A Buy Rating for Orla Mining Ltd.

Based in Vancouver, Canada, Orla Mining Ltd. (NYSE:ORLA) operates in the basic materials industry as a gold producer and currently exploits its 100% mineral interest in the Camino Rojo open pit mine, 175 km northeast of Fresnillo, Zacatecas, Mexico.

The Situation of Gold Production in Mexico and Its Development

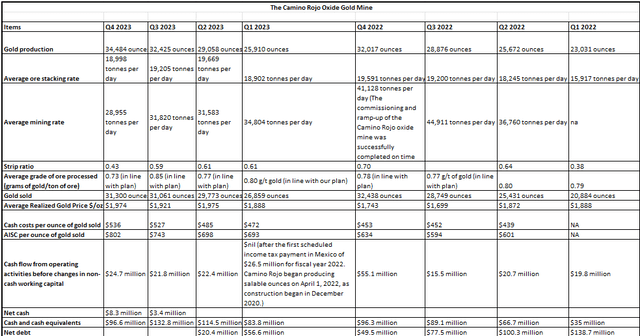

Construction of the Camino Rojo oxide mine began in December 2020, with commissioning and ramp-up work completed (on time and within budget) in the last quarter of 2022, signaled by a peak in average mining reached between Q4 and Q3 of 2022. The first production of salable ounces of gold began on April 1, 2022, resulting in the first planned income tax payment in Mexico of $26.5 million for fiscal year 2022. The payment was made in early 2023, therefore operating cash flow in the first quarter of 2023 was nil. After a peak in late 2022, the mining rate gradually normalized, but thanks to a steady concentration of precious metals in the ore, which did not fall short of expectations during ore processing, Camino Rojo oxide mine fared well, setting two consecutive production records in the third quarter of 2023 at 32,425 ounces and in Q4 2023 with 34,484 ounces.

Source od data: Orla Mining Quarterly Financial and Production Reports

In terms of annual production, the Camino Rojo oxide mine also had a strong performance, reaching a record 121,877 ounces for the full year 2023, exceeding the upper end of the forecast range of 110,000 to 120,000 ounces and growing 11.2% year-on-year as 109,596 ounces were produced for the full year 2022. The cost of gold production at the Camino Rojo oxide mine is not very expensive compared to other productions taking place worldwide: in terms of All-in sustaining costs (or AISC), Camino Rojo endured $736 per ounce of gold sold in the full year 2023, which is admittedly higher than the full-year AISC of $611 per ounce in 2022, when the company was still ramping up operations, but Orla Mining’s production is so far cheaper than most operators, as shown by the following trends for the global industry: The sharp increase in energy prices due to the recovery of the economy after the lockdown and restrictions during the pandemic, as well as the outbreak of war in Ukraine in early 2022 with upward pressure on commodities, resulted in an AISC of $1,276/oz in 2022, which was 14% above a peak that the industry reported in 2012. Also, looking at the full year 2023, the Camino Rojo oxide mine appears to be well ahead of many operators in the global mining industry. But mining is becoming increasingly expensive as the depletion of mineral resources around the world requires faster replacement of equipment and the use of more advanced technology to dig deeper into the earth: The benchmark is provided by S&P Global Market Intelligence: Its AISC of $1,289 per ounce of gold in early 2023 is the average of a group of selected top gold miners, such that each of these gold operators produced at least 500,000 ounces in 2022. S&P Global Market Intelligence also notes that AISC/ounce is rising significantly at nearly three out of four analyzed competitors.

The Upside Potential for Orla: Relatively Low-Cost Production from the Camino Rojo Oxide Mine

