A Buy Rating for New Pacific Metals Corp.

We do not change the rating for the shares of the Vancouver, Canada-based explorer and developer of Bolivian silver assets New Pacific Metals Corp. (NYSE:NEWP) (TSX:NUAG:CA) and reiterate the “Buy” recommendation, as encouraged by the results so far achieved from previous analysis.

The previous analysis also suggested not implementing the buy recommendation immediately but waiting for a dip which if exploited then the subsequent uptrend would have provided a better opportunity to generate good returns via NEWP or NUAG:CA shares due to silver price cyclicality, driven by a positive correlation between stock prices and metal prices.

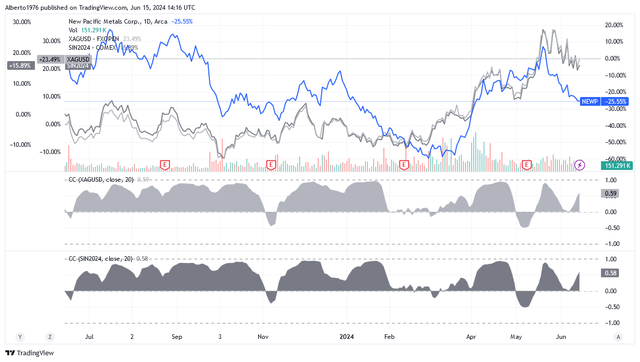

The Positive Correlation Between the Stocks Prices and Silver Prices

This analysis shows, using a graph, that the shares of New Pacific Metals Corp. – hereinafter also referred to as “New Pacific” – have a positive correlation with the price of silver. This means that when the prices of NEWP or NUAG: CA stocks trend up (or down), the silver price is likely to be affected by positive or bullish sentiment (or negative or bearish), i.e. of a market sentiment of the same sign, regardless of the returns, which may even vary significantly between the securities in question.

The correlation between NEWP share prices and XAGUSD physical silver spot prices or SIN2024 silver futures prices over the past year: The correlation is represented by the two area curves at the bottom of the chart below – one light gray (NEWP and XAGUSD) and one dark gray (NEWP and SIN2024). The correlation is generally positive as the colored area is above zero most of the time.

Source: TradingView

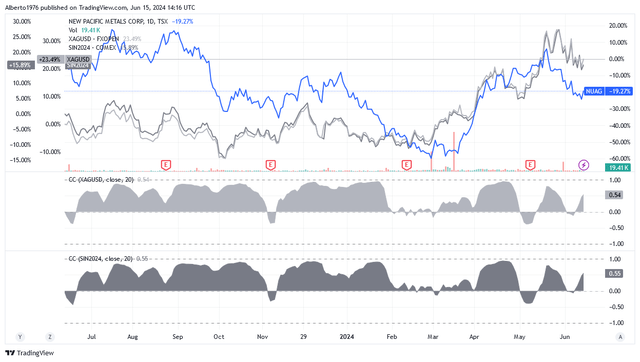

The correlation between NUAG:CA share prices and XAGUSD physical silver spot prices or SIN2024 silver futures prices over the past year: The correlation is represented by the two area curves at the bottom of the chart below – one light gray (NUAG:CA and XAGUSD) and one dark gray (NUAG:CA and SIN2024). The correlation is generally positive as the colored area is above zero most of the time.

