“ “Whoever coined the expression ‘Magnificent Seven’ for these companies presumably didn’t see the movie.””

We have no idea which companies will dominate the stock market a decade from now — the “Magnificent Seven” of 2033, in other words.

But we have a good idea which companies won’t be on that list: today’s Magnificent Seven — Microsoft

MSFT,

Apple

AAPL,

Amazon.com

AMZN,

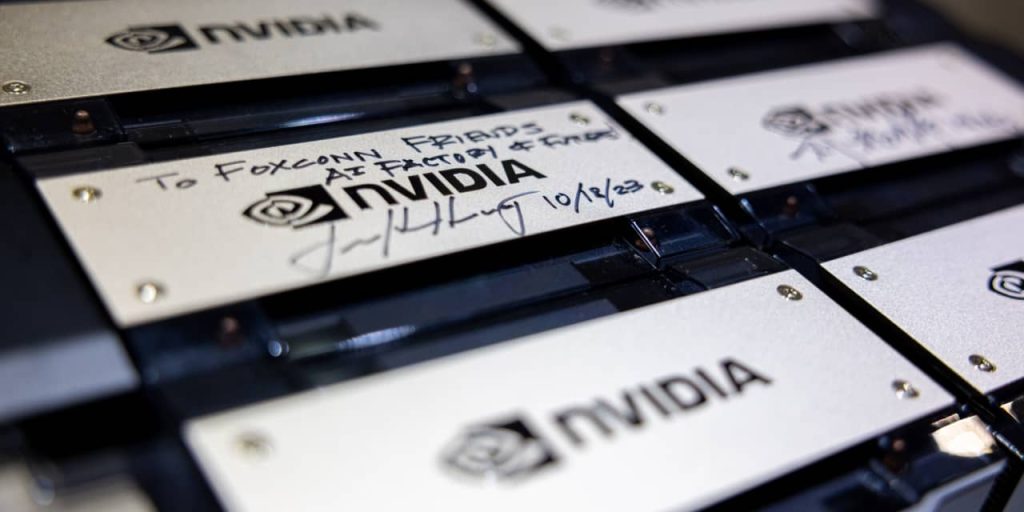

Nvidia

NVDA,

Alphabet

GOOGL,

Meta Platforms

META,

and Tesla

TSLA,

That’s because it’s rare for the largest companies to still be among the largest in a decade’s time. On the contrary, the largest companies in a given year will lag the market on average over the subsequent decade.

These are the results of research conducted by Research Affiliates, the investment firm headed by Robert Arnott. He and fellow researchers focused on the 10 largest-cap companies at the beginning of each decade since 1980. They found that, on average, eight of those 10 were gone from the top-10 list by the end of that decade. Furthermore, the average 10-year performance of all 10 was significantly below that of the overall U.S. market.

If the future is like the past, we should expect that perhaps one, maybe two, of the current Magnificent Seven will be in an equivalent list in 2033. Meanwhile, a portfolio of all seven should lag the market over the coming decade.

What accounts for this result? There are several contributing factors:

- Overvaluation: It’s almost certain that the largest-cap stocks are, on average, overvalued. They are the largest because they are riding a wave of investor sentiment and enthusiasm. Unless you believe that overvaluation doesn’t exist, it’s far more likely to occur among stocks that are in favor than those that are out of favor.

- Competition: In a 2012 study entitled “The Winners Curse,” Arnott and Lillian Wu, also of Research Affiliates, wrote that “When you are #1, you have a bright bull’s-eye painted on your back. Governments and pundits are gunning for you. Competitors and resentful customers are gunning for you. Indeed, in a world of fierce competition and serial witch hunts in the halls of government, that target is probably painted on your front and sides too. In a world that generally roots for the underdog, hardly anyone outside of your own enterprise is cheering for you to rise from world-beating success to still-loftier success.”

- Law of diminishing returns: Many of the largest companies are trading on investors’ assumption that they will continue growing at impossibly fast paces, despite already being huge. But it becomes harder and harder to grow at a fast pace the larger a company becomes. Furthermore, even if one of these mega-cap companies could grow at the necessary pace, which is in itself unlikely, it’s mathematically impossible that all of them will be able to, since that would mean than in several years’ time they collectively would be bigger than the economy as a whole.

The bottom line? Regardless of how they may perform over the shorter term, the Magnificent Seven’s long-term prospects are mediocre at best. As Arnott wrote in an email: “Whoever coined the expression ‘Magnificent Seven’ for these companies presumably didn’t see the movie, where four of the seven are dead by the end of the film.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Also read: ‘Magnificent Seven’ stocks have shed more than $1.2 trillion in value since the market’s July peak

More: Apple’s new Mac laptops aren’t good enough to keep buyers from switching to PCs

Read the full article here