The property and casualty insurance sector consists of firms that are steady, defensively oriented, and incredibly profitable. I don’t ever recall a time when premiums were lowered by these companies, and the reality is that many of them have mini-local monopolies in terms of little to no competition. So why not consider investing in this part of the marketplace?

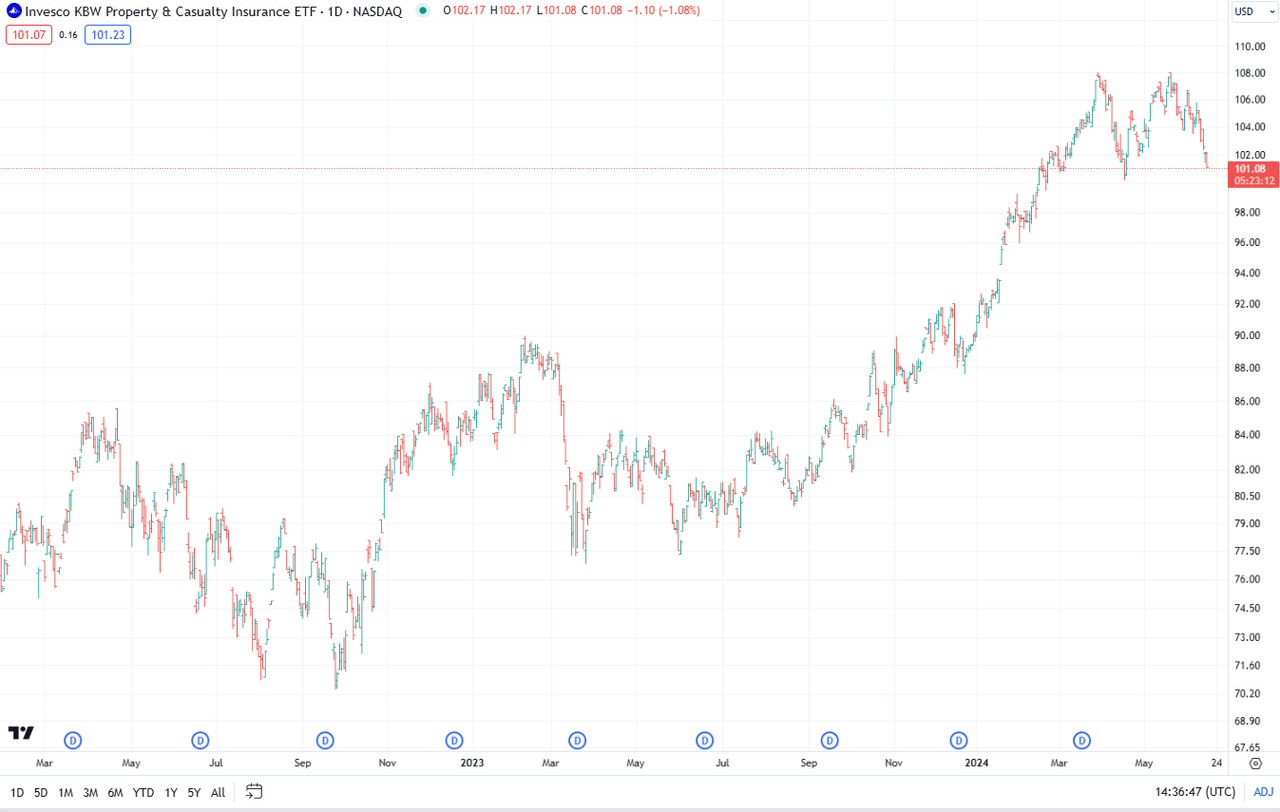

There’s an ETF for just that – the Invesco KBW Property & Casualty Insurance ETF (NASDAQ:KBWP). This fund started trading at the end of 2010, tracks the KBW Nasdaq Property & Casualty Index, and aims to provide broad diversification among the companies engaged in US property and casualty insurance businesses.

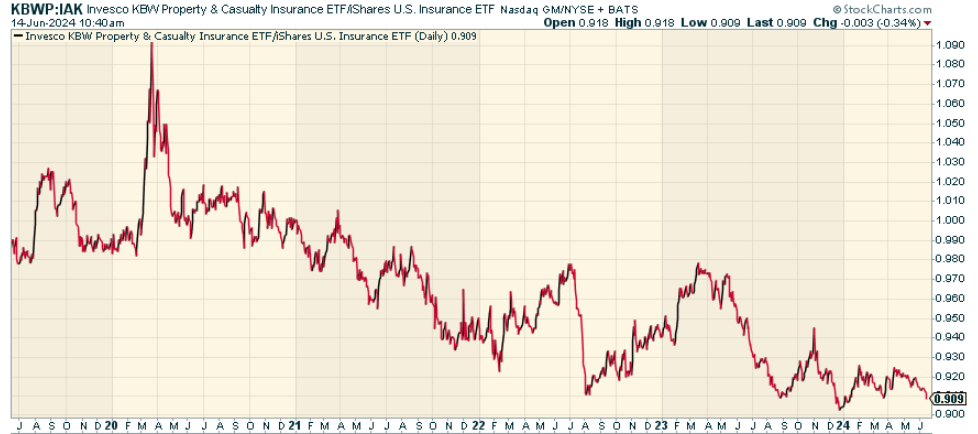

I like the sector overall, though I will say upfront I worry about the near-term trend in what looks like a double top on the chart. Still – this is one to unpack for the long-term investor.

TradingView.com

As mentioned, the core of KBWP is the KBW Nasdaq Property & Casualty Index. It’s a modified market-cap-weighted index, meaning its weights are adjusted to reduce the impact of huge companies and limit the influence of a few particularly large securities on the index. The index is then rebalanced and reconstituted every three months to capture changes in the ebb and flow of the property and casualty sector. This prevents concentration risk by shifting capital out of strongly rising companies that could have outsized impacts on the total portfolio.

