With their Quarterly Refunding Announcement for 2Q24, the U.S. Treasury revealed the launch of their new Treasury Buyback Program, to commence on May 29th.

The Treasury plans to conduct weekly Liquidity Support Buybacks of up to $2 billion in coupon securities, and up to $500 million in TIPS, per operation.

This will be the Treasury’s first Buyback Program since 2000-2002, and only the third in the last century.

The Treasury’s stated goals of the program are to make the Treasury market more liquid and to help achieve their debt management objectives.

Treasury Market Liquidity

The Treasury market has always been the largest and most liquid segment of the bond market. Large quantities of securities are traded daily. Size trades typically have little impact on the bid/ask spread. This is known as market depth.

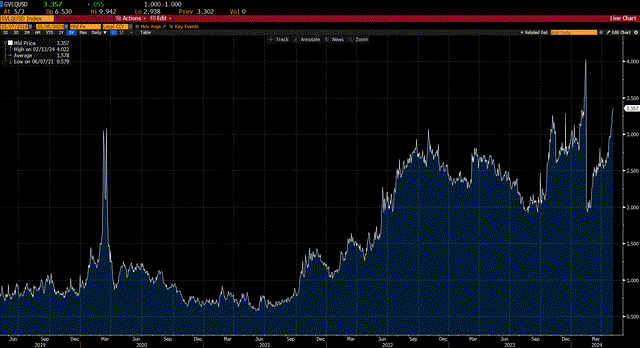

Recent activity, however, has shown a troubling deterioration in market depth. As measured by the Bloomberg US Government Liquidity Index, seen below, liquidity is evaporating. This index measures, on average, how far yields are away from where fair market value models suggest they should be. As the level climbs, liquidity decreases.

The index has been elevated for the past two years, climbing in February 2024 to exceed the pandemic induced spike. It is again approaching that level.

Bloomberg

The deterioration in market liquidity is due to a combination of the rapid growth in the market and several major investors reducing their exposure.

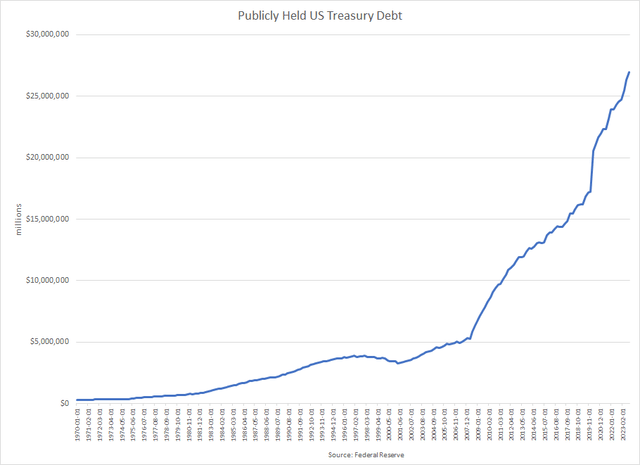

Publicly held US Treasury debt has quintupled since the Great Financial Crisis (GFC), increasing from $5.4 trillion to $27 trillion.

Federal Reserve

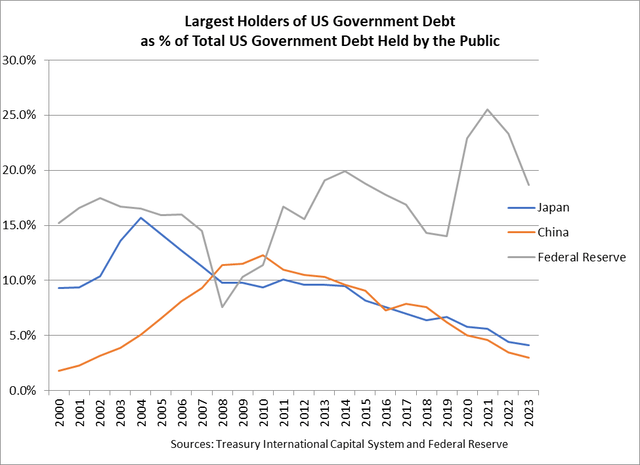

Yet as the Treasury has increased their debt issuance, traditional buyers are pulling back. The largest owner of Treasury bonds is the Federal Reserve. Their holdings peaked at $6.0 trillion in 2Q22, but as the Fed has been executing their Quantitative Tightening policy of shrinking their balance sheet, their holdings of Treasury Bonds have dropped to $4.7 trillion. As a share of Treasury Debt Outstanding, the Fed’s holdings have fallen from 25.5% to 18.7%

Treasury International Capital System and Federal Reserve

The largest foreign buyers of Treasury bonds are Japan and China. Their share of Treasury Debt Outstanding has also fallen to 4.1% and 3.0%, respectively.

