Red Pumpjack in Alberta

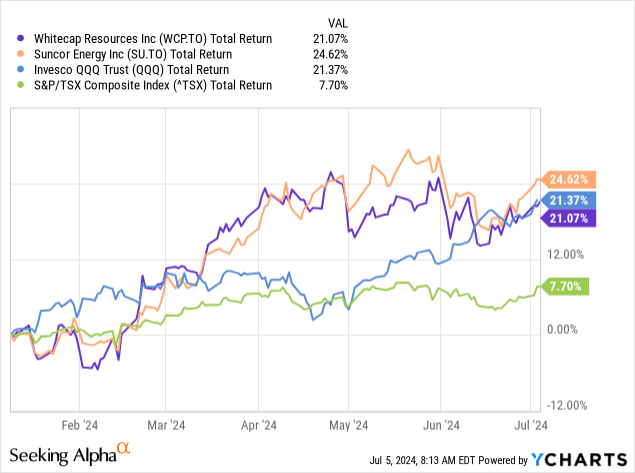

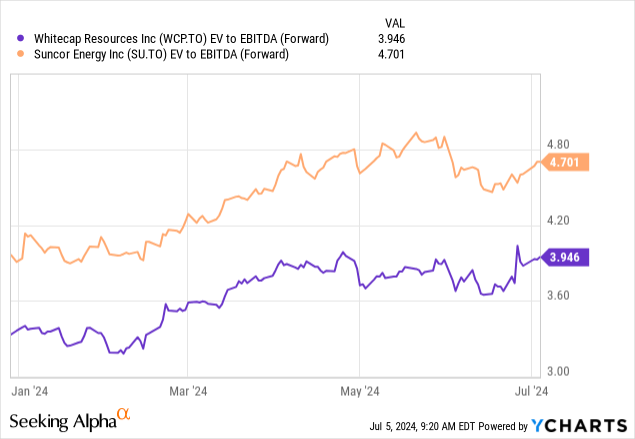

In our last coverage of Whitecap Resources (TSX:WCP:CA), we compared the company to Suncor Energy (SU:CA). We came away with four reasons why Whitecap was a better investment, and we thought it would outperform Suncor over the next couple of years. While we own both, we were exclusively buying Whitecap over Suncor around that time with fresh cash. So far, while neither stock has done badly, Suncor is still winning. But this is a good problem to have. We rather have this happen where both stocks we own have done so well and outperformed the TSX Composite by large margins, rather than win our relative bet. The two have even kept up with the unbreakable AI bubble.

That said, let’s look at what has happened so far and why we are backing Whitecap again today, despite the company lagging behind Suncor.

Q1-2024 and 2024 Guidance

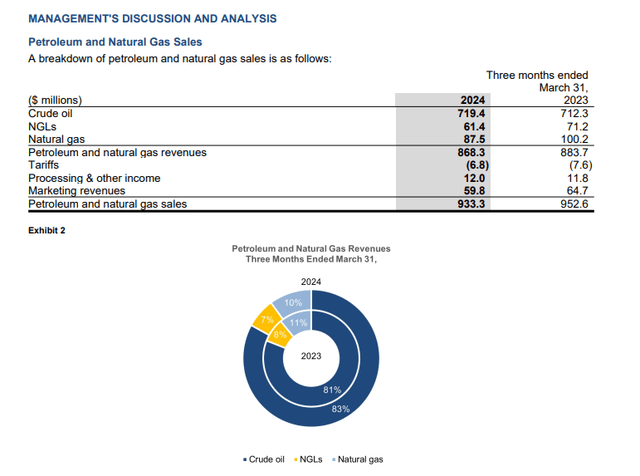

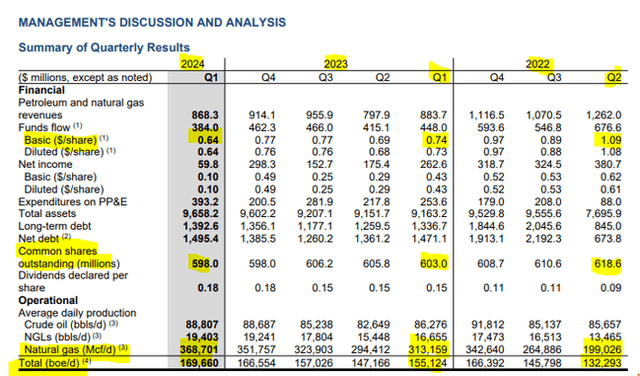

In Q1-2024, Whitecap’s total revenues edged down marginally year over year. Both NGLs (natural gas liquids) and natural gas were significantly lower, while crude oil revenues moved up by 1%.

