In December of last year, I wrote an interesting piece on SLR Investment Corp. (NASDAQ:SLRC), where I laid out several advantages of SLRC and how these should warrant a somewhat stable performance going forward.

However, at the same time, I was quite explicit about the potential limitation for SLRC’s upside. The following excerpt from my previous article on SLRC captures the essence well:

High exposure to equity-type instruments, half of the portfolio invested in inherently unpredictable sectors such as life science and non-bank lending sectors, and a significant chunk of the investments made on fixed rate loan basis have been some of the key reasons for the notable underperformance of SLRC relative to the overall BDC sector.

Based on the then-current market dynamic and the structure of SLRC’s recent originations, I really did not see any major signal that would indicate a shift in any of the aforementioned risk parameters.

Namely, while SLRC’s portfolio and balance sheet had many of the necessary characteristics to substantiate a sound investment thesis, it was primarily the exposure to high volatility (risk) segments, which, in my view, rendered the overall risk/reward mix unfavorable. Also, the presence of some fixed rate financings in combination with higher probability of incremental non-accruals worsened SLRC’s prospects of outperforming the BDC market.

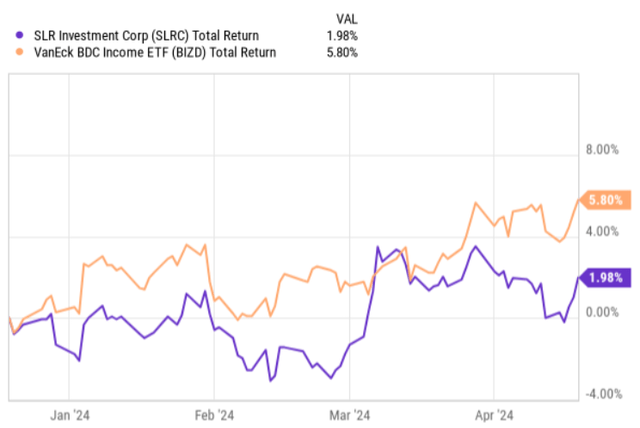

Well, if we look at how SLRC has performed since the publication of my article, we can see that the thesis has played out.

Ycharts

While SLRC has indeed advanced a bit, it has fallen short of the broader BDC space – the VanEck BDC Income ETF (NYSEARCA:BIZD).

Let’s now dissect the most recent quarterly earnings deck and contextualize the prevailing market dynamics with my previous (relatively neutral) stance on SLRC.

Thesis review

In a nutshell, 4Q23 came in strong with improvements across the board, providing a decent uplift in the core BDC performance metrics.

The net asset value at year-end, 2023 landed at $18.09 per share compared to $18.06 per share at September 30, last year. The uptick was registered despite the juicy dividend distribution, as it was driven by the strong core performance at the net investment income level.

The top line or gross investment income totaled $59.8 million, compared to $59.6 million for the 3Q23. The net investment income component expanded accordingly, registering $0.44 per share compared to $0.40 per share in the past quarter. While the increased top-line definitely contributed to higher net investment income result, it was primarily the expense side that helped SLRC deliver a stronger bottom line. One key aspect here that is worth mentioning is the incentive fee savings, where during 4Q23 SLRC waived ~$90,000 that were related to the previously conducted merger, which as of year end, 2023 totaled around $2 million in cumulative waivers.

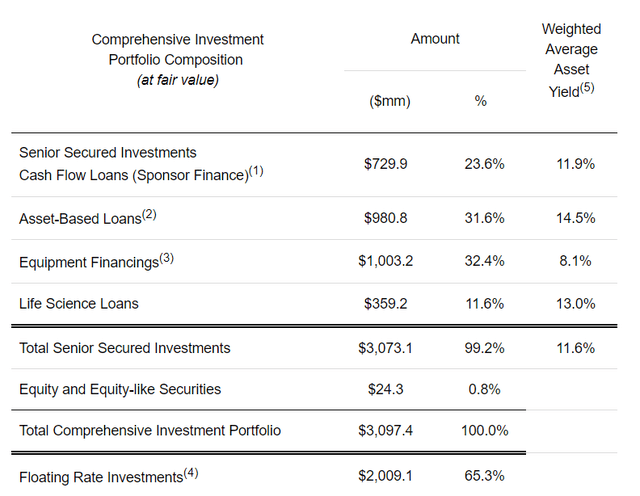

The net portfolio activity was also positive, where SLRC managed to grow its portfolio by ~$132 million over the course of 2023. Interestingly, all of the core portfolio platforms experienced an uptick in the AUM values except for the asset-based loans, which could be deemed as the most volatile and riskiest segment in SLRC. Also, the growth in sponsor finance and equipment finance outpaced the increase in the life science related portfolio, which on an incremental basis helped further de-risk SLRC’s exposure.

