The Distillate U.S. Fundamental Stability & Value ETF (NYSEARCA:DSTL) is an actively-managed U.S. equity ETF focusing on cheap, high-quality stocks with significant, stable cash-flows. DSTL has outperformed the S&P 500 and benchmark U.S. value equity indexes since inception, in spite of unfavorable market conditions. DSTL’s cheap valuation and strong performance track-record make the fund a buy. With a 1.3% dividend yield, the fund is an ineffective income vehicle.

DSTL – Overview and Analysis

Strategy and Portfolio

DSTL selects 100 U.S. equities based on value, quality, and risk metrics. The specific process is proprietary, so details are few and far between, but the fund explicitly mentions considering free cash flow, or FCF, stability and yields, as well as indebtedness. In a simple diagram:

DSTL

Although we know little of DSTL’s strategy, I quite like the focus on FCF yields and stability. Cash-flows are real and tangible and are much harder to massage and don’t come with other negatives (asset values and depreciation), so focusing on these seems smart. Stable cash-flows are also a straightforward positive for investors. Avoiding highly indebted companies is an obvious positive too, especially for a value fund, to avoid potential value traps.

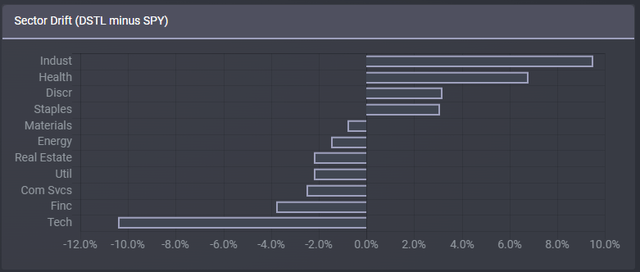

Looking at sector weights, the fund is overweight several old-economy industries, including industrials and consumer goods, on valuation grounds. On the flipside, it is underweight tech, for similar reasons. These tilts are quite common for value funds. At the same time, the fund is underweight energy, quite uncommon for value funds, due to the unstable cash-flows of these companies. It is also underweight financials, rare for a value fund, for reasons unclear to me.

Etfrc.com

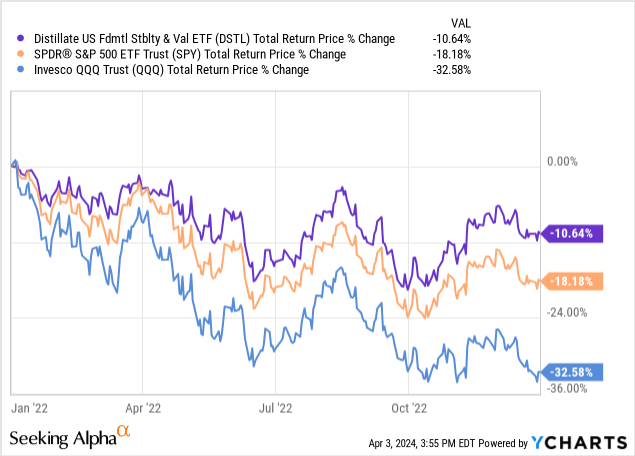

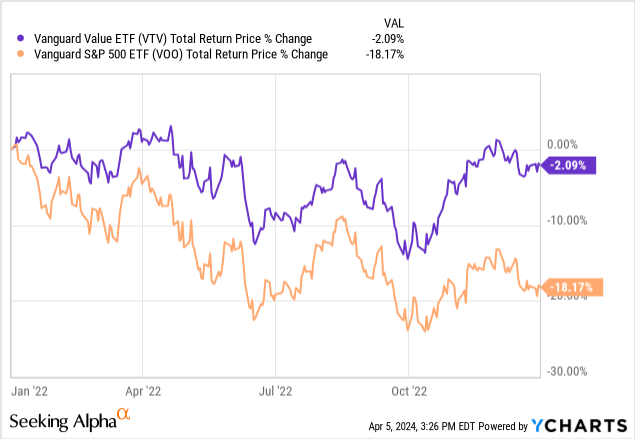

DSTL’s sector tilts impact the fund’s performance, especially its relative performance to the S&P 500. Expect the fund to outperform when tech underperforms, as was the case during 2022.

