Dear readers/followers,

Every so often I look through subscriber and follower requests and settle on a company to look into as a fun exercise. This latest time, 2 weeks ago, I settled on one Canadian gentleman’s question about the Canadian software company Dye & Durham (TSX:DND:CA). As those of you who commonly follow my work may know, I don’t typically review software companies. And IT companies don’t have a superb history in terms of investment allocation. Even during ZIRP, I wasn’t exposed to any significant degree to the sector.

But legal software, that’s a different deal and something I feel that I can both understand and somewhat get into. So I thought this would be a fun company to look at, despite what will turn out to be a “HOLD” or “SELL” rating and me not investing in the business.

Still, I will say that some parts of this company look interesting, and I can see why my subscriber found the prospect of investing here interesting.

Let’s get going – just what the heck is DND?

Dye & Durham – Looking at what the company does

So, first off.

When I first looked at this company based on the name, I expected some sort of 250-year-old British boot- or umbrella-maker. The name has the sound of something very storied and old-timey. I certainly did not expect a betimes class-leading practice management software with an edge for the ” modern”. However, it does have an explanation for the name – the company is actually over 130 years old and comes from a business founded in 1874 as a stationary/legal form business, that eventually went into legal office supplies, which eventually turned into legal tech provider.

The office product offerings were sold in the GFC to Connie Fenyo, and the business established itself, at this time, as a Canada-wide registry and legal support services provider.

Today, Dye & Durham unfortunately, as I see it, does not have a working business model. What I mean by this is that the company has less than 0.02x cash to debt a debt-EBITDA of 14.2x, an interest coverage of 0.51x and a net margin of negative 38.31% for the 2022 period.

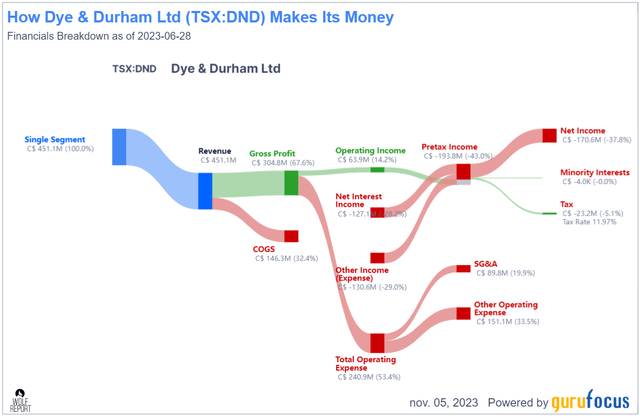

DND Business model (GuruFocus)

A quick glance at the fundamentals tells us that the company generates around half a billion of annual revenues (Canadian dollars), managing an acceptable/decent 67% GM, a less impressive 14.2% that all flows into a mix of negative net interest income, other income expenses and issues that leaves the company with negative net income – at least for the 2023E fiscal, which ended in September 2 months back. (Source: FY23 DND results)

Of course, DND is a tech business – so at times these go negative – but the company’s earnings look nothing close to positive here. Let’s find some of the challenges in the business model.

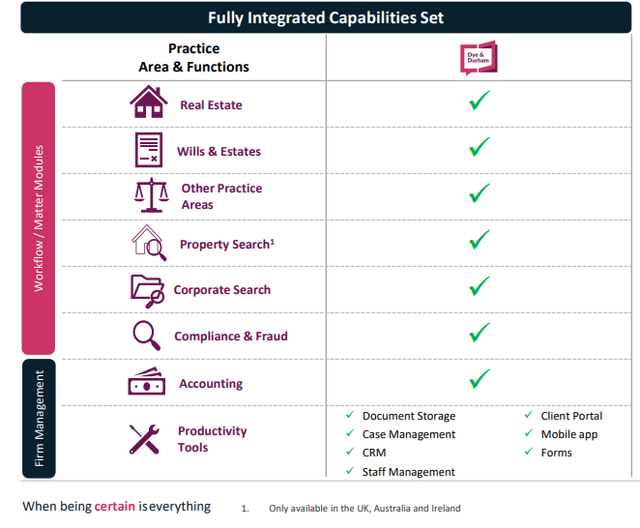

DND IR (DND IR)

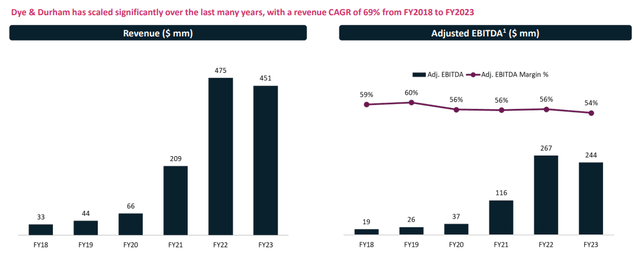

Out of $451M of annual revenue, the company generates $244M of adjusted EBITDA from 60,000+ customers across Canada, the UK, Ireland, and Australia with 19% of ARR under some sort of contract. The company does this through selling access to its market-leading practice management software, built to empower its clients – lawyers and legal professionals. The company also works with data insights and due diligence, supporting decision-making, and offers payment infrastructure software. (Source: FY23 DND results)

This business serves financial institutions across Canada and Australia, providing critical technology and products which support essential front-end and back-end uses, including payments, information services and property settlements, and core banking infrastructure.

