Thesis

Based on Aldeyra Therapeutics, Inc. (NASDAQ:ALDX)’s imminent catalysts (Reproxalap), considering the company holds $133 million in cash, cash equivalents and marketable securities, as per March 31st, with a market cap around $230 million, I believe ALDX is still trading at a discount. Hence, in my opinion, Aldeyra offers a high-risk/high-reward investment opportunity, which supports a “Strong Buy” rating for investors with high risk tolerance.

In this article, I will be explaining the most recent updates on the Reproxalap program, Aldeyra’s pipeline beyond Reproxalap, the company’s financials, valuation, and risks to be considered.

Background

Aldeyra is a biotechnology company in clinical-stage, focused on the development of immune-mediated and metabolic diseases with unmet clinical needs. The company’s main therapeutic strategy is to develop reactive aldehyde species (RASP) modulators, aimed to reduce pathological inflammation associated with ocular diseases and systemic diseases.

In this sense, Aldeyra’s lead product candidate is Reproxalap, for the treatment of chronic and acute symptoms associated with dry eye disease and allergic conjunctivitis. Reproxalap has been successfully tested in several preclinical and clinical trials, providing satisfactory results in terms of efficacy and safety. Indeed, the drug’s promise was recognized by AbbVie Inc. (ABBV), who is partnering with Aldeyra in this program.

Last October, ADLX’s share price plunged from $5.4 to around $1.4 when the company announced Reproxalap’s new drug application (NDA) was on the verge of being rejected by the U.S. Food and Drug Administration (FDA). Since then, Aldeyra’s share price has seen a moderate recovery, standing now at $3.86.

In my opinion, the share price recovery is in line with Aldeyra’s and AbbVie’s quick response on the matter, organizing not 1 but 3 parallel Phase 3 trials that aim to demonstrate, beyond doubts, the efficacy of Reproxalap on the treatment of acute and chronic symptoms associated with dry eye disease.

Last week, Aldeyra’s President and CEO Todd Brady was at the Jefferies Global Healthcare Conference, where he confirmed the company’s expectations to resubmit Reproxalap’s NDA by Q4 2024, which it would translate into a PDUFA date by Q2 2025. In addition, Aldeyra has been providing updates about its pipeline beyond Reproxalap, which shows the company’s promise on different programs including alcoholic hepatitis, weight loss, atopic dermatitis and retinitis pigmentosa.

Reproxalap Program

Dry Eye Disease

In 2021, the global prevalence of dry eye disease was estimated at 29.5%. The disease has been associated with several risk factors including age, gender, ethnicity, environmental conditions, laser eye surgeries, and the use of contact lenses. In terms of ethnicity, Asians seem to be more affected than North Americans, while females seem to be slightly more prone than men.

In this sense, the dry eye disease market size was estimated to be around $5.2 billion in 2023, with a projected CAGR of 4.2% for the next 6 years. In this sense, AbbVie’s owned Restasis (a cyclosporine-based eye drop for dry eye) at peak sales used to generate approximately $1 billion annually, while given the appearance of biosimilars and decline on prescriptions AbbVie has reported approximately 50% drop year-on-year in annual sales in 2022 and 2023. Likewise, last year, Novartis AG (NVS) sold Xiidra’s license to Bausch + Lomb Corp (BLCO) for $2.5 billion. In this sense, the latest company reported $79 million in sales in Q1 2024.

Considering that Restasis and Xiidra have a slow mechanism of action that can take weeks to months to show results, and the existence of biosimilars with a lower price tag, I am not surprised about the sales drop described in the previous paragraph. On the other hand, keeping in mind the discussion above, I believe a new product with a faster mechanism of action, such as Reproxalap, and AbbVie’s market penetration capacity have the potential to generate large revenues similar to those shown by Restasis at peak sales.

