Has Nvidia (NVDA), along with the rest of the “Magnificent 7,” the Nasdaq 100, and the S&P 500, already peaked for the current business cycle? It’s a bold proposition, but certainly possible in our view. October 29 of this year may well mark that turning point. Nvidia’s cash flow disappointment relative to analyst expectations in its earnings release on November 19 may have sealed the deal.

Stock market bulls, don’t despair. We think there are plenty of value and growth stocks to buy for the shifting macro climate. More on that further below.

In recent weeks, Michael Burry and Jim Chanos have been sounding alarms about aggressive accounting changes with respect to useful lives of Nvidia GPUs, likely having the effect of understating depreciation expense at its megacap tech customers. Meanwhile, several major financial outlets, including The Wall Street Journal, Bloomberg, and the Financial Times, have highlighted circular deals among AI “hyperscalers” and their #1 supplier, Nvidia, reminiscent of vendor financing excesses of the 2000 internet and telecom bubble.

We trust our investors and readers will recall where they first encountered the boom-and-bust theory of the capital expenditure cycle as it applies to today’s megacap tech stocks. We began discussing it, well ahead of the curve, with supporting fundamental charts and historical analogs in August of last year: Asset Bubbles and Inflation. Warnings of late-cycle excesses are now coming to light in the financial analyst community and media, and we think it is important to be on alert for potential downside risk in megacap tech and large cap index funds.

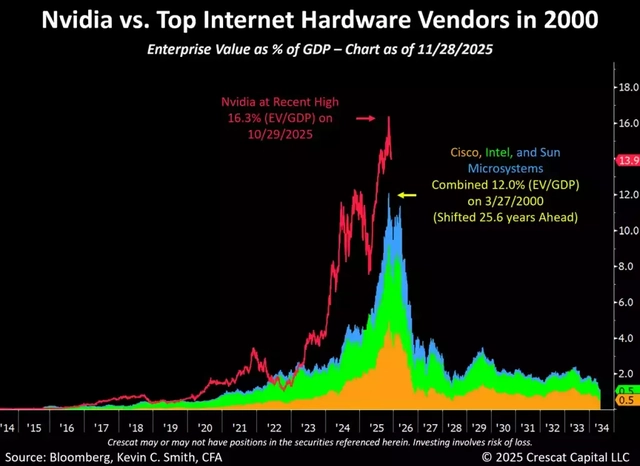

Comparisons with the tech mania that peaked on March 27, 2000 when Cisco Systems (CSCO) held the world’s largest market capitalization are warranted. Nvidia’s recent enterprise value reached almost three times Cisco’s at that time when normalized for U.S. GDP.

Indeed, as of October 29, Nvidia’s enterprise value relative to GDP was 36% higher than the EV to GDP of the three biggest internet hardware leaders of 2000 combined: Cisco, Intel (INTC), and Sun Microsystems.

Nvidia, the company that invented the graphics processors that have been key to the recent AI breakthroughs, has delivered phenomenal growth, but in or analysis, it is in a cyclical business, and it will not be able to sustain a future growth rate high enough to justify its current market cap, just like its internet hardware forebearers at the peak of the 2000 bubble. After conquering the world in brute force computing for the training and inferencing of AI models, we think the company is now poised to be a victim of its own success due to the reflexive nature of the capex cycle. The problem is that its clients will be hard-pressed to get an acceptable return on their invested capital in the current frenzied capex race. Furthermore, while Nvidia has enjoyed near-monopoly pricing power to date, it is now facing serious competition, not just from Advanced Micro (AMD), Intel, Broadcom (AVGO), Samsung (OTCPK:SSNLF), Huawei, and various Silicon Valley upstarts, but also from its own largest customers who have been developing their own AI inferencing chips. Also, as Michael Burry has pointed out, it is important to remember that in prior capex boom cycles, stocks peak first, well before the capital spending cycle peaks, and it should be no different this time.

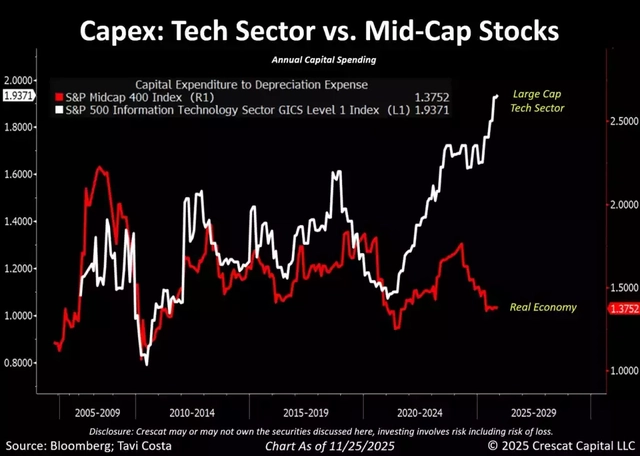

The Capital Spending Divide

We are witnessing a pronounced structural divide in the trend of capital spending: technology companies now command the overwhelming share of new investment, while the broader real economy struggles to gain traction. This imbalance is evident in the fact that capital expenditures among S&P 500 mid-cap companies remain roughly 30 percent below their pre-pandemic levels, even as nominal GDP has expanded by about 40 percent — an increase of nearly $8.5 trillion — since late 2019. Much of that economic growth has been driven by the tech sector’s concentration of capex, extraordinary fiscal outlays, and, ironically, a weakening production-oriented economy.

