Investment Rundown

DMC Global Inc (NASDAQ:BOOM) is a quite small company with a market cap of just under $400 million right now. The company has managed to do very well in diversifying itself and has three primary segments that make up the revenue streams. The share price has been on quite the rollercoaster the last few weeks and right now it’s trending down it seems. On an earning basis, BOOM is at an FWD p/e of 9 which in comparison to the energy sector is a discount of around 13%. Historically the earnings multiple for BOOM has been quite high at 84. The oil demand is still very much present and with the diversified nature of BOOM, they don’t solely have to rely on good commodity prices. We had the last earnings report released not very long ago and the bottom line saw strong improvements as it rose 47% YoY to $9.9 million. The last time the company beat on earnings the share price rose quickly, that being the Q2 report. This time around the share price dropped as the Q3 report was released on November 2, most likely because of the lackluster top-line improvements, but I find the price adequately valued right now to make for a buy case.

Company Segments

BOOM plays a pivotal role as a significant supplier of engineered products across a broad spectrum of industries, including construction, energy, industrial processing, and transportation sectors on a global scale. BOOM’s extensive operations are segmented into three distinct divisions: Arcadia, DynaEnergetics, and NobelClad.

Investor Presentation

The Arcadia segment manufactures and supplies a range of building products. Their offerings encompass an extensive array of exterior and interior framing systems, curtain walls, windows, doors, and interior partitions. Additionally, Arcadia specializes in architectural framing systems and sun control products, as well as sliding and glazing systems. DynaEnergetics takes the lead in the manufacturing and distribution of perforating systems, along with the associated hardware components, which are of paramount importance within the oil and gas drilling industry. NobelClad is involved in the production and distribution of explosion-welded clad metal plates. These specialized materials find extensive application in heavy construction industries, particularly in the fabrication of corrosion-resistant pressure vessels and heat exchangers for the oil and gas sector.