Source: TradingView

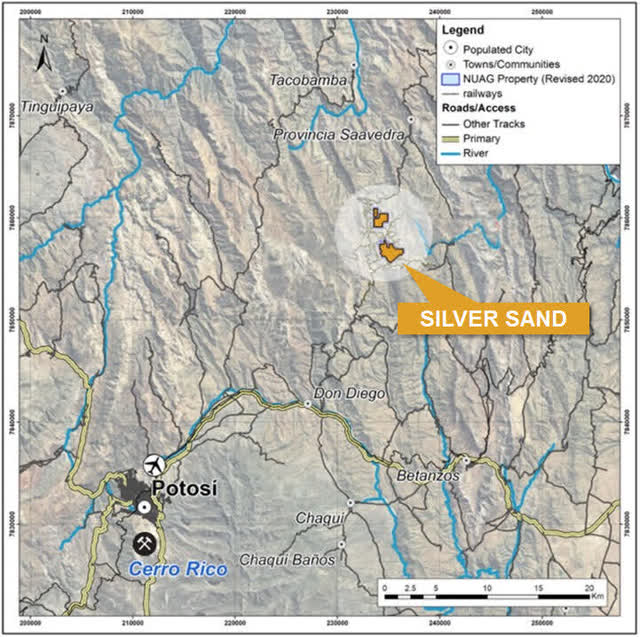

An advanced plan to build a silver production facility in Bolivia is causing New Pacific’s stock exchange to recall the commodity the company plans to mine and sell. And as the plan progresses, investors are increasingly associating the company’s stock with the precious metal. Called “Silver Sand”, the project is the most significant in New Pacific’s portfolio, for which the development team intends to build a significant and economically competitive silver production facility approximately 35 kilometers from the populous city of Potosí, also accessible via an international airport.

This is What Has Happened Since the Last analysis: Why the Strategy Should Be Re-Implemented

The dip in the stock price was seen as highly likely in the wake of the US Federal Reserve’s eleventh rate hike in July 2023, as New Pacific shares’ primary driver of silver prices had an inverse relationship to fixed interest rates. The Fed’s further US interest rate hike “powered to new multi-year highs” during the day on October 2, 2024: The yield on 10-year US Treasury bonds exceeded 4.7 percent for the first time since October 2007 and the yield on 30-year US Treasury bonds rose to almost 4.8 percent, its highest level since April 2010. Thus, at the end of the trading day on October 2, 2024, the yield on 10-year U.S. Treasury bonds was 4.682%, while the yield on 30-year U.S. Treasury bonds was 4.794%. Ever-rising US interest rates had put so much pressure on gold and silver that both commodities fell to their “lowest levels in nearly seven months,” as Carl Surran, SA news editor of Seeking Alpha, reported. He added that the gold futures price on the Comex closed at $1,830 per ounce, “the lowest settlement value since March 9” and a decline of almost 11 percent from its 52-week high of $2,048 reached just five months earlier. The silver futures price on the Comex closed at $21.218 per ounce, “also a seven-month low”. Due to the positive correlation with the bearish sentiment on silver, investors saw the decline in the market prices of NEWP and NUAG:CA shares occurring as predicted in the previous analysis: the stocks posted a dramatic decline of 37.3% to $1.48/share and 34.3% to CA$2.07/share respectively on October 4, 2023.

The Second Dip in the Stocks

The dip of early October 2023 wasn’t the only opportunity for investors to increase their holdings given the bright outlook for NEWP and NUAG:CA. (The outlook is driven by the expected bullish silver price as portfolio hedging strategies and industrial demand keep demand for silver strong.) Following a surge in the prices of NEWP and NUAG:CA stocks in late December 2023, supported by a mid-December 2023 dovish Fed-induced rise in precious metals, the onset of a new wave of pessimism about when the Fed would finally start cutting interest rates dragged New Pacific’s share price down again. Higher-than-expected U.S. inflation numbers dampened hopes of an imminent rate cut by the Fed and pushed precious metal prices to their lowest level since mid-December, resulting in New Pacific stocks dips in late February: from late December 2023, NEWP and NUAG:CA stocks prices went down more than 55% to $0.915/share and CA$1.21/share respectively on Feb. 29, 2024.

Investors Engaged in Profit-Taking

Besides the dips, the previous analysis also suggested that stocks would most likely be triggered by silver picking up as a hedge against the risk of a slowdown in the US economic cycle due to the Fed’s anti-inflation strategy. Investors got a taste of this when the stocks rose very quickly since the last dip. The surge in gold as a result of robust safe-haven demand, especially from Chinese investors fearing their US cash reserves at risk, pushed silver to a new 11-year high around May 20. Silver futures rose to $32,205/oz, the eighth gain in nine market sessions and it was also “the highest settlement since Jan. 23, 2013”.