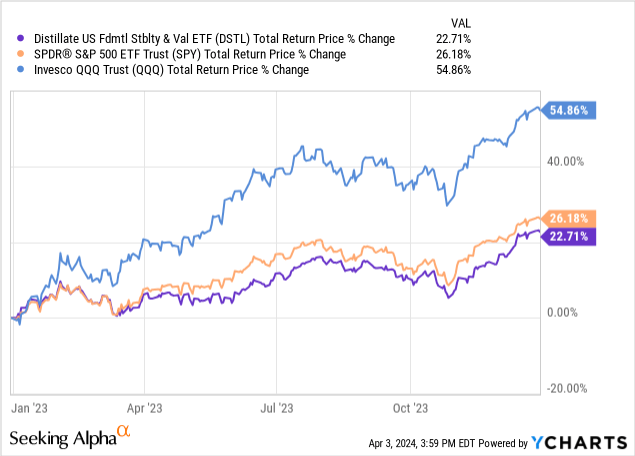

Data by YCharts

Expect the fund to underperform when tech outperforms, as was the case during 2023.

Data by YCharts

In my opinion, the above is neither a negative nor a positive for the fund, but an important fact for investors to consider. Tech bulls might prefer other funds, or pair DSTL with a more tech-heavy alternative.

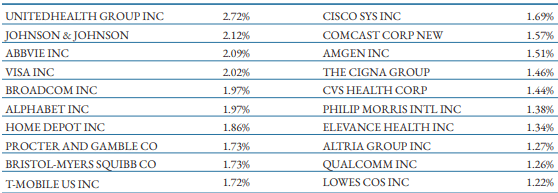

Looking at DSTL’s top holdings, it seems that the fund focuses on large blue-chip equities, including Johnson & Johnson (JNJ), AbbVie (ABBV), and Visa (V). It excludes most mega-cap stocks, including Microsoft (MSFT) and Amazon (AMZN), although it does invest in Google (GOOGL) (GOOG). Focusing on large blue-chip stocks serves to somewhat decrease portfolio risk and volatility, a solid benefit for investors. Small-caps are looking particularly cheap right now, so prospective returns are somewhat lower as well.

Due to these exclusions, DSTL focuses on comparatively smaller (less large) companies, with an average market-cap of only $47B, compared to $266B for the S&P 500, and $119B for the Vanguard Value ETF (VTV), one of the larger value ETFs in the market.

DSTL

Valuation Analysis

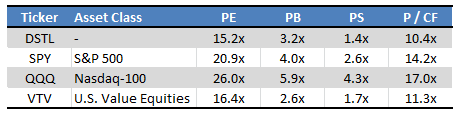

DSTL focuses on companies with above-average FCF yields, which results in a comparatively cheap valuation across the board. The fund is significantly cheaper than both the S&P 500 and Nasdaq-100, although about the same as other broad-based U.S. value ETFs.

Morningstar – Table by Author

Looking at historical prices and valuations, valuation gaps between value and growth stocks are currently around 15% wider than average. Growth always trades at a premium, but the premium is moderately larger now than in the past.

JPMorgan Guide to the Markets

DSTL’s cheap valuation benefits investors in two key ways.

First, cheap valuations can always improve, leading to significant capital gains and market-beating returns for shareholders. Valuations could normalize for many reasons, including improved fundamentals and sentiment. I personally don’t see any short-term catalyst for valuations improving, although sentiment seems reasonable enough that this could conceivably happen. Value significantly outperformed during 2022, for instance.

Data by YCharts

Second, cheap valuations boost the impact of any potential dividend payments or share buybacks. DSTL’s underlying holdings could boost their earnings by 6.6% if they diverted all profits to buying back their shares, due to its 15.2x PE ratio. The average S&P 500 component could boost earnings by 4.8% doing the same, due to their average 20.9x PE ratio. Same idea for dividend payments.

