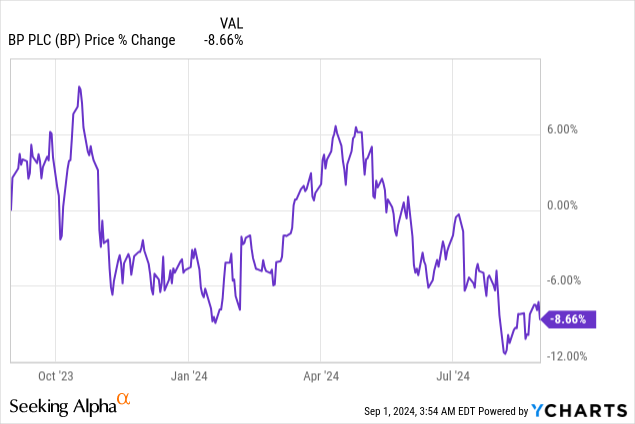

BP (NYSE:BP) (OTCPK:BPAQF) reported solid Q2’24 results that showed that the British energy company continues to benefit from earnings tailwinds related to higher petroleum prices. BP is also focusing on new major development projects in the Gulf of Mexico, which is set to be a catalyst for earnings and free cash flow growth going forward. Importantly, BP is trading at an exaggerated earnings yield of 15%, which is way above the company’s rivals in the upstream industry. Since BP is focused on growing its capital returns and raised its dividend by 10% in the second-quarter, I believe the risk profile is widely favorable.

Previous rating

OPEC+ members extended their supply cuts earlier this year and thereby provided significant pricing support for oil and gas companies… which was a reason for me to recommend BP to income and growth investors alike. The prospect for higher price realizations as well as new upstream projects could further drive a new round of attractive capital returns for shareholders, in my opinion. Since OPEC+ members are likely to enact additional production curbs in order to support petroleum prices, I believe that BP is an attractive long-term energy investment at its current price point.

BP delivers strong Q2’24 results, driven by higher average prices

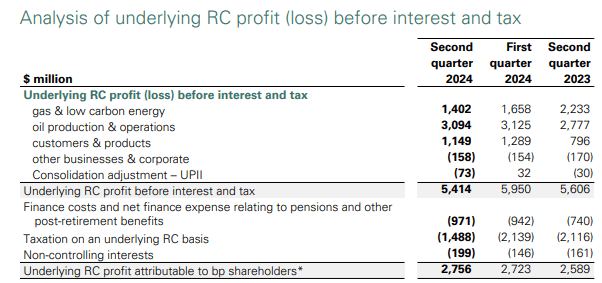

BP generated 7% year-over-year growth in its most important metric in the second-quarter, underlying replacement cost profit, which is BP’s proxy for core earnings. BP reported total earnings of $2.8B in the second-quarter, with the two largest segments being oil production & operations and gas & low carbon energy.

BP

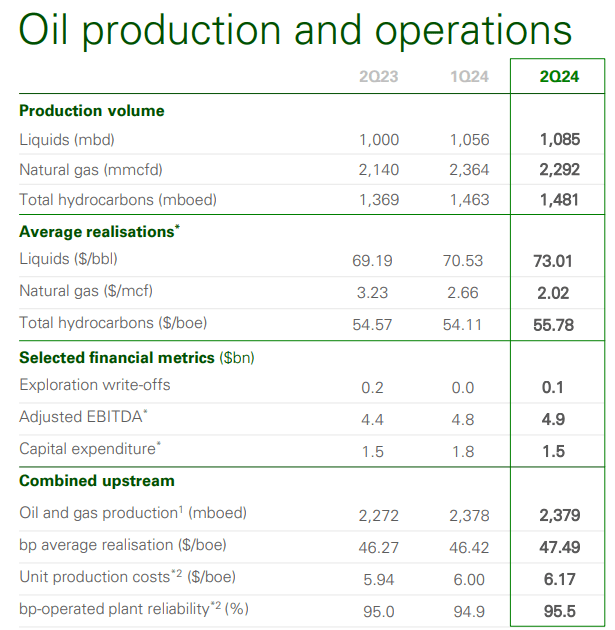

BP obviously benefits from higher average prices for petroleum, especially as geopolitical turmoil in Russia/Ukraine and the Middle East have led to a higher fear premium embedded in energy prices. In the largest segment, oil and gas, BP achieved an average price of $73.01 per barrel in Q2’24, showing an increase of 6% year-over-year. Oil and gas production increased a solid 5% year-over-year to 2,379 MBOED and the company’s expansion projects in the Gulf of Mexico add further impulses for production growth in the future.