Perhaps without waiting for the Fed to flag it, as some US Fed central bankers had already indicated many days earlier that US interest rates were likely to remain higher for longer than previously announced, investors were assertive enough to take some profits by leveraging the record highs.

Those Fed governors included Neel Kashkari, President of the Federal Reserve in Minneapolis, who on May 28 expected interest rates to remain high for an “extended” period, and John Williams, President of the Federal Reserve in New York, who on May 30 did not see any rate cuts from the Fed until inflation had convincingly slowed down.

Or in an attempt to anticipate the effects of dampening hopes of an imminent rate cut perhaps investors took their profits on or around June 7, 2023, as nonfarm payrolls up a seasonally adjusted 272,000 jobs in May, actually proved to be detrimental with a five-week low in precious metals.

As a result of the ongoing profit-taking, the stocks now appear to be heading for a new low. Investors should consider this new low ahead of further up-cycles, but also strengthen a position that benefits from the following positive factors from a longer-term perspective:

Factors for Long-Term Upside

a) Expectations of strong demand for silver, which will lay the foundation for sustained higher prices per ounce over the next years:

Michael Widmer, an analyst at Bank of America, shares this positive outlook for silver. Last week on Wednesday, he said that he believes further bullish sentiment will drive the price of silver per ounce higher in the second half of 2024, in 2025, and 2026. The price will average $35/ounce in two years, about 17% above current futures prices, even though the gray metal has already risen 23% in the past three months.

According to a recent survey by the Silver Institute, reported by Metals Focus, the silver market is likely to experience a structural market deficit for the fourth year in a row because of a very strong industrial demand. This will be provided by the electric and electronics sectors, particularly due to the boom in the photovoltaic industry in China, a leading country in the transition to clean energy sources and zero-emission devices.

“The future is bright for silver with respect to its use in green energy transition,” according to Michale DiRienzo, President and CEO of The Silver Institute.

b) the developments of the projects the company is carrying out in Bolivia, with some important news to be announced this year.

New Pacific Metals Corp. Has Its Metallic Interest in Bolivian Projects: the Risk

New Pacific Metals Corp. is financing exploration and development activities to establish silver production in Bolivia, a country that is rich in natural resources but not without risk for companies investing there.

The Sprott ESG Mining Risk Heatmap 2024 has assigned Bolivia an average rating of 3.9, indicating an increased investment risk for mining activities in the country. However, the rating has improved slightly from the 4.0 and 4.1 in the previous two analyses, which bodes well for New Pacific shareholders. From a political point of view, the situation in Bolivia has been particularly turbulent in recent years, marked by the resignation of Evo Morales from the presidency of the Latin American country and the subsequent allegation of a coup attempt against the transitional government (2019-2020) of Jeanine Áñez Chávez Evo Morales. Following, Luis Alberto Arce Catacora has been the new president of Bolivia since November 8, 2020. Last November, precious metal miners organized mass demonstrations and threatened his government with a series of strikes and blocks of streets in La Paz, demanding that he legalize so-called illegal mining areas and the exploitation of other areas. The demonstration was organized by the National Federation of Mining Cooperatives of Bolivia (or “Fecmabol”), which, according to El País, demanded, among other things, “a fixed 4.5% tax rate on annual production of metals, but the government wants 7% rate instead to reap greater benefits from the country’s gold rush.” Plus, there is also an attempt between the mining sector and the Ministry of Mines to reach an agreement on the use of mercury for miners who extract gold in the rivers of the Bolivian Amazon, which is creating great debate.