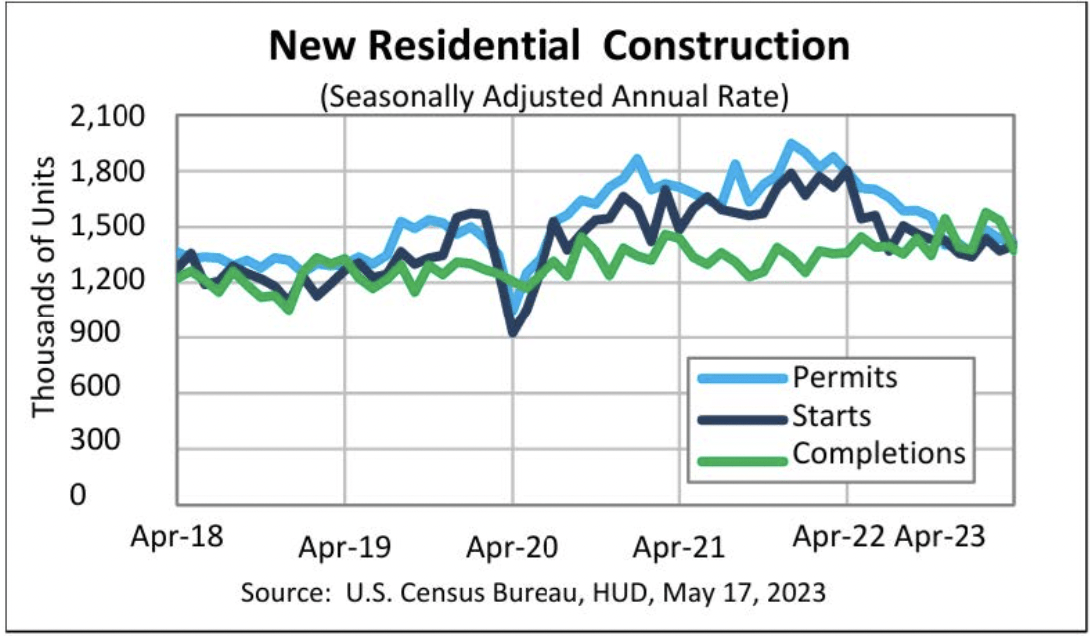

US Census Bureau

The outlook right now seems quite positive for the residential markets as completions are increasing following a lot of new starts and permits in the last few years. Higher rates have of course put pressure on the market but I think this is a short-term headwind that won’t affect the long-term prospects that much for BOOM. Should they see accelerated demand in the coming quarter like Q4 and Q1 then the market may see this as a reason for increasing the valuation it currently has. On a p/s basis BOOM only really trades at 0.5 which is nearly 80% below its 5-year average. Should revenues improve drastically then we may see a p/s closer to 0.7 applicable. I mention that multiple because it also accounts for the smaller size of the company. It doesn’t have a very large market cap so additional volatility may be present and that can equate to a lower valuation to account for it.