Reproxalap’s NDA resubmission plan

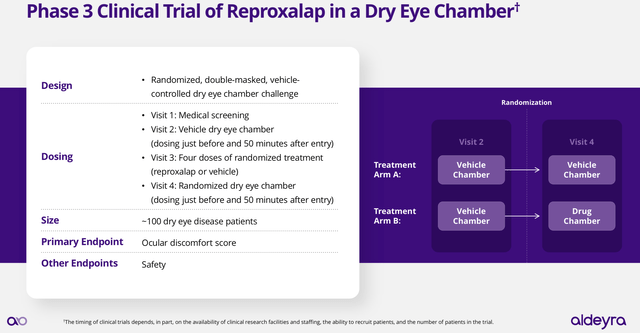

In March 2024, Aldeyra made public its plans to run 3 parallel Phase 3 clinical trials, aimed to respond to the FDA concerns about Reproxalap’s efficacy on the treatment of dry eye disease ocular symptoms. Two of them are dry eye chamber trials, also known as controlled adverse environment trials, and the third one is a six-week field trial in which the participants report on their symptoms over time while exposed to their regular day-to-day activities. The chamber trials consist of introducing the participants into a chamber that allows for a highly standardized environment of low relative humidity and high rate of airflow, while performing constant visual tasking.

Both studies are identical in terms of the experimental design (see image below), with location being the differentiation factor. The first study is located in the U.S. and the second in Canada. According to declarations made by Aldeyra’s CEO at the Jefferies conference, the redundancy of trials is aimed to de-risk the probability of finding negative results. In addition, I would presume the idea behind this is to upset potential environmental risk factors that might be affecting the participants’ responses.

Reproxalap Phase 3 dry eye chamber symptoms trial experimental design (Aldeyra’s presentation: Clinical Developmental Plan Update for Reproxalap NDA Resubmission March 2024)

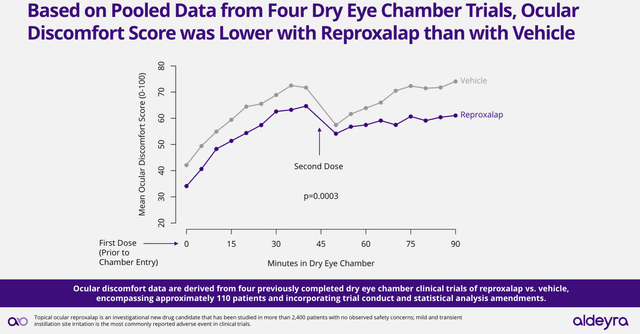

Interestingly, if successful, the chamber trials would allow Reproxalap to have a label including the treatment of acute symptoms of dry eye disease, with an efficacy measured in minutes instead of weeks. With this in mind, it is even more interesting that Reproxalap, in a previous test, has already shown significant improvements on the ocular discomfort score when compared against placebo/vehicle in the dry eye chamber (see image below). Thus, justifying Aldeyra’s optimism, Reproxalap’s capacity to deliver significant results in the new chamber trials.

Reproxalap’s efficacy vs placebo in previous dry eye chamber trials (Aldeyra’s presentation: Clinical Development Plan Update for Reproxalap NDA Resubmission March 2024)

Last month, Aldeyra reported the enrollment of the first participants in the trials, and it is expecting to have conclusive results from the first study by Q3, 2024. If Reproxalap proves its efficacy, Aldeyra expects to resubmit the NDA no later than Q4 2024, which will allow for a potential PDUFA date by Q2 2025.

In this sense, if AbbVie decides to exercise its option to co-commercialism Reproxalap, Aldeyra will own 40% of the profits and losses driven by the commercialization of Reproxalap in the U.S., while ABBV will own the other 60%. Ex-U.S. Aldeyra will be eligible to receive tiered royalties on net sales. In addition, as stated in ALDX’s Q1 2024 report, the two companies have agreed the following terms and conditions:

AbbVie would pay us a $100 million upfront cash payment, less the Option Payment and the Option Extension Fee. In addition, we would be eligible to receive up to approximately $300 million in regulatory and commercial milestone payments, inclusive of a $100 million milestone payment payable if the FDA Decision is received prior to or after the execution of the Collaboration Agreement.

Moreover, once Reproxalap has obtained the approval in dry eye disease, the company is planning to submit a label expansion request in order to include applications in allergic conjunctivitis, for which Aldeyra already has completed clinical trials demonstrating the positive effects of Reproxalap. Thus, potentially increasing further the revenue potential of the product candidate.