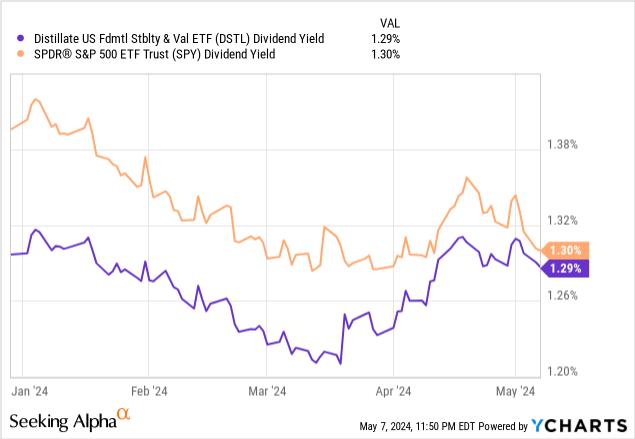

DSTL yields almost the same as the S&P 500, so no real impact there.

Although the fund does not directly focus on companies with above-average buyback programs, I would imagine it does end up doing so in practice, due to its above-average FCF yields. Not a whole lot to do with excess free cash, after opex and capex, but to deliver it to shareholders.

DSTL’s cheap valuation is a positive for shareholders, although a somewhat uncertain one, lacking clear-cut catalysts.

Performance Analysis

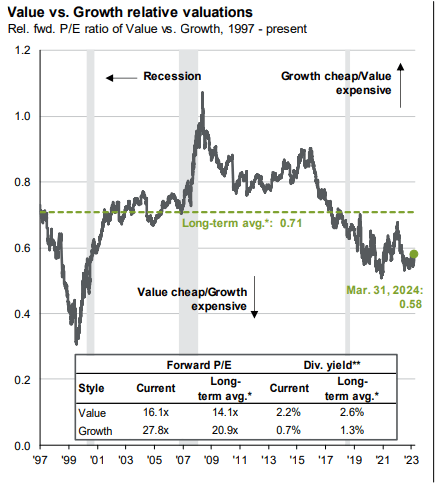

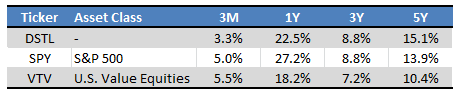

DSTL’s performance track-record is quite strong, with the fund outperforming the S&P 500 and broader U.S. value equity benchmarks since inception, and for most relevant time periods. Returns have been particularly strong since the pandemic, outperformance during 2022. On the other hand, the fund has underperformed the S&P 500 since early 2023, a period of significant tech and growth outperformance. It has still outperformed value equities, though.

Seeking Alpha – Table by Author

In my opinion, DSTL’s outperformance was due to a solid, effective investment strategy. Focusing on cheap stocks with strong cash-flows should lead to outperformance, as has been the case in the past. Under current conditions, I believe that further outperformance is quite likely: valuations remain depressed, and past performance has been reasonable enough.

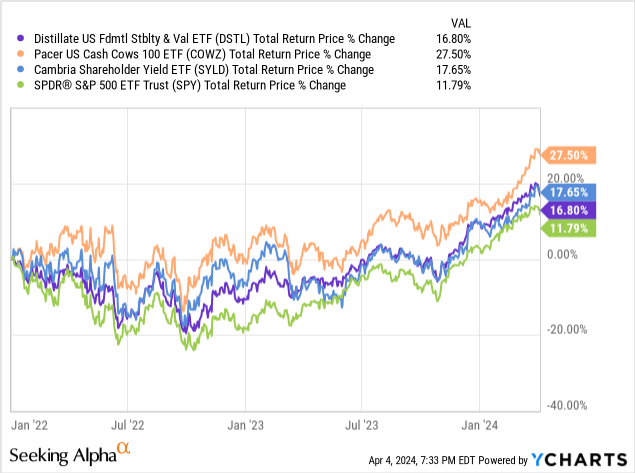

More broadly, my experience these past few years has been that broader value equity funds have performed OK, but those targeting cash-flows, dividends, or buybacks, have done much better. Besides DSTL, the Pacer US Cash Cows 100 ETF (COWZ) and the Cambria Shareholder Yield ETF (SYLD) have both outperformed since early 2022.