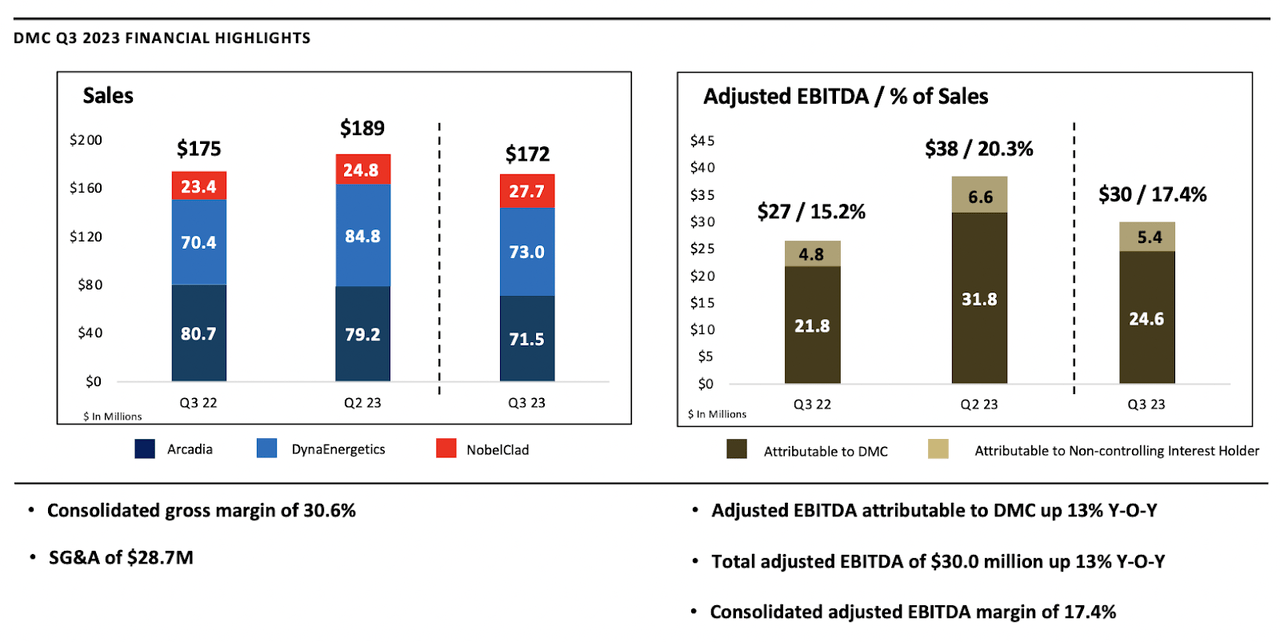

Earnings Highlights

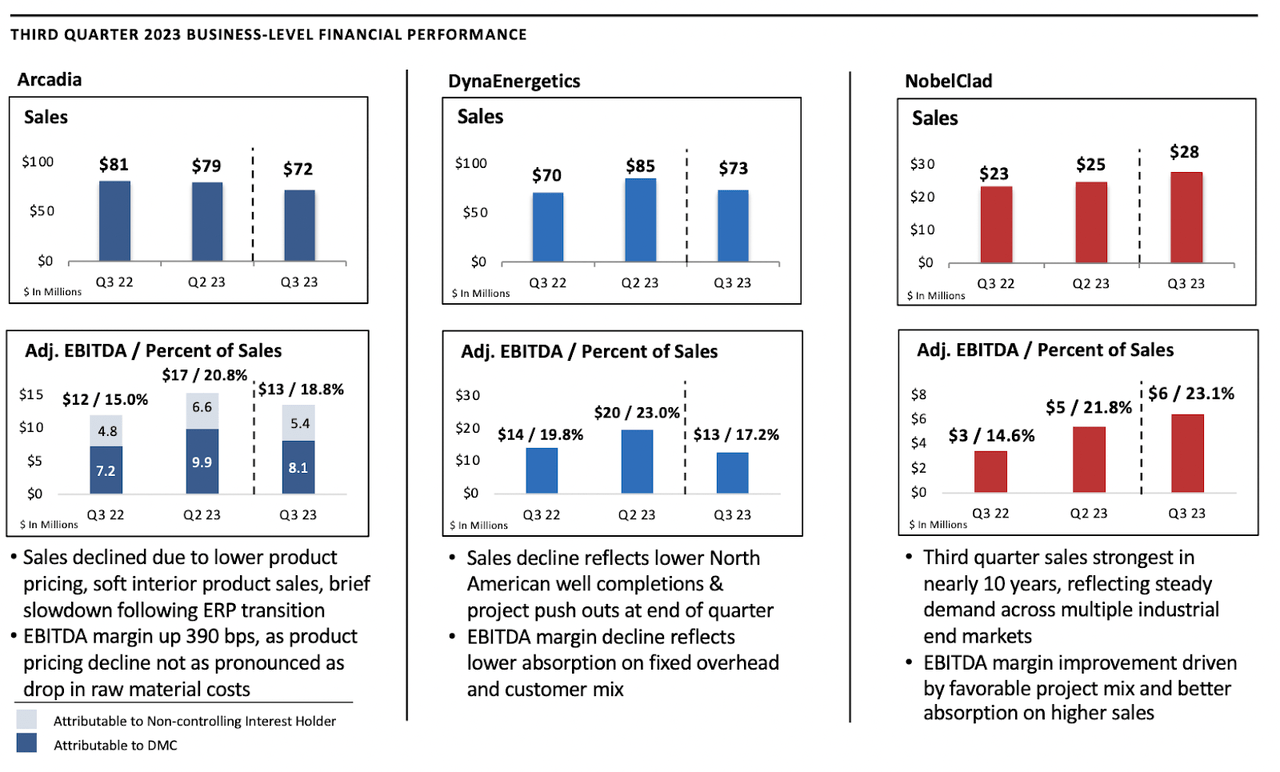

Investor Presentation

Looking at the last earnings report for the company some trends are appearing like margin improvements across several segments. Starting with the Arcadia segment the EBITDA margins improved by 390 basis points QoQ which is fantastic and should similar patterns appear in the Q4 report then we might see a spike in the share price further. The company seems to be quite positively going through its inventory as well and construction activity is resuming following more and more companies and investors adjusting to a higher interest rate environment.