We believe this divergence presents one of the strongest macro arguments for a significant rotation of capital. We expect the next major shift may favor sectors positioned to benefit from the intense competition in the AI-driven technology race and from the geopolitical push to reduce industrial and manufacturing dependencies. Only now are policymakers, investors, and the public beginning to recognize how deeply certain domestic industries have been overlooked and underfunded for decades.

In our view, capital is likely to move toward four key sectors: energy, industrials, financials, and materials, especially metals and mining. The coming transition may resemble the post-tech-bubble period, when the dramatic repricing of fast-growing technology firms redirected attention and capital toward more traditional industries that led the economy out of the 2001 recession and over the entire next business cycle.

Today’s macro environment appears to be setting up a similar shift. Persistent pro-growth fiscal policy, the political pressure to lower the cost of servicing public debt, and a likely move toward deregulation and targeted industrial support all point to a reorientation of capital toward long-neglected but strategically essential sectors.

We see this as an important moment to focus on the companies and industries poised to benefit from this realignment — businesses that have operated for years without meaningful capital inflows but now stand to gain as the economic pendulum swings back in their direction.

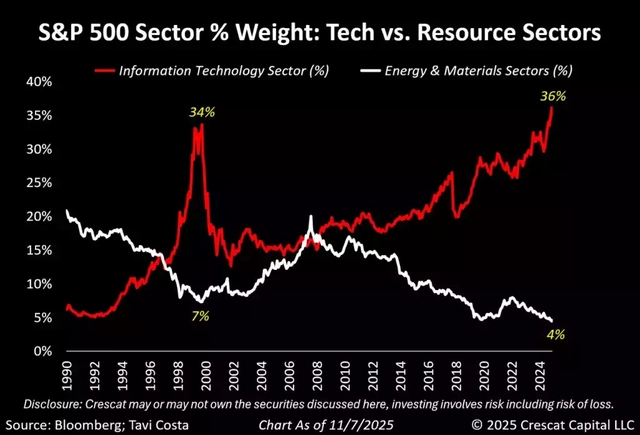

The Case for a Resource Rotation

Resource availability continues to be a critical driver of technological innovation and the broader revival of manufacturing. At the peak of the tech bubble in 2000, technology made up roughly 34% of the overall index; today, that figure has risen to approximately 36%. Notably, this calculation excludes major companies such as Amazon (AMZN), Meta (META), Tesla (TSLA), and Alphabet (GOOGL), further highlighting the extreme concentration within the tech sector.

At the same time, resource sectors have lost much of their former prominence. They once made up around 7% of the economy at the bottom of the commodities cycle in the early 2000s, rising to roughly 20% at the peak of the previous bull market. Today, the energy and materials sectors account for only 4% of the overall index, widening the gap between tech and resource sectors and underscoring the underrepresentation of industries that are critical to long-term innovation and industrial growth.

Given the strong macro tailwinds for resource demand today, persistent supply constraints, and the critical role of commodities in supporting technological progress, in our view, this imbalance is more pronounced than in previous cycles. Resource sectors appear well-positioned for a meaningful rebound, offering both structural and strategic potential for investors as the economy shifts toward renewed industrial activity.

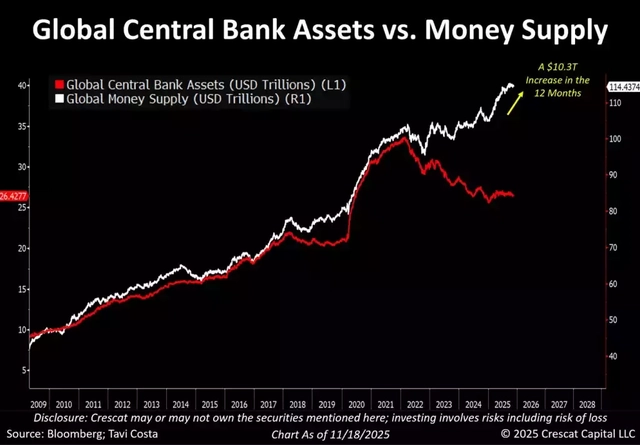

The Liquidity Paradox

It’s remarkable to see global money supply surging at the same time as major central banks are shrinking their balance sheets. Over the past year, roughly $10 trillion has been added to global liquidity. It naturally raises the question of what happens once central banks are forced—inevitably, in our view—to expand their balance sheets again.

