A lingering earnings recession

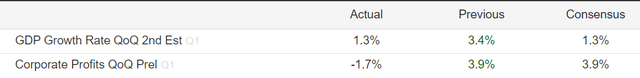

The US Bureau of Economic Analysis released the second estimate of the Q1 2024 GDP. The highlight is that GDP growth has been downgraded from 1.6% to 1.3%, as expected by the analyst consensus.

However, the big surprise is that the preliminary estimate for the corporate profits for Q1 is -1.7%, which is well below the consensus expectations of 3.9%, as the table below shows.

Trading Economics

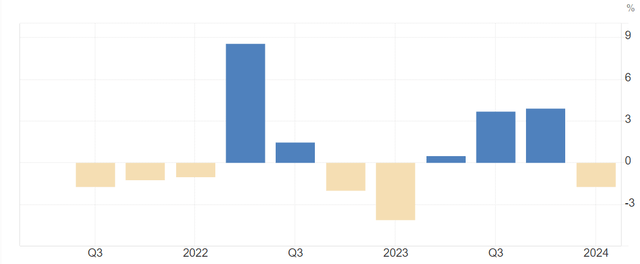

In fact, this could be the beginning of another earnings recession, which requires two consecutive quarters of negative growth. There was an earnings recession in late 2021 and early 2022, and then another earnings recession in late 2022 and early 2023.

As the graph below shows, after three consecutive quarters of positive corporate profits growth, the most recent quarter had another negative growth in corporate profits. Thus, if the next quarter (Q2 2024) also shows a profit contraction, we are back in an earnings recession.

More broadly, the graph below also shows that out of the last 11 quarters, we had only 5 quarters with positive corporate profits growth, while there were 6 quarters with negative profits growth. Obviously, there is a lingering earnings recession that has been interrupted by a few positive quarters.

Trading Economics

What’s the BEA profit measure?

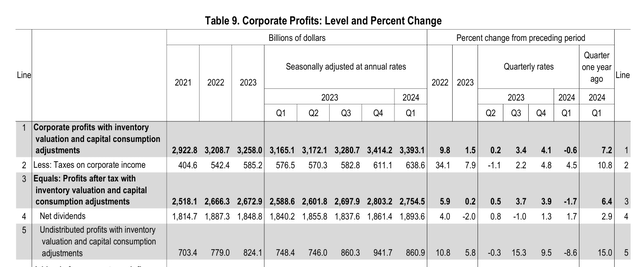

First, how is BEA measuring the corporate profit, as part of the GDI report? The BEA measures corporate profits as: Corporate profits with inventory valuation and capital consumption adjustments.

BEA defines Capital consumption adjustment (CCAdj) as: “The adjustment used to convert measures of depreciation that are based on historical-cost accounting—such as the capital consumption allowances reported on tax returns—to NIPA measures of private consumption of fixed capital that are based on current cost with consistent service lives and with empirically based depreciation schedules.” So, essentially, this is a depreciation. Depreciation is a non-cash cost on an income statement.

BEA defines inventory valuation adjustment (IVA) as: “An adjustment made in the national income and product accounts (NIPAs) to corporate profits and to proprietors’ income to remove inventory ‘profits’, which are more like a capital-gain than profits from current production.”

Note, corporate profits after tax ex CCAdj and IVA grew at 3.2% in Q1 2024. However, the BEA profit measure aims to determine the real profit growth with the accounting adjustment, and this measure was negative -0.8%.

After considering the 4.5% increase in corporate tax, the after-tax corporate profit decreased by 1.7%. However, corporate dividends increased by 1.7%, despite a decrease in after tax earnings, which caused the undistributed profits to plummet by 8.8% in Q1.

US BEA

Financial vs. non-financial

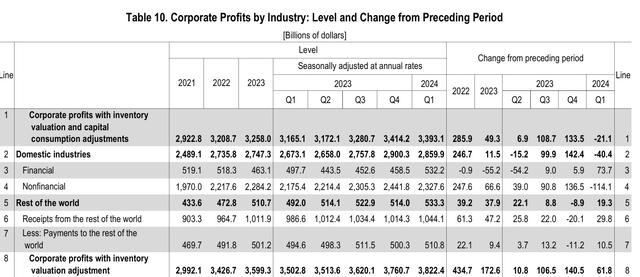

The BEA measure of corporate growth also separates the profits from financial firms, which actually includes the Fed, and non-financial firms.