BP

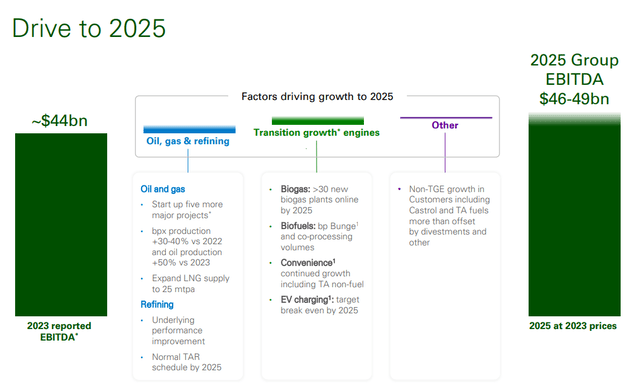

Favorable long-term outlook for EBITDA growth

BP is projecting strong growth in its EBITDA going forward as the company invests in new major upstream projects, especially in the Gulf of Mexico. BP is focusing on new deep-water projects in the Gulf of Mexico, such as Kaskida, which is estimated to hold 275M barrels of oil equivalent of discovered recoverable resources. Kaskida will be BP’s sixth operation in the deep-water Gulf of Mexico and is expected to have a capacity of 80k barrels of oil per day. At current prices, BP projects that it can grow its full-year EBITDA by $2-5B between FY 2023 and FY 2025… which would represent an 8% increase at the mid-point of BP’s guidance range.

BP

BP’s valuation

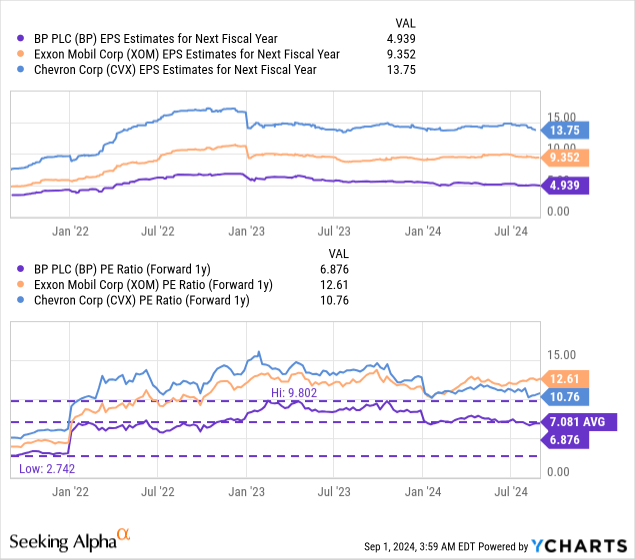

BP’s biggest advantage, in my opinion, is its low valuation based off of earnings. BP is trading at a P/E ratio of 6.9X, which is well below the price-to-earnings ratios of its U.S. counterparts: the forward P/E ratio for Exxon Mobil (XOM) is 12.6X and 10.8X for Chevron (CVX). BP’s low earnings multiplier reflects a massive 15% earnings yield, which is even higher than the historical average of 14% in the last three years. BP’s shares are now cheaper than its rivals, as well as cheaper in a historical context.

U.S. companies are more expensive than European energy companies due to growing investments in shale oil and gas, such as in the Permian. Strong production growth in the Permian Basin, as an example, was one reason why I recommended shares of Exxon Mobil, in addition to the company’s extraordinary free cash flow strength. I also recommended Chevron lately — Don’t Miss This Buying Opportunity — as the oil and gas company outperformed its U.S. rivals in terms of dividend growth.

In my opinion, BP could easily trade at an 8-9X price-to-earnings ratio, under the condition that the company remains profitable, grows its (liquids) production and continues to return more cash to shareholders (which management has already guided for). With an 8-9X P/E ratio, based off of FY 2025 earnings, shares of BP could have a fair value between $39.50 and $44.45 per-share.

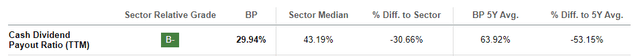

A capital return play

Besides a low valuation, the second big advantage is that BP has the potential to return more cash to shareholders going forward. BP guided for $3.5B in stock buybacks in the second half of the year, which would follow a combined $3.5B in buybacks already completed in Q1 and Q2. Additionally, BP raised its dividend by 10% to 8 cents in the second-quarter. Since BP pays out only about 30% of its TTM earnings (compared to a sector median of 43%), I believe investors can expect further dividend increases going forward.

Seeking Alpha

Risks with BP

The biggest risk for BP, as I see, relates to a slow start for its expansion projects in the Gulf of Mexico. Further, I see risks relating to fossil fuel regulation as well as lower petroleum prices, which would also stifle BP’s potential for EBITDA and cash flow growth. What would change my mind about BP is if the company were to see slowing production and earnings growth, or scaled back its stock buybacks.

Final thoughts

BP is just too cheap at this point to ignore as the fundamentals in the firm’s business look solid: BP generated high-single digit earnings growth year-over-year in the second-quarter, is growing its liquids production, especially and is investing in new upstream project like Kaskida in the Gulf of Mexico. BP is a buy mainly because of two factors that work overwhelmingly in the company’s favor: 1) Shares are just too cheap at a 15% earnings yield and BP has a serious valuation advantage over its U.S. counterparts, and 2) BP is actually becoming an attractive capital return play with the oil and gas company buying back billions worth of its shares. BP also raised its dividend 10% in Q2’24, which underscores the company’s commitment to growing its dividend, which is why I see an overall highly favorable risk profile for BP’s shares.

Read the full article here