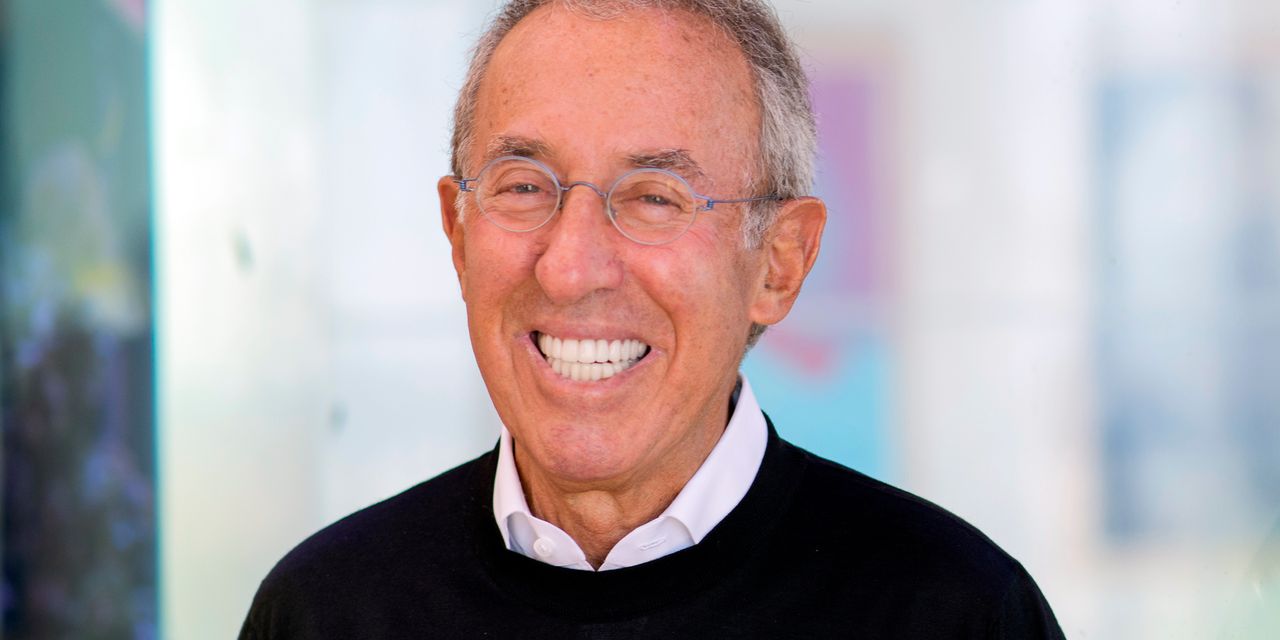

When Ron Baron was starting an investment business, he got some advice from Steve Wynn. The casino magnate told Baron to name his investment company after himself as a way to show clients and customers that he promised to stand behind it. Some four decades later, Baron Capital has made its most important investment in Elon Musk, Inc.

Baron invested $570 million in Tesla

TSLA,

mostly between 2014 and 2016, which was about 2% of his assets under management at the time. Today, after selling some shares, Tesla represents about 10.9% of Baron Capital’s $41 billion under management, and the winning position has helped Baron’s main mutual fund become the only mutual fund to beat the Nasdaq

COMP

over the last 5, 10 and 15 years, according to a recent Bloomberg analysis, during which time it returned 17% annualized.

“You get rich by being long-term and by being focused, by owning a small amount of companies,” Baron said in an interview.

Baron epitomizes a bullish buy-and-hold investing style that has worked in the current environment, where a few big tech stocks, like Apple

AAPL,

Microsoft

MSFT,

and Alphabet

GOOGL,

have accounted for a disproportionate share of the stock market’s gains. Baron runs a concentrated portfolio and owns one of the best performing big tech companies, Tesla, and has benefitted from the electric-car maker’s remarkable stock-market run. As a result, he lands on The MarketWatch 50 list of the most influential people in markets.

Musk himself may have just thrown cold water on Tesla’s long-anticipated cybertruck and expressed concern about the ability of consumers to buy his expensive cars in the face of high interest rates. But Baron says Tesla’s stock will keep rising over time and its market capitalization can grow from its current $630 billion to as much as $4 trillion in 10 years.

“In the case of Tesla, we are convinced that people cannot do what they’re doing and that, ultimately, it’s not just going to be a car company and it’s not just going to be a battery company,” said Baron. “All the other car companies, which 50 years ago, elected to become much more profitable and outsource supplies and compute to other people. We’re going to be like Intel was inside of computers. This is going to be Tesla inside of cars. All the cars are going to be using Tesla autonomous driving. No one else can possibly compete.”

But Baron is even more bullish on Space Exploration Technologies Corp., better known as SpaceX. The world’s busiest rocket-launching company and its large satellite-Internet subsidiary remain private, but Baron said he expects SpaceX will go public and list on a stock exchange within the next three years.

Baron invested about $700 million in SpaceX several years ago and a recent secondary share sale in the private market implied a nearly $150 billion valuation recently for the entire company.

“We think that by 2030 it likely will be worth somewhere around $500 or $600 billion,” Baron said. “And then in the 2030s, that’s when I expect to make another 10 times our money. So we can make over the next 15 or 20 years, we can make 30 to 50 times our money in SpaceX.”

Baron added, “I think SpaceX has a chance to be even bigger than Tesla in the 2030s.”

Baron called SpaceX’s satellite-Internet business as “Internet for the planet” and said that it will be much lower cost in many places than what any competitor could hope to provide.

“In the case of SpaceX, what they’re going to be doing there, the innovation that other people can’t possibly do, is the fact that they are able to launch rockets and re-use them over and over and over again,” said Baron. “So as a result of that, it costs other people to get to space $100 million, $200 million. It costs us a fraction of that amount … Basically, we can get our satellites to space for a very low cost.”

What is the risk of betting so big on one man? Baron said the risk was greater when Tesla and SpaceX were smaller companies with fewer people, a period when he thinks the two companies were even more dependent on Musk. But now, Baron said, those companies are teeming with excellent engineers and talented professionals. He added that 3.5 million people applied for jobs at Tesla and SpaceX last year.

“It’s harder to get a job at Tesla and SpaceX than to get into Harvard,” said Baron. “He has the most brilliant people working there, and that isn’t going to change.”

At the same time, Baron said, Musk is a unique and irreplaceable force.

“I’m betting he’s going to stay alive for at least 5 or 10 years,” said Baron. “I think that’s a good bet.”

Read the full article here