Banks have retreated from traditional market making recently as capital requirements following the GFC have made it more expensive for them to hold government debt on their balance sheet.

The buyback program would help the primary dealers to get older bonds, which are typically harder to trade, off their balance sheet and allow them to use their balance sheet more efficiently.

Terms of the Treasury Buyback Program

The Treasury plans to release the buyback schedule for each quarter as part of their Quarterly Refunding Announcement.

Liquidity Support Buybacks will take place weekly on Wednesday afternoons, and will be executed through the Federal Reserve Bank of New York.

Each weekly buyback will focus on one of seven maturity buckets for coupons, and two maturity buckets for TIPS.

The goal of the Buyback program is to reduce illiquid, off-the-run securities, so there are several exclusions as to what is eligible to be purchased. The Treasury will not buy on-the-run securities, Treasuries trading on special in the repo market, or Treasuries considered cheapest-to-deliver.

In addition, the Treasury will conduct Cash Management Buybacks, which will consist exclusively of T-Bills. This buyback will be used to help manage the volatility of the Treasury General Account, particularly around periods of tax payments.

How The Treasury Buyback Program Differs From Quantitative Easing

While the Treasury Buyback Program and Quantitative Easing (QE) both involve the Fed buying Treasury securities, there are a few differences.

First, QE is a tool of Monetary Policy, and the Fed creates reserves to make their purchases. The goal of QE is to inject liquidity into the financial system through the Fed’s purchases. The Treasury Buyback Program is different. The Treasury uses cash raised from the Quarterly Refunding to make the buyback purchases. In effect, they are replacing old, off-the-run securities with new, on-the-run securities.

Additionally, QE has been used during periods of financial stress, while Treasury Buybacks will be executed exclusively on an orderly and regular basis.

Finally, Treasury Buybacks will be used to extinguish the securities that are purchased. That is, the securities purchased will be effectively redeemed, never to be seen again.

The History of the Treasury Buyback Program

The last time the Treasury conducted a buyback program was from 1Q2000 to 2Q2002. The environment and rationale then, however, were entirely different.

At that time, the Treasury was running a budget surplus, in that total government revenues exceeded total government expenditures. As such, the Treasury’s borrowing requirements were diminished. They only needed to raise new cash to replace maturing Treasury Debt. This created a problem because they had to reduce the size of their auctions. A different type of liquidity crisis evolved. It got to the point where the Treasury eliminated issuing three-year Treasury Notes so that they could bolster the auction size of their other maturity offerings.

As a cost savings to the government, the Treasury redeemed $67.5 billion in mostly long-term, high coupon, Treasury bonds during this program. This was the only period where Total Treasury Debt Outstanding actually declined.

The Hidden Benefit of The Treasury Buyback Program

As mentioned above, under the Treasury Buyback Program, old illiquid securities that are purchased are to be redeemed.

Last month, the Treasury conducted several sample tests of the buybacks to check on operational efficiencies. What was learned from that experience is that there will be significant cost savings for the Treasury by implementing the Treasury Buyback Program.

The Treasury buys securities at market prices. Interest rates are much higher now than they have been over the past several years. That translates to many of the securities to be redeemed through the program have lower coupons than securities newly issued today. As such, the purchase price in the market for these securities can be at a significant discount.

For example, on April 17th, 2024 the Treasury bought $200 million in Treasury bonds under the test program. The average coupon for the securities purchased was 1.41%, and the average price paid for the bonds was $83.00. Consequently, since the purchase price was at a 17% discount from the par value of $100, the Treasury saved $34 million on the $200 million buyback.

Once in full implementation mode, the Treasury will by buying back more than $100 billion of Treasury bonds in a year. While the discount on the buybacks will vary over time based on the path of interest rates, it still could represent a significant savings to the Treasury.

Conclusion

The Treasury market has been experiencing a liquidity crisis as issuance has increased dramatically, and major investors have stepped away from the market. To ameliorate this crisis, the Treasury is launching the Treasury Buyback Program to redeem old, illiquid off-the run securities and replace them with new liquid on-the-runs.

The hidden benefit to the Treasury by executing this program is that they will experience significant savings as they redeem the old securities discounted to par value.

Of course, these savings are only short term, as they will be offset by the higher interest expense the Treasury will pay over time on the newly issued higher coupon Treasury bonds.

Read the full article here