Whitecap Q1-2024 Financials

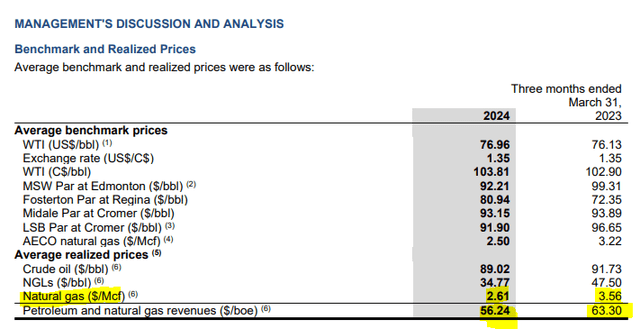

This was of course a function of realized prices, as both those commodities cratered while crude oil held firm.

Whitecap Q1-2024 Financials

Whitecap produced 64 cents a share of funds flow in the quarter. Investors must know by now that funds flow is calculated before capex, and they need to keep that in mind before they get extremely excited with the 18 cents of declared dividends in relation to the funds flow. But overall, Whitecap continues to invest its cash flow in a way that’s funding the dividend and growing production.

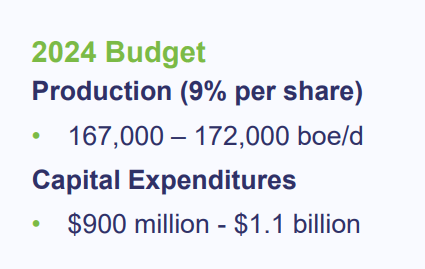

Whitecap Presentation

At current strip prices, we expect Whitecap to generate close to $1.7 billion in funds flow for 2024. If you strip out that capex above ($1.0 billion at midpoint) and then strip out the dividend payments, we’re left with about $250 million. In other words, a fully funded dividend, 9% growth and $250 million buffer. All this may sound remarkable, but Whitecap has managed to do exactly this kind of growth alongside tuck-in acquisitions over the last two years. It has done so while reducing shares outstanding. Of course, the key problem with the picture below is that funds flow is now lower than 2023 and lower than what we saw in 2022.

Whitecap Q1-2024 Financials

The reason? Whitecap has focused its growth on gassy production, and there’s little joy there today at today’s strip prices. But that’s the precise reason we’re investing in Whitecap. There’s zero credit given for this optionality for higher prices. So we get the current dividend and an undervalued play with the potential upside down the line. We do prefer companies like Whitecap, where the oil side of the ledger can carry the day while we wait. This is the opposite of companies like Birchcliff Energy (BIR:CA) where an unsustainable dividend gets more unsustainable with every day of low gas prices.

Asset Sale

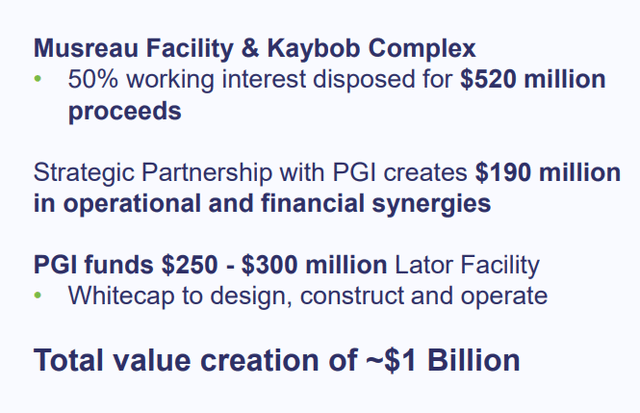

While Q1-2024 was rock solid, Whitecap did its real magic in June. They sold a 50% working interest in the Musreau Facility and Kaybob complex for $520 million. The buyer was Pembina Pipelines (PPL:CA).

Whitecap Presentation

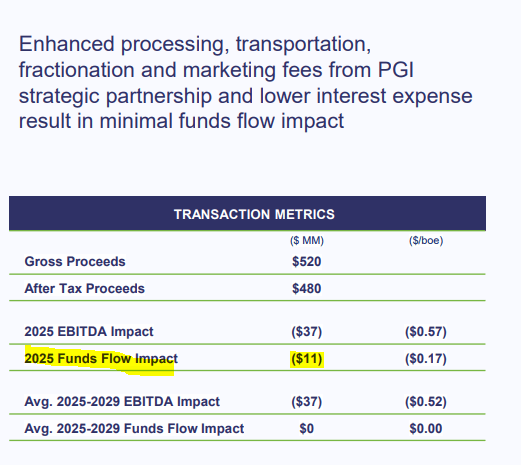

This is a fascinating transaction considering the sheer metrics for Whitecap. You can get a sense of that by examining the EBITDA and funds flow multiples here.