In summary, I believe Reproxalap has high probabilities of showing success in the current Phase 3 trials and therefore a very high possibility of becoming Aldeyra’s first FDA approved product by Q2 2025. Furthermore, the potential milestone payments are likely to have a positive impact on Aldeyra’s balance sheet and a very positive share price reaction.

Pipeline beyond Reproxalap

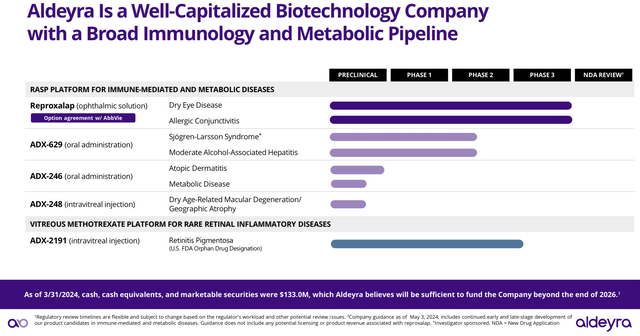

Despite Aldeyra’s small market cap, I believe it has a promising pipeline (see image below) that may allow them to provide solutions to clinical conditions with large revenue potential. In this sense, in the following sections, I will be focusing on ADX-629 and ADX-2191, which have been highlighted by Aldeyra’s CEO as lead product candidates beyond Reproxalap.

Aldeyra’s Pipeline (Aldeyra’s Corporate presentation June 2024)

ADX-629

ADX-629 is a small molecule able to modulate RASP production, which the company is developing as an oral formulation intended for the treatment of alcoholic hepatitis and Sjögren-Larsson Syndrome (SLS). SLS is considered a rare condition which is characterized by scaling skin (ichthyosis), as well as developmental delay and speech disabilities. Its cause is associated with a mutation on the gene that encodes for the fatty aldehyde dehydrogenase (ALDH3A2), which plays a major role in the detoxification of aldehydes generated by alcohol metabolism and lipid peroxidation.

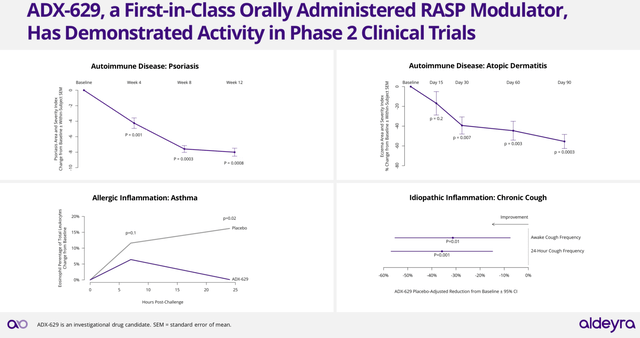

Interestingly, ADX-629 has been already tested in Phase 2 clinical trials and provided positive results in the treatment of psoriasis, atopic dermatitis, allergic inflammation, among others (see image below).

ADX-629 Clinical Trial results in diverse indications (Aldeyra’s Corporate Presentation June 2024)

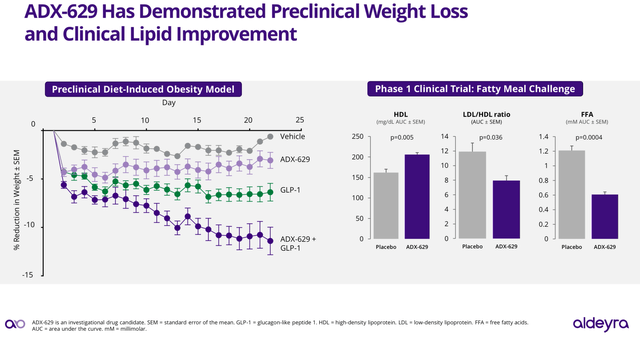

However, I think one of the most interesting features of ADX-629 is related to preclinical and Phase 1 clinical trial results released by the company in its June 2024 corporate presentation (see image below). In particular, ADX-629, when combined with GLP-1, demonstrated a synergistic effect promoting a dramatic weight reduction, while in the clinical trials ADX-629 induced significant decrease in high-density lipoprotein (HDL), HDL/LDL (high-density lipoprotein/low-density lipoprotein) ratio and free fatty acids (FFA).

