Invesco S&P 500® Top 50 ETF (NYSEARCA:XLG) offers one of the best ways to track mega and large caps performance in the S&P 500 index, which I believe could be a smart investment strategy to exploit the current bull run. In addition to market-beating returns potential, XLG’s almost 30% stake in the largest companies from other sectors broadens the ETF’s share price uptrend and lower the downside risk. Therefore, I’m initiating coverage of XLG with a buy rating.

S&P 500: Bull Run Or a Big Correction?

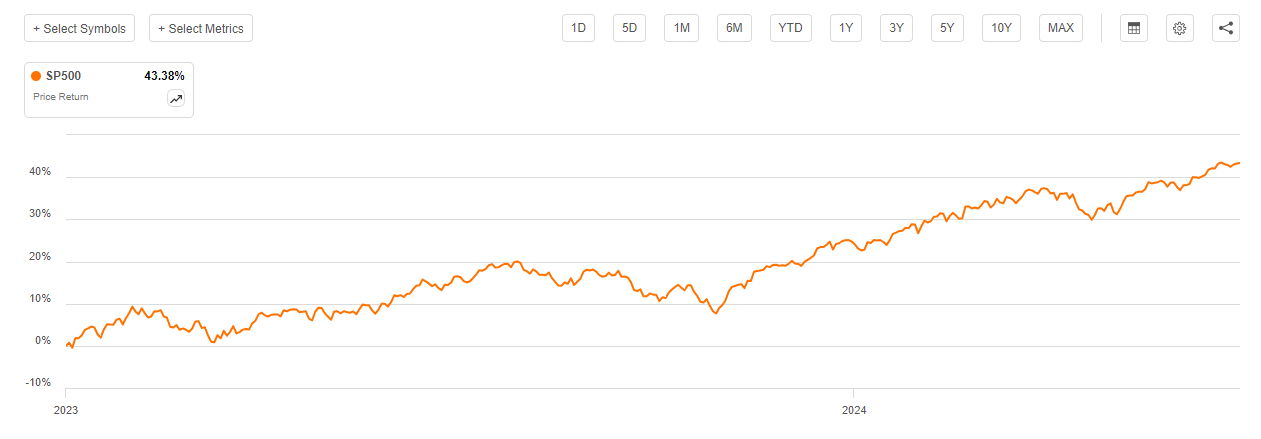

S&P 500 price performance (Seeking Alpha)

Before moving on to the ETF or stock selection, it is crucial to gauge how markets are likely to behave in the short to mid term. Some market pundits expect stocks to extend the rally with a year end price target of 6000 points, representing nearly 10% increase from the current level. Meanwhile, bears anticipate a big correction ahead due to multiple reasons. For instance, the chief market technician at Piper Sandler anticipates a correction, expecting the S&P 500 to plunge 10% this summer to around 4900 points from its current level. He believes that poor market breadth and declining momentum are among the signals of potential correction. In a note Johnson wrote:

“When driving a car and an Engine Warning Light pops on, most drivers would safely pull over the vehicle and assess the meaning of the Warning Light(s) on the car’s dashboard. Like the car dashboard, equity market warning lights are starting to flash, but most investors can’t hear or see them as the F.O.M.O (fear of missing out) in the markets is cranked up, and investors are just enjoying the ride.”

Despite the fact that the breadth of the market declined in the past weeks and momentum slowed, I believe there is a limited risk of correction because the upcoming second quarter earnings season, which will begin in a few days, is likely to improve the stock market’s breadth and fuel the share price momentum. Earnings growth has always been considered one of the biggest drivers of stock market performance. The bull run in the past quarters was also mainly driven by corporate earnings growth and prospects of soft landing.

