me a lot of when institutions were running away from “toxic” residential mortgages, and PIMCO was sitting there scooping them up. With historical hindsight, PIMCO was absolutely right to be a buyer.

Stable to declining interest rates will be positive for debt prices in general, but real outperformance will come from identifying opportunities that are especially undervalued. PIMCO has an excellent track record at identifying these opportunities, and PDO is one of the funds I’ve been using to piggyback on that expertise.

Pick #2: OBDC – Yield 9.5%

If interest rates remain “higher for longer,” one of the clear winners will be BDCs (Business Development Companies). BDCs borrow at fixed rates, and lend at floating rates. As a result, the past few years have been very positive for cash flow.

Of course, nothing in the world comes without a downside. The sun is wonderful to enjoy, but after a few months of no rain and never-ending heat, those who were wishing for the sun will be wishing for rain. For BDCs, high interest rates lead to higher earnings, but it can also put stress on the borrowers. Higher interest rates can lead to more strain on borrowers, and some might default. High interest rates are good, but the borrowers need to be secure enough to be able to afford them.

Blue Owl Capital Corporation (OBDC) is a BDC that has grown from being unable to cover its dividend in 2020, to raising its regular quarterly dividend to $0.37, 19% higher than when the Fed started its hiking cycle. Additionally, OBDC has adopted the practice of paying a separate supplemental dividend, paying out excess earnings that are due to high interest rates. That supplemental was $0.08 last quarter. Instead of tying it in with the quarterly dividend, OBDC has adopted the point of view that being paid more frequently is a good thing. So, we have been enjoying two dividends per quarter about a month apart. Getting paid more money, more frequently, I think OBDC is trying to become one of my favorites!

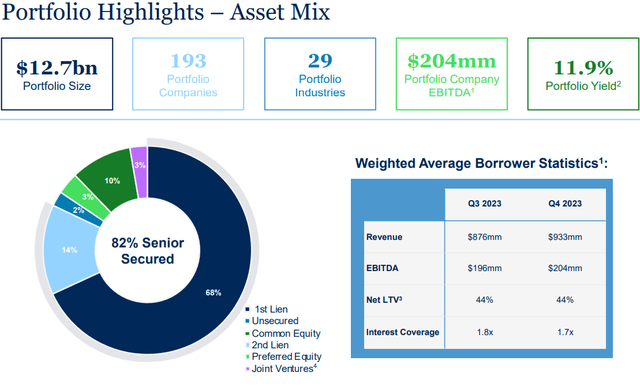

As long as interest rates remain high, we expect these supplemental dividends to continue. OBDC primarily focuses on senior secured debt with companies that fall on the larger end of companies that borrow from BDCs. Their portfolio companies have an average EBITDA of $204 million per year. Source.

OBDC February 2024 Presentation

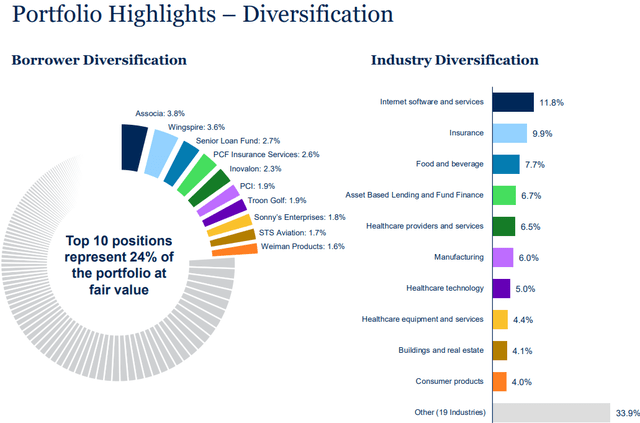

OBDC also protects itself by having a diversified portfolio. The largest borrower represents 3.8% of fair value, and the largest sector is 11.8%.