(Source: Dye & Durham)

These are the company’s 3 business lines.

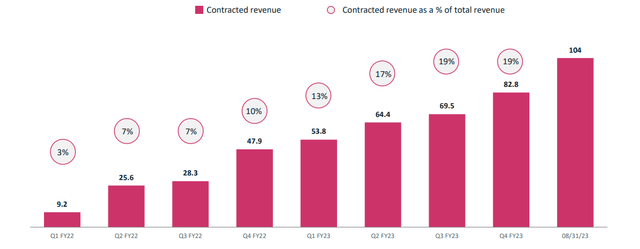

Contracted revenue growth is good – and this is the key, to what the company wants to be growing.

DND IR (DND IR)

The company, in its current form, IPO’ed in July of 2020 following multiple changes from the storied 130+ year company I spoke of. it has deployed almost $2B on M&A’s across its focal areas, which are Canada, UK, Ireland, Australia, and South Africa, and insofar as EBITDA multiples go, these transactions have come at relatively attractive multiples. Higher in 2021, lower now, but still impressive. (Source: FY23 DND results)

At IPO, DND had an EBITDA of $40M. Now, it’s adjusted at more than 6x that. So in terms of growing its EBITDA on an adjusted basis, DND has done well.

The company is working from a vision rather than from hard, existing numbers and profitability. DND’s target is to be the most trusted provider of mission-critical legal software across multiple geographies and deliver 20-25% EBITDA growth. It wants resilient revenue streams from a better mix, and part of this is rolling out its global unity platform.

Targets include 50% annual recurring contract revenue (19% now) in 3 years, build to over $1B EBITDA (4x+ the current), and less than 33% global real estate exposure in 3 years (58%+ now). (Source: FY23 DND results)

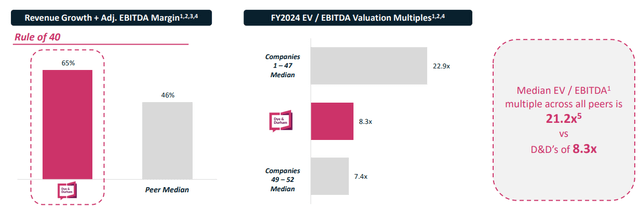

Part of its arguments for the company being a great deal read somewhat like we’re still in the middle of ZIRP with so many non-IFRS adjustments that you wonder what’s remaining after everything is “adjusted”.

DND IR (DND IR)

The company’s annual financial performance is decent, but there are already some cracks showing in the company’s annual targets relative to its performance. FY22 was the top year in both revenue and EBITDA – and since then, things have actually gone downward.

DND IR (DND IR)

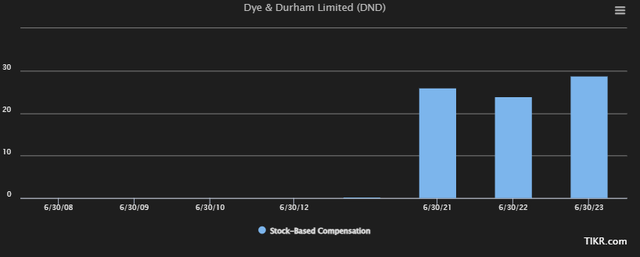

Also, despite the company’s revenues going down, and EBITDA going down -both margins and amount, some other things are going up.

Like stock-based compensation, which is something I look very closely at in companies such as this.

DND SBC (TIKR:com)

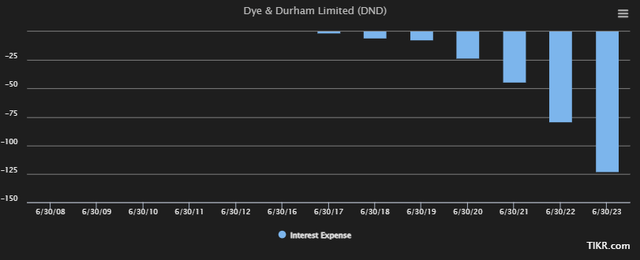

Also, as the business model suggests, the company has been seeing significant and increasing pressure from the interest rate. Interest expense is more than double what we saw in 2021.

