Investment Thesis

We initiate EverCommerce (NASDAQ:EVCM) with a Neutral rating as a result of 1) continued challenges in its marketing technology segment facing demand headwinds due to tepid SMB environment 2) bleak recovery within its fitness vertical which still remain remains significantly down compared to pre-COVID levels 3) acquisitive model which had been a driver of growth is not sustainable in current environment and 4) decelerating momentum in its payments business. We are positive on the company’s cost management initiatives which has led to an upside to EBITDA margins while a 7% RIF (~160 employees) is also adding to the resilient outlook on the EBITDA margin. However, we remain skeptical on the demand environment and await signs of stability in the face of macro headwinds.

Company Background

EverCommerce is a leading vertical SaaS application vendor for SMB services companies in home services, health services, and fitness and wellness verticals. It has evolved into an end to end software stack for business management, marketing, CRM and payments across its service segments. It has a diversified revenue base with about 700,000 customers out of which 90% of customers contribute less than $2,000 with about 5% contributing over $5,000 to the top line. It principally generates revenues from the US that contributes more than 90% of the revenue with rest of the world contributing the balance amount. The company primarily generates revenue principally from three sources

1) Subscription and license fees: Sale of software licenses and related support services including business management related software applications

2) Transaction fees: Transaction fees in relation to fulfillment of payment processing services

3) Marketing technology solutions: Includes digital advertising solutions such as content creation, SEO and paid advertising as well as consumer connection services to provide fixed or variable payment based on targeted leads

Historical Financials

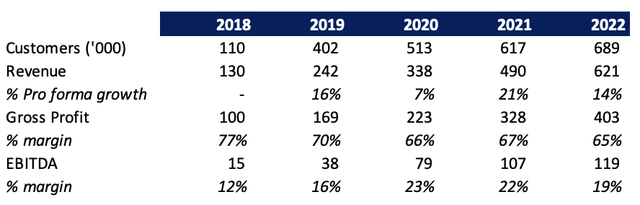

EverCommerce has primarily grown through acquisitions having completed 52 acquisitions since inception including 14 acquisitions since 2020. Its acquisitive business model has allowed them to rapidly grow its revenue at a CAGR of 48% during 2018-2022 period as well as enabled them to expand its EBITDA margins to 20%+.

Company filings

Note: Pro forma growth is considering a like for like growth of the acquired companies.

The growth stumbled in 2020 as a result of COVID-19 particularly within the fitness and wellness verticals which were the most affected as a result of shutdowns. However, the reopening in post-COVID environment driven by recovery in Total payments value (TPV) enabled them to report strong rebound in 2021. It was able to maintain 20%+ margins in 2020 and 2021 despite decline in gross margins driven by strict cost control. It reported a healthy 14% organic growth in 2022 while investments in product development and personnel expenses lead to margins declining to sub-20%.

Mixed Q3 Results

EVCM reported mixed Q3 with revenues growing by over 10% YoY to $175 mn, slightly below the consensus and at the lower end of the guidance. Subscription and transaction fees segment revenue decelerated to 10% YoY (from 31% growth in Q3 2022 and 13% in 2023) as a result of decline in contractor equipment spends and softness in certain other transactional areas. Marketing technology segment remains challenged despite posting a positive 1.5% growth which reflects the lingering effects of the weakness in SMB environment leading to demand driven headwinds. The company foresees continued demand driven headwinds within the marketing technology segment which will continue to dampen growth. The company has made progress in customers enabled or utilizing more than 1 solution to 173k customers, however, cross-sell progress remained relatively flattish from Q2 2023 (29% growth in Q2 vs 28% growth in Q3). Fitness vertical continues to be the most challenged with the segment yet to fully recover from COVID-19 disruption.

Strong Cost Control and Levered Balance Sheet

EVCM reported gross profit margins of 64.8%, up 130 bps YoY, driven by growth in its high margin payments solutions and subscription fees along with cross selling initiatives on YoY basis. SG&A expenses leveraged by about 350 bps YoY driven by active cost management on the back of lower selling and marketing expenses and incentives and tight G&A cost controls along with slightly lower product related expenses. This eventually lead them to post an Adj. EBITDA of $42 mn compared to analyst expectations of $36 mn with margins expanding 480 bps YoY to 23.9%. Levered FCF margin expanded by 650 bps YoY to 12.2% primarily driven by strong cash flow from operations while unlevered FCF margin continues to be robust at 18%.