As regards the geophysical or natural risk, we must point out the particularly productive rainy season of the last few months in the region of Bolivia where New Pacific operates, which caused problems for road transport and led to a reduction in production at the metal processing plants in San Bartolomé. This precious metal project is carried out in the Cerro Rico mine, located just three to four kilometers south of the city of Potosí and about 40 kilometers from New Pacific’s Silver Sand project. Although this is a rather irregular weather phenomenon for the time of year, it must be said that a recurrence cannot be ruled out if the effects of climate change are considered as the triggering factor.

The Metal Mineral Projects: Advancing the Company’s flagship Silver Sands project and other plans

The Silver Sand Project is New Pacific Metals Corp.’s flagship project and is located 35 kilometers from the populous city of Potosí.

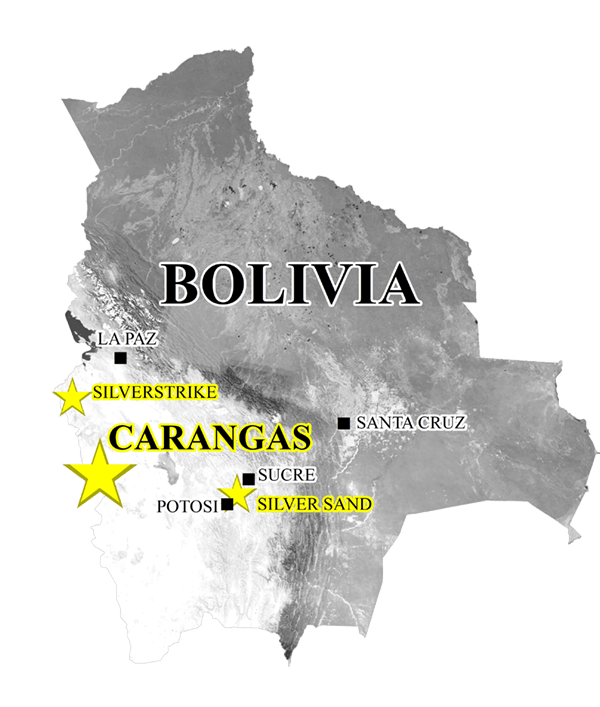

New Pacific operates two other projects in Bolivia: the Carangas Project, located approximately 190 km southwest of Oruro in the South American Epithermal Belt, and the Silverstrike Project, located approximately 140 km southwest of La Paz. However, Silver Sand is the most important metals project as it has received the most funds allocated to date, approximately 79% of the total of $106.8 million for the three assets, while 16% has been spent on Carangas and 5% on Silver Strike.

In the first nine months through the first quarter of 2024 alone, nearly $2 million has been invested in Silver Sand to complete a pre-feasibility study, which is expected to be released in a few weeks along with the initial announcement of the reserve. In addition, the expenditures have also been used to continue all activities necessary for an environmental impact assessment that New Pacific must submit to local regulators, the results of which will guide subsequent technical studies. New Pacific Metals has completed metallurgical testing critical to the upcoming PFS, indicating potential operating cost savings that could further reduce investment risk. Silver recoveries are consistent with the PEA and do not preclude further steps to get closer to 94%, said Andrew Williams, President and CEO of New Pacific.

The project is already significant in terms of the availability of the main infrastructure on site that allows connection to the end markets of the product, reducing the investment risk in this project.

Source: New Pacific Metals Corp. – Company WebSite

New Pacific Metals owns 100% of the Silver Sand Project in Bolivia. The January 2023 Preliminary Economic Assessment (“PEA”) indicates the strong possibility of establishing a low-capital conventional open pit and tank leach operation, which will produce an average of approximately 12.2 million ounces of silver doré per year over a mine life of 14 years.

Near the city of Potosí, the map shows another precious metal production site, Cerro Rico, roughly in the middle of which is the San Bartolomé project operated by Andean Precious Metals Corp. (APM:CA) (OTCQX:ANPMF), a growth-oriented precious metals producer. The San Bartolomé project has been in continuous operation since 2008, producing an average of 5 million ounces of silver equivalent per year, and given its proximity to the Sand Silver project, it provides a reliable benchmark to evaluate some aspects of the flagship project of New Pacific: In particular, the cost and profitability of the project.

