Key Takeaways

- Bank Stocks Kick Off Earnings On A Positive

- War In Middle East Intensifying

- Commodity Prices Rally

Stocks were down small Thursday, following a mixed Consumer Price Index (CPI) report and ahead of the kickoff to earnings season. The S&P 500 and Nasdaq Composite both fell by 0.6%. Earlier on Thursday, the latest CPI report showed prices were up 3.7% on a year-over-year basis, which was the same as August. Core CPI, which excludes food and energy prices, was up 4.1%, down from the 4.3% reported in August. While the reported numbers do show inflation continuing to cool, the numbers were also slightly higher than had been forecast.

Earnings season kicked off this morning with some of the bank stocks reporting. Both JP Morgan and Wells Fargo

WFC

United Health Group, reported better than expected earnings sending its shares higher by 2%. United Health Group is a Dow stock so that could help the Dow Jones Industrial Average today. Also this morning, UK regulators just approved Microsoft’s

MSFT

ATVI

The positive start to earning season could be a good sign for what’s to come. Currently, the S&P 500 is trading just over 18 times projected 12 month earnings, in line with its historical average. That is down from the nearly 20 times projected earnings multiple stocks traded at back in July. If earnings continue coming in ahead of estimates, that would mean stocks are actually trading at even less than that 18 multiple and would be below the historical average. Stated differently, if earnings continue beating, it would mean stocks are undervalued on a fundamental basis.

The biggest story today; however, is what is happening in the Middle East. This morning, Israel is urging all 1.1 million civilians to evacuate Gaza in the next 24 hours. The warning suggests a ground war is imminent. Fears of contagion in the region are sending commodity prices sharply higher with oil up over 4% at more than $86 a barrel. Other commodities such as corn, soybeans and wheat are also higher along with gold and silver.

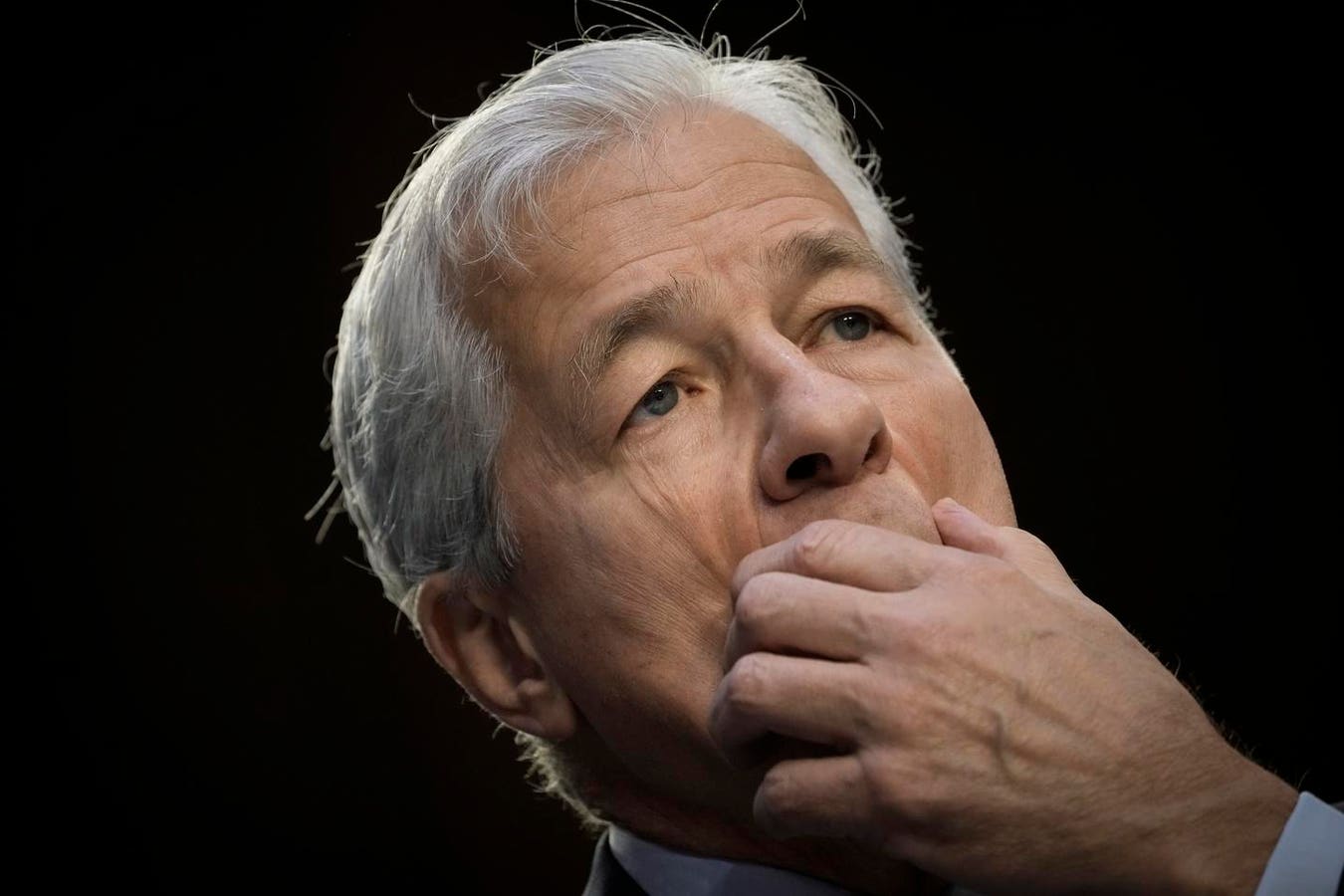

In his comments following JP Morgan’s earnings, Jamie Dimon warned that the world could be facing its most dangerous period in decades between the wars in Ukraine and Israel. There are concerns the war in Israel could expand, bringing in Iran with whom Russia has been fostering stronger ties during its war in Ukraine. Taken in its totality, the combustible situation shows no signs of improving at the moment.

Finally, the situation in both the Middle East and Ukraine are humanitarian disasters and my heart goes out to all the innocent victims of these horrific wars. At the same time, it is my job to analyze how situations like this may shape markets. This week’s economic data was slightly stronger than expected. However, given what is happening in the world, including what is happening domestically where the House of Representatives still has no speaker and a government shutdown in November looming, I think it would be challenging for the Fed to raise interest rates. According to the CME, chances of a rate hike in November are less than 10%. For December, the chances are higher at 33%. Obviously, all these situations are fluid and I will continue monitoring them closely. As always, I would stick with your investing strategy and long term objectives.

tastytrade, Inc. commentary for educational purposes only. This content is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.

Read the full article here