With mining costs well below the global gold industry average, Orla Mining is in a very advantageous position compared to many operators. The Camino Rojo oxide mine would, in theory, more easily generate resources to finance production and exploration, as well as to develop additional producing mines, than many other operators who, on the contrary, would be excluded from good profits if the price of gold were not favorable enough. The US stock market is aware of this, and the performance so far in Orla Mining shares, which have significantly outperformed US-listed small gold producers, may well be a reflection. A period longer than YTD was not considered for three reasons: a) As the first full year of commercial gold production for Orla Mining, as 2022 was the year of commissioning and ramp-up for Camino Rojo, 2023 served as a time for the market to get to know Orla Mining better and have a more informed opinion based on more comprehensive data on production, costs, and other mineral activities; b) The year 2023 is excluded from the interval because sentiment towards Orla Mining shares last year was influenced by Panama’s decision to withdraw mineral concessions for Orla’s Cerro Quema project (but also for a few other companies), as discussed later in this analysis, which is likely to distort the comparison with the performance of shares of other small gold stocks that have no assets in Panama; c) The rapid rise in gold prices year-to-date on expectations of interest rate cuts from the Fed is a good test of the market’s weight on Orla Mining’s profit margin, as rising prices could give Orla Mining shares more upside than many other operators with Orla’s Camino Rojo oxide mine (seen earlier) entailing competitive extraction costs. The other operators with more expensive production will inevitably rely even more on debt to finance projects, but debt is now less practical because of the sharp increase in borrowing costs as the Fed combats increased inflation. Companies could also raise capital by issuing new common stock, but aside from the costs of the transaction, this route is not without negative consequences: An increase in the number of shares outstanding reduces earnings per share (or EPS). Since earnings are a major driver of stock prices, diluted earnings tend to lead to negative sentiment toward the stock with the increased number of shares outstanding. In the stock markets, where decisions are often dictated not by rational but by impulsive behavior, lower EPS is not well received, even if the latter is due to the increase in the shareholder base. Orla Mining has been issuing common stock in recent years, but the high potential for good profit margins as long as mining costs remain competitive and gold prices are robust means it is less likely inclined to increase outstanding shares to fund growth projects.

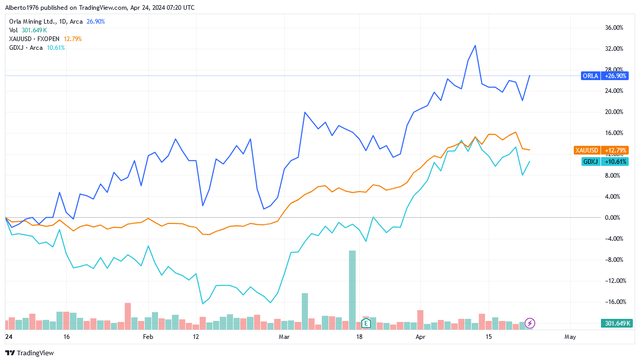

Returning to the YTD performance of Orla Mining shares compared to its more direct peers, ORLA rose 26.9%, while the VanEck Junior Gold Miners ETF (GDXJ), a benchmark for North American listed small gold producers, rose a lower 10.61%, while the Gold Spot Price (XAUUSD:CUR) was up 12.79%.

Source: TradingView

The Financial Position Is Robust vs Planned Mineral Expenditure

In 2023, Orla Mining generated an operating cash flow of $65.3 million. After retaining $20.9 million in capital expenditures and other expenses, the company was left with a free cash flow of approximately $44.1 million. As of December 2023, Orla Mining’s balance sheet had cash and cash equivalents of $96.6 million and a net cash position of $8.3 million, a significant improvement from the net debt position of $49.52 million at the end of 2022, despite a final installment of $22.8 million that the company paid to Fresnillo plc (OTCPK:FNLPF) as part of a layback agreement. In addition, the total inventory could potentially free up additional cash resources worth $29.5 million. The debt is mainly in an outstanding balance of $88.4 million under the revolving credit facility, which was reduced in the last quarter of 2023 following the company’s $25 million repayment to the facility. The total capital required in 2024 will be $31 million, of which $18 million will be in sustained capital expenditures, primarily for the planned heap leach pad expansion (called “Phase 2” Project) in the first half of 2024, and $13 million will flow primarily into non-sustainable capital for the exploration of the Camino Rojo open pit resource Extension.