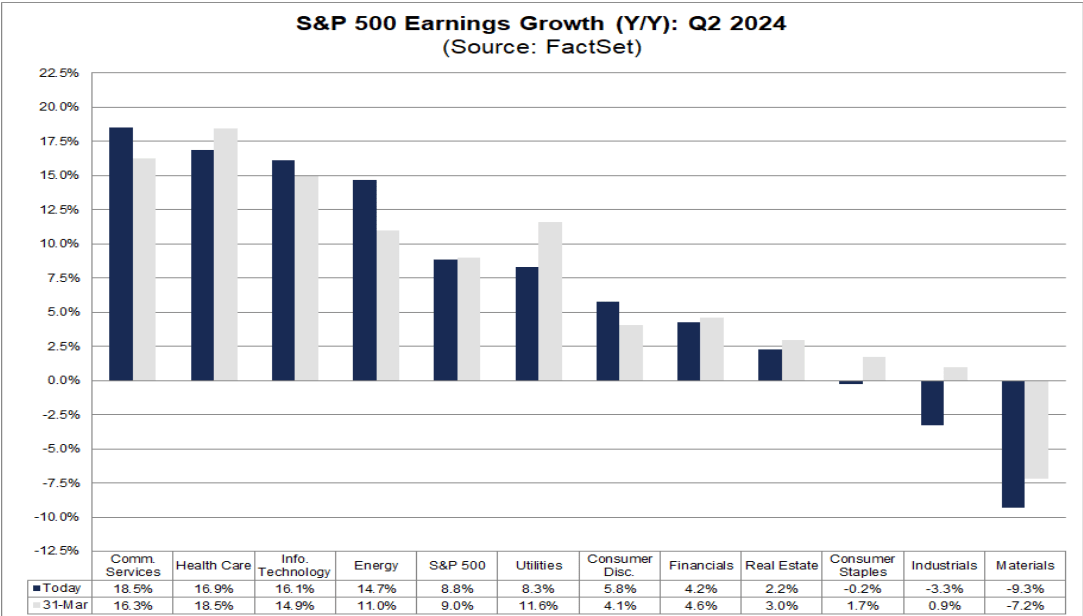

Q2 earnings forecast (FactSet)

FactSet data shows that the earnings growth rate for the S&P 500 is likely to range around 8.8%, which will be the highest earnings growth rate since the first quarter of 2022. For full 2024 and 2025, earnings growth is forecasted around 11% and 14%, respectively. The most important factor for the continuation of the bull run will be the performance of mega and large caps from the communication, information technology and consumer cyclical sectors. Data shows that mega and large cap stocks, particularly magnificent seven, are positioned to lead the earnings growth trend. In the first quarter, 64% of S&P 500 earnings growth was contributed by 5 of seven stocks from the group. These corporations include NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOG) (GOOGL).

Meta Platforms is expected to generate 35% earnings growth for the full year while Microsoft is also expected to deliver double-digit earnings growth. NVIDIA, which is among the key drivers of the current bull run, reported more than 260% revenue growth in the latest quarter, with expectation to produce 109% year over year revenue and more than 100% earnings growth for the full year. The market analysts also showed significant confidence in mega-caps staggering cash generation potential. For example, Bank of America analyst Vivek Arya anticipates that NVIDIA could produce $120 billion in free cash flows in the next two years, which will position it to invest aggressively in growth opportunities and return significant cash to shareholders. Here is what Vivek Arya stated:

“NVDA is not just growing sales faster than any other mega cap (Q1 sales up 262% YoY), but also generating over 57% FCF margin,” Arya wrote in an investor note. “At this pace, NVDA could generate over $120bn in FCF in the next two years and over $200bn in FCF in the next three years (by CY27), creating strong growth optionality.”

Why XLG is Best for High Risk-Adjusted Returns?