For the full fiscal year of 2024 Andean’s San Bartolomé project targets between 4.75 million and 5.25 million ounces of silver equivalent (or “AgEq ozs”) at:

- CGOM per equivalent ounce sold of $3.88/oz [= average selling price per equivalent ounce minus average cash cost of sale per equivalent ounce sold].

- GMR of 19.5% [= (the revenue of equivalent ounces minus the cost of sale as reported in the income statement) divided by revenue from sales of equivalent ounces].

The company’s 2024 forecast for the Andean’s San Bartolomé project is based on a commodity price of approximately $20 per ounce of silver. The cash cost to the Andean employees and shareholders of operating the San Bartolomé project will then be approximately $16 per ounce.

The PEA for Silver Sand assumes that mining operations will result in significantly lower operating cash costs of $8.45/oz, and all-in sustaining costs (AISC/oz) will average $10.42/oz of silver.

In terms of project profitability, if we assume a silver price per ounce at $20, which is the 2024 full-year forecast for Andean’s San Bartolomé project, New Pacific’s future production in the Silver Sand would have a net present value (or “NPV”) of $562 million and an after-tax internal rate of return (or ” IRR”) of 33%. Regarding the last parameter, this seems to indicate a financially sound project versus other precious metals mining projects that we have read about in previous research where the IRR rarely exceeded 25-30% and with assumed silver prices well above $20/oz. As for the NPV of $562 million, if this is divided by the number of common shares outstanding of 171.26 million, it gives an NPV/share of $3.28. Comparing that to the current share price of $1.69/share on the NYSE American or $2.43/share in Canada (or approx. $1.77/share), that represents significant upside potential going forward.

New Pacific Metals is working on the Carangas silver-gold project as well, approximately 190 km southwest of Oruro, Bolivia. Last year, the company announced its first estimate of a total of 214.9 million indicated tonnes, containing 205.3 million ounces of silver and 1.6 million ounces of gold, as well as other metals such as lead, zinc, and copper, for a total of 559.8 million ounces of silver equivalent. The company has also estimated total inferred mineral resources at 109.8 million silver equivalent ounces and there is significant potential for the exploitation of an underground gold deposit. Based on this initial resource estimate, a PEA for New Pacific Metals Corp.’s 98% owned Carangas silver-gold project is expected to be released in the coming weeks, revealing the economics of the project though from a conceptual perspective only.

The third project, the Silverstrike silver-gold project, involves exploration in an area where previous drilling has discovered a near-surface zone of oxidized gold with a valuable metal concentration. However, exploration activities are still on hold as the company prefers to focus on the Silver Sands and Carangas projects.

Source: New Pacific Metals Corp. – Company WebSite

The Stock Valuation: A Buy Opportunity as the Stock Dips

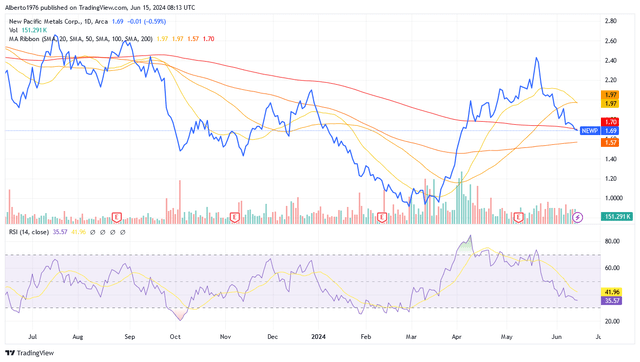

As of this writing, under the NEWP symbol New Pacific Metals Corp. stock is trading at $1.69/share for a market cap of $283.79 million, which is not completely above the MA Ribbon, the chart below shows. The share price is slightly below the midpoint of the 52-week range of $0.87 to $2.71.