DND Interest expense (TIKR.com)

With fundamentals like these, I’m not impressed with the company’s near-term prospects – not even the medium-term ones. Currently, S&P Global analysts are expecting GAAP profitability, meaning a positive GAAP EPS as early as 2025, followed by more growth in 2026E. That’s also the view of the FactSet analysts here. But given this is 2-3 years in the future, and considering the macro environment we’re currently in, forecasting that is a very tall order – especially with a negative GAAP EPS in excess of $2/share for this fiscal, and expected to amount to almost negative $1/share in the next fiscal (Source: S&P Global).

The company is seeing a continued decline in both revenue and operating income, both growth and actual numbers. The one positive is that the company has been reducing SO – meaning it’s been reducing dilution of its shareholders. Aside from this, I see far more risks than I see positives here. With a lack of clarity on churn (the company doesn’t disclose more than very general specifics), and the most important metric (by the company’s own words), revenue growth having stalled, I don’t see any reason to buy an unprofitable company with decline operating power here.

The bullish thesis I can find reads much like what investors were expecting during ZIRP – good M&A trends and TAM specifics equating a potential high valuation, and compelling valuations at even higher levels than we’re seeing here, with some arguing that the company was a compelling valuation at just below forward 6.5x EV/adjusted EBITDA.

The problem is that its aggressive M&A strategies don’t work as well outside of ZIRP as it did during ZIRP. You can, if you want, talk about the advantages of SaaS all you want – that does not change the fact that this company is very far from being a profitable software company, and the fact that the software can be argued as being mission-critical for its end users does not change that.

Prove it to me with hard data first. The state of the company’s balance sheet is the main concern to me here, aside from the current declining income and revenue growth. The current ratios are down, and as I’ve already specified, the debt ratios are absolutely abysmal, and we’re well below 2.3x to equity here now. The company’s debt was locked in a prime +4.75% – how the company manages this risk is going to be a key component here – but the fact is that the company’s share price over the last 12 months has not been a promising development. I saw people giving this company a share price target of $25-$28/share not that long ago, and to me that just reeks of ZIRP logic.

So let me give you my valuation take.

Dye & Durham valuation – Not great

So, this company’s valuation is not great for where it’s currently at – no matter how you slice it. Previous positive price targets were based on analyst historicals, which implied something along the line of $25-$26/share prices. Indeed, a year ago this company was targeted by 5 analysts to be able to trade between $23 as a low and $60 as a high. Boy, I’d love to see those analytics for that $60/share price target. However, despite those exuberant valuations at the time, only 2 out of 6 analysts were actually at a “BUY” at the time, despite the company trading at $17.

That means that despite all of those analysts giving the company a higher price target than $17/share, over 50% did not have a “BUY” target on the company.

Starting to see a problem here?

Today the picture is different.

7 analysts follow the company and go from a $12 low to a $30/share high. Still, only 2 analysts consider the company a “BUY” here.

Again, the lack of conviction, given that the company now trades at $10.14 is a bit bothersome here.

In terms of multiples, this company trades at almost 4x to NTM revenues, almost 1.2x to sales, close to 6.6x to NTM EBITDA and 11x the unlevered free cash flow. I could put this in context to other IT companies, companies with actual working business models – but let me just say that there are plenty of companies, profitable companies, that trade at less than this.

The argument could be made that through growth, the company should be able to capture these higher valuations and justify them – but given that we’re just now seeing a slowdown in revenues and operating income, that argument falls flat as well. Both on a NAV, on a Tangible Book, and on a current earnings potential analysis, given the company’s current negative trends, this company is not even close to justified as a “BUY” here. If we use an Altman Z-score, which is a calculation including assets, liabilities, retained earnings, incomes, expenses, revenues, and market cap, this company comes out very clearly in “distress” territory at 0.08x. It keeps issuing new debt, its asset growth is faster than its revenue growth, it has declining gross and operating margins, and it has an extremely low interest coverage.

Until the fundamentals in this company pick up, I cannot see my way to recommending anything close here.

I would not even in fact, “HOLD” this company if you held the shares, unless you really know what you’re getting into. If you bought this as a “dip bet”, and you’re still mostly in the green, I’d consider selling here.

Here is my thesis on DND as it stands today.

Thesis

- Dye & Durham is an interesting play for software in the legal field and a company that’s trying to grow to address a vast market in multiple geographies.

- The core problem is that this is not a profitable company, and only a working business model if you accept adjusted metrics. Also, the company’s revenues and income growth have both been stalling, and the headwinds of interest rates and SBC are starting to rear their heads here.

- For now, I’m at a “HOLD” for this company with a PT of $8/share – that’s for the Canadian DND ticker.

- Outside of that, I am not interested here.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I’m giving the company some margin of error here, because in truth I believe that a company with these fundamentals has to defend the notion that its either qualitative or well-run.

Still, it’s a “HOLD” here, due to the risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here