Pitfalls of the Banking Industry

Investing in a banking stock is generally not the most exciting thing one can do in the world of the stock market. Banking history spans hundreds of years, and their business practices have remained largely unchanged. Despite introducing new products and putting new twists on existing ones, the core business model remains the same: collect deposits, lend money, and generate income from the interest rate spread.

Mainly, coming face to face with an investment in a bank, you realize that overall, as an industry they have a crisis every decade. We already started this decade with the failure of Silicon Valley Bank and 5 banks failed in 2023 alone (The stress is still well present in the system with a consulting group analyzing around 4000 banks and finding 282 banks facing the dual threat of commercial real estate loans and potential losses tied to higher interest rates). The late 2000s became famous for the Great Financial Recession. Between 1980 and 1994, more than 1,600 banks insured by the

Federal Deposit Insurance Corporation (FDIC) were closed or received FDIC financial assistance. Big or small, the size barely matters, and the judgment can be swift when you make a misstep in this industry.

Boredom and capital wipeout. Not exactly what you are looking for when investing.

Despite all this, the National Bank of Canada (TSX:NA:CA) has been one of my core portfolio holdings for a few years. It is also one of those investments for me where I aggressively added on any dips or pullbacks and I have reached my maximum allocation for the portfolio. Sometimes I feel that I can fill a book with my thoughts on the stock, so the difficulty was distilling it down to a thesis with a clear direction on why I invested the way I invested.

So let us dig into my motivation behind this investment.

Growth among its Canadian banking counterparts

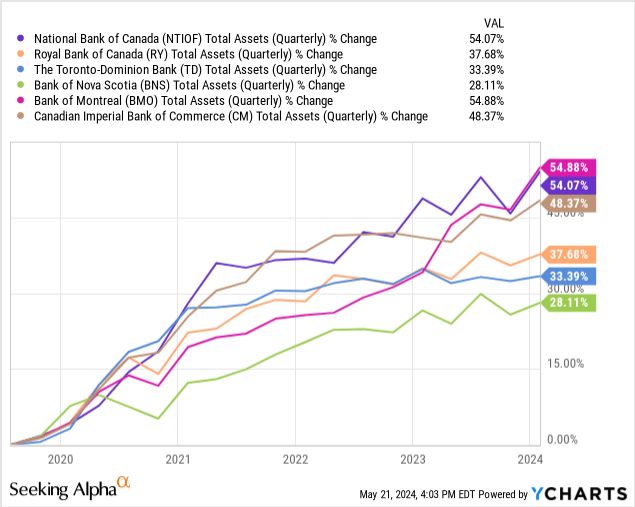

The National Bank of Canada has grown tremendously in the last decade, despite being the David among the banking Goliaths of Canada. Its total assets are only second in terms of growth in the last 5 years (It has to be mentioned that although BMO may rank first in asset growth, a bulk of it comes from its elephant-size acquisition of Bank of the West completed in 2023)

The below table shows the Revenue CAGR of all the big Canadian banks over the last 5 years. Here, too, National Bank outshines the other banks.