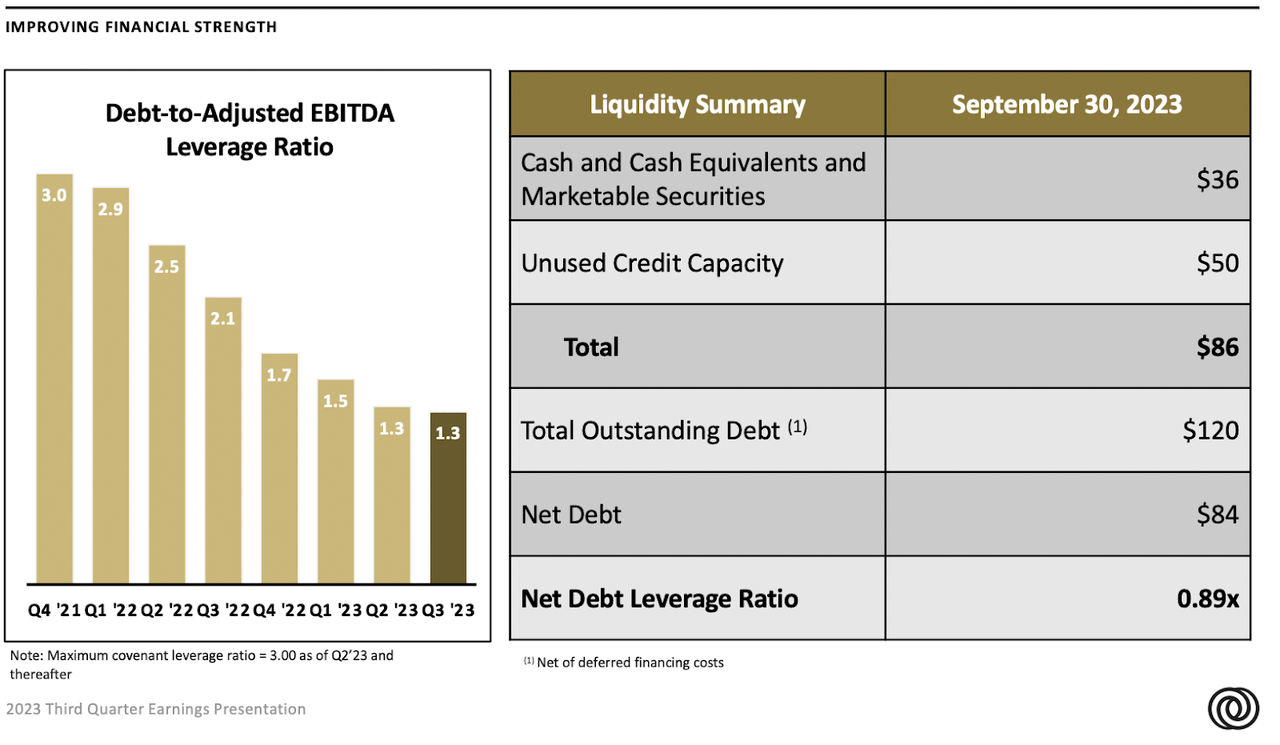

Investor Presentation

Highlighting some other improvements the company has made we have the leverage ratio which now sits at a historical low of 1.3 with debt to adjusted EBITDA in mind. The debt levels have risen quite quickly but thanks to improved margins and a growing EBITDA level this has been largely offset somewhat as rates have gone higher. Some of the key objectives that the company has noted are improved targets for the FCF of the business. The levered cash flows are not at their highest levels yet, as that was in 2019 but they are quickly approaching the record of $36 million. Efficient FCF growth will also better position BOOM to take advantage and invest in more operational capabilities following their increased backlog of orders in the NobelClad segment. Highlighting the FCF from the last quarter it reached $21.9 million in total, which is a strong improvement YoY.

We saw a spike following the Q2 quarter’s results and the same could likely happen in Q4 and Q1 reports too seeing as the company boasts a quite small market cap and some volatility is to be expected. Following the Q3 report that was recently released and covered above here, there was instead a drop-down, which may also happen in the coming quarters if BOOM fails to post strong top-line growth. Those looking at the long term may have wanted to hold shares through earnings and potentially pick up more shares should they drop. I think we have gotten that drop now and it’s a good time to add more. The bottom line improved very well even as the revenues stagnated somewhat. If margins expansion slows down in Q4 or Q1 I think a lower p/e may be applicable, something like 7.5 – 8 which would result in a drop of around 10 – 15% for the share price. For the moment though, it doesn’t seem that BOOM is experiencing any margin contraction and that has me bullish on the business.

Risks

A significant drop in oil prices has the potential to exert adverse effects on both the revenues and earnings of BOOM, which may subsequently result in a diminished valuation. The company is inherently exposed to the volatility of commodity prices, and its capacity to effectively hedge against these fluctuations can justify a higher valuation multiple. However, if their risk management strategies prove ineffective, there is a likelihood that the company may appear expensive, particularly when assessed from a p/e perspective. Commodity price risk will play a pivotal role in shaping the market’s perception of BOOM’s valuation and growth potential. Should oil prices continue to fall then it will harm earnings for the company, but perhaps not to an extent that it would warrant a sell rating. We have to keep in mind that BOOM is still a very well-diversified business that I think won’t see negative earnings because one segment of the business lacking.