The level of risk that is associated with each of SLRC’s platforms could be implied from the asset yields reflected below.

SLR Investment Corp Q4, 2023

Another important driver of SLRC’s solid performance was the situation in non-accruals. During the quarter, SLRC registered no new non-accruals, which helped avoid unnecessary headwinds for the underlying net investment income generation.

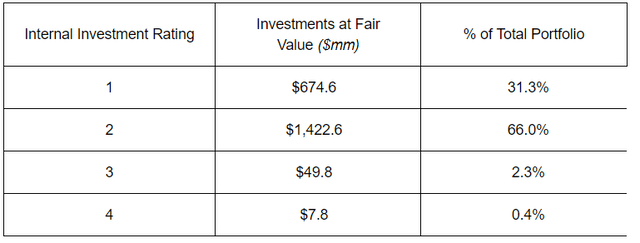

Apart from the non-accruals, the overall credit profile of SLRC’s investments remained robust, as can be observed in the internal investment rating table below. Roughly 30% of fair value concentration in “category 1” and more than 97% for combined “category 1 and 2” serve as a clear indication of a healthy portfolio. While typically other BDCs tend to also have a heavy bias into the first two rating categories, SLRC could be deemed as a positive exception given the extent of the total fair value base that is spread between these two categories as well as the notable percentage that is placed under “category 1”.

SLR Investment Corp Q4, 2023

A critical component of why SLRC has actually managed to keep the portfolio so healthy despite the focus on lenders finance and life science businesses is the integration of tight covenants in the new investment generation volumes.

For example, SLRC’s fourth quarter investments were made all in first lien and had leverage of 4.8 times with interest coverage ratio of 1.7x. Plus, the life sciences platform in itself is not overly speculative, as more than 80% of the relevant AUM figure is invested in loans to businesses that have over 12 months of cash runway. This coupled with a fact that all of the life science businesses that are embedded in SLRC’s portfolio have already achieved cash generation phase and have at least one in the commercialization stage has indeed helped SLRC shield the portfolio from rising non-accruals.

Finally, since the publication of my initial article on SLRC, some macro level aspects have changed. First, it is clear that the scenario of higher for longer will be active for a prolonged period of time, which will provide a sufficient time for SLRC to gradually capture the full benefit of higher interest rates as the exposure to fixed rate investments shrinks (i.e., organically comes due or gets refinanced). Second, the competition in the private credit (including BDC) space is rising, which puts downward pressure on spreads and the net investment volumes. Third, because of the higher interest rates and more restrictive financing markets, we already can see the first signs of increasing non-accruals among some BDCs out there.

In this context, it is worth highlighting the commentary from Chairman and Co-CEO Michael Gross on the recent earnings call:

While M&A activity has remained muted thus far in 2024, and competitions increased for this limited direct lending deal flow, we remain excited about the opportunity set for direct lending in 2024 from an expected acceleration in M&A activity in the second half of the year. Our life science, ABL and equipment finance strategies continue to benefit from being uncorrelated to the broader cash flow market.

The bottom line

The bottom line is clear, SLRC’s diversified portfolio comes in handy against the backdrop of tightening competition and general slowdown of M&A activity as it can offset the struggling areas with the ones for which there is a strong and uncorrelated demand. This, together with a very healthy portfolio, where even the life science component has been performing well due to conservative investment strategy, creates favorable conditions for SLRC to actually outperform the market.

In my opinion, given all of the aforementioned dynamics and the fact that SLRC trades at a significant discount to NAV (P/NAV of 0.83x), while having external leverage levels in line with the sector average, the investment case of SLRC has become very attractive.

In my opinion, SLR Investment Corp. is a buy.

Read the full article here