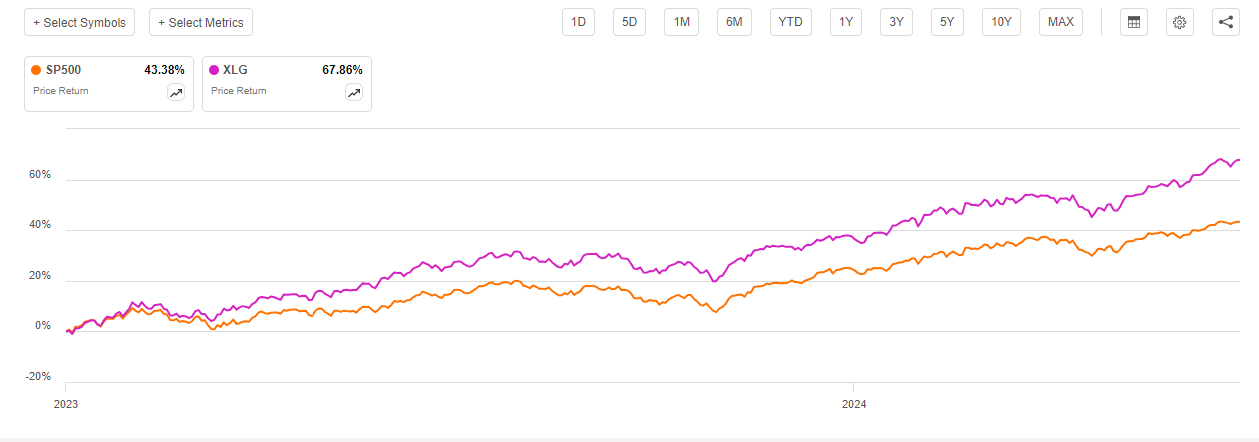

XLG Vs S&P 500 price performance (Seeking Alpha)

Invesco S&P 500 Top 50 ETF tracks the performance of the 50 largest companies in the S&P 500 index using full replication technique. I believe initiating a position in the top 50 ETF will be a smart move in the bullish market conditions because the ETF’s 68% of overall portfolio is composed of tech stocks from the information technology, communications and consumer cyclical sectors. Moreover, XLG’s significant portfolio weight from these sectors is concentrated in the magnificent seven stocks, which accounted for half of the total S&P 500 returns last year and 75% year to date. The ETF held stake in all seven magnificent seven stocks.

Tech stocks and magnificent seven helped XLG to generate substantially higher share price returns compared to S&P 500 since the bull run began in 2023. These companies have not been flying higher only on fear of missing out, but investor optimism in these stocks is fully backed by their robust corporate earnings and balance sheet performance. Some of them are playing a leading role in the AI market while others are benefiting from improving ad revenue and significant user growth. Stabilizing economic trends has also been adding to their performance.

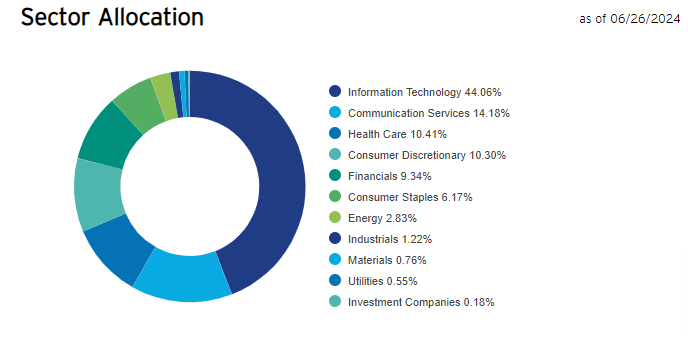

XLG sector exposure (Invesco.com)

Besides tech stocks and magnificent seven, XLG’s portfolio is also concentrated in largest companies from the healthcare, financials and consumer defensive sectors. Stocks from the healthcare sector represent nearly 10% of its portfolio weight while financials and consumer defensive stocks made up 10% and 6%, respectively. With exposure to healthcare and financial sectors, the ETF’s share price upside is likely to broaden because both sectors are expected to experience solid financial performance in 2024.

For instance, FactSet data shows that earnings of the healthcare sector is forecasted to increase by 17% in the second quarter of 2024, with expectations for double digit growth for the full year. Meanwhile, the Fed’s policy of holding rates at a peak level continues to improve the earnings of financial corporations, particularly banks. XLG’s other financial holdings such as VISA (V) and MasterCard (MA) are also on the verge of generating double-digit earnings growth in 2024. Overall, XLG’s portfolio offers a solid combination of tech and non-tech stocks to generate high returns in the bullish condition while lowering the downside risk.

