The US 10-2yr Treasury yield curve has been inverted (two-year yields higher than ten-year) for 23 months since July 2022. An inversion in this spread has preceded the onset of every recession in the last 50 years by an average of 10 months. Generally, longer-than-average inversion periods (11 months Sept 12, 1980, to Oct 23, 1981, 19 months Dec 13, 1988, to June 29, 1989, 12 months Feb 2 to Dec 28, 2000 and 18 months Jun 8, 2006, to Mar 20, 2007) preceded deeper than average loss cycles for stocks and real estate.

However, market participants have short attention spans and the longer the inversion lasts, the more the consensus typically dismisses the indicator as no longer relevant. History says that’s a mistake.

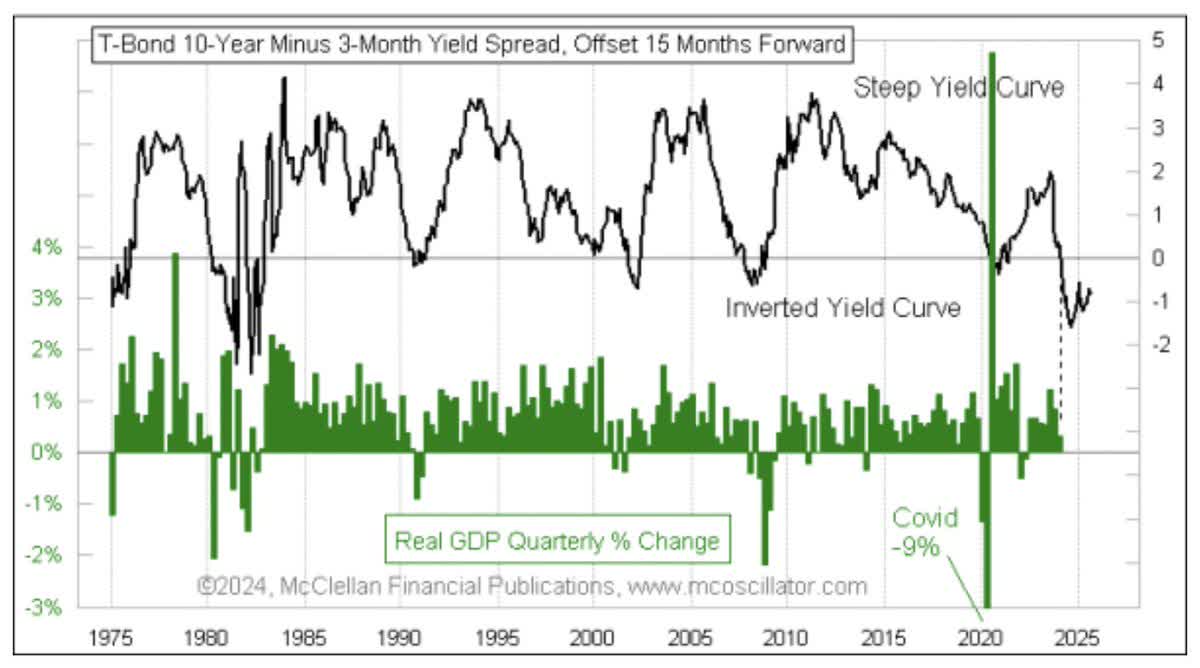

The 10-3 month yield spread offers a similar heads up to the onset of recessions with an average lag of 15 months, as shown below since 1975 courtesy of Tom McClellan, see Yield curve’s 15-month lag:

This week’s chart shows the spread between the 10-year and 3-month Treasury yields. It is shifted forward by 15 months to help illustrate how GDP responds with that lag time. This yield spread first inverted on a monthly basis back in November 2022. Counting forward by 15 months takes us to February 2024, which was in the first quarter (Q1). We did not get a negative real GDP growth rate in Q1, but it did fall to a very low positive number. The full effect of the current inversion of the 10y and 3m rates has not yet been felt.

Moreover, once Fed cutting cycles drop short rates, the curve starts to normalize or “disinvert,” but rate relief to the economy also takes a multi-quarter lag:

Furthermore, that economic effect should continue to be felt for a period of 15 more months after the 10y-3m spread finally disinverts. In other words, the FOMC members might believe that they are fighting current inflation right now by making current economic conditions tougher via their high interest rates. But in reality, the effect is delayed, and so the continuing inversion of the yield curve means poor GDP conditions for 15 more months after the moment when the yield curve disinverts. And we do not see any sign yet of any disinversion happening anytime soon.

Disclosure: No positions.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here