OBDC February 2024 Presentation

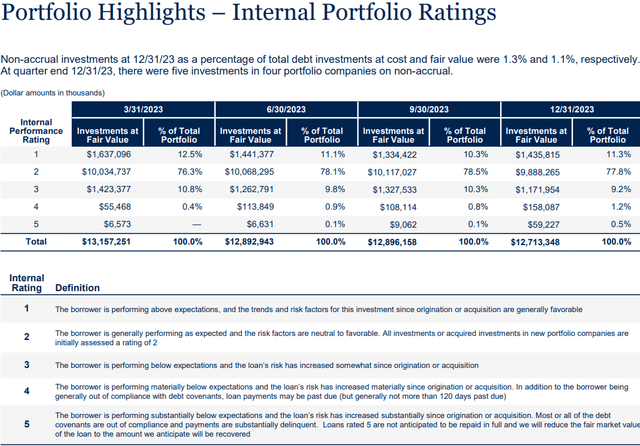

As a result, OBDC is well insulated from the impact of one bad borrower or a troubled industry. This is a good thing because, like most lenders, OBDC has seen some weakness from borrowers. However, thanks to diversification, only 1.7% of its portfolio is with borrowers that have been performing materially below expectations, while over 89% of borrowers are performing at or above initial underwriting expectations.

OBDC February 2024 Presentation

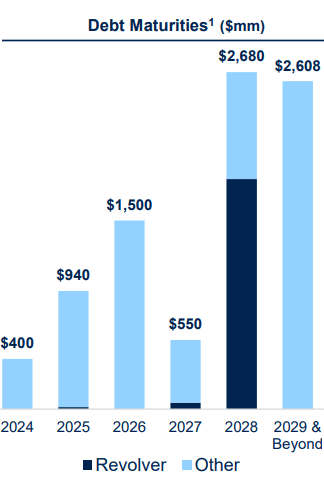

In terms of OBDC’s debt, it only had $400 million maturing in 2024:

OBDC February 2024 Presentation

This 2024 debt has a coupon at 5.25%, and OBDC was able to issue new debt in January with a coupon of 5.95%. So, there is an increase in interest expense, but it isn’t much compared to how much the Fed has been hiking. The reason is that OBDC has been able to obtain an investment-grade credit rating. So, while interest rates are higher, OBDC’s improvements in its balance sheet help offset that.

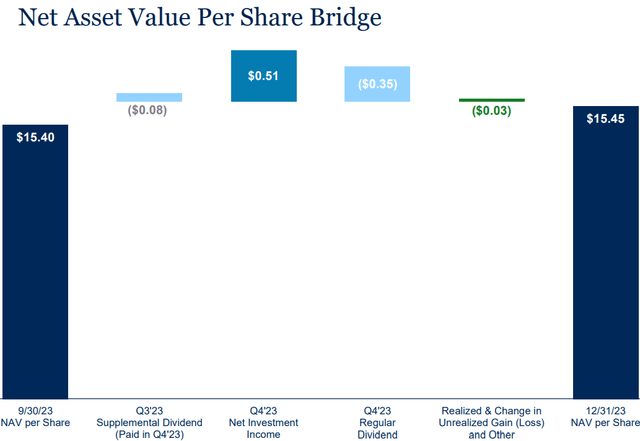

As a result, we don’t expect the maturity and refinancing of the 2024 Notes will have a material impact on OBDC’s bottom line. OBDC has been growing its NAV as NII (Net Investment Income) has continued to exceed its two dividends per quarter.

OBDC February 2024 Presentation

Currently, OBDC is trading right around NAV. We continue to believe that OBDC has proven its quality enough to be a BDC that trades at a 10% premium to NAV. While we wait for the market to realize that, we are happy to continue collecting a couple of dividends every quarter!

Conclusion

With PDO and OBDC, we can enjoy regular income from the market. PDO will be a clear winner when interest rates are cut, as its fixed-income holdings will skyrocket in value. Meanwhile, OBDC is benefiting from rates being higher for longer, continuing to pay out large special dividends as its income exceeds its expectations. Either way, I am reaping wonderful income from the market, and I am a winner.

When it comes to retirement, the less you allow your surroundings to impact your life, the more stable and steady your life will be. One reason many retirees have so much stress in their retirement is that there are too many variables that can result in unfortunate outcomes. Instead of having a retirement that is filled with simplicity and ease, they have a retirement that is like a Rube Goldberg machine that needs constant fine-tuning and adjustment to achieve the simplest of outcomes. By having a portfolio that generates an outstanding level of current income with solid prospects for continued payments for the foreseeable future, you can create a retirement that is marked by ease, plenty, and happiness.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here