Data by YCharts

So, the more common value strategies have performed OK these past few years, some of the more niche ones focusing on cash-flows have outperformed.

I have two hypotheses for the above.

First, some of the more traditional value benchmarks or strategies are too crowded, too well-known to work. My understanding is that this was the case for lots of older research / models, including Fama-French. These outperformed, outperformance meant more assets and investors following the strategies, which meant prices rose until outperformance ceased. Focusing on cash-flows is a bit of a niche strategy, right now at least, so it continues to outperform. ETFs focusing on cash-flows are becoming more popular, at least for retail investors. I’m not sure that the same is true in other areas of the market (hedge funds, family offices, etc.).

Second, due to bearish investor sentiment valuations only matter insofar as these are leveraged through dividends and / or buybacks. This is easy to notice in the energy industry.

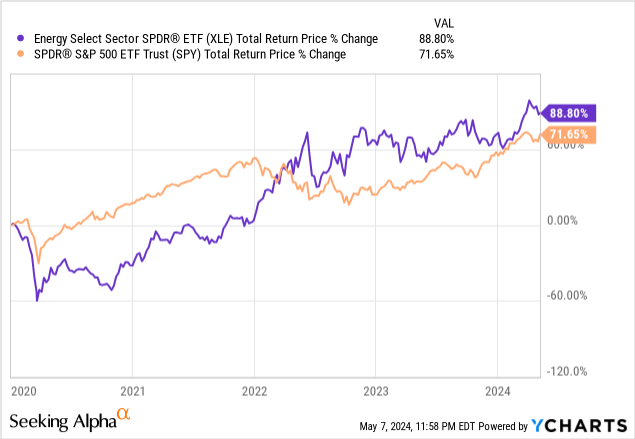

Energy is one of the most hated sectors in the market, due to past underperformance and climate change concerns. BlackRock (BLK), the largest investment manager in the world, believes in a transition to a low-carbon economy, and invests quite heavily in renewable energy. For lots of investors, cheap energy industry valuations either don’t matter, or simply reflect long-term weakness.

Partly due to the above, energy industry companies have decided to focus on cash-flows and buybacks, less so on capex, especially compared to the shale boom of the 2010s. My understanding is that the shift has been quite popular and has led to strong returns these past few years.

Point being, many investors don’t seem to care that energy industry valuations are cheap, but they do care that the energy industry is spending $114B in buybacks and dividends. These issues are related insofar as cheap companies can achieve higher dividend yields or buy back a larger proportion of their shares.

An issue with the above is that DSTL does not directly focus on companies with significant buybacks, dividends, or similar. Of course it does focus on companies with significant FCFs, and one would expect these companies to return a lot of free cash to shareholders. I’m quite confident that this is the case for COWZ and other cash-flow ETFs, but I don’t really have the information necessary to make that determination for DSTL. I do think it is likely though.

In any case, DSTL has significantly outperformed since inception, as have similar value ETFs. I’m quite bullish on the fund, and optimistic about future outperformance.

Other Considerations

As a quick aside, some of my top value ETFs are managed by institutions with several best-performing ETFs, unlike DSTL and Distillate.

Pacer ETFs has COWZ, and several other strong cash-cow ETFs.

Avantis has the Avantis U.S. Small Cap Value ETF (AVUV), which has outperformed since inception, and several other strong value ETFs.

Distillate has two other ETFs, the Distillate Small/Mid Cash Flow ETF (DSMC) and the Distillate International Fundamental Stability & Value ETF (DSTX). DSMC has outperformed relevant benchmarks, DSTX has not. ETFs from Pacer ETFs and Avantis have stronger overall track-records.

Although the issues above are not deal-breakers, they do make me lean towards COWZ and AVUV over DSTL. DSTL remains a strong investment opportunity though, in my opinion at least.

Conclusion

DSTL’s cheap valuation and strong performance track-record make the fund a buy.

Read the full article here