| Bank | Oct ’19 | Oct ’20 | Oct ’21 | Oct ’22 | Oct ’23 | TTM |

| NA | 6.15% | 5.11% | 10.75% | 8.36% | 7.40% | 7.68% |

| TD | 6.01% | 4.12% | 6.06% | 7.03% | 6.21% | 6.45% |

| RY | 6.09% | 4.60% | 6.25% | 4.18% | 5.39% | 5.04% |

| CM | 6.87% | 4.43% | 7.26% | 6.10% | 4.67% | 4.77% |

| BNS | 4.95% | 2.70% | 4.22% | 3.65% | 2.26% | 2.07% |

| BMO | 6.86% | 3.44% | 5.90% | 9.34% | 5.46% | 6.16% |

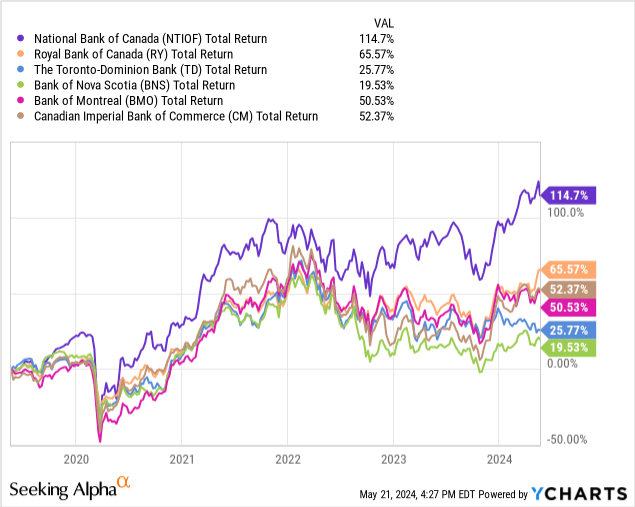

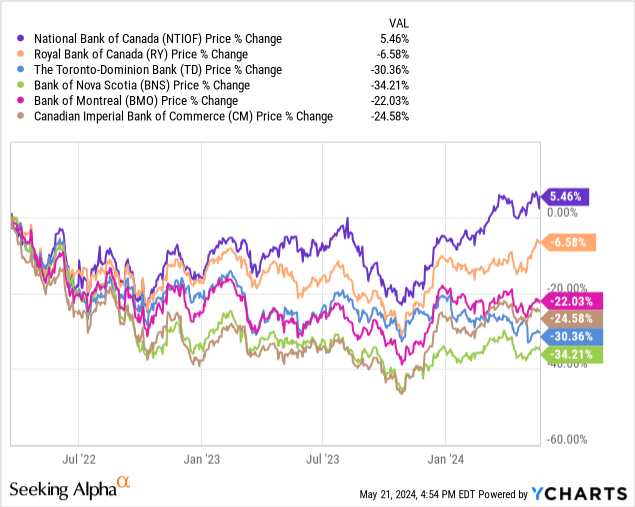

Investors have recognized this. Despite the short-term pessimism in the Canadian banking industry (for reasons we will dive into in the risks section), its returns are close to double that of the nearest competitor, and here is the interesting part. Except for the National Bank of Canada stock, all the other banks have seen their stock price remain flat or have declined heavily in the last two years!

National Bank’s Safety Profile

As I mentioned, the banking industry is so often prone to failure, that growth almost should be looked at in hindsight when compared to safety in its growth. So let us evaluate the quality/safety of its growth.

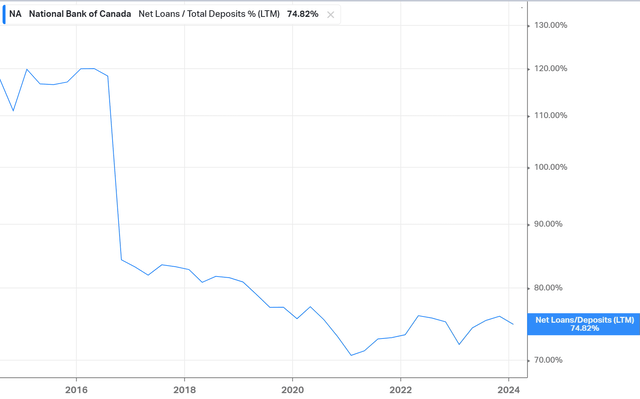

National Bank of Canada’s financials show that it has total assets of CA$433.9B and total equity of CA$23.9B. Total deposits are CA$300.1B, and total loans are CA$224.5 B. It earned a Net Interest Margin of 2.36% as of the latest quarter. Cash and investments are CA$154B. Its Assets to Equity is at 18x and 73% of its liabilities are made up of customer deposits, which is far less risky than financing through external sources. The fall in net loans to deposits post-2017 suggests the bank’s focus on liquidity and a more conservative approach to lending and risk management by the bank.