A big part of what’s driving this latest jump in money supply is the deregulatory push moving through the financial sector in the U.S. Liquidity typically enters the system through three channels: central bank asset purchases, fiscal spending, and commercial bank credit creation. While the current U.S. administration is trying to avoid outright quantitative easing in favor of commercial bank asset expansion, all three drivers are present on a global basis, and this is unmistakably dilutive for fiat currencies, which we believe will continue to lose ground to hard assets. That shift, in our view, is the core opportunity in the current macro backdrop.

For investors, the challenge is to tune out the short-term noise around natural resource volatility. Those swings distract from the broader and far more important trend—the liquidity cycle itself, the over-riding force that, in our analysis, will drive the rotation out of overvalued tech and into undervalued energy and materials, the next predominant macro phase of the economy.

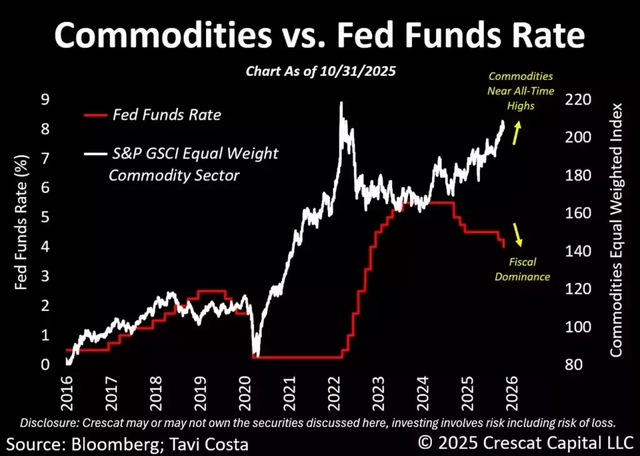

Commodities and the Inevitable Rate Cut Cycle

We’re seeing a very unusual macro divergence right now. The GSCI Equal-Weighted Commodities Index is up roughly 25% year-over-year, even as the Fed is actively cutting rates. That’s a stark contrast to the last time commodity prices surged — back then, prices peaked just as the Fed was launching one of the most aggressive tightening cycles in history.

Today, the situation is completely different. Neither the Fed nor the government can sustain high rates. Instead, the U.S. is being forced to cut rates quickly to manage its growing debt burden. All of this makes for one of the most bullish environments for mining and metals in financial history in our view. It is both a significant risk to investors in overvalued technology assets and an opportunity for gold, silver, copper, zinc, and other critical metals mining investors.

If the overall stock market falls and economic conditions weaken, we believe lower interest rates are inevitable, strengthening the case for hard assets all the more.

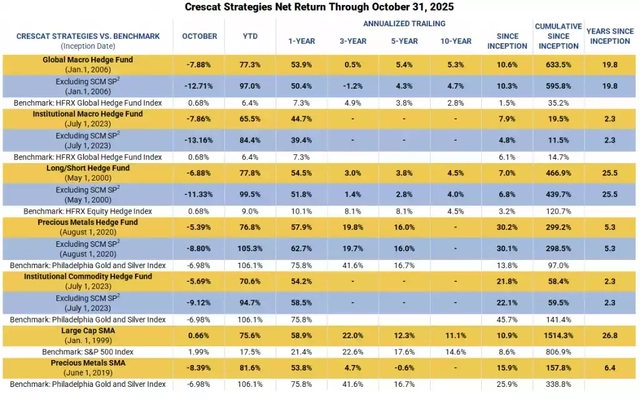

All Crescat Funds and SMA Composites vs. Benchmarks Performance

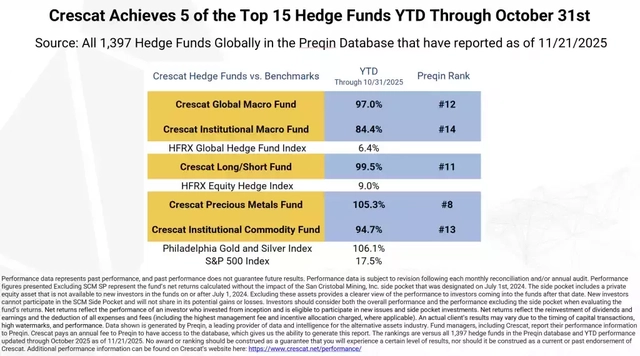

Preqin Rankings for 2025

While Crescat’s hedge funds were down in October, primarily due to the pullback in precious metals mining stocks, it is important to note that Crescat still had 5 of the top 15 performing hedge funds through October 31st year to date, according to the Preqin database.

November 2025 Performance

Net performance was positive across all five Crescat Hedge Funds in a volatile overall market for November. We will have November and year-to-date performance estimates available on Monday for all who inquire.

We encourage you to reach out to Marek Iwahashi, Head of Investor Relations, via email at [email protected] or by phone at (720) 323-2995 if you are interested in getting positioned in our funds for the current monthly window.

Sincerely,

Kevin C. Smith, CFA, Founding Member & Chief Investment Officer

Tavi Costa, Member & Macro Strategist

Quinton T. Hennigh, PhD, Member & Geologic and Technical Advisor

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here