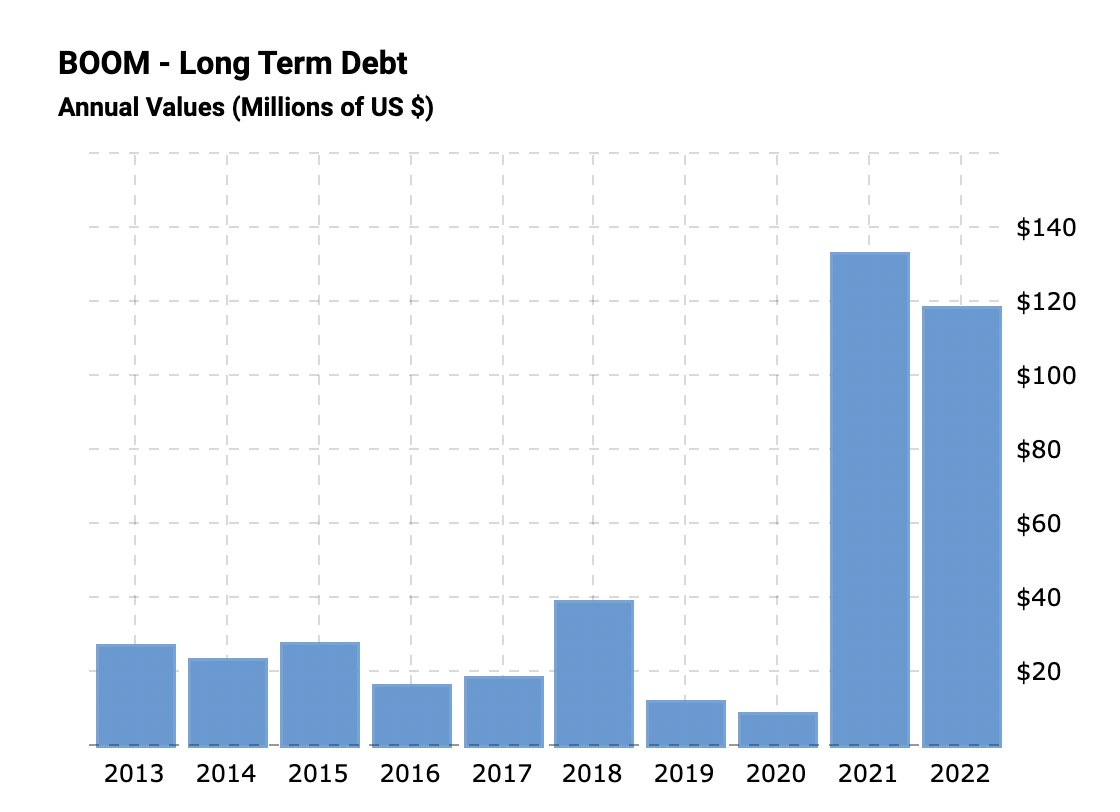

Macrotrends

In the event of further interest rate hikes, investors anticipate that BOOM, along with many other companies, could face heightened financial pressures. This concern stems from the fact that BOOM, for instance, has assumed a substantial amount of debt, much of which is tied to floating interest rates, leading to an increase in interest expenses. If this upward trend in interest expenses ultimately translates into negative earnings for BOOM, it is anticipated that the market may respond by devaluing the company’s shares.

Final Words

BOOM has been on a very volatile road the last few quarters but some positive trends are appearing. The last report showcased strong margin growth as one of the largest segments showcased EBITDA margin improvements of 390 basis points. It’s lower than the last report but I think as rates have risen we will see impacts like this. The market reacted to the lack of revenue growth of the business by letting the valuation drop. I think this has opened up a decent buying opportunity as BOOM still showcased very strong bottom-line growth, 47% YoY to be exact. FCF is reaching record levels and I think it will enable the business to quickly expand. BOOM is still a small company and allocating a smaller portion to it seems advisable. This all concludes to me rating BOOM a buy.

Read the full article here