Net Loans/Total Deposits (LTM) (Koyfin)

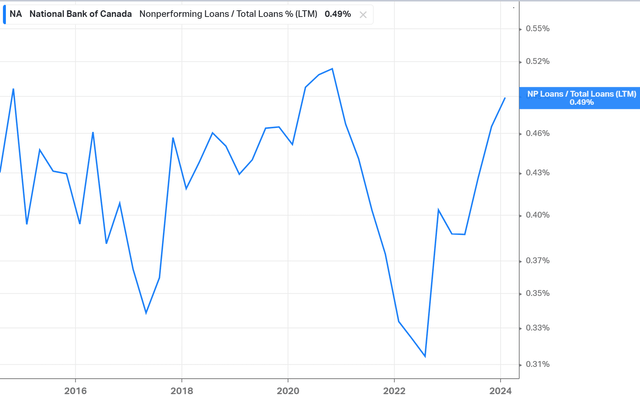

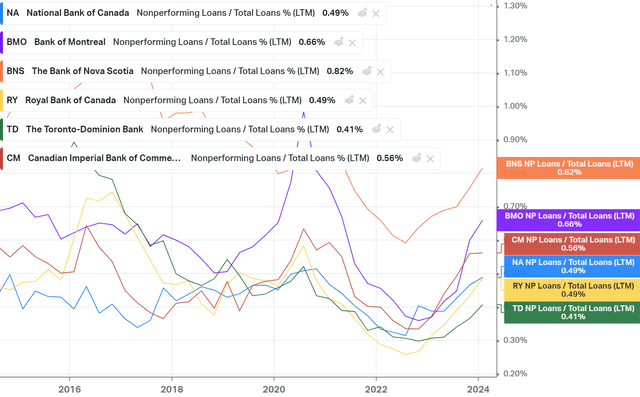

It has sufficient allowance for bad loans, which are currently at 0.5% of total loans (110% for allowance of credit losses/Non-Performing Loans) and are currently at healthy levels. Also, it currently boasts one of the lowest levels of non-performing loans to total loans among the big Canadian banks.

Nonperforming Loans/ Total Loans % (LTM) (Koyfin)

Nonperforming Loans/ Total Loans % (LTM) among the 6 largest banks in Canada (Koyfin)

National Bank of Canada 2024 Q1 – Results

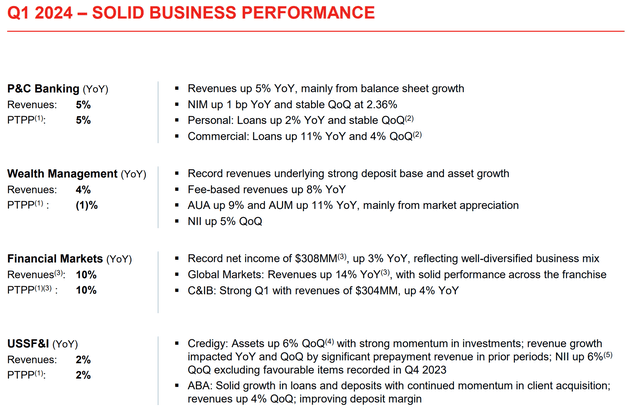

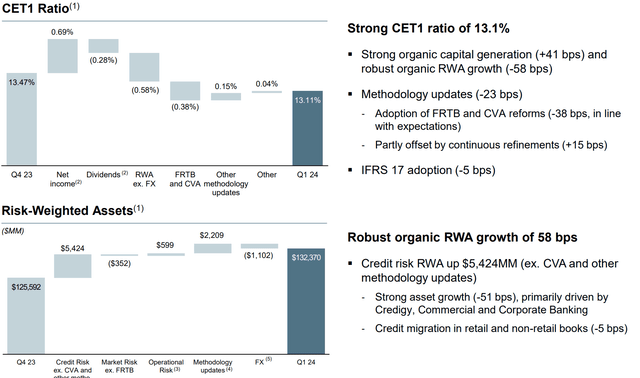

Diving into its latest financial results, the National Bank of Canada reported a strong performance for the first quarter of 2024 with robust growth and operational efficiency across its various business segments. The bank reported an EPS of $2.6 and a ROE of over 17% reflecting strong profitability and efficient capital utilization. The bank also demonstrated a strong capital position with a CET1 ratio of over 13%. Segment-wise, all segments reported low single-digit revenue growth to low double-digit revenue growth.