At the end of 2023, proven and probable mineral reserves were 115.604 million tons of ore with a grade of 0.75 grams of gold per ton of ore (g/t), leading to 2.787 million ounces of gold. There were also Total proven and probable mineral reserves of silver of 31 million ounces. Measured and Indicated Mineral Resources totaled 412.755 million tonnes at a grade of 0.82 g/t, leading to 10.925 million ounces of gold. There are also total Measured and Indicated Silver Mineral Resources of 102 million ounces, Measured and Indicated Lead Mineral Resources of 413.6 million pounds, and Measured and Indicated Zinc Mineral Resources of 1,496.9 million pounds.

In 2024, exploration of Camino Rojo’s open pit resource Extension is likely to be prioritized over the following, but which will also continue:

a) activities aimed at achieving higher ore resolution and gold recovery efficiency at the sulfide deposit where high-grade polymetallic intercepts show strong potential for significant polymetallic sulfide replacement mineralization, which metallurgical test work indicates is suitable for standard cyanide treatment and flotation.

b) the discovery of new satellite deposits on the Camino Rojo property.

An Altman Z-score of 6.16 in the “Risk” section (scroll down until you find the index) indicates that Orla Mining’s financial position is robust to fund ongoing operations at the Camino Rojo oxide mine, exploration activities, and the development of its 100% mineral interest in South Railroad for future gold ounce production in Nevada, USA. The Camino Rojo oxide mine forecasts 110,000 to 120,000 ounces of gold in 2024, which is slightly lower compared to 2023 due to planning for higher waste mining from the east-west extension of the open pit mine, leading to a higher waste-to-ore strip ratio of 1.20. Camino Rojo’s total cash costs in 2024 are expected to be in the range of $625 to $725 per ounce of gold sold, while AISC is expected to be in the range of $875 to $975 per ounce of gold sold. Costs will be higher compared to 2023 as Camino Rojo increases waste stripping and employs capital necessary for the expansion of the heap leach plant.

Orla is currently developing its 100% mineral interest in South Railroad consisting of Dark Star and Pinion deposits, where the company plans to install gold ounce production through open pit mining techniques 43 km southwest of Elko, Nevada, USA, along the Carlin-type trend. Exploration results to date indicate the potential for significant oxide gold mineralization on the property of South Railroad, with metallurgical test work also underway.

The Problem of the Mineral Concession Rejected in Panama: What Happened and Why

Orla Mining also has a 100% interest in the Cerro Quema project, 47 km southwest of Chitre, Panama, which aims to establish gold production operations using open pit and heap-leach processing techniques. The mineral deposit is a copper-gold sulfide resource that is in the permitting phase, but the situation is currently at a standstill.

In the wake of the unrest and protests in September/October 2023 against the exploitation of the country’s resources by private companies, with Panamanian citizens specifically calling for the termination of an agreement between the Panamanian government and First Quantum Minerals Ltd. (OTCPK:FQVLF) (FM:CA), by presidential decree dated October 28, 2023, the President of Panama, Laurentino Cortizo, rejected all new and ongoing metal mining applications with immediate effect. The measure affected not only First Quantum but also other companies, including Orla Mining’s applications to extend concessions for the Cerro Quema project and Orla Mining’s ongoing mineral concessions for Cerro Quema, which were declared canceled. In late December 2023, Orla Mining submitted a request to review the decision regarding the concession for its Cerro Quema project, but this was rejected by the Ministerio De Comercio E Industrias (or MICI) in March 2024. Currently, MICI is also prohibited from granting mining concessions for the extraction of metals and exploration activities in an area if this is reported as a reserve area under the Panamanian Mining Code, and Cerro Quema concessions were also announced by the MICI as part of the Panamanian Mining Code.

The situation in Panama is currently causing inconvenience not only to Orla Mining Ltd. but also to other multinational companies. As Panama’s economy also develops thanks to the exploitation of its natural resources, which the country is rich in, the political situation will be resolved sooner or later. Multinational corporations cannot be banned from mining forever. However, until the current standoff is resolved, Orla Mining does not intend to allocate additional funds to invest in the Cerro Quema project. Orla Mining had to take an impairment charge of $72.4 million in 2023 due to the Cerro Quema project.

