Since I last wrote about tobacco company Philip Morris (NYSE:PM) in February, it has had a pretty good three months, with a 12% price rise. For context, this is higher than the ~8% increase in the S&P 500 Consumer Staples index in the same period.

The company’s superior performance and the stock’s attractive market multiples compared to its five-year averages indicated the likelihood of a price rise, and developments since have further supported it. Specifically, its strong Q1 2024 results and an upgrade in its 2024 outlook have worked in Philip Morris’s favour.

But after the price rise over the past quarter, PM’s dividend yield has softened and the market multiples aren’t attractive either. At the same time, the continued progress for its smoke-free products is encouraging and there’s also the possibility of a dividend increase. Here, I assess what the balance of these factors means for PM for the remainder of the year and over the long term.

The challenges: Dividend yield softens

There’s no denying the significance of dividends for tobacco stocks as such. And PM is no different. Even though PM’s trailing twelve months (“TTM”) dividend yield at 5.18% lags significantly behind peers like British American Tobacco (BTI) and Altria (MO) at 9.41% and 8.51% respectively, dividends have made no small contribution to the returns on the stock.

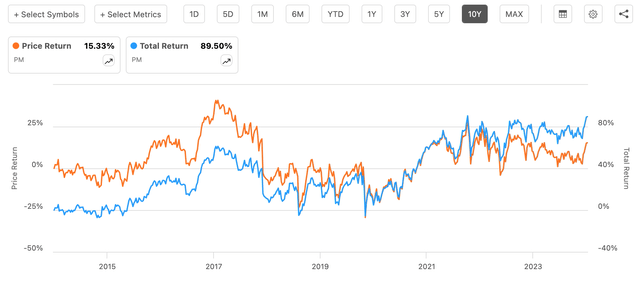

This is evident from the fact that over the past decade, total returns on the stock are at a significantly higher 89.5% compared to a 15.3% price return (see chart below).

Price and Total Returns (Source: Seeking Alpha)

Despite the long-term perspective on dividends, however, PM isn’t as attractive as it was three months ago, with an over 0.6 percentage point dip in its TTM yield compared with 5.8% in February. Similarly, the forward dividend yield comes to 5.2% for 2024 assuming that PM’s dividends remain unchanged at USD 1.3 per share, as declared in Q1 2024. This too, is a decline from 5.8% three months ago.

Note that this decline in yield has nothing to do with the absolute dividend levels, though. The company has maintained its dividend levels for the past three quarters. This is in keeping with its historical pattern of increasing dividends once a year, after the second quarter. As a result, PM’s dividends are actually up by 2.3% year-on-year (“YoY”). But the price rise in the interim has shaved off from the dividend yield.

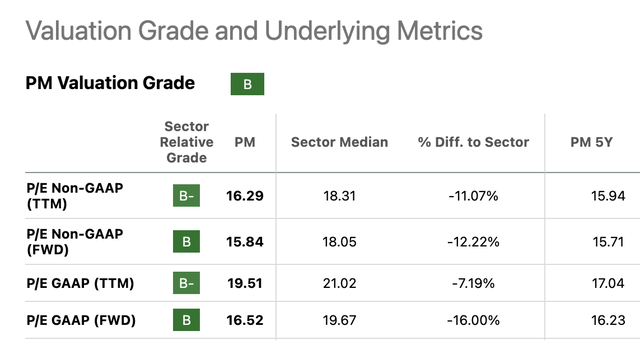

The challenges: High market multiples

The price rise also implies higher price-to-earnings (“P/E”) ratios. The TTM GAAP P/E was at 14.8x when I last checked, and is now at 19.51x. Similarly, the TTM non-GAAP P/E, which was at 13.7x at the time is now at 16.4x. These levels also now exceed the stock’s five-year averages (see table below), indicating that at least from the perspective of TTM P/Es, there’s actually some downside to the stock.