Earnings Presentation

The strong results again came with discipline in its growth. Expenses only grew 4.2% YoY (Growth in salaries and benefits, up 3.2% YoY, Canadian FTE count down 2.0% YoY). Liquidity ratios also reflect well above regulatory minimum requirements, with an LCR ratio of 145% and NSFR of 117%. All in all, the bank exhibited a strong capital position while also generating robust growth in Risk-Weighted Assets

Earnings Presentation

National Bank of Canada 2024 preview for upcoming quarters

Given that the bank is scheduled to release its second quarter 2024 results on May 29, 2024, it would be helpful to see what is in store. Even with the weak macroeconomic outlook, which is not conducive for the banks, the resilience exhibited by the National bank may continue. In that regard, we may expect revenue and EPS growth in the low single-digits in the worst-case scenario (Unlike other big banks, the bank has low exposure to mortgages in the highest-priced real estate areas, which can explain the resilience. More on this to follow in the risks section)

Currently, 6 analysts have forecasted a 6.7% revenue growth and 11 analysts have predicted a 1.2% EPS growth (consensus) for the upcoming quarter. For fiscal 2024, however, consensus EPS is at $9.84 (YoY growth at 7% approximately) and consensus revenue at $11.22B (YoY growth at 5.3% approximately). Also, revenues have seen 4 up revisions and EPS has seen 10 up revisions for the fiscal year-end. All are good signs, and I will be eagerly awaiting the results.

National Bank of Canada stock is fairly valued

| Bank | PE | PB | Dividend Yield |

| NA | 12.1x | 1.7x | 3.7% |

| TD | 12.1x | 2.7x | 5.1% |

| RY | 13.2x | 1.8x | 3.8% |

| CM | 10.1x | 1.2x | 5.4% |

| BNS | 10.6x | 1x | 6.5% |

| BMO | 17.6x | 1.2x | 4.6% |

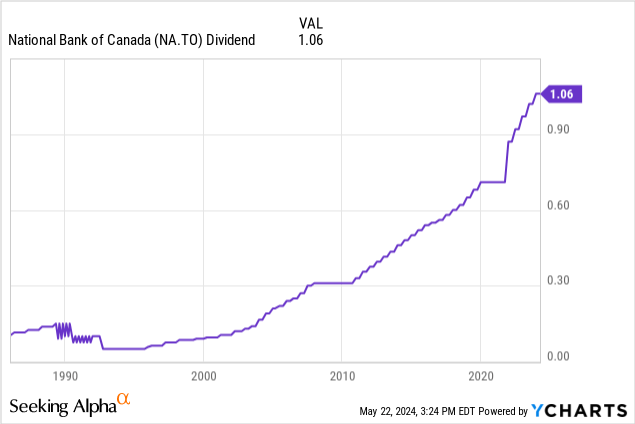

At the outset, it does look like the stock has the lowest yield among its Canadian counterparts, and the reason is obvious. As we saw, the stock has been rising much more than its competitors, which is why it looks relatively unattractive. But the dividends have been constant or rising for over a decade, which is good news. Its Price-to-earnings and Price-to-book multiples look fair in my opinion, and this may start to inflate if we see continued outperformance. I believe this because the market is generally much more willing to pay a premium for quality growth.

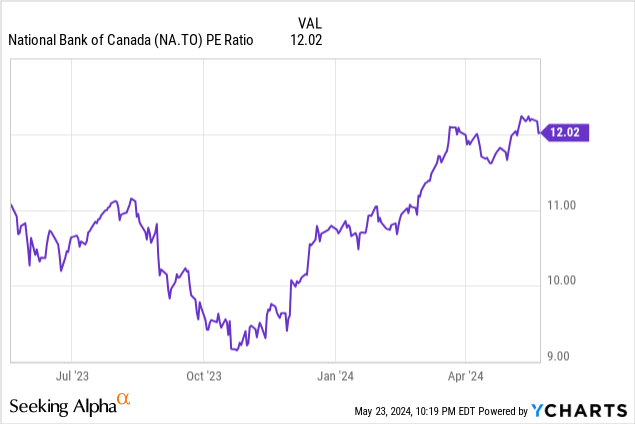

Currently, the bank’s Price-to-Earnings (P/E) ratio, at 12x, reflects a growth of about 9% over the past year. Historically, the P/E ratio has shown fluctuations, with a notable value of 9.2x during 2023. The Price-to-Book (P/B) ratio is currently at 1.74x, indicating a growth of 4.9% for the same period.