Overall, the adjusted corporate profits decreased by $21B, with Domestic industries losing $40B, and the rest of the world gaining $19B.

From domestic industries, the financial sector actually gained $73B, which includes $5B lost by the Fed, while the non-financial sector lost $114B.

Thus, the non-financial sector seems to be in an earnings recession.

US BEA

The analysts’ EPS growth prediction

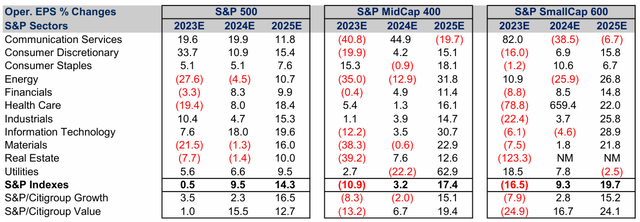

The BEA measure of corporate profits is broad, across all firm sizes and industries. Based on the market-based analysts bottom-up EPS measure, we already know that 2023 was a tough year for corporate earnings, in support of the BEA profit measure.

- The S&P500 earnings increased only by 0.5% in 2023, led by 34% earnings growth on Consumer discretionary sector (XLY), mostly from Amazon (AMZN), and 20% growth in Communication Services sector (XLC), mostly from Alphabet (GOOG) (GOOGL) and Meta (META).

- The Mid-caps companies had -10% earnings growth in 2023.

- The Small-cap companies had -17% earnings growth in 2023.

Thus, with the exception of a few Mega-cap firms, overall corporate profits were negative in 2023.

CFRA

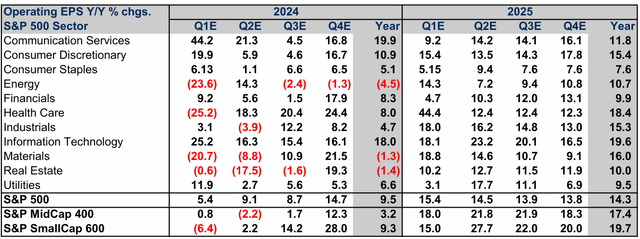

However, analysts predict that earnings growth is going to pick up sharply in 2024.

- The current prediction is that corporate profits will increase by 9.5% for the S&P500 companies in 2024 (and by 14.3% in 2025).

- The current prediction is also that corporate profits will increase by 3.2% for the Mid-cap S&P500 companies in 2024 (and by 17.4% in 2025).

- Additionally, the current prediction is that corporate profits will increase by 9.3% for the Small-cap S&P500 companies in 2024 (and by 19.7% in 2025).

Furthermore, the analyst bottom-up measure of EPS for the S&P500 companies shows an estimated 5.4% growth in Q1 2024. This measure would be consistent with the expected GDI measure of corporate profit at 3.9%. However, the preliminary BEA estimate came at -1.7%. Thus, there is a disconnect between the analysts’ EPS measure and the BEA corporate profit measure for Q1 2024.

The analyst-based EPS measure for Q1 seems to be skewed by the megacap companies in the Tech sector (XLK), most notably Nvidia (NVDA), as well as the other Mega-caps. Based on the preliminary GDI data, the rest of the companies, on average, are in an earnings recession.

CFRA

Implications

Corporate earnings generally decrease in economic recessions, usually by 10-15%. Yes, there could be earnings recessions outside the economic recessions due to the negative earnings effect from one or a few sectors – without the systematic implications.

However, a broad-based negative growth in corporate earnings is a reflection of an economic recession. Thus, the decline in corporate profits in Q1 could be a sign of a forthcoming recession.

The S&P500 (SP500) is currently not priced for a recession. The earnings estimates for 2024 are too high, while the official GDP/GDI data shows that corporate profits are actually declining.

There is no reason to expect that Q2 earnings would be any better than Q1 earnings – given that the interest rates remain restrictive, the yield curve remains inverted, the consumer excess savings are exhausted. Thus, the S&P500 earnings estimates are likely to be downgraded. In addition, the current PE multiple of 22 is likely to sharply contract as the recession unfolds. Thus, the S&P500 is facing a significant drop as the recessionary bear market unfolds.

Read the full article here