The Outlook Remains Positive: Expected Renewed Rallies in Gold Prices

Apart from the Cerro Quema project, with the market that has likely discounted the situation in Panama, the future of the gold price will be crucial to the progress of the Camino Rojo open pit mining operations, the development of the South Railroad, and especially for Orla’s bottom line, which, as we have seen, can count on lower production with slightly increasing costs in 2024.

Gold prices are seeing a healthy technical pullback and are likely to push deeper below $2,300 in the near term as easing fears of escalating tensions in the Middle East weakened the metal’s safe-haven appeal, but geopolitics remains a bullish wildcard for analysts in 2024 and beyond. The precious metal is thus expected to have new strong rallies after the current decline: Compared to $2,323 per ounce as of this article, analysts at Trading Economics are currently forecasting a gold price of $2,443.81 per ounce in 12 months, and according to analysts at JPMorgan Chase & Co. (JPM), gold prices will average $2,500 per ounce in the fourth quarter of 2024, with further increases in 2025. This analysis is in line with the above analysts that gold prices will rise again after the current decline: As an inflation hedge – “as sticky inflation narrows the chances of rate cuts” – gold is set to rise very strongly. Assuming a 10-15% premium to the $2,300/oz price level achieved after the current decline, we forecast a price range of between $2,550 and $2,650 per ounce by the end of 2024. Roughly in line with the gold price recovery in 2021, when inflation rose very quickly, sparking fears among investors seeking protection in safe-haven gold for their portfolios.

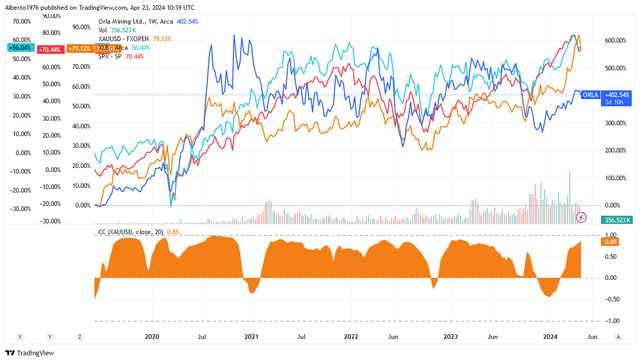

Overall, it is advisable to keep Orla Mining Ltd. shares in your portfolio in the medium-long term, taking advantage of the increasingly uncertain scenario ahead, which enhances gold’s safe-haven properties. As seen in the following graph, ORLA is up 402.54% better than the US market benchmark S&P 500 Index (SPX) +70.44%, the basic materials (XLB) +56.04%, on a gold spot price (XAUUSD:CUR) which increased 79.12% over the last 5 years.

Source: TradingView

Due to the likely impact of improved profitability and overall mining profile on expected higher gold prices, based on a very positive correlation coefficient between ORLA and gold prices, ORLA shares are on track to potentially trade above current levels.

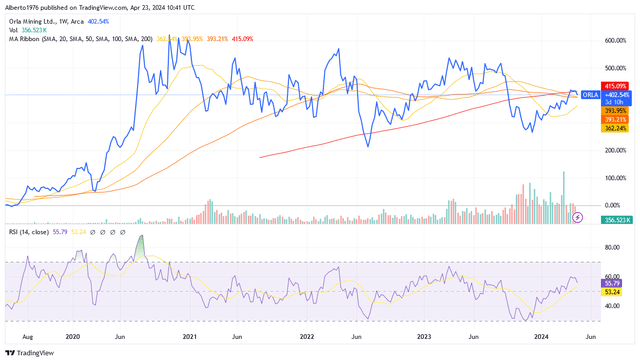

The Goal of a More Attractive Share Price

ORLA shares, which are trading at $4.01 apiece at the time of writing, for a market cap of $1.21 billion, are a buy ahead of the positive outlook, but investors may want to hold on to the end of the current decline in the gold price, as this headwind may lead to a more attractive level in the share price of the ORLA share.

Source: TradingView

The stock price has been between $2.60 and $4.82/share over the 52-week range, but the current stock price is closer to the upper bound than the lower bound of the interval. Perhaps as a target price, an investor may want to look for the formation of a lower buy price, say once it bottoms out below the MA Ribbon in the descending cycle.