ADX-629 preclinical and phase 1 results associated with weight loss (Aldeyra’s Corporate Presentation June 2024)

Based on the potential application of ADX-629 in weight loss, the revenue potential of ADX-629 could be far beyond the estimated SLS market size of $234 million. In this sense, a recent report published by Goldman Sachs estimated the GLP-1 market to reach up to $100 billion by 2030. Therefore, if ADX-629’s preclinical results are also demonstrated in clinical trials, Aldeyra might have on hand a potential blockbuster drug.

However, given the fierce competition in the weight loss market, the company seems to be more focused, at the moment, on targeting the low-hanging fruits such as atopic dermatitis and SLS.

ADX-2191

It is another RASP modulator that Aldeyra acquired via the acquisition of Helios Vision Inc. ADX-2191’s active molecule is methotrexate (a generic drug) formulated as an intraocular injection, which originally was aimed for the treatment of vitreoretinal lymphoma. However, after receiving a CRL from the FDA regarding this application, the company decided to deprioritize the program and focus on the indication associated with retinitis pigmentosa, for which the drug delivered encouraging results in a Phase 2 trial.

Currently, Aldeyra is preparing to start a Phase 2/3 clinical trial for retinitis pigmentosa in H2 2024. The trial will be testing the efficacy of monthly injections of ADX-2191 (doses 10 μg vs 400 μg) on improving peripheral vision and vision in the darkness during 12 months.

Taking in consideration the clinical trial design, which is lacking placebo control, it is likely that the company will be required to conduct another clinical trial prior to obtaining FDA approval for this application. Therefore, despite the revenue potential of ADX-2191 in retinitis pigmentosa and its promising clinical trial results, in my opinion, the company is far from commercializing this product candidate.

Q1 2024 Financials

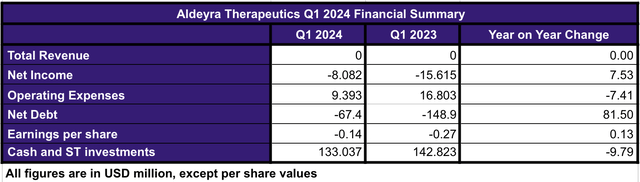

Based on the Q1 2024 (see image below), the company is currently relatively healthy in terms of its balance sheet considering that Reproxalap has a large potential to reach milestone payments, should ABBV exercise its options, and become a commercial product by 2025.

Q1 2024 Financial Summary (Data collected by the author from Q1 2024 report)

In summary, given that the company doesn’t have any commercial product, they are lacking product driven revenues. Nonetheless, Aldeyra has reduced its operating expenses by 44% when comparing Q1 2024 vs Q1 2023. The reduction is attributable to the completion of the clinical trials associated with Reproxalap, as well as de-prioritization of the ADX-629 programs in allergic inflammation and chronic cough, the completion and de-prioritization of the ADX-2191 indication on vitreoretinal lymphoma, among others. Thus, ALDX has been optimizing its resources in order to secure the progress of its most promising product candidates to date.

Likewise, the optimization of resources has also resulted in the reduction of the net loss by approximately 48% when comparing Q1 2024 vs Q1 2023. In line with those efforts, the company has also reported a net debt decrease and an EPS increase in the same period of time.

In this sense, the current cash, cash equivalents and marketable securities amount the company has available is $133 million, which is 9% below the reported amount in the Q1 2023.

Keeping in mind the current operating expenses, the quarterly cash burn rate of Aldeyra can be estimated as $10 million, which considering the company holds approximately $133 million in cash and equivalents, equates to a cash runway of 3 years from now. Therefore, ALDX has enough cash to cover its operations far beyond the potential Reproxalap PDUFA date in Q2, 2025.