Balance sheet position remain stable with the company ending with cash balance of $66 mn and an undrawn RCF facility of $190 mn with total debt outstanding of $539 mn. This points to a net leverage ratio of ~4.5x which further points to limited flexibility to pursue further transformational acquisitions to drive growth amidst weakening fundamental outlook.

Bleak Outlook

EVCM guided Q4 revenues to be $172 mn at midpoint, up 6% YoY which was below the consensus expectation of $182 mn further pointing to demand deceleration and drag from marketing technology and fitness segment. The company announced a 7% RIF amid demand deterioration which is expected to provide a cushion on the margins. Its revenue growth in 2023 was primarily driven by pricing initiatives which may be challenging going forward and we expect a more modest benefit as a result of negative overlap with the company facing a dual challenge of customer retention and pricing growth. We like the tuck-in acquisition of KickServ (Source: Company presentation), which will add about 1,000 paying customers will continue to aid incremental revenues. However, the company’s acquisitive model which was driving robust incremental growth is not very sustainable given the current environment and its slowing pace of acquisitions (only 1 acquisition since last 18 months compared to 6-7 acquisitions in a year) further points to decelerating growth trends.

Valuation

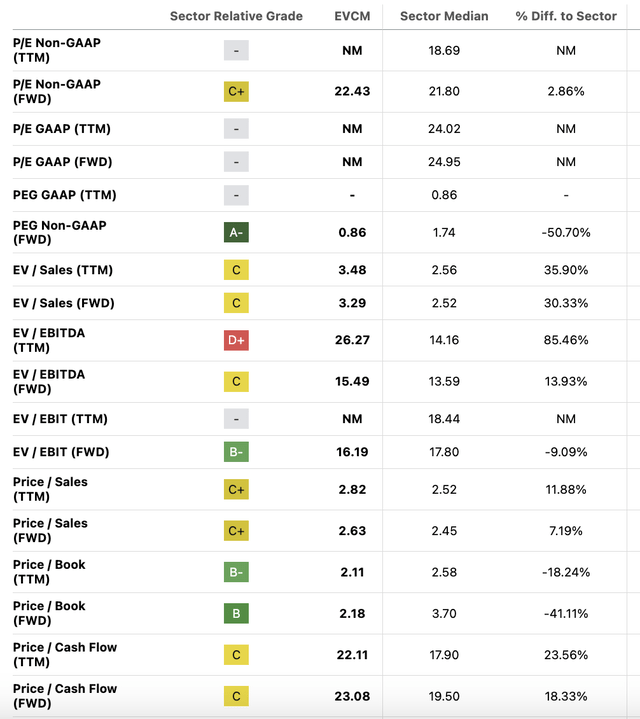

Seeking Alpha Quant’s Valuation grade assigns a ‘C’ rating primarily as a result of limited margin of safety compared to sector median. On a Fwd P/E basis, the company trades at 22.4x largely in line compared to sector median of 21.8x. On PEG basis the company does look attractive, however, given the weak macro environment and cautious outlook in its core payment solutions business along with continued challenges within marketing technology and fitness vertical, estimates are likely to be revised downwards. In addition, on Price to cash flow basis, the company trades at 23.1x which is at a slight premium compared to 19.5x.

Seeking Alpha

Despite the lukewarm response with shares tumbling by as much as fifth of its value on print, we believe the downside risks remain which could lead to derating of the multiples. We initiate with a Neutral rating and await improvements on its payments business and signs of stability in its marketing technology business.

Risks to Rating

Risks to rating include

1) Macro headwinds may intensify which can significantly affect the SMB customers which are relatively less capitalized and can lead to a further slowdown in technology spends

2) EVCM growth has been driven primarily from acquisitions and its inability to drive efficient acquisitions along with execution challenges can impact growth and margin profile

3) Upside risks include improvement in macro environment, higher than anticipated growth in its payments solution business, recovery in fitness vertical and continued shareholder activity such as share repurchases (which was recently upsized to $50 mn through 2024)

Final Thoughts

EVCM has done well on reporting robust margin expansion in YTD as well as most recent quarter on the back of stringent cost control. However, demand headwinds persists within its marketing technology segment (~20% of total) which has been highly sensitive to economy along with lingering challenges in fitness segment from COVID-19. The payments segment remains the focal point which has also been lauded by the management as a key growth driver, however, also points to decelerating trends. Despite the steep fall on print, we believe there are pronounced downside risks and initiate at Neutral.

Read the full article here