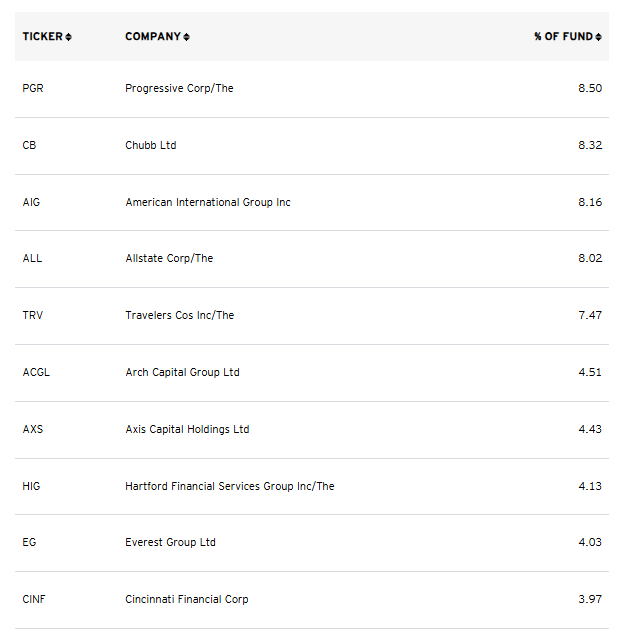

A Look At The Holdings

The portfolio currently consists of 25 equity holdings, which are essentially the blue-chip companies that dominate the property and casualty insurance business. There is concentration risk here, as Progressive, Chubb, AIG, and Allstate constitute a third of the fund.

invesco.com

What do these companies do? Progressive offers competitive auto insurance products. The Allstate Corporation (ALL) is a household name in the property and casualty insurance business, focused on the retail market. American International Group, Inc. (AIG) is a global property and casualty insurance company offering products and services to customers in more than 130 countries across six regions. Put simply, these companies are precisely how you play the sector, and explains why they make up such prominent weightings.

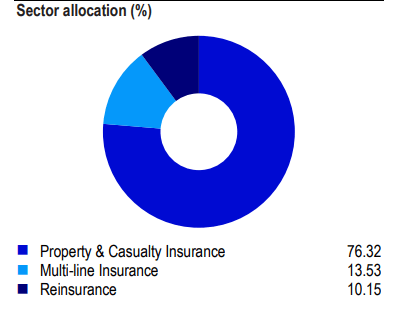

Sector Composition and Weightings

Property and casualty insurance makes up 76.32% of KBWP’s entire portfolio, with multi-line and reinsurance a distance 2nd and 3rd respectively.

invesco.com

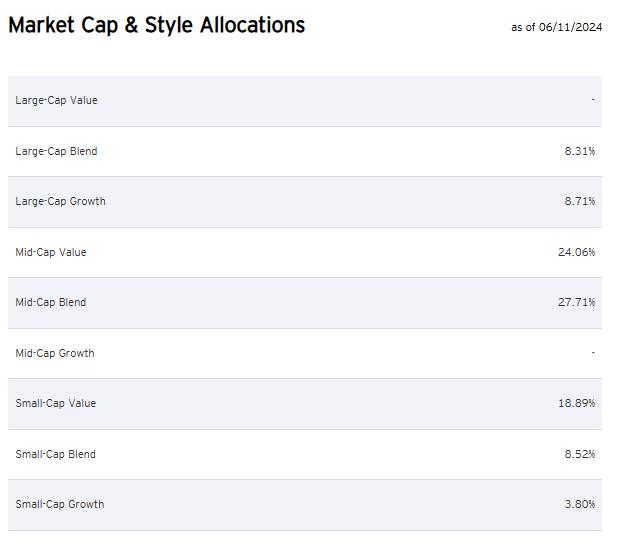

Interestingly, the fund skews mid-cap and small – two parts of the market cap landscape I’m a fan of generally at this point in the cycle relative to mega-caps where all the momentum has been.

invesco.com

Peer Comparison

One fund worth comparing against is the iShares U.S. Insurance ETF (IAK). This fund offers exposure to an array of other insurers, including property and casualty or multi-line companies, as well as life insurers. Its additional diversification may appeal to investors looking for a more broadly based insurance sector bet. From a price ratio perspective, we find that KBWP has lagged, perhaps because property and casualty haven’t been as big of a winner relative to other forms of insurance that IAK has broader exposure to.

StockCharts.com

Pros and Cons

On the positive side, the sector is attractive. KBWP allows investors to gain exposure to the property and casualty insurance industry, which has historically stood up to all kinds of economic conditions. Firms in this industry tend to be defensive, with their revenue streams generally less dependent on overall economic conditions. Such an overlay can provide some insulation to a portfolio, especially during periods of market turbulence. It’s a low-cost fund as well, with a net expense ratio of 0.35%.

The downside? Any ETF focused on a specific sector is likely to be more concentrated – a risk inherent in owning KBWP that might otherwise be lacking in a broader index or broadly diversified fund. If adverse events or shifts in federal regulatory policy directly affect the property and casualty insurance industry, they could affect the fund in a disproportionate way.

Conclusion

For those who want narrow-targeted exposure, the Invesco KBW Property & Casualty Insurance ETF provides strong exposure to the property and casualty insurance sector. The fund provides exposure to a portfolio of industry leaders and a robust, longstanding index methodology which helps keep weightings in check.

I like Invesco KBW Property & Casualty Insurance ETF and think the long-term case is there. I would just wait short-term given what looks like a near-term top overall, not just for the fund, but perhaps as of this writing the broader stock market.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here