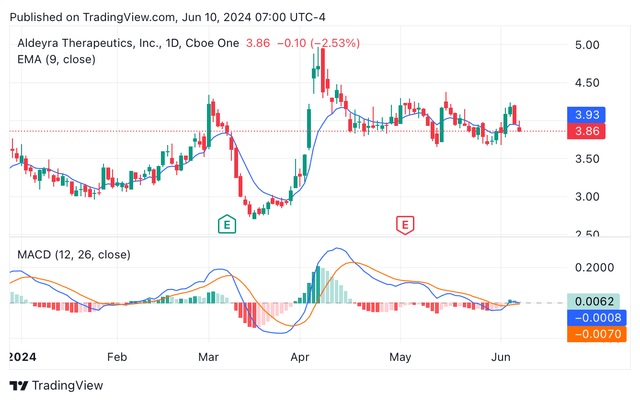

Valuation

ALDX shares are currently trading at $3.86, accounting for a market cap of $230 million. Despite the justified crash after Reproxalap’s NDA rejection, the company shares have seen a rebound, showing a year to date increase of 9.97%. In terms of technical indicators, the exponential moving average and the moving average convergence/divergence are still signalling for a “sell” rating. However, the imminent release of Reproxalap’s ongoing dry eye chamber trial has started to generate more interest from bullish investors since April, as it can be seen in the candle chart below (see image below).

ALDX’s year-to-date candle share price chart showing EMA and MACD indicators (TradingView.com)

Although Reproxalap’s approval is still speculative, if the dry eye chamber results are as significant as Aldeyra is hoping, I would expect the FDA will grant the approval, within six-months from NDA resubmission.

In this sense, I think, Reproxalap would have the potential to generate revenues matching with the $1 billion annual sales of Restasis at peak sales, from which Aldeyra would receive 40%, should ABBV exercise its co-commercialization option. Moreover, the approval and commercialization of Reproxalap should also trigger a series of milestone payments totaling $394 million (in addition to the $6 million that had been already paid). Therefore, if the imminent results of Reproxalap are positive, I would expect a strong reaction in terms of share price that might bring the shares up to its 52-week high ($11.97) or at least to match Wall Street’s average share price target of $9.25.

Risks

Despite Reproxalap’s likelihood of providing good results in Q3, at this moment in time there is no certainty that the results will indeed translate into FDA approval, and more importantly, that this will guarantee that ALDX will be able to receive large product-sale revenues. As a result, I will still consider ALDX as a high risk/high reward stock. As commented before, Reproxalap has a large revenue potential, especially if it achieves a product label on acute treatment of the symptoms of dry eye disease, given that to date, there is no FDA-approved treatment with such a label. In this sense, Aldeyra’s management stated in the Q1 2024 report the following:

We do not expect reproxalap or any of our other product candidates to be commercially available, if at all, before at least the first half of 2025

Additionally, AbbVie might decide to not exercise its co-commercialization option. In this case, Aldeyra’s revenue expectations would be profoundly affected, not only because they will not receive the milestone payments but also because Aldeyra might not be able to secure a strong launch of Reproxalap on its own. Hence, I believe, that if Reproxalap delivers positive results, this scenario is very unlikely given that ABBV extended its option to co-commercialize Reproxalap even after the CRL response was received. But, a second rejection might be enough for AbbVie to turn away from this drug.

Finally, the pipeline beyond Reproxalap is promising, especially ADX-629 with potential applications in weight loss. However, none of the other product candidates are close to becoming commercial products in the near-term. Thus, at this point, all the hopes are on Reproxalap.

Conclusions

Aldeyra Therapeutics Inc. had a rough H2 2023, after receiving CRLs related to Reproxalap and ADX-2191, which forced it to restructure its research programs and optimize its resources. The negative responses were also translated into a justified sell-off of the ALDX stock, with the share price crashing to its 52-weeks low.

Although the situation was terrible at the time, I think the company has responded in a very positive manner, to the point that now it looks like there might be an opportunity for investors with a high risk tolerance. In a way, I believe that by buying Aldeyra’s shares, you would be betting on the likelihood of success of Reproxalap and obtaining the rest of the pipeline for “free”.

On the other hand, investors with a lower risk tolerance might decide to wait at least until the Phase 3 results for Reproxalap are officially out or even until the FDA has issued a response to the NDA resubmission. However, those investors will need to reassess the valuation of the company, as the share price is likely to have a strong recovery once Reproxalap starts delivering positive progress.

In summary, after a careful evaluation of the current state of Aldeyra’s pipeline and financials, I consider ALDX worthy of a “strong buy” rating, based on the large upside potential. However, should investors decide to start or increase positions in Aldeyra Therapeutic, they should also be aware of the speculative nature of such an investment.

Read the full article here