The current headwinds mean that there is a chance for the portfolio hedge gold price to decline as tensions in the Middle East ease somewhat, and the 14-day RSI of 56 indicates that there is plenty of room to move down to a significantly lower price for ORLA shares.

The risk of missing an opportunity associated with not buying now is very low, as with such a good outlook for the gold price, ORLA will have a very favorable tailwind to continue to fare well in 2024 and beyond. But since there is now a chance for a more attractive price amid the retreat of the gold price, wait a little longer for the dip in the stock price.

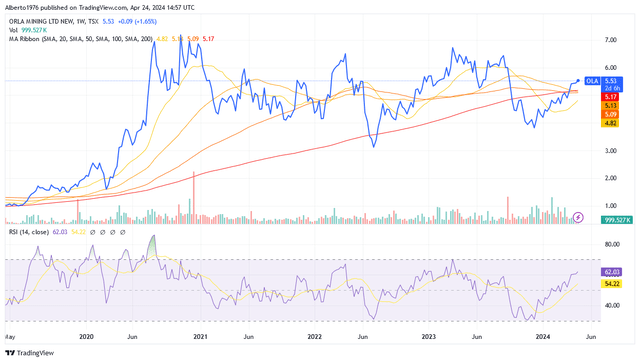

The same considerations apply to shares of Orla Mining Ltd. under the symbol (TSX:OLA:CA), which are traded on the Toronto Stock Exchange (or TSX). As of this writing, the stock price of OLA:CA traded at CA$5.53 apiece for a market cap of CA$1.66 billion. The share price was closer to the higher bound than the lower bound of the 52-week range of CA$3.53 to CA$6.52. The stock price was completely above the MA Ribbon.

Source: TradingView

The RSI of 62 indicates that there is plenty of room to move down to a significantly lower price for ORLA shares as gold prices continue to pull back.

Conclusion

Orla Mining is a small gold producer in Mexico in the range of 110,000 to 125,000 ounces of gold at a cost that is not high compared to the gold industry globally. With commissioning and ramp-up completed in 2022, the subsequent year of 2023 marked Orla’s first full year of commercial production. The company has performed well, supported by robust metal content in the ore during processing activities and by a robust gold price.

The share price in 2023 was influenced by the situation in Panama, where Orla Mining is advancing an exploration project, but mineral concessions are stopped by a decision by the country’s president, triggered by popular unrest and demonstrations against foreign private explorers of domestic natural resources. Orla had to record an impairment loss due to Panama, affecting the net profit. The Panama factor has probably been completely discounted in the stock market, and Orla is not the only company interested in minerals in Panama. For the sake of the country, whose economy is also dependent on natural resources, the impasse will be resolved sooner or later in my opinion.

Orla Mining is also working on resource expansion in Mexico and exploration activities in Nevada near the town of Elko along a trend of Carlin-type mineralization. The aim is to install future open-pit gold production for the mine’s eight-year life, averaging 124,000 ounces per year as per estimates.

In 2024, production will be slightly lower and costs slightly higher than in 2023 due to less favorable trends expected in the waste-to-ore strip ratio from the exploitation of certain mineral areas of the open pit gold mine in Mexico. However, the macroeconomic and geopolitical conditions set the stage for gold prices to potentially trade significantly higher in 2024, offsetting lower gold production and higher operating costs. Due to a positive correlation with gold prices, investors can expect strong upward pressure on Orla shares in both North American markets amid rising gold prices, driven by bullish earnings sentiment (driving share prices), while write-downs from Panama were already recorded last year.

The shares are a buy given the rosy outlook, but as they could fall if gold prices continue their sharp healthy retreat, investors may want to wait until a more attractive entry point emerges.

The investor must be aware that the Orla Mining stock is characterized by a not high volume of liquidity in the NYSE market, as the stock had an average volume (3 months) of 523,124 shares, and in the TSX as the stock had an average volume (3 months) of 672,809 shares, both, as of this writing, out of shares outstanding of 315.07 million. If the investor takes too large a position in Orla Mining Inc., it may be difficult to reduce or exit shares when circumstances warrant.

Read the full article here