Source: Seeking Alpha

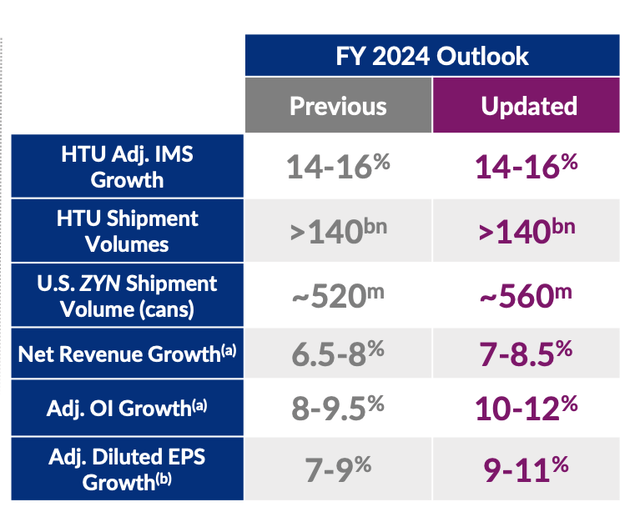

But there are still the forward P/Es to consider. This brings me to Philip Morris’s upgraded earnings outlook. Both revenues and profits are expected to grow faster now (see table below). But here’s the catch.

The projected growth rate for adjusted diluted earnings per share (“EPS”) at 9-11% now compared to the 7-9% earlier is at constant exchange rates. However, the company also expects an unfavourable impact of 36 cents on the EPS now, with the actual figures expected to range between USD 6.19 and 6.31. At the midpoint of the range, the YoY growth forecast is far more underwhelming at 6.6%.

In other words, the potential from a better outlook on lowering the forward P/E is lost as a result. The forward non-GAAP P/E is also now high at 15.97x, compared to the five-year average of 15.94x. Still, a case could be made for the stock if its peers were trading at even higher multiples. That’s not the case either. It has the highest forward P/E among them, and MO comes only a distant second with a ratio of 9.04x.

Source: Philip Morris

The opportunities: Smoke-free products

The stock metrics could be of particular concern if the company’s future was shaky. This is possible, considering that tobacco companies are in a transitional phase, as the popularity of traditional products wanes. In fact, in this context, its peer, Altria’s case looks cautionary right now, with shrinking revenues due to tobacco and no meaningful pivot to non-smokeable products.

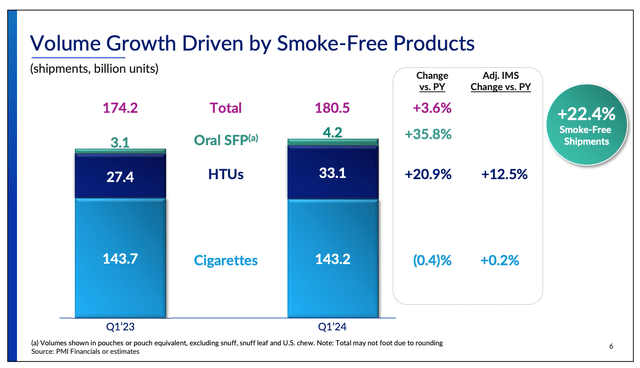

Philip Morris, however, is a very different story. Almost 39% of its revenues and 37.5% of the gross profit were obtained from smoke-free products (“SFP”) in Q1 2024. In fact, the segment is driving up overall volume growth even as cigarette volumes declined during the quarter (see chart below), with the East Asia, Australia and Duty-Free segment now garnering 75% of its revenues from SFP

For the full year 2024, the company targets a USD 15 billion revenue from the category, which is an over 17% growth from 2023. It’s also an acceleration from the 12.8% increase last year. Philip Morris also expects the “majority of OI growth” to come from SFP too, the outlook for which has also been upgraded (see FY24 Outlook table above).

Source: Philip Morris

The opportunities: Dividend growth possible

Further, for now, there’s also a possibility that the company’s dividends can continue growing. The dividend payout ratio as a proportion of reported earnings remains uncomfortably high at over 100%.

But as I had pointed out the last time as well, there’s some solace to be found in the ratio as a proportion of adjusted earnings. If the company keeps the dividends unchanged in 2024, the forward payout ratio is at 83.2% in adjusted terms. Even if it were to increase dividends by ~3.4% this year, the ratio would still be at 85%, which is the same as last year. This is possible, considering that Philip Morris has increased dividends, every year since its public listing in 2008. This can make up for the fact that its dividend yield has softened in recent months.

What next?

Considering that PM’s unique selling point is its long-term total returns, owing to its dividend payouts, it remains a Buy. And that’s the rating I’m going with. Its future looks fine, with substantial revenues from its SFP segment and promising growth for the future too. There’s also a likelihood for dividends to increase after this quarter, which can bump up the forward dividend yield at least a bit.

However, for investors looking to make gains from PM in the short term, this might not be the best time to buy it. The stock is due for a correction, and the dividends might or might not be able to make up for the loss of capital from the correction. In other words, the stock might have performed recently, but the trend is probably not here to stay for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here