It could have been Wilfred Frost, or it could have been another CNBC interviewer this morning (Friday, August 30 ’24), but some anchor at CNBC had Tom Lee on after the market opened and asked him about 2025 S&P 500 earnings, and Tom (whose FundStrat Insight firm does excellent research work), responded that he thought that the full-year 2025 S&P 500 EPS would be somewhere between “$260 and $280”.

Data Source: LSEG

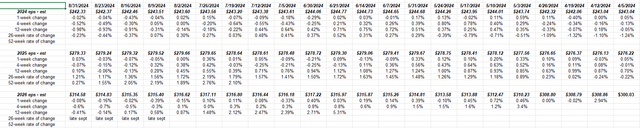

Here’s the trend in 2024, 2025 and 2026 S&P 500 EPS since early April ’24.

The important aspect to 2025’s EPS trend is that it’s slowly rising over time, where the normal pattern is similar to 2024 and 2026’s trends, which have been seeing negative revisions.

But the expected 2025 S&P 500 EPS estimate has been rising the last 5 months.

Don’t ignore it.

S&P 500 data:

- The forward 4-quarter estimate (FFQE) rose for the 2nd straight week to $259.74 from last week’s $259.61. Prior to last week, the FFQE had fallen for 7 consecutive weeks.

- The P/E on the FFQE is now 21.75x versus the 21.7x last week and the 21.3x to start the July ’24 quarter.

- The S&P 500 earnings yield fell to 4.60% from last week’s 4.61%. The S&P EY has ended each week between 4.60% and 4.87% all quarter.

- The S&P 500 EPS and S&P revenue “upside surprise” are the same the last few weeks, i.e. at 4.7% and 1.1%.

Technology sector:

At some point this weekend, this blog will publish some thoughts on the technology sector forward earnings estimates, which actually look positive. The stocks have been trading flat to nowhere, but the forward earnings estimates continue to improve, albeit (like 2025) slowly.

Summary/conclusion

The 3% GDP print on Thursday morning, August 29th, accompanied by the +2.9% rise in consumption (a big chunk of consumption is consumer spending, but not all of it) which is healthy growth, is not really bond-market-friendly.

It seems the Fed/FOMC/Powell is less concerned about US growth and inflation, and more concerned with a slowing job market in advance of a Presidential election.

The August ’24 jobs report next week is expecting roughly 150,000 in “net, new jobs added” in August ’24 by the US economy, which is probably right in line with historical averages, post Covid and post FOMC rate hikes.

The jobless claims and payroll weakness around late July and early August ’24 could have been Hurricane Beryl-related. The “household” portion of the monthly payroll report is measured in the first weeks ending with the 12th day of the reported month, and Beryl hit Texas on July 8th, right at the halfway point of the payroll household measurement period.

I haven’t read anything conclusive on this in terms of data, but saw a few comments of Beryl’s potential influence at a critical time.

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can involve the loss of principal, even for short periods of time. Readers should gauge their own comfort with portfolio volatility, and make changes if needed.

Thanks for reading.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here