Source: TradingView

According to this analysis, the investor may want to buy shares but wait a bit before acting based on this valuation: Based on a 14-day Relative Strength Indicator of 35.57, there is still room for stock prices to go lower due to the negative pressure caused by the Fed’s persistently “Higher-For-Longer” stance, which does not bode well for zero-income bearing silver bullion. As this analysis has already shown, macroeconomic factors such as changing expectations about whether or not the Fed will make the first-rate cut have led to stock price dips that investors could take advantage of. As a note, these declines occurred when the RSI was at 30 or even below.

Policymakers will be more confident that inflation is heading towards 2%, which has so far prevented the first rate cut, as soon as the labor market situation eases. US non-farm payrolls hit a five-month high in May 2024 with gains across many industries. Plus, unemployment is not expected to rise until 2025, and only slightly by 0.2 percentage points in 2024 from the current level of 4%.

Also, policymakers revised core PCE inflation upward to 2.8% in 2024 (from the previous estimate of 2.6%) and 2.3% in 2025 (from the previous estimate of 2.2%). It is not clear at what PCE level the Fed will make its first rate cut. However, the market appears to be underestimating that the estimates for the inflation may trend higher given the upcoming summer holidays as people tend to spend more money on vacations: Perhaps the Fed is waiting to see what effect the summer holidays will have on inflation. The reason for delaying its first-rate cut is that the disinflation process is still unconvincing. At the time of writing, the CME FedWatch tool predicts a 61.1% rate cut for September, up from last month’s 53.5 but the gap is narrowing due to the robust labor market and inflation that has not yet convinced. The risk of a rebound in inflation over the summer holidays could lead to cooling expectations for the first rate cut in September in the coming weeks, raising the likelihood of a further dip in New Pacific stock price with an RSI at or below 30. Investors may want to wait for the dip before buying shares.

Additionally, the average volume of NEWP stock is 334,932 shares traded in the past 3 months. Scroll down this Seeking Alpha page to the “Trading Data” section to view it. NEWP stock is a low-liquidity stock, and investors should not hold too large positions, otherwise they will find it difficult to reduce them accordingly if circumstances require it.

The same considerations apply to shares of New Pacific Metals Corp. under the symbol NUAG:CA: Shares were trading at CA$2.43 each at the time of writing, giving them a market cap of CA$390.48 million. Shares were trading not completely above the MA Ribbon, sitting roughly in the middle of the 52-week range of CA$1.17 to CA$3.64.

Source: TradingView

Additionally, the 14-day RSI’s trend of 43.60 suggests that shares have plenty of room for downside in a high-interest rate environment, forming fresh dips.

Additionally, the average volume of NUAG:CA stock is 195,625 shares traded in the past 3 months. Scroll down this Seeking Alpha page to the “Trading Data” section to view it. NUAG:CA stock is a low-liquidity stock, and investors should not hold too large positions, otherwise they will find it difficult to reduce them accordingly if circumstances require it.

Conclusion

New Pacific Metals Corp. shares continue to receive a Buy rating, but the implementation of this rating should be delayed, taking advantage of any significant price declines that are likely to occur. The Fed’s “higher for longer” interest rate policy – which does not help to hold income-free silver bullion – has a dampening effect and the possibility of further dips.

Since the last rating, this dynamic has led to price declines, prompting investors to increase their long-term exposure to silver as a critical element for green projects and electrification, as well as a hedge against economic problems and geopolitical tensions. The dips also contributed to strong gains following the price increases triggered by rallies in silver.

The market associates this stock strongly with silver thanks to two projects underway in Bolivia. The main project aims to produce about 12.2 million ounces of silver annually for 14 years at a cost that is not high compared to another production that has been taking place “within walking distance” for several years.

The flagship project Silver Sand also promises very interesting profitability, which makes the stock very attractive and should give it further impetus during bullish sentiment on silver markets.

A PFS for the project is expected by the end of Q3-2024 and a PEA for the second Bolivian project in Carangas is also expected by the end of the third quarter. These announcements may serve as additional upside factors for New Pacific’s share price.

Read the full article here