XLG’s Top 50 Portfolio Beats the Tech ETF

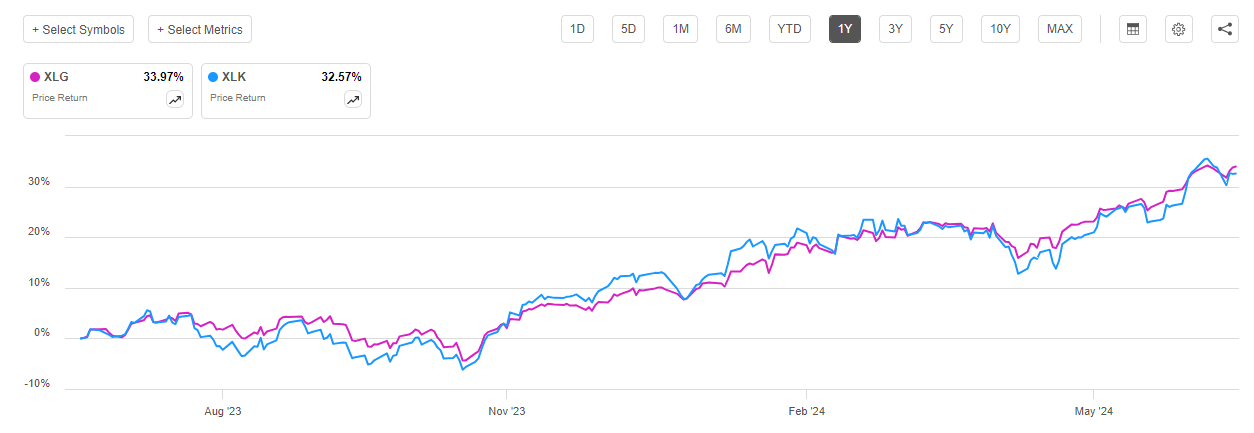

XLG Vs XLK price performance (Seeking Alpha)

As the bull run is mainly driven by tech stocks, information technology focused ETFs like The Technology Select Sector SPDR® Fund ETF (XLK) are in the limelight. XLK has topped the broader market index year to date and in the last twelve months. Despite that, I believe there are a number of other investment vehicles investors can use to generate higher risk-adjusted returns. XLG is among those investment vehicles. Its shares have performed better than XLK year to date and in the last twelve months while offering a lower risk. XLG’s robust performance compared to XLK is mainly attributed to its portfolio mix and a greater concentration in the magnificent seven group.

XLK focuses only on the information technology sector, with more than 40% of portfolio concentration in Microsoft and NVIDIA. Its portfolio does not contain other top performing mega-caps, such as Meta, Alphabet and Amazon. Therefore, on the basis of portfolio diversification, the risk factor with XLG is lower compared to XLK. Seeking Alpha quant rating provided a negative C grade to XLK on the risk factor.

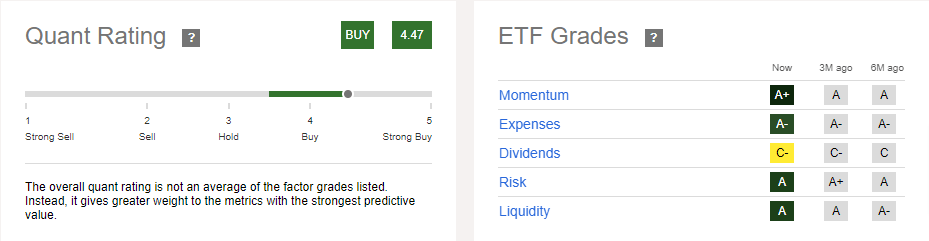

Quant Rating

XLG quant rating (Seeking Alpha)

It’s also prudent to use quantitative techniques for analyzing any stock or ETF because it eliminates emotions. XLG earned a buy rating with a quant score of 4.47, slightly down from a strong buy rating range of 4.50. It received an A plus score on momentum due to its solid share price gains year to date. Other key factors like expenses and liquidity also received strong quant grades. Moreover, An A score on the risk factor vindicates my opinion that the ETF carries less risk compared to tech focused ETFs.

In Conclusion

XLG appears like one of the best investment vehicles to make healthy gains in the bullish conditions while lowering the risk factor. The ETF’s better portfolio combination, strong share price momentum, low expense ratio and healthy liquidity also makes it a solid contender for long term holding. In addition, I believe waiting for a price correction could lead to missing out on the profit-making opportunity as the robust earnings growth prospects of tech and no-tech stocks are likely to offset the concerns over lofty valuations.

Read the full article here