Forward valuation also looks quite attractive if we consider the consensus EPS growth. At 7% EPS growth, forward PE is at 11.6x. The contrast is quite evident when you consider that all of its Canadian competitor banks are seeing negative EPS growth for fiscal ’24. So you should not be surprised if you end up seeing lower forward estimates for only National Bank as the quarters go by!

Risks and how the bank has handled it

We started off the thesis with how risky the industry itself can get overall. The good news is that the National Bank is mostly exposed to the Canadian market and the country is known for its banking regulations and safety profile of its banks. Even during the height of the financial crisis, the Canadian banking industry came out unscathed (On a side note, the heavy regulations make sense as the country’s financial market is dominated by 6 banks and the failure of anyone could have a disastrous impact on the economy)

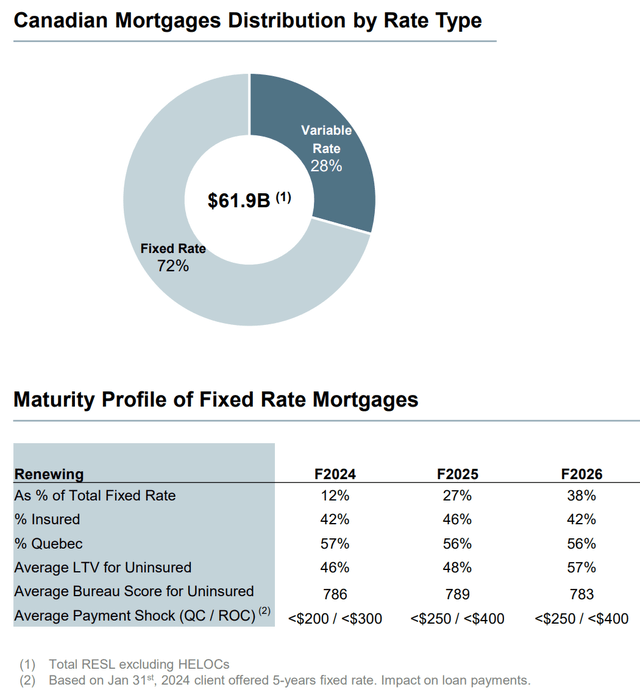

But the problem faced by the Canadian banks is a little more nuanced this time. Most banks have a big exposure to the mortgage sector and unlike the U.S., mortgages in Canada are dominated by 5-year fixed-rate mortgages. This coupled with the over-extended housing/real estate market means mortgage holders could potentially face payment shock due to higher interest rates. As per Canada’s banking regulator, real estate-secured lending and mortgages are among the top risks the country’s financial system is facing. The good news is that the bank is looking quite skillful heading into this storm and may very well perform better than other banks in the country.

1. Uninsured mortgages and HELOCs in the Greater Toronto Area (GTA) and Greater Vancouver Area (two key areas with the highest property prices in Canada) make up 12% and 2% of the bank’s total Real Estate Secured Lending (RESL) portfolio, respectively. The average loan-to-value (LTV) ratio for these loans is 52% (the percentage of a property’s value that is financed through these loans) a low and safe ratio.

2. For condos, it is 9% of the total RESL portfolio with an average LTV of 58%

3. High-risk uninsured borrowers represent less than 0.5% of the total portfolio

Overall out of the $62B RESL portfolio (excluding HELOCs), the majority of its Canadian Mortgage portfolio has been repriced, absorbing the impact of rate increases (28% of the mortgage portfolio is a variable rate, and 34% of fixed-rate has renewed or originated over the last 15 months).

What all of this tells me is that the bank has been conservative and disciplined and has low exposure to high-risk sectors/areas of the economy.

Earnings Presentation

National Bank of Canada stock is a Strong Buy

I already own shares of the National Bank of Canada stock in my portfolio and hope to hold it for the long term. Out of the other Canadian banks in my portfolio, this one has indeed outperformed all of them. Short-term or long-term, this bank is in a better position both in terms of growth and risk profile, and I believe it will continue to outperform going forward as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here