Whitecap Presentation

The gross proceeds were at 14X EBITDA. That’s fairly astounding by itself. It gets even better as Whitecap as a whole is trading at way lower valuations.

Valuation

Whitecap’s numbers here are still on the cheap side. The forward EV to EBITDA multiple has also not incorporated this transaction.

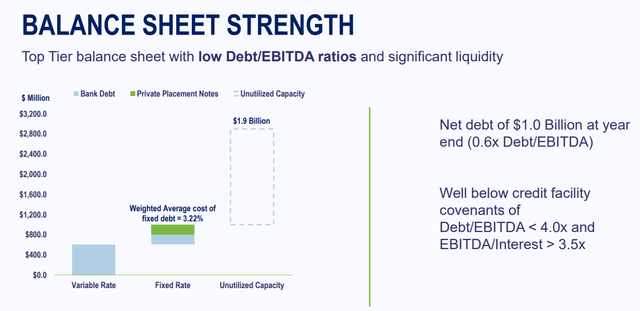

If you subtract out that and also subtract out a similar value for the remaining 50% stake, you’re getting the base business for peanuts. The valuation also comes now with one of the best balance sheets you can find.

Whitecap Presentation

Verdict

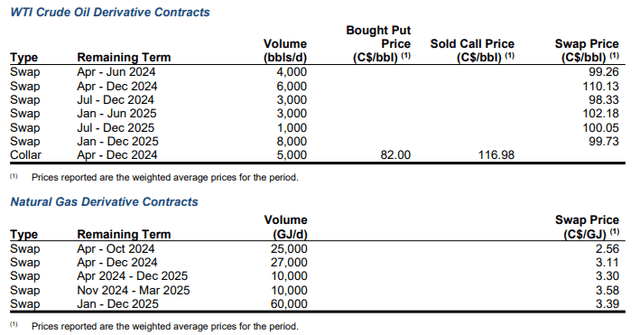

The sustainability of all of this, of course, hinges on oil prices. Alternatively, natural gas prices will really have to kick up by a lot, if crude oil prices tank. Whitecap has a few hedges in place, but they are really rounding errors on its total production of 170,000 barrels of oil equivalent a day.

Whitecap Q1-2024 Financials

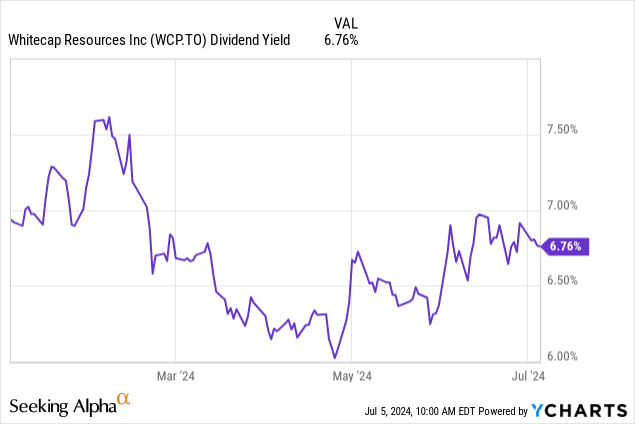

We wish there would be more prices locked in. Especially with the extremely favorable combination of weak Canadian dollar and high oil prices in USD currently in play. But at least Whitecap is one where the balance sheet can withstand some temporary weakness in the fundamentals (we are looking at you Birchcliff). Our outlook calls for $65-$70 to provide a longer-term floor for oil, and we believe that the biggest bullish factor around that level will be the refilling for the Strategic Petroleum Reserve. Whitecap’s dividend is currently sustainable till around $70/barrel with the current capex. Should Whitecap only try and maintain production (as opposed to growing it), the dividend is sustainable down to $50/barrel, even without incurring more debt. We like the model and we like the yield.

While the stock is obviously not as cheap if you just examine the price, we think this recent transaction actually resets the clock back. Post execution of this, the stock actually appears exactly as cheap as when we wrote our January article. We’re maintaining our Buy rating here and still believe that Whitecap will win out over Suncor in the medium term.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here